Bill Barr and His DOJ: More Corrupt Than We Knew

Trump’s Attorney General Bill Barr has been appearing on Fox News lately, apparently trying to repair his reputation by speaking out against Trump. “I think the whole idea of a special master is a bit of a red herring,” Barr told hosts Sandra Smith and John Roberts. “I think it’s a waste of time.”

He has talked back to those outraged by the FBI’s search of Mar-a-Lago with, “People say this [raid] was unprecedented, but it’s also unprecedented for a president to take all this classified information and put them in a country club”. He scoffed at Trump’s claim that he had exorcised the classification of all the documents no matter their secrecy. Barr told the House January 6 committee Trump’s claims about election fraud were “bulls*t,” “nonsense” and “idiotic”, worrying that Trump had become “detached from reality” about voting machines designed to rig the election.

It’s been quite a turnabout. Before the 2020 election, Barr had gone along with Trump’s imagining that forged ballots would come in from other countries, that the election would be rigged, but he didn’t sign on after the election to the Big Lie. Barr had taken stock and realized that the claim of a stolen election was simply Trump trying to stay in power. On December 1 he told the Associated Press that no significant fraud had been found, earning Trump’s enmity, and three weeks later resigned to be quit of Trump’s chicanery after almost two years supporting all of it.

Barr had been a Trump loyalist, grounded in his outspoken advocacy of a “unitary executive theory”, which holds that the original intent of the Constitution gives all executive authority solely to the president. That certainly appealed to Trump. In what commentators called Barr’s audition for the attorney general job, he had written a 19-page memorandum criticizing former FBI director Robert Mueller’s inquiry as weakening the office of the president and arguing that a president could not be investigated while in office. The FBI probe into possible Trump campaign connections to Russia was for Barr a “travesty”. The FBI operated in “bad faith”, the nation “turned on its head for three years based on a completely bogus narrative that was largely hyped and fanned by a completely irresponsible press”. The Mueller investigation was illegitimate in conception, “a grave injustice” that was “unprecedented in American history.”

Barr had only been on the job for a month when Mueller turned in his team’s report on Russian influence in the 2016 election and Russian contacts with the Trump campaign. Barr sabotaged two years of work by the special counsel by hastily writing a four-page letter to say, weeks before the redacted report would be released to the public, that Mueller found no conspiracy “despite multiple offers from Russia-affiliated individuals to assist the Trump campaign”. President Trump was triumphant. “There was no collusion with Russia”, he declared on the tarmac returning from Mar-a-Lago. “No collusion” and “Complete and total exoneration” became Trump’s mantra, adopted at once and repeated endlessly. Bill Barr was now branded as Trump’s lawyer rather than the nation’s. In March 2020, a federal judge sharply criticized Barr’s characterizations of Mueller’s conclusions.

