Republicans Cripple the IRS to Serve the Rich, Starve Government

The Senate has produced a 2,700 page bill to provide roughly $1 trillion for infrastructure improvement across the next 10 years but with only the vaguest notions of how to pay for it, not least because Republicans disallowed inclusion of $80 billion across those years to beef up tax collection by the Internal Revenue Service. That is in keeping with budget cuts across the years despite the IRS being the one government agency that more than pays for itself. Sure enough, the Congressional Budget Office has since estimated that the repayment plan falls short by $250 billion.

After

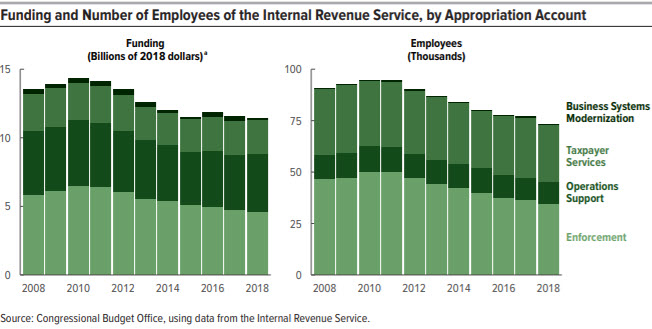

an 11% hike in funding by the Obama administration, money dried up when Republicans won the House in 2010 and the IRS budget has been driven downward in real terms by nearly 15% over the last decade.

The consequences have been dramatic. Since peak in 2010, the agency has had to let 19,000 full-time employees go, with the number of auditors at a low not seen since the 1950s when the country’s population was half its current size. Audit rates have hit a 40-year low declining by 37% for corporations from 2010 to 2018 and by 46% for individuals. The decline was even more drastic for those with incomes over $1 million, their returns being more complex — a 74% drop. The 1 in 90 rate at which returns were scrutinized in 2011 was down to 1 in 161 by 2017 and by 2019 that had become only 1 in 222 returns.

money to be had

The White House estimates that its proposed $80 billion infusion to crack down on tax evasion would yield as much as $700 billion over the coming 10 years. A bipartisan group working on infrastructure was considering a smaller plan of $40 billion with a payoff of $140 billion. Lawrence Summers, economist and former Treasury secretary under Clinton, and associate Natasha Sarin, a University of Pennsylvania professor now hired by Sec. Janis Yellin at Treasury, foresee $1 trillion collected over a decade. These widely divergent estimates tell us that certainty is not available, but doing nothing to equip the IRS to go after taxes that are owed and not paid is a deliberate gift to the rich.

It would be a long process. Thousands of accountants sophisticated in the intricacies of global tax havens, interlocking partnerships and subchapter S corporations must be hired and others trained by the IRS to build back the shrunken agency.

Those on the right scoff. A Wall Street Journal editorial calls it “Mr. Biden’s phony $700 billion bogey” and fret that the “dedicated funding stream” that Biden wants — locked in annual funding across 10 years — would insulate the agency from accountability to Congress and its appropriation power. Given the history, they mean the ability of Republicans to resume IRS budget cutbacks when they regain control of the House. The editors fret that “it makes little sense that millions of Americans are willfully violating the tax code”, but the IRS’s random audit program shows that nearly 15% of taxes are outstanding, resulting in a tax gap of around $600 billion a year. The Journal says the congressional coalition’s claim of “fully paid for” is phony while a sentence away virtually congratulates Republicans for “deep-sixing” the IRS funding that could have filled the hole because that money, you see, was not to ferret out tax cheats but “to harass small businesses”.

There are literally millions of corporations that people have formed that “pass-through” engineered amounts of income to their personal returns. A National Bureau of Economic Research study estimates that 20% of pass-through business income is under-reported.

At the top, the 0.5% of the highest-earning Americans account for about a fifth of the tax gap, a University of Michigan study concluded. Income of ordinary workers is reported directly to the government, making compliance assured, whereas the wealthy are more likely to have types of income — capital gains on sale of property, rental income, etc. — that is more readily concealed. When they are challenged, the IRS is routinely confronted by accounting firms and lawyers who present sophisticated arguments why what appears to be income is instead something else. It can take years and hundreds of hours to litigate tax disputes. But it pays, and the alternative which the IRS, strapped for funds, cannot help but follow is to allow a certain class of people to cheat at will.

auditing the poor

The straitened budgets of the IRS explain why the service therefore audits little more of the wealthy than those with low incomes. More than 25 million Americans qualify for the Earned Income Tax Credit (EITC). They are paid — using 2019’s figure —

Charts show the persistent decline in funding and therefore personnel over the recent decade.

an average of almost $2,500 each, so the IRS must pump out hundreds of thousands of letters asking for proof of eligibility if tax returns don’t make that clear. Pro Publica, which makes taxes a specialty of its reporting, said that in 2019 the “top 1% of taxpayers by income were audited at a rate of 1.56% while EITC recipients, who typically have annual income under $20,000, were audited at 1.41%”.

