The Republican Tax Plan, a Colossal Indulgence at the Nation’s Expense

Dec 8 2017Republicans have long condemned Democrats for pushing through by simple majority vote, without a single Republican on board, the Affordable Care Act. How could they force on the nation a health care plan that affected one-sixth of the American economy.

Republicans are now employing the same maneuver — reconciliation, which requires only a simple majority — to ram through massive tax cut legislation that this time affects the entire U.S. economy, and for decades to come, without a single hearing, without a single Democrat on board.

The same conservatives, who in 2009 so objected to Obama's $858 billion

stimulus, a desperate measure to shore up the economy to prevent a depression in the wake of the financial crisis, are now in their mania for tax cuts injecting a huge stimulus not during a recession but at a time of an overheating economy and full employment, a bill that has been scored to add at least $1 trillion to the deficit.

These are the same conservatives who have long been the guidon bearers for reducing the national debt. That mission collides with that passion for cutting taxes, which cuts the government's revenue and aggravates debt. Since at least the Reagan years, they resolved the contradiction by insisting tax cuts are a kind of magical elixir which produces growth enough to fill the revenue void, even potentially to overflowing.

That's where we are right now with House and Senate Republicans arguing the

virtues of their tax plans. Underpinning this moment, they had previously voted themselves a gift of $1.5 trillion in play money over and above the running annual deficit for the coming decade because all the things they yearn to do will cost plenty. Actually, not really, they assure us. Growth will fill in the gap. The tax cuts will pay for themselves.

Senate Majority Leader Mitch McConnell had said six months ago that the tax plan should be revenue neutral — tax rate cuts should be balanced by loophole closings so there would be no addition to the deficit. But that was a mirage. McConnell has since downed the elixir, saying in a CNN interview that "a fairly conservative estimate …of this pro-growth tax reform" should make up for lost revenue. That's the general chorus. A Wall Street Journal editorial had said, flat out, "The revenue hole would be filled by faster economic growth". And not just filled. "This plan will cut down the deficits by a trillion dollars", said Treasury Secretary Steven Mnuchin.

"There's no evidence anywhere that a tax cut of that magnitude…will offset the full cost", says Douglas Holtz-Eakin, the Congressional Budget Office (CBO) director under George W. Bush. "Tax cuts rarely pay for themselves", agrees conservative-leaning economist and Harvard professor Gregory Mankiw. "Dynamic scoring", used by some of the groups that evaluate tax and budget proposals, do allow for tax cuts to spur some growth, but they and economists such as Mankiw don't think growth can go beyond covering a third of the shortfall.

That means the proposed tax plans would add a net of $1 trillion to the national debt over 10 years, and that is added to the business-as-usual deficits forecasted. For fiscal 2017 the nation's deficit reached $666 billion, the sixth highest on record. The CBO projects that, if no action is taken, the deficit 10 years out will reach almost $1.5 trillion for the single year 2027.

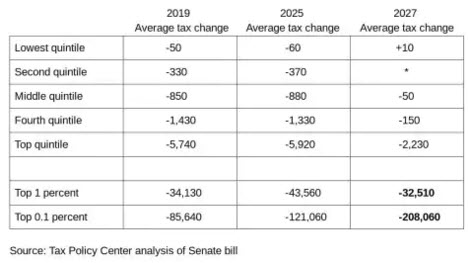

bait and switchAs analysts and the media quickly discovered in the 400-plus and 500-plus page bills of the House and Senate, a number of the treats that bring about cuts for the different tax brackets must be quietly taken away several years out if the tax plans are to be shoehorned into the $1.5 trillion deficit limit. To come in under that number the bills' authors have implanted expirations for almost 50 provisions. In the Senate plan after 2025 virtually everything begins to expire– the doubled standard deduction, the expanded child deduction, even the revised tax brackets. For the prototypical family of four earning the national median income of $59,000 that House Speaker Paul Ryan used as exemplar, their $1,082 tax dwindles to nothing by 2027. That's the general condition for all but the top 0.1% for which, as shown in this illuminating table from the Tax Policy Center, the tax cut bizarrely grows ever larger.

White House Budget Director Mick Mulvaney (and now the disputed head of the Consumer Finance Protection Bureau) blew the cover off this deception on "Meet the Press" just before Thanksgiving.

“One of the ways to game the system is to make things expire... What we tell folks is if it's good policy, it will become permanent. If it's bad policy, it will become temporary. A lot of this is a gimmick.”

