The Deficit Soars, the Debt Balloons, So Let’s Cut Taxes Again

Trump wants to make that a second term promise Mar 2 2020We've kept this outdated article on the page as a reminder of what life was just recently but now seems quaint considering how the deficit is not about to balloon but rather to explode.

In his State of the Union address, the president celebrated the economy with exuberance:

"In just over two years since the election, we have launched an unprecedented economic boom — a boom that has rarely been seen before. There’s been nothing like it… The U.S. economy is growing almost twice as fast today as when I took office. And we are considered, far and away, the hottest economy anywhere in the world. Not even close."

Hyperbole and "twice as fast" falsehood aside, the economy is indeed flourishing. Unemployment is near an historic low with millions of jobs created, wages of the

lower-paid have finally been rising, inflation remains tamed. Mr. Trump is in the habit of taking all credit but the boom arrived at the culmination of a long and continuous upward trajectory from the deepest dive we've seen in our lifetimes dubbed the Great Recession. For his part, he did give the economy an added boost by signing the Tax Cuts and Jobs Act of 2017 that slashed corporate taxes from 35% to 21% and left the public with a bit more money after withholding's bite of their paychecks.

But he did so at a great cost that went unmentioned in his speech. Days earlier the Treasury Department announced that the deficit for calendar year 2019 had topped $1 trillion for the first time since the 2008 economic collapse, a plunge that brought unemployment of 9.9% at the outset, followed by an economy of part-time "gigs" and minimum wage paychecks that crippled government revenues. Government revenue in 2009 was only $2.1 trillion compared to $3.44 trillion last year.

Compared to those years, how could a $1 trillion deficit happen at a time of 3.6% unemployment, rising wages, a soaring stock market? A trillion-dollar-plus deficit will be the case this year as well, says the Congressional Budget Office, and will continue for several years. Worse, the CBO forecasts that if nothing is changed, in less than 10 years the U.S. will begin running deficits closer to $2 trillion. Nt to worry, says this president:

“I’m the king of debt. I’m great with debt. Nobody knows debt better than me. I’ve made a fortune by using debt and if things don’t work out I renegotiate the debt. I mean, that’s a smart thing, not a stupid thing.”

How do you renegotiate debt with the United States government?

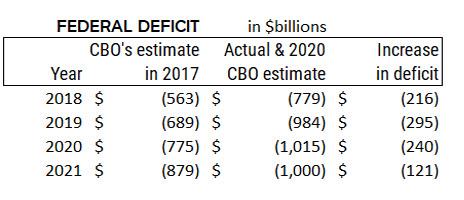

The increased deficit owes to the 2017 tax cuts, slated to cost $1.5 trillion in lost revenue over 10 years, and a whopping $1.4 trillion bipartisan, months-late spending bill rushed to completion to avoid a government shutdown in December. Some would add the rising costs of Social Security and Medicare, but these costs are demographic, known from far off, and built into the original CBO estimate of the 2020 deficit made in 2017 before the tax cuts. Seen in the table, that number was a deficit of $775 against today's post-tax cut estimate of $1.015 trillion:

Laffer Lore

But weren't the tax cuts supposed to pay for themselves? The architects of the Trump administration tax plan said they would. That has been the Republican incantation ever since economist Arthur Laffer sold the idea to Ronald Reagan. Tax cuts would generate enough growth that taxes on higher wages paid to more jobs would exceed the forgone revenue of the tax cuts.

Even though it has never proved true, it is a useful fantasy for selling costly tax cuts to a gullible public. Treasury Secretary Steve Mnuchin has been the standard bearer for this administration. Arguing for the tax cuts in 2017 he had said, “The plan will pay for itself with growth.” As recently as a year ago he claimed that if growth could be sustained at 3% a year, the entire "revenue hole would be filled". And not just filled. "This plan will cut down the deficits by a trillion dollars", he had earlier said. He seemed to be channeling Donald Trump who had on several occasions boasted of balancing the budget. “We can balance the budget very quickly …I think over a five-year period", Trump said to Sean Hannity of Fox News in January, 2016, and that April he went on to tell The Washington Post that he would get rid of the national debt “over a period of eight years”. “I’ll stick with my projections that the tax deal will pay for itself,” Mnuchin just said at the World Economic Forum in Davos, Switzerland.

For proof, just look at federal revenue. It has risen from year to year not just despite the tax cuts but because of the tax cuts, say believers on the Right. For example, revenues for 2019 were $3.44 trillion versus $3.33 trillion for 2018. Those on the Left and the economist fraternity say that the measure should be taken against revenues that were expected had there been no tax cut. In 2017, the last year before the tax bill, the CBO estimated that revenues for 2019 would be $3.69 trillion. But then the tax cuts were enacted and the actual government take proved to be the $3.44 trillion mentioned — a shortfall of $250 billion. So, no, the cuts aren't paying for themselves. But the myth won't die.

