Biden Wants a $15 an Hour Minimum Wage. Good Idea?

With Republicans in control of the Senate for the last six years, and Mitch McConnell thwarting its consideration, raising the national minimum wage ceased to be a topic. That has left the minimum stranded at $7.25 since 2009, equating to less than $15,000 for a year of 40-hour work weeks. That’s anyone’s definition of poverty level. Update: Feb. 27:

Behind the move in the midst of a pandemic is the strong sentiment that the true heroes, those who have worked in public places with high contact, caregivers to the old, supermarket workers supplying us with food, are to be rewarded with higher wages in an economy that rewards so many with outlandish incomes. consequences

But then a week into February, the Congressional Budget Office came up with an analysis of the wage hike’s effect on jobs and the budget . Headlines ran with the CBO’s conclusion that while Biden’s plan would “lift 900,000 out of poverty”, some “1.4 million would lose their jobs” and “cost taxpayers $54 billion across 10 years”.

This page has pressed for a minimum wage increase several times, paying greater attention to the CBO’s belief that 1 in 10 workers — 17 million in all, measured against those 1.4 million — would see their incomes rise. As would another 10 million, their pay pushed upward by the increases to those at the pay grade below them. Put another way, those who would keep the minimum the same to protect the 1.4 million from being furloughed would be holding back 27 million people from an economic improvement in their lives. What to do about the 1.4 million predicted to lose their jobs? Didn’t the Trump administration initiate an apprenticeship program that we never hear about? If such a program were made an option, the cohort displaced by unaffordable wages could wind up with a better future than the low-pay jobs they lost. A big question is whether the CBO’s job loss projection is overstated. Staff economists at a government agency are obliged to follow economic orthodoxy which has its own Newtonian 3rd law of motion: When the chalk line on the blackboard labeled “wages” goes up, the equal and opposite reaction makes the chalk line labeled “jobs” go down. So they must formulaically assume job losses. But there have been a number of studies and actual cases that show the losses to be modest. There was the sudden jump to a $15 an hour minimum in the city of SeaTac (between Seattle and Tacoma) in 2015 that caused few layoffs, for example. There was the oft-cited study by David Card and Alan Kreuger, economists with roots in Princeton who compared the job market in adjacent counties of two adjacent states (Pennsylvania and New Jersey) after one state had raised the minimum while the other had not and found their job-loss differences negligible. Arindrajit Dube, once a kid flipping burgers at a Seattle McDonald’s in 1989, took that approach further from his perch as an economist at the University of Massachusetts at Amherst. He compared wage changes in all side-by-side counties in adjacent states in the country and concludes about job loss, “My reading of the evidence is that those risks are probably not very high”. Questions for the CBO