Funding that is inadequate to go after those hiding income leads to a regressive system in which low income earners are the ones heavily targeted. Nicolas Kristof of The New York Times tells us that, “The county in all America with the highest audit rate is Humphreys County, Miss., which is poor, rural, and three-quarters black”.

smokescreen

Nothing more clearly shows protection of its wealthy campaign donors than the Republican insistence that IRS funding be removed from the infrastructure bill. There may be debate about how much could be collected by going aggressively after tax cheats, difficult as it can be, but there is no denying that the amount of taxes legally owed but not paid is immense. Summers and Sarin think that over the next decade the IRS will fail to collect $7.5 trillion. Charles Rettig, the current IRS commissioner, a Trump holdover, estimates that the United States is losing about $1 trillion in unpaid taxes every year by crippling his agency. But with their perennial campaign to hobble the IRS, the Republican objective is to keep the audit rate of the wealthy as low as possible.

Excuses are feeble. Like clinging to its Benghazi obsession, the right-wing media still cites a 2013 contretemps with the IRS as justification for not giving the agency the money it needs. An office in Cincinnati that vets non-profits that apply for tax-exempt status was caught screening applications for terms such as “Tea Party” and “patriot” to identify organizations that may be overly political and taxable rather than their stated purpose of being engaged in social welfare. These non-profits were free to conduct their activities in any event; taxation was the only question, and we would argue that they all — left and right — were entirely political and trying to chisel the government with phony social pretexts. Oh, and by the way, the Treasury Department’s inspector general in 2017 found that the Cincinnati office was doing the same to spot left-wing non-profits, screening for words such as “progressive,” “occupy” and “green energy”.

Republicans made a villain out of Lois Lerner, whose position was IRS “director of exempt organizations”. Even though her Cincinnati outpost had nothing to do with the main business of the IRS, Republicans won’t let this go. It serves as their excuse for defunding the IRS which in turn truly punishes the government itself, as well as the rest of we taxpayers left holding the bill, by seriously reducing tax collection.

And now Republicans have acquired a new weapon: the Pro Publica exposé of tax returns of a number of the wealthiest Americans showing that they have been paying little or no taxes. “If the IRS can’t even meet its most fundamental responsibility of keeping its most sensitive information confidential, should the president and Congress even be talking about giving it more power?”, writes one pundit who goes on to mention — there she is again — Lois Lerner.

Fact is, there is no preventing the leak of sensitive information by someone in any agency who has access and is determined to do so. And maybe lack of “more power” is what makes possible the leaks, arising from millions of attempts to infiltrate the IRS’s antiquated computer systems by hackers on the prowl to steal taxpayer data. That correlation is, of course, never mentioned.

“More power” so it can “harass entrepreneurs and pass-through business owners who provide millions of jobs?” is what the IRS would do with funding, writes one columnist, showing how the right-wing wields a leak that exposed the monied-élite to plead for minimal auditing of all in the business class that Republicans bat for. Why? Because facilitating tax evasion results in millions of jobs.

“As we learned in 2013 [Lois again], Democrats have weaponized the IRS as a political tool, and now they want an even more powerful IRS to target their political enemies, just as they did under Obama”, said David McIntosh, president of the Club for Growth. “Their proposal is … just another example of the vicious tactics of the radical socialist left.” We should never be allowed to learn that the very rich pay next to no taxes, is the message. But did you know that in Sweden and Finland, people can find out about anyone else’s tax returns just by making a phone call, and in Norway one can simply look up anyone’s tax information on a government website?

overburdened

As it is, the IRS is asked to do far more than originally conceived. On top of handling tax returns from a steadily expanding population, it has been handed the job of administering a slew of government programs that have nothing to do with collecting taxes. It had to take on enforcement of the Foreign Account Tax Compliance Act and the Affordable Care Act when they became law. It has to manage the EITC as described above because deciding on amounts due and sending millions of checks are based on the income tax returns the IRS receives. It was the IRS that suddenly had to process all three stimulus checks because it has the data — people’s physical addresses, the bank transfer routing codes submitted by everyone who’d ever gotten an electronic refund. This demand landed in the agency’s lap without a thought to workload consequences. So at the end of the current tax season the IRS had a backlog of 35.3 million unprocessed tax returns. And now it falls to the IRS to issue the $250 to $300 payments to all taxpayers with children under 17 in age every month for a year — and possibly for good if the program is extended — because it knows who has child dependents.

All this is somehow managed with legacy information technology that is reportedly among the oldest in the entire federal government. Symptomatic is that, as in the rest of the federal government for the most part, the computer language used is Cobol. Cobol was created more than a half-century ago.

When you make one of the 95 million phone calls (the 2018 count) that Americans make to the IRS each year and are on hold for 41 minutes (2019 average) reserve your rage not for the IRS but for Republicans and their fiscal starvation diet.