IRS Struggles to Keep House Republicans from Stealing Funding

Mar 15 2024October’s $106 billion supplemental funding request may be dead in the water in the House, but should $60 billion in assistance for Ukraine go forward, there is a threat which does not get the attention needed to spur outcry.

In a continuation of their decades-long practice of beggaring the Internal Revenue Service, House Republicans passed a bill last fall with $14.3 billion aid to Israel that they would pay for out of the $80 billion allotted to the IRS in 2022’s Inflation Reduction Act. On its own, without Ukraine aid, it went nowhere, but it’s clear that Republicans view the $80 billion as a slush fund to be dipped into for their own purposes. “I love cutting the IRS. I’m here for that,” said Sen. Josh Hawley (R., Mo.). “And if we can cut the IRS and fund Israel doing it, then I think that’s great.”

Last summer, to get Republicans in the House to raise the debt ceiling, President Biden had to agree with House Speaker McCarthy to cut $21.4 billion from the IRS funding: $1.4 billion in the debt ceiling bill itself, and $20 billion repurposed for 2024 and 2025. The Congressional Budget Office estimated that the $20 billion, applied to going after tax cheats, would bring in $44 billion. Thus, by taking the money from the IRS in a move to spare their wealthy donors from having to pay that amount of concealed tax obligations, Republicans will add a net of $24 billion to the national debt. Republican House Speaker Mike Johnson can’t seem to fathom the concept:

“Only in Washington when you cut spending do they call it an increase in the deficit. We don’t put much credence in what the CBO says.”

It's also doubtful that the rube from Louisiana's backwater is aware that the Internal Revenue Service is the one government agency that makes money.

The intent of House Republicans to take still more from the IRS is stunning on its face: hobbling the Service from bringing in a cascade of money to lower the annual deficit, raising the debt instead as the CBO ratio tells us, and sending the money to Israel for them to buy munitions to flatten Gaza and kill thousands more Palestinians. Biden is already in trouble among younger voters who in the primaries opted for “uncommitted” rather than voting for him. Paying still more to Israel – we already, year after year, inexplicably give $3.3 billion to that well-developed economy — might well cost Biden re-election.

thorough overhaulThe $80 billion to the IRS is spread across ten years with the objective of providing them a stable flow of funding to count on that is being used to improve seriously degraded service to taxpayers such as phone support owing to an acute shortage of personnel; to upgrade ancient computer systems; and to go after the wealthiest in search of tax evasion. It’s the last of these goals that Republicans want most to prevent with the threat to mega-dollar election campaign contributions in mind.

From what audit data it has been able to conduct, the IRS estimates that there is a “tax gap” – money owed but dubiously hidden or unreported — that runs to the staggering total of… $600 billion uncollected every year. Before the $20 billion was cut, the White House estimated that the enhanced IRS audit program would bring in $700 billion over the coming decade. The agency, which calculates that every $1 spent on enforcement brings in $6, is more optimistic; it recently estimated that the funding will lead to $851 billion in enforcement collection by 2034.

But that amount over ten years compared to the $600 tax gap every year speaks loudly for how disastrous is a tax code that makes possible such evasion. It is why thousands of accountants sophisticated in the intricacies of global tax havens, interlocking partnerships, and subchapter S corporations had to be hired and others trained by the IRS to revitalize the shrunken agency.

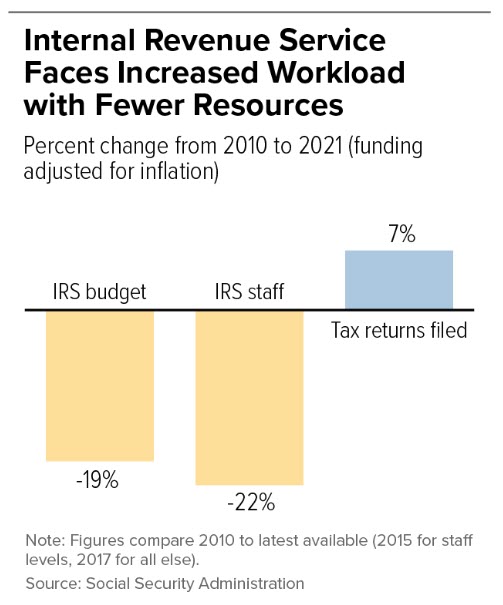

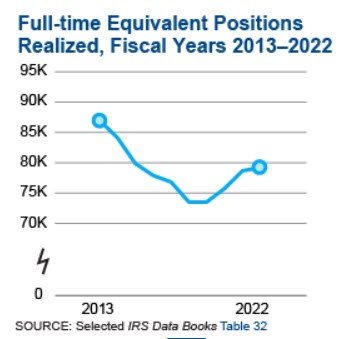

These charts succinctly show why the service has not been able

to go after this stash of taxable income. Across the decade ending in 2021, the IRS budget was cut 19% and body count

consequentially by 22% while the population grew and tax returns along with it. The second chart shows that same staffing drop-off and the up-tick that began with Biden’s Inflation Act funding. A year after the cash infusion, the headcount was at a level not seen in more than a decade.

Congress thinks nothing of burdening the IRS with work extraneous to collecting taxes, and then finds fault with the agency’s inability to do its basic job. With the pandemic raging, the IRS was called upon to mail checks to just about everyone in America — and three times over, two under Trump and once under Biden — a colossal job accomplished despite staff reduced by the virus’s ravages.

