Let’s Permanently End Minimum Wage Stupidity

Jul 29 2013Workers at fast food chains have been rebelling against their low wages. There have been demonstrations and one-day strikes in seven cities against McDonalds, Burger King, Taco Bell and Domino’s Pizza, with employees typically demanding that wages rise to $15 an hour. The movement is growing and has attracted financial support from unions, even though organizing the nation’s four million fast food workers is not an expressed plan.

In Washington, D.C., Wal-Mart threatened to cancel building six stores when this July the city council passed a “living wage”measure that would require the giant chain to pay wages of $12.50 an hour.

Wal-Mart Wins Again: Sept 11: The D.C. mayor vetoed the bill that would have required Wal-Mart to pay $12.50 an hour calling it a "job-killer".

Workers are reminded constantly of the huge pay increases awarded the heads of their companies, but have seen no upward movement in their own paychecks for years.

Their plight is now made worse by the growing practice of fast food and other retail businesses putting payroll on plastic cards to save money on printing checks. The research firm Aite Group says that in 2012, dozens of major companies filled 4.6 million payroll cards with $34 billion in 2012 and expects those counts to double by 2017. In order to get their money, workers must pay fees at ATM machines for every withdrawal — as much as $2.25 for out-of-network withdrawals — plus per-purchase fees and $7-$8 penalties if the card is not used actively. Workers unwillingly bear these costs, reducing wages further.

The minimum wage is not a living wage. It comes to $15,080 a year (less if no pay for holidays, sick days, or vacations). Somehow, less than $1,300 a month is supposed to pay for rent, food and clothing for children, light, heat, getting to work — and let’s hope no one gets sick.

McDonalds came in for ridicule for a tutorial on its website titled “Practical Money Skills” that educates its employees how to budget and save money. First step, get a second job. The chain admits that a family can’t live on its wages, even following its budget that assumes monthly expenses of only $600 for rent, $20 for health insurance, and $0 for heat.

disinterestedCongress last passed a bill increasing the minimum wage in 2006, which added increases gradually from 2007 to 2009 leading to today’s $7.25 an hour. As with all past increases, there was no provision to adjust annually for inflation, and the rate continues well below the $10.51 an hour that was the minimum, adjusted for inflation, long ago in 1968. Eighteen states and the District of Columbia have broken with the federal government by setting their own minima above $7.25, but the increases are mostly slight, and the highest is $9.19 in Washington State.

And then there’s the minimum wage for workers otherwise paid with tips. Congress has ignored that for 22 years since 1991 when it set the minimum at $2.13 an hour, a period during which Congress gave itself raises 13 times.

President Obama wants to raise the minimum to $9.80 an hour, which, says the Economic Policy Institute, a left-leaning research organization, would lift pay for more than 28 million Americans. There is a bill in Congress, the “Catching Up to 1968 Act of 2013,” sponsored by Congressman Alan Grayson of Florida that would raise the federal minimum wage to $10.50 per hour, and with automatic increases indexed to inflation thereafter. It has the backing of 104 economists (whom we exempt from our sub-head fatwa) who signed this petition supporting a $10.50 an hour minimum wage.

But until legislators act, they leave on the books a minimum that for a single mother with two kids is $4,000 below what is considered the poverty level. Nevertheless, whenever the issue is raised in Congress, a chorus of business lobbyists descend on the Hill with money and dire predictions of calamitous job losses. They rely on numerous surveys of economists who are avid adherents of Newton’s 3rd law of motion in their chalkboard belief that for every rise in one vector there must be an equal and opposite decline in another. Economists therefore reflexively theorize that a minimum wage’s mere existence, all the worse when there’s an increase in same, must inexorably increase unemployment.

But those are just surveys of opinion, and economists' opinions tend to align with the dogma of their profession. What count are actual studies.

David Neumark of the University of California and William Wascher, a Federal Reserve Governor, are solidly in the camp that says minimum wage increases cause job loss. They are steadfastly critical that a minimum wage exists at all and their study presents evidence showing that a higher wage will cost some low-skilled workers their jobs while helping those who keep them.

Other studies, especially those done in recent years that have taken different approaches, find minimal effects. Economists at the University of Massachusetts-Amherst compared employment levels in contiguous areas with different minimum-wage levels for the 16 years between 1990 and 2006 and concluded in a 2010 paper there are “strong earnings effects and no employment effects of minimum wage increases”, as reported here.

What these studies seem to leave out is that not only have the fast food and big box stores brought down wages at smaller competitors forced to compete, but their own workers are disproportionately reliant on safety net programs like food stamps and Medicaid. Taxpayers thus subsidize these chains so they can pay those low wages.

standoffThere are no end of studies arriving at opposite conclusions and it could be argued that they pretty much cancel each other out. The standard counterclaim of opponents of a minimum wage increase — that it causes job losses — seems too pat. How does a businesses continue to operate by shedding workers rather than increasing pay if those employees are needed to keep the business humming? The more plausible claim is that a business may need to raise its prices to keep those employees. But even in major retail chains with a significant labor component, wage increases can be absorbed without major price hikes just they have in the past, witness those restaurant and retail chains having grown bigger than ever.