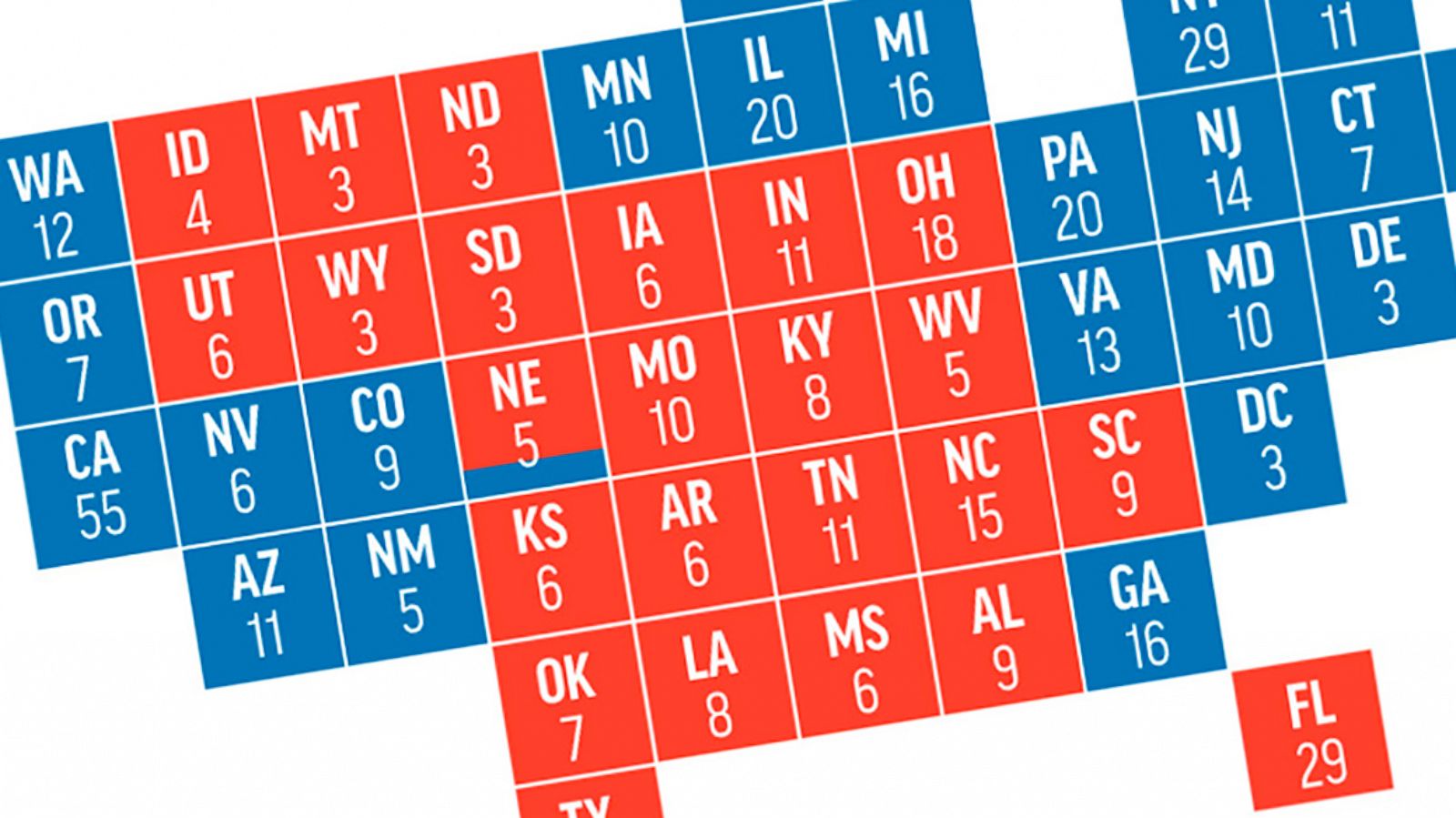

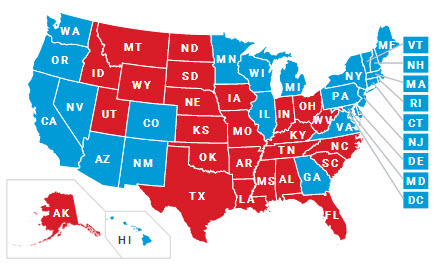

The news accounts of the CBO report don’t show evidence that the writers actually read the report. For the first time, the Office has introduced “behavioral effects” into its assumptions, “behaviors among businesses and people that result in changes in relative prices, the distribution of income, employment, and other economic factors.” The effects that higher wages bring about ripple across “a broad set of federal programs” and the report gives the impression that they pin blame for the $54 billion added cost on the minimum wage increase although the costs arise from the rules of those programs. Some direct effects are obvious: higher wages mean increased government revenue from payroll taxes, and reduced costs from fewer people qualifying for food assistance. But the report tracks through every cranny of government looking for every butterfly wing beat and its knock on effect. Social Security, for example. An increase in the minimum wage would lead some workers with serious health conditions to claim disability benefits, so thinks the CBO, so their disability benefits are folded in. So is an assumption that some older workers would claim retirement benefits earlier. And then this: A higher minimum wage would cause Social Security benefits across the board to rise, because… “initial benefits are indexed to economy wide average wages, which would be boosted by a higher minimum wage. Average benefits would also increase because raising the minimum wage would increase inflation, in CBO’s assessment, which would in turn boost annual cost-of-living increases in Social Security benefits.” Thus does the report throws the book at the wage increase. Most puzzling, there is not a single mention in its text or tables that so many states have been raising their minimum wage for years. Only 21 states still have not budged from the federal $7.25 an hour. Seven — such as California, Massachusetts, and Florida — are on the way to the full $15 an hour. On the 1st of this new year, 20 states and 32 cities and counties raised their minimum wage, most having done so for several years, and 27 of them headed for $15 an hour. Does no mention of the states strides in taking the minimum wage into their own hands mean the CBO’s calculations use the federal $7.25 an hour with no regard that half the country decoupled from the federal minimum years ago, meaning so many of the CBO’s assumed costs are already behind us? The report is utterly silent on the point. Moreover, across the several years of these state and city wage increases, did we hear that they brought about severe job losses? To the contrary, we reached the lowest unemployment percentage in memory. benefits