But that doesn’t compare to what the employee retention credit (ERC) has foisted upon the agency. In 2020 Congress passed a program of funding businesses to keep paying their employees during the months the pandemic had driven away customers. It was a smart move that, among others, miraculously headed off what could have been a calamitous economic plunge.

But in return, American businesses, having no interest in the ethics called for in a national health crisis, responded with staggering fraud, scrambling for government handouts whether needed or not, whether they did continue paying their employees or not. Outfits sprung up to find businesses and, for fee, encourage them to apply and show them how, not necessarily with scrupulous honesty. The U.S. Government Accountability Office (GAO) estimates that the federal government made $528 billion in improper payments in 2021 and 2022.

What was intended to be a temporary lifeline of $55 billion has so far cost over four times that amount – with far more to come. Astonishingly, Congress left the window wide open for receiving claims years after the pandemic subsided; submission for 2020 ERC finally ends April 15 of this year, but claims for 2021 ERC are still accepted until April 15 of next year.

It has fallen to the IRS to determine who is truly eligible and who is cheating. This is slow going, and the agency is faced with appraising over a million claims, with 3.6 million already processed. New claims keep pouring in while the service works to recover the fraudulent old payouts.

In July the IRS slowed and halted processing of Employee Retention Credit applications received after mid-September due to their complexity and…

"the aggressive and misleading marketing campaigns luring small businesses and organizations that are not eligible into into claiming the ERC."

In December, the agency offered a deal: ERC recipients in doubt of their eligibility could avoid audit if they repaid 80% of the monies they received.

There are hundreds of criminal investigations in the works and thousands of audits to recover money that should not have been awarded. This will take years and for the moment is impacting the fielding of 2023 tax returns and impeding refunds due to taxpayers — all thanks to loosely crafted and irresponsible law writing without a thought to the burden it loads onto the IRS's plate. A bill that cleared the House would at least change the cutoff of application to the January 31st just passed and places a number of restraints on application promoters, but of course the bill has not yet been taken up by the Senate as applications continue to flow in.

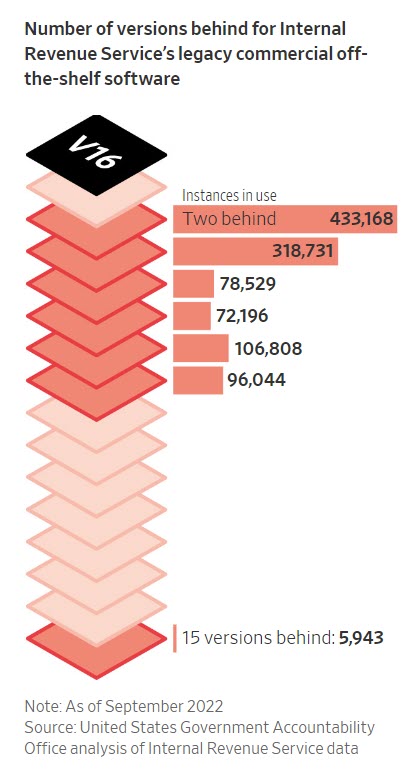

ancient systemsSo many of the additions to staff were for handling taxpayer phone inquiries that owes to the grotesquely tangled tax code dumped on the IRS (and us) by Congress. That makes the $21.4 theft from the $80 billion especially damaging as it crimps the vast need for upgraded computer systems and software. The IRS is audited by the GAO. Some findings (to the surprise of no one at the IRS) that the GAO came up with as reported in The Wall Street Journal:

• There is no single point of access to all the data about your account. “There are 60 different case-management systems throughout the IRS,” said Nina Olson,

the former national taxpayer advocate, “and they don’t all talk to one another.”

• Hundreds of IRS applications have been around for at least 25 years. Dozens are older than 50. There were also pieces of software running 15 updates behind the current version as shown in the illustration that counts the number of instances each version is put to use (timespan not mentioned).

• Even the most important application used by the IRS is written in COBOL, a programming language no longer taught in schools that was created half a century ago.

progress nevertheless• With the added staff afforded by the funding, at taxtime the IRS answered 2.4 million more phone calls with live assistance in 2023 than the year before. Wait time dropped from 27 minutes to 4.

• From forms such as W-2s and 1099s, the agency has identified some 125,000 individuals who appear to be earning more than $400,000 a year, yet did not file tax returns from 2017 and 2021. They are receiving letters telling them to pay up what is expected to bring in hundreds of millions of dollars in taxes, interest, and penalties. The Biden administration's 2022 funding has added the staff needed to deal with these people.

• Democrats want to see tax cheats outed; Republicans want them protected and for smokescreen claim the IRS will just use the money to go after small businesses, which IRS Commissioner Daniel Werfel says is "a myth". So, welcome in the Biden camp was the announcement last September that the service began audits of 75 large hedge funds and real estate firms averaging $10 billion in assets. The IRS used AI to identify them. As the Journal put it, "the tax agency tries to build its case for keeping what is left of a pot of money Congress gave it last year". Werfel said in a briefing with reporters,

"These are complex cases for IRS teams to unpack. The IRS has simply not had enough resources or staffing to address partnerships. In a real sense, we’ve been overwhelmed in this area for years.”

The $20 billion grab hasn't become law yet but is expected to be part of a spending bill this year. In its 2025 budget the White House wants a hoped-for Democratic majority in the House to return the $20 billion that the IRS was counting on.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.