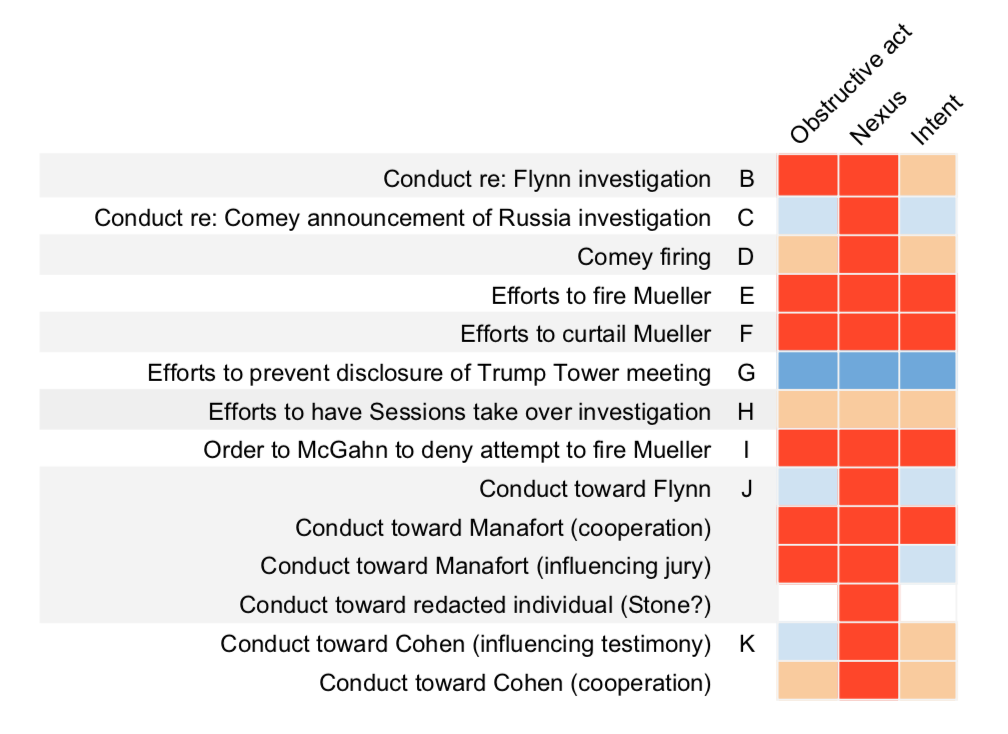

The Mueller report was, of course, nowhere near so easily dismissed. It bluntly stated that “while this report does not conclude that the President committed a crime, it also does not exonerate him.” It found that “the Russian government perceived it would benefit from a Trump presidency and worked to secure that outcome, and that the Campaign expected it would benefit electorally from information stolen and released through Russian efforts”. Moreover, attempts by President Trump to shut down the probe were so many that they made for a second section of the report that, to outline ten instances of obstruction, ran to as many pages as the investigation proper. MAKING OBSTRUCTION GO AWAY

This August, a federal appeals court ruled that the Justice Department could no longer keep secret a legal memo that laid out the reasons for Trump not to be prosecuted for obstruction. It found that Trump’s actions — his attempts to have Mueller fired and to shut down his investigation, the firing of FBI Director James Comey for what the memo acknowledged was Comey’s refusal to publicly state that Trump was not under investigation — none of these actions rose to the level of a crime. The memo said Trump believed the investigation… “cast a cloud on his nascent Administration and that it was being exploited, if not outright conducted, by his political opponents to frustrate his efforts to implement his agenda”. In other words, consideration of possible crimes was to be waived for political reasons. The memo by two senior department officials that recommended no prosecution of Trump is dated March 24, 2019. Barr’s signature accepting the recommendation is dated that same day. And that’s the date of Barr’s four-page letter undercutting Mueller, which in turn is just two days after Barr got the 448-page Mueller report. Which says that Barr and his team had pre-decided to dismiss the report no matter what it said. Neil Katyal was an acting solicitor general in the Obama administration, has argued more than 30 cases before the Supreme Court, and is a professor at Georgetown University Law Center. In a searing opinion piece in The New York Times he laid out just how corrupt this was of Barr. “Opinion” is a misnomer because he explains that Barr violated the Department’s own rules governing independent special counsels. Katyal is an expert because it was he who drafted the special counsel regulations in 1999.

The rules call for the special counsel to decide whether an investigation had revealed crimes. The attorney general may object, but to do so must make the case before Congress. The rule is to prevent partisan political appointees, including the AG, from undermining a special counsel’s investigation. The authors of the memo recommending no prosecution were both political appointees, Steven Engel and Edward O’Callaghan, not career officials at Justice. Instead of calling on the special counsel to make the determination of whether Trump had committed the crime of attempting to obstruct the special counsel’s investigation, Barr ordered up a memo to immediately cut in front of Mueller, an immediately declared it classified to keep it from the public, brought to light only now. “The regulations were written with an untrustworthy president in mind, more so than the problem that Mr. Barr presented, which is an untrustworthy attorney general”, writes Katyal. “But the political appointees in his Justice Department took what was the most important part of that inquiry — the decision of whether [Trump] committed crimes — and grabbed it for themselves.” EXPOSING THE ROT AT BARR’S DOJ

In mid-September, just days after the memo was made public, out came Geoffrey Berman’s book, “Holding the Line”. Hidden from view but now in the open is his recounting of a supposedly independent Justice Department in fact doing Trump’s bidding. Berman was the U.S. Attorney for the Southern District of New York, the most renowned of all DOJ outposts for the mighty it has brought low. “Throughout my tenure as U.S. attorney, Trump`s Justice Department kept demanding that I use my office to aid them politically, and I kept declining in ways just tactful enough to keep me from being fired. I walked this tightrope for 2 1/2 years. Eventually, the rope snapped.”