One assumption we can make is that every dime added to the paychecks of low-wage workers will be spent, which should be an attractant to Republicans who always seek growth in the economy. Higher wages are not just pure cost, a number of businesses have found. They can increase worker loyalty, morale and effort, reducing turnover and therefore training costs of replacements. So we have seen Costco, Amazon, and Target raise their starting wage to $15 an hour. Lower wages make for resentment, productivity slow downs, absentee problems and quitting. And those who take the job and shove it tend to be the most productive, according to one study. roadblocks

The president wants to tack the $15 an hour minimum wage onto his proposed $1.9 trillion pandemic relief bill. Republicans propose only $618 billion and, more concerned for small businesses than their employees, think raising the minimum in the midst of a recessionary pandemic would be catastrophic.

Legislation that has a budgetary impact cannot be filibustered in the Senate, a hurdle that can only be surmounted by a 60 votes or higher. The relief bill surely has budgetary consequences and needs only a majority vote for passage under the so-called “reconciliation” rule.

Republicans argue that Biden’s minimum wage proposal is out of bounds, that it’s not a budgetary measure because the business sector pays for it. Democrats are trying to make the case that, because higher wages would result in higher payroll tax income and a mix of higher and lower governmental costs, it has a budgetary impact. That puts the issue in the hands of the Senate parliamentarian to decide. But even if the parliamentarian agrees with the Democrats, they may be short two votes. West Virginia’s Joe Manchin doesn’t like $15 an hour nor does Arizona’s Kyrsten Sinema. Manchin’s state’s minimum wage is $8.75 an hour and, as The Wall Street Journal pointed out, the median wage in his state is barely higher at $16.31 than the proposed $15. So maybe once again the federal minimum wage will stay at a level that hasn’t changed in a dozen years. There are many states like West Virginia, and Manchin’s dilemma brings up the wider point that, as a Journal editorial put it, the nationally imposed $15 an hour “would mean imposing the urban labor costs of San Francisco and Manhattan on every out-of-the-way gas station in rural America”. The U.S. economy differs by region and the concern is that doubling the wage floor would lead to prices in those locales that people could no longer afford. A few years ago, the editorial crew at the Journal huffed that it was, Hard… to understand why so many of our media brethren have been persuaded that suddenly it’s the job of America’s burger joints to provide everyone with with good pay and benefits. Why shouldn’t it be? As Biden said, “No one should work 40 hours a week and live below the poverty wage”. An employer usurps workers’ time, all the time that they are able to give to work, time that may be all they have to sell. When employers pay too little for that time for employees to make their way in life, their workers are forced to apply for assistance — food, Medicaid, housing, child care — from state and federal governments, which is to say, we taxpayers. The public is made to subsidize business models that don’t work financially were they to be required to pay a living wage. So, as for those burger joints, it seems to be national policy to keep the price of fast foods low by shifting much of the cost into public assistance programs where the rest of us get to pick up the tab.

The Senate’s parliamentarian has ruled that the minimum wage increase cannot be a part of Biden’s proposed $1.9 trillion relief act if the “reconciliation” rule is to be used for its passage by a filibuster-proof simple majority. That leaves the question of whether Biden will pursue a minimum wage increase and of a lower amount for it to possibly surmount a Republican filibuster.

Senate control has shifted and President Biden is passionate to raise the minimum to $15 an hour. Not all at once. He proposes a schedule of incremental increases across the next five years, with the minimum indexed to the median wage of all workers thereafter. That corrects a failure of the current law. Its fixed minimum has seen the buying power of $7.25 slip to only $5.66 even with mild inflation.

The Fight for $15 movement began in 2012

when two hundred fast-food workers walked

off the job to demand $15 an hour and union

rights in New York City. They are now a

global movement in over 300 cities on six

continents in support of underpaid workers

of every sort.