Three Years On, Still No Bankers in Jail

Our two-tiered justice system Nov 15 2011Update: Why No Prosecutions?

Dec 6: ProPublica today asks the same and adds "Ex-Justice Official Says it's Just too Hard". And as we said, the banks have deeper pockets than the government.

Judge Blocks Settlement: Nov. 28: A federal judge has blocked the SEC's settlement with Citigroup (below in this article) saying that if the bank does not admit its wrongdoing, he has no basis for deciding if the settlement is fair.

The Occupy Wall Streeters around the country may have been a bit fuzzy as to exactly what they want but they are savvy enough to recognize that the bankers who brought us the Great Crash have gone scot free while the 99% are paying the price. After triggering the worst recession since the Great Depression by selling mortgages that could never be repaid and bundling them into putrescent securities peddled around an unsuspecting world, why hasn’t a single bank executive even been indicted?

The inescapable conclusion is that the Obama Administration, early on stocked with advisers from the Wall Street fraternity, told the Justice Department to go easy and just appear to be taking action. Asked recently about why no indictments, we have Treasury Secretary Timothy Geithner saying “you should stay tuned for that”. Really? For how long? It’s already been three years.

Mortgage Fraud

Instead we now have the Administration pressing for a settlement with the attorneys general of all fifty states to prevent them from pursuing claims against banks for fraud and abuse in the origination of mortgages. The settlement would deliver relief to borrowers, to be sure,

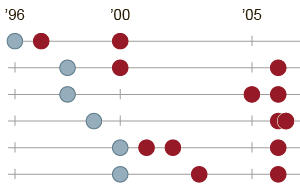

To see patterns of fraud by financial

institutions, click this graphic from

The New York Times

although not by all that much. It would have the banks reduce the balances on a million or so loans by just $17 to $20 billion in the aggregate. Even then the banks would be issued some sort of “credits” as an award for their magnanimity.

Fortunately, the deal is likely to come undone. Three attorneys general have balked. First Eric Schneiderman of New York said ‘no’, then Kamala Harris of California, and now the Vice President’s son, Beau Biden of Delaware. Besides objecting to terms that would partially inhibit the states from taking further action, these officials say the settlement is too cheap. That’s the pattern with this administration — letting the banks off the hook for money, not enough of that to make it hurt, and without a single criminal case for the admitted fraud that is the reason for extracting a settlement.

As for one of the root causes of the Crash, Countrywide Financial is not a bank, but as the nation's largest mortgage lender, its aggressive sales force pushed hundreds of billions of dollars of subprime mortgages into the system at a rate averaging about 200,000 loans a month. A year ago October, accused of fraud and insider trading, its CEO Angelo Mozilo agreed with the SEC to pay a $67.5 million fine. But $20 million of that would come from a corporate liability insurance policy and what's $67.5 million if your net worth is estimated at $600 million? Here at last was a case aimed at an individual, but, as usual, money buys a stay out of jail card. Also, in what has become standard SEC practice, Mozilo was not required to admit any wrongdoing.

Soft Touch for CitiLike Goldman Sachs before it, Citigroup put together and sold to customers a package of malodorous mortgages in a “collateralized debt obligation” (CDO) — and then shorted it. That is, knowing what they had sold to customers resembled something your dog leaves on your neighbor’s lawn, as one trader is quoted in the SEC settlement, Citi bet $1 billion in mortgages would fail and found unknowing investors to take the other side of the bet. In Goldman’s case, an outsider, hedge fund owner John Paulson, was allowed to pick the cannot-fail-to-fail mortgages which Goldman then sold short. In Citi’s case, the bank itself exercised “significant influence” in the choice of contents of half of the deal. Not that it makes much difference. It’s fraud either way.

“As a result, about 15 hedge funds, investment managers and other firms that invested in the deal lost hundreds of millions of dollars, while Citigroup made $160 million in fees and trading profits”, reported The Wall Street Journal. Yet the SEC is content to settle with Citigroup for $285 million — which looks to us like a net cost of only $125 million against those fees and profits. This is a bank that last quarter reported a profit of $3.8 billion. Compared to that the settlement brings the “rounding error” cliché to mind.

Again, Citigroup settled “without admitting or denying” any guilt, in the language of the SEC agreement. Both the amount and this exculpatory language has rankled U.S. District Court Judge Jed S. Rakoff, who has held up the deal, so perhaps there is hope. He asks why he should authorize a settlement “in which the SEC alleges a serious securities fraud but the defendant neither admits nor denies wrongdoing”. And once again, no executives or traders were singled out for permitting or committing the fraud. “The CDOs, apparently, were contrived by no one and sold by no one”, as Richard Cohen observed in The Washington Post.

Rakoff also wanted to know why the fine portion of the Citi settlement was "less than one-fifth of the $535 million penalty assessed" against Goldman Sachs for the same fraudulent act. The SEC decided to go easy on Citi because “Citigroup did not predict or profit from the subprime crisis, the collapse of housing prices, or the collapse of the CDO market", said one of the bank's lawyers. Did you get that? It’s not as much of a crime if one doesn’t make as much money.

promising never to do it again…until they do

Whenever the SEC catches a bank in a swindle, it extracts a promise from the bank never to do it again. Fraud is illegal absent such promises, so it’s a very curious practice. It suggests that the SEC merely scolds these malefactors much like one scolds a child, rather than treating them like the crooks they are.

So when Bank of America in 2005 was caught allowing traders to buy and sell mutual funds at the previous day’s closing price — profiting from the new day’s change in price — the bank only paid a fine and promised not to do it again. No trader and no one from management who green-lighted the practice went to jail. And, of course, the bank settled neither admitting nor denying what they had done.

Yet in 2007-8 Bank of America crossed the line again, telling investors the $4.5 billion of auction-rate securities they were selling were as solid as money market funds. Came the Crash, the securities nose-dived and investors couldn’t unload them. Again a fine, again a promise.

That’s just one bank. The New York Times has posted this graphic of repeated violations by 26 banks and financial institutions.

The SEC can only file civil suits. It is for the Justice Department to develop criminal cases. But Justice does nothing partly because it is reluctant to spend its budget fighting the bottomless depths of the pockets of the big banks. So we now have banks too big to follow the law. They simply pay off the government in amounts that barely nick their balance sheets and no one goes to jail. It’s like telling bank robbers no harm done if they would just be so kind as to return the money.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.