We're not ChinaAnother failing of a principle objective for Mr. Trump was growing the economy. The results have disappointed him. In the fall of 2017, contemplating the effect of the tax cut bill about to go through Congress, he thought 3% growth per year would be the minimum, but "I don't see why we don't go to 4%, 5%, even 6%" growth. He did see an average of about 3% in a burst for four quarters bracketing 2017-18 and a 3.1% first quarter last year, but 2019 ended at 2.3% for the whole year after averaging 2.1% for the last three months of 2019.

That's the 2% range economists and the CBO had forecast for years to come. The economy is already operating at a high level and demographics are against heady growth with the population growing more slowly and an increasing percentage shuffling into the retirement years. For this mammoth economy to grow at 2% every year compounded is quite stunning. Shouldn't the emphasis shift to how well the average citizen is doing?

Trump always needs to assign blame, so he has pointed to Boeing's 737 Max problems and severe storms for holding back the economy, as if he was owed trouble-free clear. He makes no mention of the depressing effect of his tariff wars.

But mostly he blames the Federal Reserve. "Had we not done the big raise on interest, I think we would have been close to 4%". He was referring to rate increases between 2015 and 2018. But the Fed dropped rates three times last year to the current rate of a mere 1.75%. Still too high, says the president, who has spoken favorably of negative interest rates, where financial institutions charge us for parking our savings.

The New York Times asked Evercore ISI, an investment advisory, about the president's complaint. An economist there said that, absent the 2015 to 2018 period of interest increases, 2019 growth might have been 1% or so higher to 3%, but so might the trade wars have brought growth 1% lower. So 2% it is, Mr. Trump's arguments notwithstanding.

The president is now proposing a $4.8 trillion budget for fiscal 2021 (begins October 1) that, based on the rosy assumption of 3% growth every year with nary a recession, will go on to balance the budget by 2035. That assumption leads to revenue over the next decade that is 7% higher than the CBO's projection even though the Trump budget assumes that he and Congress will make the 2017 tax cuts permanent, reducing revenue, whereas the CBO expects all 2017 tax cuts will expire in 2025 according to "current law", boosting revenue. Straighten out this conflict in assumptions, and the 7% grows worse.

But to keep the 2021 deficit slightly under $1 trillion the Trump budget takes the ax to funding for a number of government departments. Commerce would get 37.3% less, Energy 28.7% less, Environmental Protection 26.5%, etc. he is finally going back on his oft-repeated campaign pledge not to cut Medicare or Medicaid. This is the Republican playbook: cut taxes, causing the deficit to balloon, then declare that entitlements need to be cut. As the deficit for the calendar (as opposed to fiscal) year looked headed past the $1 trillion mark last fall, sure enough, there was Mitch McConnell calling the red ink "very disturbing" and that cuts needed to be made in "Medicare, Social Security and Medicaid".

Stuck in a hole? Dig deeperWith a peak economy stuck at 2% annual growth and a breathtaking yearly deficit greater than $1 trillion despite only 3.6% of the populace failing to contribute payroll taxes, what does Donald Trump want to do? Hey, it's an election year. Time to buy votes and juice growth again with still more debt. He is promising yet another tax cut once reelected.

There is recognition in the Republican camp that they made a mistake with the 2017 tax reform which Trump incorrectly proclaimed as "massive tax cuts, the biggest in the history of our country”. The tax revisions — mostly benefiting corporations and the wealthy — proved deeply unpopular in polls that showed only about a third of the public approving. In fact, multiple polls showed that a majority of Americans didn't think they had gotten a tax cut at all, despite everyone getting some money in the revised tax rates for individuals. People became aware that cutting the top bracket from 39.6% to 37% handed the rich big dollar windfalls whereas the dollar amounts for the middle class were modest.

Republicans would need to win back the House, presumably on the coattails of a Bernie Sanders drubbing. Democrats would block any tax cut. But once again they would be increasing debt to cut taxes whereas they would never vote to spend that same money on the forever postponed repair of the nation's infrastructure. As indicator, Trump's budget cuts the Corp of Engineers a whopping 22%.

This time the plan is to give the top brackets no further cuts while awarding the big cuts to the middle class. That portends another big jump for the annual deficit because the Trump budget doesn't provide for this planned tax cut in his second term. But here's a thought that doesn't stand a chance: don't just leave in place the 2017 cuts for the top brackets. Roll them back and use the revenue increase to pay for the middle class cuts.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.