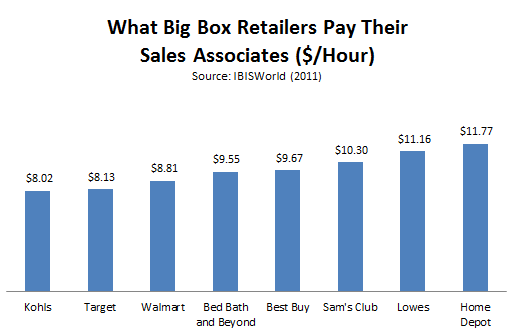

This group of economists calculates that McDonalds would only need to raise the price of a Big Mac by five cents — a 1% increase — if the minimum wage were raised to $10.50 an hour. A study from UC-Berkeley's Center for Labor Research and Education calculated that if Wal-Mart raised its average wage from $8.81 to $12.00 an hour, and passed on the cost to consumers, their average shopper would pay only $12.49 extra a year.

Moreover, as with rising tides lifting all boats, a universal minimum wage rise would affect all businesses, such that price increases by one would be matched by others, putting no one at competitive disadvantage.

Economists are equally at odds over what effect minimum wage increases have on the general economy. Those in favor of an increase have the intuitive advantage — minimum earners spend every cent of their paychecks, and economists who as a breed believe every action has a reaction cannot argue that extra money flowing into the economy will have no effect. It might even create jobs. Yet Neumark and Wascher are highly dismissive of that notion.

a cycle of impoverishmentBut all the arid studies seem to lose sight of the true subject matter: the lives of humans. Those advocating that the minimum wage be held at today’s $7.25 an hour (or eliminated altogether) would condemn millions to stagnant poverty. Does it make good sense to save the jobs of “some low-skilled workers” at the price of holding everyone else to an unlivable wage? Is it morally defensible that the rest of society should go on enjoying low prices that depend on keeping the low stratum of society at the poverty level? There’s the irony that those who believe the minimum wage should be kept at a minimum tend to be those who decry the expanded ranks relying on food stamps, not wanting to connect cause and effect.

Henry Ford famously believed that he should pay his workers enough for them to buy a Ford, whereas, as Harold Meyerson noted in The American Prospect, those who suppress the minimum wage make sure that workers can afford only Wal-Mart. Stephen Moore, from The Wall Street Journal’s editorial page, calls Wal-Mart the greatest anti-poverty program ever, lauding the ever-downward cycle of a massive company that pays poverty-level wages so as to provide cheap prices for other poverty-level earners.

Today we have the opposite of Ford in Charles Koch who, in an interview with the Wichita Eagle, said he wants to eliminate the minimum wage altogether because it creates a culture of dependency and keeps people with limited capital from starting their own business.

breaking the moldIn defiance of those major American companies that believe they must pay as little as possible for labor are some other big outfits that have found the opposite. Store chains such as Costco Wholesale, Trader Joe’s and QuikTrip, highlighted in this article, pay an average annual wage in the vicinity of $40,000 to their personnel. In fact QuikTrip, a convenience store chain with 645 outlets in 11 states, pays exactly that plus benefits to entry-level employees.

Costco, which Bloomberg/BusinessWeek called the happiest company in the world in a recent cover story, has spurned Wall Street’s repeated urgings that it cut wages so that the money will be given instead to stockholders. CEO Craig Jelinek says, “I think people need to make a living wage with health benefits. It also puts more money back into the economy and creates a healthier country”. The average Costco employee earned around $45,000 in 2011, according to Fortune magazine, while Wal-Mart’s equivalent, Sam’s Club, pays its sales associates an average of $17,486 per year.

These companies find that paying people a living wage pays off. Costly turnover plunges, and worker diligence increases because they value their jobs more.

Meanwhile, Congress drags its feet. Once and for all, this nation, its minimum wage less than all developed countries with such a law, needs a base living wage; not just an arbitrary number like the $9.00 or $9.80 an hour proposed; a rate arrived at over a few years to allow businesses to adjust, tied to cost indexes thereafter; a wage beneath which no corporation may pay, finally putting an end to the exploitation of an underclass now kept in perpetual penury.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.

Regardless of how much you make the minimum wage, it’s not going to be a living wage.

McDonalds, Wal-Mart, and other low-wage jobs aren’t meant to provide a living. They provide an initial entry into the workforce or a second job.

If you make the min. wage $50 an hour, you’ll be writing editorials that $50/hr is too low for a person to make a living within a couple of years.