He leads off with his office receiving an urgent phone call from the same O`Callaghan deputized to shut down Mueller. The SDNY was instructed to bring criminal charges against Gregory Craig, formerly Obama`s White House counsel, for purportedly lobbying for a foreign government. Moreover, Berman was told to bring those charges before Election Day. Tarring a Democrat was thought to help Republicans in their bid to control the House and Senate in the midterm elections just weeks away. Berman had had just prosecuted two Trump loyalists, Republican Congressman Chris Collins and Trump`s private attorney, Michael Cohen, so O’Callaghan’s message was that it`s time for the guys in New York to even things out. Berman refused. “I ignored the edict. But this episode was not a one-off. It was part of a pattern.”

The SDNY was also told to cease all investigative work on Trump’s payoffs to a porn star and a Playboy playmate to keep them quiet about his sexual indulgences before the 2016 election. “Not a single investigative step could be taken, not a single document in our possession could be reviewed”, wrote Berman about O’Callaghan’s edict. Trump’s lawyer Michael Cohen had already been convicted for the campaign finance law felony. To make it go away Barr even tried without success to get SDNY to undo Cohen’s guilty plea. New York was told to slim down the charging document and remove its references to “Individual-1”, who was of course Donald Trump. Michael Cohen often asked in interviews why he was the only one who did time for this crime. Ask Bill Barr. The U.S. attorney in D.C. who had dutifully followed Barr’s order to prosecute Greg Craig? Barr pushed her out so as to bring in his guy, Timothy Shea. Undercutting career persecutors at Main Justice, Barr and Shea brought in a prosecutor from outside the department to review the case of former National Security Adviser Gen. Michael Flynn, who had twice pleaded guilty for lying to the FBI. They installed a clutch of outsiders to review the handling of other politically sensitive matters. They moved to drop the charges and undo Flynn’s two guilty pleas. They ordered that sentences recommended by department prosecutors be cut way back for Trump adviser Roger Stone, who had just been convicted on multiple felonies,. Four line prosecutors quit the Stone case in protest; one left the department for good. Berman could see what was coming. Ultimately Barr told him to resign, even publicly saying that Berman had already resigned. Berman issued a newsworthy statement saying he had not resigned, would not resign. That all cases in hos office would go on unimpaired, that he would have to be fired — setting up what Berman called a “noisy” public exit that prevented Barr from slipping in his own deputy to undo SDNY’s ongoing cases. POLTICAL REVENGE

Barr told Congress he thought “spying on a political campaign is a big deal”, that “I think spying did occur”, and questioned whether the FBI investigation “was adequately predicated”. Just two months after the release of the Mueller Report, Barr unleashed his personal animus against Mueller’s “grave injustice” by starting his own investigation. He tapped John Durham, U.S. attorney for the District of Connecticut, to search for the “origins” of the FBI probe and whether it had broken laws in the investigation the FBI called “Crossfire Hurricane”. Three years later — half again longer than Mueller’s inquiry — Durham has come up with next to nothing. With his grand jury about to expire, there have been a meager three cases: against an FBI attorney for altering an email to help a FISA application go forward, for which he was sentenced to probation and community service; against a lawyer for lying to the FBI that he was not connected to Hillary Clinton’s campaign, for which he was acquitted; and against Igor Danshenko, who was found to be the principal source of Christopher Steele’s bogus dossier, and whose trial for five counts of lying to the FBI begins in October. (Durham will reveal that the FBI hired Danshenko as a paid informant for three years despite his being untrustworthy, which is treated as a “bombshell” at Fox News for reasons unclear. Is it news that the FBI pays informants? Because Danshenko has been linked to Russian intelligence services? Didn’t that make him all the more valuable?) Along the way, Durham was silent but Barr would sully the FBI’s reputation by fabricating that he was “troubled” by what Durham had found when Durham had found nothing. Given all that is coming out about how Barr conducted of the Department of Justice, one comment of his stands out. He said to Congress that he joined the Trump administration because “I became deeply troubled by what I perceived as the increasing use of the criminal justice process as a political weapon”. He certainly put an end to that.

This “heat map” by Quinta Jurecic at lawfareblog.com weighs, where red is flagrant and blue is benign, each Trump action against the three criteria for obstruction.