Spooked by Talk of Downturn, Trump Opted for Chaos

President Trump is showing signs of panic. Signs are increasing that we may be heading into a recession after an historic boom, but Trump’s belief that the economy “I gave you” is key to his winning re-election has caused him to lash out,

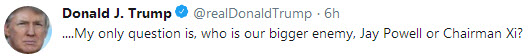

asking in a tweet who is the bigger enemy, Federal Reserve Chairman Jerome Powell or China’s President Xi Jinping, and on the same day, issuing a four-part tweet that said we should no longer import anything from China — plus…

“Our great American companies are hereby ordered to immediately start looking for an alternative to China, including bringing your companies HOME and making your products in the USA.”

The tirade was prompted by China’s retaliating against Trump’s 10% impost on most of China’s imports not yet tariffed that is about to take effect, in part, September 1. China returned fire with tariffs on $75 billion of their imports from the U.S. When Powell, on the same as that announcement, failed in a speech in Wyoming to succumb to Trump’s demands to lower interest rates, that was enough to send the president off the rails in a week in which he had battled Denmark, calling her prime minister “nasty” for her unwillingness to agree to his arrogant pitch to sell us Greenland, announced that “I am the Chosen One” to deal with China, and accused American Jews of “disloyalty” to Israel by voting for Democrats, using in the process a word that infuriates Jews with its implication that they split loyalty between America and Israel.

flailing

Trump is irate that the headlines are every day predicting a looming recession. Even as he protests that the economy is rip-roaring, with tweets such as…

…he betrays his doubts by proposing a grab bag of options to pump up an already inflated boom as if it had already gone bust. “We’re very far from a recession”, he said, while nonetheless talking about further tax cuts. He says such talk is not a symptom that he is worried because “I’m looking at that all the time anyway”.

To head off any downturn, the media was reporting that Trump and his advisers would give the wealthy another huge gift by cutting taxes on capital gains, and had even considered cutting the payroll tax that funds Social Security and Medicare.

Not 24 hours later, Trump abandoned these ideas because “We don’t need it. We have a strong economy”. The White House realized that these panicky proposals were simply feeding the perception of a looming recession. Out came more tweets such as:

If negative signals persist, you can be sure these cuts will be back on the table. In fact, as soon as the world made one more revolution, there was Trump’s economic adviser, Larry Kudlow, outside the White House saying that what he called a “long range project” of further tax cuts “probably will come out during the campaign” next year “to provide additional relief to middle income people, blue collar people, small business, and so forth”. In other words, short range tax cuts to buy votes — never mind the soaring national debt. Kudlow didn’t mention what The Washington Post reported, that also under consideration (under cover of those middle class cuts?) is dropping the top capital gains rate to 15% from 20% to keep those campaign dollars coming from the grateful wealthy.

One ploy that was never taken off the table was the continued harangue against Powell, Trump’s own appointee, for his “horrendous lack of vision” by raising the central bank’s posted interest rate too rapidly and now cutting it too slowly, currently still 2.25%. But if the U.S. economy “is very strong”, why is a rate cut needed? Trump undermines his own bravado.

President Trump wants the rate cut by a full percentage point, perhaps unaware that a precipitous move like that would say that the Fed thinks a recession is heading our way. And even when there is no certainty that there will be a recession, Trump wants the Fed to resume the crisis program known as “quantitative easing” that it deployed after the 2008 crash, that of buying up hundreds of billions of dollars in financial assets from banks and financial institutions so as to inject liquidity (i.e., money) into the system.

By attacking Powell, the president is laying the groundwork for making the Fed the entire cause of any recession, never mind his own tariff policies, as evidenced by statements such as, “If the Fed would do its job, you would see a burst of growth like you’ve never seen before”. Kudlow said on “Fox News Sunday” that the state of the economy under Trump “is kind of a miracle, because we face severe monetary restraint from the Fed”. In fact, the 2.25% rate is historically low. Trump’s mania for sharply lower interest rates leads us to wonder whether the hundreds of millions the Trump Organization reportedly owes Deutsche Bank is at variable rate.

so, what about this recession?

The economy grew by a 2.1% annual rate in the second quarter, down from a 3.5% annual rate in the second quarter of 2018, but that’s no surprise: 2.1% in 2019 was forecast a year ago. Unemployment continues to be at record lows. Consumer spending is vigorous; the retail sector just reported higher earnings.

But there are warning signs. This month’s University of Michigan survey of consumer confidence took a sharp drop in its August reading, which portends reduced consumer spending ahead. A key manufacturing index — it measures purchasing of supplies — dropped just below its neutral midpoint for the first time in nearly a decade, signaling a contraction. The trade war with China that has just grown worse will cause still further reductions in economic activity. Corporate profits have been heady but their growth has stalled. Business investment has retrenched, likely a casualty of the ongoing turmoil that causes CEOs to wait and see.

