Can the U.S. Navy Win in a War Against China’s?

< military|218|40|>

A war with China would be a naval war, and the United States Navy is not at all prepared. Long assuming our invulnerability as a navy centered on aircraft carrier strike groups while the nature of warfare changes, we have watched China rapidly develop a navy of far more ships equipped with advanced weaponry that has surpassed our own.

Compounding this mounting disparity, our navy has been plagued by mishaps. Two years ago a fire aboard the USS Bonhomme Richard, a ship designed to land amphibious Marine assaults, burned for five days, so destroying the ship that the Navy decided to decommission it for scrap. The captain of the carrier USS Theodore Roosevelt was relieved

USS Theodore Roosevelt entering port at Da Nang, Vietnam.

of command for disputing Navy command’s reluctance to evacuate the ship when a Covid-19 outbreak at sea in the spring of 2020 sickened a thousand of the 4,800 crew members and led to one death.

In June 2017, the destroyer USS Fitzgerald collided with a commercial vessel near Japan, killing seven U.S. sailors. Two months later, USS John S. McCain collided with a commercial vessel near Singapore, killing 10 American sailors. And there had been other less serious collisions earlier that year that damaged two Navy cruisers.

These occurrences led Sen. Tom Cotton of Arkansas together with three House representatives to commission a report just released by Marine Lt. Gen. Robert Schmidle and Rear Adm. Mark Montgomery on the “Fighting Culture” of the surface fleet. Based on interviews with 77 active and retired service members of all ranks, it looked for underlying problems affecting performance and came up primarily with an insufficient focus on warfare officer training, a preoccupation with micromanagement, and zero tolerance of one-off errors that remove valuable officers discarding their years of experience. Former Secretary of the Navy John Lehman cited a few of the victorious admirals of World War II. “Nimitz put his first command on the rocks,” Lehman told them, “and Halsey was constantly getting into trouble for bending the rules or drinking too much…Ernie King was a womanizer and a heavy drinker”. None would have made it to the rank of captain in today’s Navy.

“But in each case, there was a critical mass of leadership in the Navy that recognized that these were very, very promising junior officers. And so, while they were punished for mistakes, they were kept in a career path. That’s not the case today. It’s just not done because it’s too dangerous for anybody that tries to help someone who has made a mistake.”

stretched thin

The accidents of 2017 brought to the surface other factors affecting performance. Of the 297 ships that make up the fleet, the Navy keeps up the pace of 100 ships always overseas around the world, the same number as during the Cold War when the Navy peaked at 594 ships in 1987 under Reagan. “The Navy is predisposed to say ‘yes,’ primarily because they see forward presence as central to their conception of what the Navy provides this nation,” said Robert Work, a retired Marine Corps officer who has served as deputy defense secretary and Navy undersecretary.

Before the Cotton report, interviews in 2020 with crews on ships based in Japan assessed that their commanding officer was unable to say ‘no’. Vice Adm. Joseph Aucoin, who commanded the Seventh Fleet during the collisions, wrote that he had “made clear” to his superiors “the impact of increased operational demand on training and maintenance well prior” to the accidents. Despite “explicitly stated concerns,” he wrote, “the direction we received was to execute the mission”. He was fired shortly after the accidents.

The Navy fired Capt. David Adams after his submarine ran aground in Florida, resulting in $1 million in damage. He had warned his superiors that his crew was too inexperienced to handle a predawn return to port, but was told to perform the mission nonetheless.

This has the Navy trying to do too much with too little, with shortcomings the result. Sailors arrive at their ships with too little training, lacking skills in the basics of sea navigation, and are then worked an average of 108 hours a week instead of the Navy’s standard 80-hours. When in port, the Navy has traditionally put its sailors through 3-to-5 week courses to teach them the seafaring skills that have made it the world’s best navy, yet a General Accounting Office report in 2018 said that the Japan-based Seventh Fleet had “no dedicated training periods”, and that warfare-training certifications of more than a third of its ships had expired. Overlong deployments wear on fatigued sailors who spend a year at sea in some cases. Aircraft carriers have recently been overworked with back-to-back “double pump” deployments. Maintenance is deferred or eliminated.

“I guarantee you every unit in the Navy is up to speed on their diversity training,” said one recently retired senior enlisted leader quoted in the Cotton report. “I’m sorry that I can’t say the same of their ship-handling training.”

outnumbered

At less than 300 ships, how will the U.S. Navy combat China, which already boasts a 350-ship fleet and is poised to build more at a stunning rate? Donald Trump promised a 355-ship Navy when campaigning in 2016, a promise quickly forgotten. Instead, procurement averaged eight ships a year, which is only the replacement rate for the 30-35 year expected life of the Navy’s ships. “Look, I accomplished the military,” Mr. Trump said obscurely at one point, but force expansion of the Navy did not happen. As if suddenly making good on his pledge, his administration spent some of its last days in office planning for that 355-ship goal, leaving the job to President Biden.