He is saying that, like the Bush tax cuts when they were about to expire, Congress and President Obama made all but one of them permanent. That's the Republican assumption this time around, that when the time comes, even Democrats will vote for permanence rather than face voters after allowing tax rates to revert to their earlier highs. And what that says is that the tax plan, with the expirations that hold down costs rescinded, will ultimately cost more than $1.5 trillion. But we were not supposed to figure that out.

And in fact a number of the outfits that have been "scoring" the tax plans estimate that, as written, they will blow past the $1.5 trillion. The Committee for a Responsible Federal Budget outlines why they think the deficit will reach $2.2 trillion and why the national debt will exceed the size of the annual economy in just over a decade. In three different models of the tax plans run on the Penn Wharton Budget Model by the University of Pennsylvania’s Wharton School, the tax plan would see deficits zoom up to $3.5 trillion over 10 years.

how tax cuts become tax revenueHow do Republicans make their case that growth will overcome this soaring debt? The multiple corporate tax cuts. The tax on profits slashed from 35% to 20% , and some $2.6 trillion in foreign profits enticed to come home at only a 12% levy instead of 35% is money that corporations don't have to pay to the government. That will lead to expanded hiring and higher wages, which means more and fatter paychecks and a bonanza of taxes remitted to the government. Paul Ryan tells us so:

“Fixing the business side of our tax code is really all about helping families and workers. Cutting the corporate tax rate means more jobs here in the United States. It will foster increased competition, which will directly drive up wages for our workers.”

The White House Council of Economic Advisers is similarly convinced. The corporate tax cut would add from $4,000 to $9,000 to the typical household's income.

Where's the proof of that? Since the financial crisis we've seen corporations pile up record profits but little has flowed through to the workforce. Corporate execs have preferred using profits to boost the price of their stock — buying it back to spread net worth on fewer shares, increasing dividends to make the stock more attractive. That's what they did when the Bush administration offered a no-strings tax holiday for repatriated foreign profits in 2004. Not only did they not create jobs; the top 15 companies laid off 21,000 workers over the subsequent three years.

Corporate CEO's didn't need tax cuts for stock indexes to go on their record-breaking tear. Not to be overlooked, they and the management class own a lot of that stock. Using corporate profits to maximize value to shareholders maximizes value to themselves. Why raise wages for the thousands who work for them?

Gary Cohn, Trump's economic adviser, asked a group of corporate chieftains at a conference convened by the Wall Street Journal how many of them would use tax cuts to increase company investment, essential to job growth. "Why aren't the other hands up?", he asked, when only a few were raised. Businesses run on market opportunity, not taxes. Or, as Warren Buffet's notably said, "I have yet to see [anyone] shy away from a sensible investment because of the tax rate on the potential gain".

So what will happen if the big corporate tax plunge doesn't lead to many new jobs, doesn't produce paycheck taxes to fill the revenue hole, and the deficit soars. Those on the left are looking over the horizon and they see Paul Ryan telling us in panic mode that entitlements — Social Security and Medicare — are the cause and must be cut. Today's tax cuts will have engendered the rollback of the social programs, the ultimate conservative dream fulfilled.

to do and not to doAn international competition to lure companies to take up residence with of the outfits that have been "scoring" the tax plans estimate that, as written, they will blow past the $1.5 trillion. The Committee for a Responsible Federal Budget outlines why they think the deficit will reach $2.2 trillion and why the national debt will exceed the size of the annual economy in just over a decade. In three different models of the tax plans run on the Penn Wharton Budget Model by the University of Pennsylvania’s Wharton School, the tax plan would see deficits zoom up to $3.5 trillion over 10 years.

how tax cuts become tax revenueHow do Republicans make their case that growth will overcome this soaring debt? The multiple corporate tax cuts. The tax on profits slashed from 35% to 20% , and some $2.6 trillion in foreign profits enticed to come home at only a 12% levy instead of 35% is money that corporations don't have to pay to the government. That will lead to expanded hiring and higher wages, which means more and fatter paychecks and a bonanza of taxes remitted to the government. Paul Ryan tells us so:

“Fixing the business side of our tax code is really all about helping families and workers. Cutting the corporate tax rate means more jobs here in the United States. It will foster increased competition, which will directly drive up wages for our workers.”

The White House Council of Economic Advisers is similarly convinced. The corporate tax cut would add from $4,000 to $9,000 to the typical household's income.

Where's the proof of that? Since the financial crisis we've seen corporations pile up record profits but little has flowed through to the workforce. Corporate execs have preferred using profits to boost the price of their stock — buying it back to spread net worth on fewer shares, increasing dividends to make the stock more attractive. That's what they did when the Bush administration offered a no-strings tax holiday for repatriated foreign profits in 2004. Not only did they not create jobs; the top 15 companies laid off 21,000 workers over the subsequent three years.