That has led to the bellwether signal from the bond markets where yield — the effective rate of interest — on 10-year treasuries has been slipping below the yield on short-term debt. That says that traders in government securities expect a downturn that will drive interest rates down in the future. Here’s Paul Krugman, columnist for the The New York Times and a Nobel economist:

“An old economists’ joke says that the stock market predicted nine of the last five recessions. Well, an ‘inverted yield curve’… predicted six of the last six recessions… The short-versus-long spread is down to roughly where it was in early 2007…on the eve of the worst recession since the 1930s.”

In several outbursts, President Trump has complained that it’s all a conspiracy meant to derail his prospects in 2020. “The Fake News Media is doing everything they can to crash the economy because they think that will be bad for me and my re-election”, Mr. Trump tweeted early in August. “The problem they have is that the economy is way too strong and we will soon be winning big on Trade, and everyone knows that, including China!”

But he has been saying that for a year, and a couple of weeks later he tweets that “We don’t need China and, frankly, would be far better off without them”.

This was not an impetuous tweet of momentary anger. Axios reports that the president has been saying in private meetings that we should “decouple” from China, a move that would cause massive disruption in supply chains. The Wall Street Journal reports that no other countries are as developed with one CEO asking “Where are we supposed to go?”. Trump may be listening to the national security fraternity who view China as a profoundly bad actor and question whether we can ever profitably co-exist.

came the maelstrom

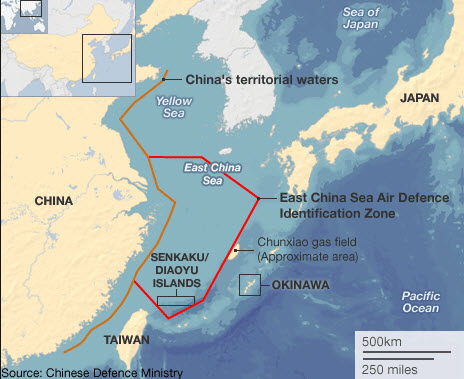

Donald Trump told us that “trade wars are good, and easy to win”. But the escalation of the third week in August was like nothing that preceded, and he is losing. Certainly losing compared to what he claimed he would be winning. And to be clear, this “paper” wants him to win (see ” What China Wants: Today, the South China Sea. Tomorrow, Everything Under Heaven” and just search “China” at our site). Here’s the timeline of everything coming apart:

On the first day of August, when Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer returned from Shanghai to report an unyielding China, an angry Trump announced — on Twitter, of course — a 10% tariff on $300 billion of Chinese imports to begin this September 1. That would be in addition to the 10% tariffs on $250 billion of Chinese goods imposed in September a year ago, which were increased to 25% at the beginning of this year.

Days later, as China allowed the value of their currency to drop and announced they would not accede to Trump’s demand to buy more U.S. farm products, the Dow fell 767 points. Trump had Treasury brand China as a currency manipulator.

The backlash from the business community against the new 10% levy on $300 billion caused the president to postpone the tariff until December 15th on an estimated $160 billion of the $300 billion of imports — “cell phones, laptop computers, video game consoles, certain toys, computer monitors, and certain items of footwear and clothing” — so as not to raise prices in the Christmas season. Trump has all along lied to the public that China pays for tariffs (“We’re taking in billions and billions of dollars from China”). That’s not how tariffs work. And he unwittingly admitted that with the rollback to December 15th. Why was it needed if not to save consumers from paying the tariffs? But do his faithful even get that he’s lied to them?

In mid-August the yield curve inverted– the “CRAZY INVERTED YIELD CURVE” tweeted he — for which Trump predictably blamed the Fed chairman. The Dow plunged 801 points.

On a Friday three weeks into August, Powell announced no rate cut plans in a speech at Jackson Hole , Wyoming, and semaphored that Trump should not look to the Fed to cure global trade battles.

On the same day, China retaliated against Trump’s 10%-on-$300 billion with tariffs of its own: it will charge 5% and 10% on $75 billion of U.S. exports arriving in Chinese ports, pointedly in two batches on September 1 and December 15 to match Trump’s timing. An outraged Trump first lashed out at Powell…

…and then announced that the tariffs on the original $250 billion of goods would rise to 30% from 25% on October 1, and on the $300 billion tranche the tariffs would be $15% rather than 10% on September 1 and December 15.

The president made this announcement — once again national policy by tweet — after the markets closed. The Dow had already plunged 673 points.

When will this lunacy end? Trump is doing his damnedest to bring about that recession, not to mention destroying the world’s trading system.