Prospects under Biden so far appear to be no better. He is preoccupied with infrastructure, social programs, and withdrawing from Afghanistan. His fiscal 2022 budget calls for $211.7 billion for the Navy and Marine Corps, a 1.8% increase from 2021, but asks $22.6 billion for shipbuilding, a decrease of $700 million.

“China ‘crost the Bay!”

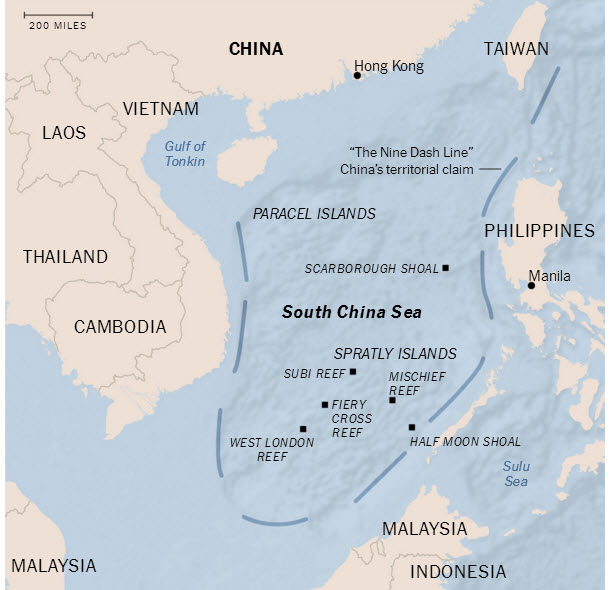

With the coming of Xi Jinping, China abandoned the “peaceful rise” disguise of former leader Hu Jintao and adopted a policy of open belligerence, defying international rules of the oceans by declaring ownership of the South China Sea. First drawn in 1947 and revealing China’s long-held secret designs, a “nine-dash” line had appeared on clandestine Chinese maps unseen by the West, a line that rings the sea from Vietnam to the Philippines and

South China Sea map showing the

nine-dash line ringing China’s claims.

Indonesia, embracing the island of Taiwan, and on to just west of Japan’s Okinawa in the Senkaku Islands. Half a dozen nations surround the Sea and lay claim to one or another sector, but China claimed as its own the rocks, reefs and shoals long in dispute, and began turning them into islands.

In reaction, the United States and other nations began periodically sailing through the South China Sea as proclamation of the freedom of navigation of the world’s oceans. The Sea holds a strategic importance that cannot be exaggerated. A third of the world’s shipping passes through it, the sea floor covers extensive deposits of oil and gas, and its fisheries feed millions in Southeast Asia. For China, two-thirds of its maritime trade and four-fifths of its oil imports pass through these waters, which they view as a vulnerability were the Sea to be left to other navies to patrol.

In 2015, Xi Jinping stood beside President Barack Obama in the Rose Garden and pledged that these newly-created islands would not be militarized. He promptly broke the pledge, saying it was a security matter caused by the temerity of the U.S. not staying out of the South China Sea. In 2016 an international arbitration tribunal in the Hague, Netherlands, ruled that atolls and reefs do not confer territorial rights, that China’s claim to those waters has no legal basis, and that China had violated the 1982 United Nations Convention on the Law of the Sea Treaty to which Beijing is a party. The U.S. never signed, but on the fourth anniversary of that ruling, the U.S. formally declared its concurrence for the first time, with Secretary of State Mike Pompeo calling Beijing’s actions “completely unlawful”. On the fifth anniversary days ago, his successor Antony Blinken reaffirmed the Trump policy, castigating China for continuing “to coerce and intimidate Southeast Asian coastal states, threatening freedom of navigation in this critical global throughway”.

China ignored the 2016 verdict. President Xi warned Marine four-star and Trump’s first defense secretary Gen. Jim Mattis on his visit to China that Beijing would not yield “even one inch” of territory it claims as its own; Xi’s policy is to declare as its own territory that does not belong to China. Under his rule China went on to turn shoals into artificial islands and fit them out with army barracks, radar installations, missile launchers, and airstrips capable of handling aircraft from fighter jets to heavy-lift cargo transports. Beijing has even mapped the areas as administrative districts encompassing the Spratly and Paracel islands and created the imaginary city of Sansha to govern them. China accomplished this with extreme rapidity while the U.S. only watched it happen.

confrontations

There has been a steady procession of incidents. A year ago April, Vietnam accused a Chinese patrol ship of ramming and sinking a Vietnamese fishing boat near the Paracel islands. That June, another was rammed in the same zone by a Chinese ship. During the same period a Malaysian drillship was harassed near Borneo. American and Australian warships came to its relief. Chinese boats protected by the coastguard have been fishing in Indonesian waters. To drive off Philippine boats and deprive them of their catch, swarms of Chinese fishing vessels band together as a “maritime militia” near Thitu, an island in the Spratly archipelago controlled by the Philippines but now claimed by China. Beijing clearly thinks that steady pressure will over time drive all others out with China having the Sea entirely to itself.