Corporate CEO's didn't need tax cuts for stock indexes to go on their record-breaking tear. Not to be overlooked, they and the management class own a lot of that stock. Using corporate profits to maximize value to shareholders maximizes value to themselves. Why raise wages for the thousands who work for them?

Gary Cohn, Trump's economic adviser, asked a group of corporate chieftains at a conference convened by the Wall Street Journal how many of them would use tax cuts to increase company investment, essential to job growth. "Why aren't the other hands up?", he asked, when only a few were raised. Businesses run on market opportunity, not taxes. Or, as Warren Buffet's notably said, "I have yet to see [anyone] shy away from a sensible investment because of the tax rate on the potential gain".

So what will happen if the big corporate tax plunge doesn't lead to many new jobs, doesn't produce paycheck taxes to fill the revenue hole, and the deficit soars. Those on the left are looking over the horizon and they see Paul Ryan telling us in panic mode that entitlements — Social Security and Medicare — are the cause and must be cut. Today's tax cuts will have engendered the rollback of the social programs, the ultimate conservative dream fulfilled.

to do and not to doAn international competition to lure companies to take up residence with of the outfits that have been "scoring" the tax plans estimate that, as written, they will blow past the $1.5 trillion. The Committee for a Responsible Federal Budget outlines why they think the deficit will reach $2.2 trillion and why the national debt will exceed the size of the annual economy in just over a decade. In three different models of the tax plans run on the Penn Wharton Budget Model by the University of Pennsylvania’s Wharton School, the tax plan would see deficits zoom up to $3.5 trillion over 10 years.

how tax cuts become tax revenueHow do Republicans make their case that growth will overcome this soaring debt? The multiple corporate tax cuts. The tax on profits slashed from 35% to 20% , and some $2.6 trillion in foreign profits enticed to come home at only a 12% levy instead of 35% is money that corporations don't have to pay to the government. That will lead to expanded hiring and higher wages, which means more and fatter paychecks and a bonanza of taxes remitted to the government. Paul Ryan tells us so:

“Fixing the business side of our tax code is really all about helping families and workers. Cutting the corporate tax rate means more jobs here in the United States. It will foster increased competition, which will directly drive up wages for our workers.”

<%

Please subscribe if you haven't, or post a comment below about this article, or click here to go to our front page.

The U.S. is not under taxed. Government is overspent. It will always be so because votes these days are bought with the illusion that the goodies are paid for by someone else. In fact, the tax and mandate burden is a significant brake on the entire economy. We all pay for government overspend, and the poor get hurt worst of all.

The corporate income tax, for example, represents double taxation on the profits – first within the company, and then again on the dividends in the hands of the shareholders.

Then there are the parole taxes. When a business works out how much to pay an employee, it takes into account the total cost of employing him. If you want to know how much tax is being taken out of the employee’s pay packet, you should include the employer’s contribution to social security, and the cost of all the mandated employee rights, because the pay an employee could negotiate is reduced by that amount.

Then there is that pesky corporate income tax. Who do you think actually pays it? any combination of the following 3 things happens: (1) less money for wages (i.e employees pay it) (2) higher prices (i.e. customer pays it), (3) money is sheltered in some scheme which hampers its deployment in productive investment.

The tax sheltering effect (3) is probably the most economically damaging of all, because it is productive investment that grows the real economy. If rates are high, sheltering behaviour becomes more prudent than the uncertainty of investment with its risk of failure.

Those who bleat about “tax cuts for the rich” are fixated on dividing up what they think is a fixed size pie. But those “rich” people are not stupid. If they are over taxed they modify their behaviour to preserve what they have. The net result is a shrinking pie – and guess who gets hurt first when that happens?

Bottom line: don’t confuse tax rates with tax take.

This article touched only lightly on the corporate tax cut because the article that preceded it on the tax plan reminded readers that the effective rate was far lower than 35% but had agreed with the corporate cut nevertheless — although with reservation:

“The biggest cut would be the drop in the corporate rate from the world’s highest at 35% to 20%.There’s bipartisan consensus that this should be done — Obama proposed it in 2012 — in order to compete with other countries that have been slashing their own rate to attract corporations to their shores. But the quid pro quo for the steep drop in the tax rate was to be the elimination of scores of loopholes that corporations use to reduce their effective tax rate well below the posted 35% to an actual 18.1%. Getting rid of the myriad of loopholes that lobbying has inserted into the tax code was to be a big part of “simplification”. What’s happened to that? Instead, under the proposed plan, corporations would apparently still have loopholes to reduce their taxes below even the new 20%.”

Given these realities are you saying that corporations should pay no taxes at all?

Stephen Wilson

Editor