The Tax Reforms That Never Come

Four years of hype in the State of the Union Feb 1 2012At least Mitt Romney’s tax returns have had the salutary effect of making the public more aware of the 15% capital gains provision in general and “carried interest” in particular. More than any other factor, it is this privileged treatment of income that has made the gap between the 1% and the rest a chasm.

Everyone but accountants and tax lawyers has always been for tax reform, but it never happens. You will find entreaties for reform in all four of President Obama’s state of the union addresses. For corporations he recognizes that the 35% rate is uncompetitive but has taken no action; for individual taxpayers he has not pressed Congress for anything beyond raising the rate for the top bracket, temporarily trimming the payroll tax again, and is now pushing for the “Buffet Rule”.

Whether or not you believe the wealthy should be taxed more, that last is a vote-getting populist maneuver by the President. It makes for a strange outcropping in the tax table. The Buffett Rule says that anyone earning $1 million or more a year should pay a minimum of 30%. We find no mention of this being a new bracket, whereby only the income above $1 million is taxed at 30%. Which raises the question: What about someone who earns less, and entirely from investment income taxed at 15%? Everyone up to $1 million would pay 15%; then suddenly the rate doubles for one’s entire income for a person who earns more than $1 million?

This idea just adds to the clumsy inequities of our tax policy. The patchwork of the Buffett Rule fails to confront the principal reason the wealthiest pay a lower rate than Buffett's secretary: the 15% applied to capital gains.

It also distracts from the needed reform of a tax code grown impossibly complex. With nearly everyone long ago driven to use tax software, a tax service, or an accountant to avoid the tax code’s thickets, few of us have been anywhere near the 179-page (and that’s without forms) 1040 instruction booklet in years. Most are unaware that the tax rate schedule is simple — just a few lines long (and only one of those lines pertains to you). It’s the page after page of worksheets in the instructions, with their inscrutable step-by-step calculations, their barnacles of special exemptions, exceptions and dependencies on other calculations, and the entire extra layer of the Alternative Minimum Tax that are the cause of the complexity.

And that doesn’t begin to cover the gallimaufry of rules and statutes and declarations that led to the gargantuan return of 547-pages the Romneys had to file.

It is Congress that has brought us this mess, ever adding to the pile to reward special interests while giving not a thought to the brambles of tangled instructions that are the consequence of their actions. Nothing is ever removed. The federal tax code is now almost 72,000 pages; it has grown some 20,000 pages in just the years since before the Bush tax cuts were introduced.

Sweeping and sensible reform is what is needed. But how does one go about unraveling the hairball of self-referencing articles, sections and clauses in 72,000 pages — and then moving each through Congress for repeal? That tells you it won’t be done. It says that the only sensible approach is to jettison the whole thing and start fresh. Which most certainly won’t be done.

So what can be done?Both Obama’s Bowles-Simpson commission and a similar tax reform panel under George W. Bush in 2005 proposed reducing or eliminating major deductions and income exclusions so as to broaden the tax basis — which would in turn allow reduced and simplified rates applied to that base. Neither went anywhere, and Obama has been roundly criticized for missing a signal moment for reform by ignoring his own commission’s report at the end of 2010.

Deductions should be reviewed for the value of the purpose they serve. People should be encouraged to insure their health rather than burden society’s emergency rooms, and continue to be rewarded with a deduction for so doing. We want people to set aside money for self-sufficiency in old age for the same reason, so income parked in 401k plans for taxing much later makes sense. A well-educated workforce has become urgent in the face of global competition, so deductions for tuition are key (except they are paltry, are denied outright beyond a too-low income level, and are continuously eroded by irresponsible college tuition increases).

So with that in mind, what can be done for a government that is starved for money. Those who howl at the deficit choose to ignore that the Bush tax cuts, which left rates for the individual taxpayer near their all time low, combined with the recession have reduced the sum of all the revenue collected by the federal government to just 14.8% of our gross domestic product, the lowest in about 50 years.

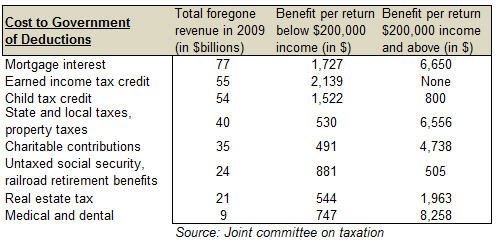

The cost of deductionsTwo “tax expenditures” for individuals that stand out for the amount they cost the government are those that Bowles-Simpson recommended changing: the mortgage deduction and health insurance paid for by corporations.

The deduction of mortgage interest from taxable income is effectively a subsidy to the housing industry helping to reduce the effective cost of buying a house. What is indefensible is the generosity of the subsidy; you can deduct the interest on not just one, but two houses, and on loans up to $1 million, thus pointlessly encouraging the building of outsized houses for the fairly well off who deserve no help from the rest of us.

Because it figured into the affordability calculus for those who bought a house, the deduction cannot fairly be yanked summarily from those already locked into mortgages (apart from the above-named undeserving). Its elimination would have to be staged over, say, a 10-year period. But that should be done, and most economists agree. We have seen the fiasco of what the social policy of encouraging home ownership has brought us. There is no rationale for continuing to subsidize this particular industry.

But not to worry if that gores your ox. As we said, nothing changes. Getting elimination of the mortgage deduction in any form through Congress, which would be showered with money from the housing industry, would be close to impossible.

The largest tax break in the code by far is that company-paid health insurance does not count toward an individual’s income. The average family premium for company-sponsored insurance runs about $12,000 a year with $9,000 of that paid by the employer. The company takes it as an expense, reducing profit on which it pays taxes. The employee sees nothing of this on his or her W-2. So the government takes a hit twice over. By not taxing the employee for what is effectively compensation, the government in 2010 forfeited $264 billion in revenue.

To double the inequity of this arrangement, the self-employed and anyone working for a company that does not provide health insurance are fully taxed on all income and thus buy their health insurance with after-tax dollars. They have only the medical deduction, and that only to the extent that medical and dental exceed the high hurdle of 7.5% of their income. Nothing is ever proposed to redress this unfair treatment.

If employees had to pay taxes on the value of company-paid insurance, they would insist on less lavish packages. Any attempt to make this change would bring torrents of money from the insurance companies to buy off Congress. So, short of driving money from politics, we are here again just entertaining ourselves by contemplating what ought to be done.

Which goes for the rest of the principal deductions. As information, below is table showing by how much each costs the government. This is over and above the “standard deduction” taken by millions. Health insurance’s cost — the $264 billion cited above — is not in the table because it is not a deduction. Taxes are, of course, a much bigger subject than the narrow focus of deductions. Fixing this intolerable monstrosity should be an abiding cause for us all and a continuing subject in these pages.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.