For its part, the U.S. and other nations conduct one or two destroyer sail-throughs as a way of insisting that, save for the 12-mile limit that extends from China’s shores, the South China Sea is international waters. These are met with Chinese navy or coastguard ships ordering ours over bullhorn to “leave immediately” followed by Beijing denouncing us for “provocative behavior”. Some of the sail-throughs make our point more emphatically as when a year ago two carriers, the USS Ronald Reagan and USS Nimitz, went on station in the South China Sea

USS Ronald Reagan in the South China Sea on the 4th of July 2020.

and launched from their decks hundreds of jet and helicopter flights day and night across the July 4th weekend to project a dramatic display of force.

Taiwan

China is moving closer to annexing Taiwan as its own, much as it has taken over Hong Kong, with the difference that Taiwan would require an invasion. China has upgraded military bases on its

A Chinese warplane flew near Taiwan in September.

southeast coast and deployed its DF-17 missiles there in what could be preparation. “Every rocket-force brigade in Fujian and Guangdong is now fully equipped”, reported Hong Kong’s South China Morning Post. In January, China flew more than two dozen fighters near Taiwan, possibly as a message to America’s new president, and in April, when Biden loosened restrictions on contacts with Taiwan officials, Beijing repeated the sorties, this time entering Taiwan’s airspace and accompanied by a message to Biden not to “play with fire”.

The U.S. withdrew formal ties with the island nation in 1979 in order to establish relations with mainland China, but we are pledged to aid Taiwan if attacked, and a law even calls for us to ensure that Taiwan can defend itself. Abandoning them would be calamitous, especially in the wake of leaving Afghanistan, telling the world that they can no longer count on the U.S. and had best made accommodations with Beijing.

Whether elsewhere in the South China Sea or a move against Taiwan itself, a U.S.-China confrontation is all but certain. Its outcome is anything but certain.

what the navy would be up against

China’s navy is already a formidable opponent. Its newest ships, such as a new class of heavy cruisers, are comparable to modern American ships. Compared to 12 U.S. aircraft carriers, China has only two with a 3rd under construction and a suspected five or six

China’s first aircraft carrier, a reconditioned Russian castoff sold to China by Ukraine.

planned. But the balance shifts asymmetrically in China’s favor in the assumed theater of conflict close to China’s shores in the South and East China Seas. China now has more submarines than the U.S. Its new Type 055 stealth guided missile destroyers, coupled with air defense networks, present a shield against our fighters and bombers from getting through. Its arsenal of anti-ship ballistic missiles known as “carrier killers” is capable of targeting those ships at a distance of up to 2,000 miles. Our Navy doubts the ability of missiles to hit maneuvering ships, but ships are slow, China’s network of radar and satellites grows increasingly sophisticated, and to take the prize of a carrier, China would likely send a swarm of missiles.

The strategy is designed to hold our carriers at a range beyond the reach their aircraft while Chinese forces conduct missions in its local waters such as the invasion of Taiwan that is sure to come. Beijing needs only to make Washington realize that intervention in its region too costly when faced with the decision to risk its carriers and their crews of 5,000. By three years ago our Navy was telling Congress. “China is now capable of controlling the South China Sea in all scenarios short of war with the United States”, Adm. Philip Davidson told the Senate during his confirmation process to head the Indo-Pacific command. “There is no guarantee that the United States would win a future conflict with China”.

Christian Brose was from 2015 to 2018 the staff director of the Senate Armed Services where he worked for Sen. John McCain, is now in private industry, and wrote “The Kill Chain: Defending America in the Future of High-Tech Warfare”. This excerpt, from an opinion piece in The Wall Street Journal of a year ago May, seems to be a dismayingly accurate summation:

“The core problem is that the decades-old assumptions underlying the U.S. military are increasingly obsolete. We have long assumed that no adversary would be able to overmatch us technologically and deny our ability to project military power world-wide. As a result, we have built our force around small numbers of large, expensive, manpower-intensive and hard-to-replace platforms: ships, aircraft, satellites and vehicles. Our political, military and industrial leaders have continuously directed most defense resources to these traditional platforms. And nothing…has altered the demands of our defense establishment for more of the same.”