The Middle Class Takes Center Stage

Obama hopes to force the theme for 2016 Feb 12 2015The "income-redistribution themes" put forth in President Obama's budget are "amusingly detached from the reality of the largest GOP majority in Congress since 1949", said The Wall Street Journal's editorial page, missing the point. Others were quicker to realize that Obama of course knows that none of what he put forth would survive in that Congress. The kinder, gentler America he portrays — expanded child day care, paid sick leave, middle-class tax cuts, free community college — is designed to cast Republicans as curmudgeons for begrudging all such goodies and to put them on the defensive in the run-up to the 2016 elections.

That strategy will become more apparent when Republicans counter with a budget that will seem harsh in comparison. The President's 10-year budget accepts an annual deficit of 2.5% of gross domestic product rising to 4% further out. But the Republican budget is expected to hammer the deficit down to zero over the ten years, which means cutting social programs, trimming the Social Security and Medicare benefits that Obama's plans leave untouched, and casting themselves as the party of grim austerity compared to what Mitt Romney called the Democrats' "free stuff". “It is going to be a very difficult challenge for conservatives to make the argument that they have better solutions, because these things sound so appealing” is the warning of Lanhee Chen, Romney's top economic adviser in 2012. Add also that Obama would pay for his "latest giveaway", as The Weekly Standard put it, with crowd-pleasing taxes on big financial institutions, multinational corporations and the wealthy.

There are several in the Republican Party who realize that the failing middle class must be resuscitated, so some programs could find common ground. Marco Rubio has for some time spoken of increasing the child tax credit and replacing the earned-income tax credit with a more generalized benefit (see our "New Republican Thinking Would Overhaul Safety Net"). Rand Paul wants tax breaks to spur investment in low-income communities. And there is agreement that the nation's infrastructure has been neglected too long.

But Obama wants to pay for infrastructure rehabilitation with a 14% tax levied on accumulated profits held offshore by American corporations, and a 19% tax on each year's foreign profits hereafter. It's illogical why a tax on profits earned in other countries should pay for infrastructure improvements in this country, but Obama unabashedly reaches into whatever pockets he can find to support his plans.

Many Republicans are in favor of infrastructure spending and the jobs it would bring, but not if it means taxing business (or raising taxes on anyone), but they have no answer to where the money will come from. John Boehner on "60 Minutes" said "we believe that through tax reform we can find the funds to fund a long-term highway bill". That makes repair of highways and bridges depend on tax reform that never happens. And how would that yield more money anyway, if the only tax reform that Republicans will accept must not raise taxes nor, therefore, revenue?

The coming budget takes effect October and will be the first to feel the full effect of the draconian spending cuts of the "sequester" after a two-year lessening of those constraints, and both sides want to explore relief from its "meat axe" approach out of fear that it will halt the economic recovery in its tracks. But Republicans want to lift only defense spending caps whereas Obama insists that defense increases be matched dollar-for-dollar with help for other discretionary items.

In every one of these differences sensible people can see opportunity for compromise but instead are met with the stalemate of entrenched positions. Failure to deal with reality has turned the budget exercise into an annual charade which results in Congress financing the government with "continuing resolutions" rather than considered programs and allocations.

For their part, Democrats will not consider — to the point of avoiding the subject altogether — any modifications to Social Security or Medicare despite their being unsustainable at present rates. There was no mention of entitlements in Obama's State of the Union, nor any proposed modifications in his budget, nor any movement toward dealing with Social Security going negative in 2017. Beginning that year, what it pays out will exceed what it takes in and the difference must be paid out of general tax revenues.

So-called entitlements — expenses made mandatory by law (until the law is changed) — will put the squeeze on all other spending. Obama's own budget shows discretionary spending (which includes defense) falling between 2015 and 2025 from 6.5% of GDP to 5.1%, the lowest level since 1962 (the first year in which such data were reported). Non-defense discretionary spending dwindles from 3.1% of GDP to a mere 2.2%. By 2025 Medicaid spending will be $567 billion compared to $301 billion in 2014, mostly due to Obamacare. By not dealing with elephantine entitlements, Obama undercuts the very proposals he is making. Columnist William Galston of The Wall Street Journal calls it "a slow-motion reordering of the nation's priorities".

Republicans speak continuously of "growth" but without specifics of how to achieve that growth other than to cut taxes still further, reduce regulations that are never particularized, and leave it to the free market to perform its miracles. Obama is pursuing “the wrong priorities…instead of helping to grow the economy and helping to grow opportunities for middle-class families” was House Speaker John Boehner's reaction to the President's budget. Presidential candidate in waiting Jeb Bush is already citing the catechism of "growth above all" — a goal of 4% a year but only "broad outlines" of how to get there. Any tax increase "destroys jobs". Increasing the capital gains tax "could harm business expansion and job creation". Never mind any evidence to back that up.

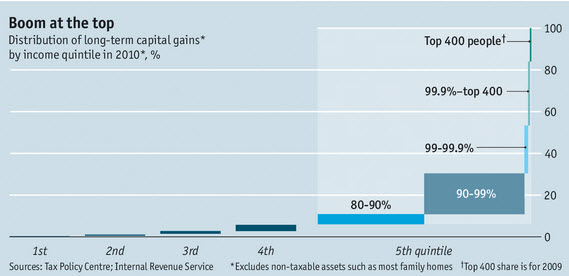

Spend a few moments with this table from The Economist and you will see that 70% of all capital gains go to a mere 1% of the population.

To pretend that the 1% is busily using the money to create jobs (rather than just trading securities amongst themselves) — or even to say that our economy is so feeble that it depends so heavily on just 1% to create jobs — is to reveal the lie that raising the capital gains tax would destroy jobs.

And lies there are aplenty in this never-ending failure to come to agreement and move the country forward. Just as many fortify their opinions from reading the editorial and op-ed pages of The New York Times, so do others solidify theirs from The Wall Street Journal, so it matters what they say.

Obama's budget is greeted effusively in a Times editorial, but about taxing non-repatriated funds held abroad by multinationals, neither "tax" nor "foreign profits" are mentioned; they are called "greater contributions from corporate America". The added taxes on "those atop the wealth ladder" would also be "contributions". He does indeed deal with the problems of Social Security, says the Times, by his budget's assuming passage of immigration reform, "essential to the financial health of the Social Security system".

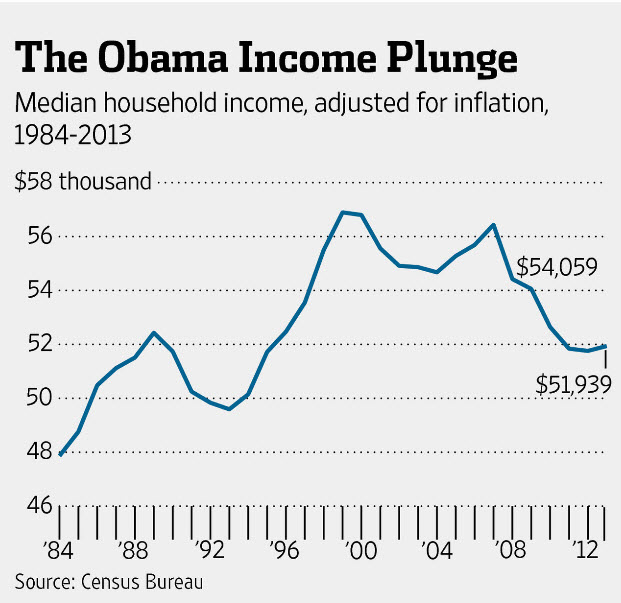

The Times choice of words amounts only to shading whereas honesty is cast aside in The Wall Street Journal's editorial writers' reaction to the President's idealistic plans for a middle-class rescue. The wide divide in incomes in America have long been an Obama meme yet readers are told that, "The President has suddenly discovered that middle-class incomes have plunged on his watch" and it is Obama's "policies that have done so much to reduce middle-class incomes".

How's that again? Obama caused incomes to drop? Are they maybe talking not about income but the added cost of health insurance for those who do not qualify for subsidies? Rather, it turns out they are referring to this chart

accompanying their editorial. They want their readers to believe that the plunge in incomes caused by the economic crash — which occurred in September of 2008, before Obama was president, before he was even elected — and the Great Recession that resulted, were somehow his doing.

That brings to mind the other standard agitprop, that Obama has added more to the national debt than all other presidents combined. When Sean Hannity of Fox News recited that a while back, the program's liberal foil Juan Williams objected that Hannity was blaming the President for the fallout from the 2008 crash; government revenues had plunged due to job losses in the millions. Hannity's response was, "Oh, c'mon. That again, Juan?"

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.