Biden, Trump Deciding What They’ll Do to Your Taxes

Jun 27 2024A fight is brewing over which direction taxes should take. The catalyst is the expiration at the end of 2025 of a number of the tax cuts enacted in 2017 by Congress during the Trump administration. Donald Trump wants the lower rates extended and would push to cut them further. Joe Biden wants the cuts to lapse but only for higher income earners. And with taxes a hot topic again, a raft of nutty ideas has surfaced, which we’ll get to.

Republicans claimed that the 2017 tax cuts would pay for themselves by spurring growth that would bring in at least enough extra tax revenue to cover the void. But even The Wall Street Journal admitted that “a recent study

found it boosted growth but didn’t pay for itself”. In fact, the CBO says the Trump cuts will have added $2 trillion to the national debt.

Democrats decry the Trump cuts for individuals as a handout to the rich with only token tax savings for the middle class.

If Congress does nothing, higher rates will return for individuals and households, the standard deduction will be cut in half, and so will the child tax credit, but in the other direction per-person exemptions will return, and state and local taxes will again be deductible for those who itemize. Almost everyone will find themselves in a higher tax bracket, says Forbes. The Tax Foundation estimates that 62% of households will pay higher taxes, 9% will pay less.

The Congressional Budget Office (CBO) estimates retaining the Trump tax cuts will cost the government $3.4 trillion over the next 10 years. And yet Biden intends to keep his pledge not to raise any taxes on households with incomes less than $400,000. That means that over 95%

of taxpayers will keep the cuts, adding a large slice of that $3.4 trillion to the debt. Biden then imagines he can raise nearly $2 trillion over 10 years by raising taxes on only the wealthy. At best it’s a wash.

getting creativeMr. Trump wants all of his cuts to be extended. Here and there he has said he wants to cut taxes still further.

Here’s one: Make tip income tax-free, he proposed last weekend while campaigning in Nevada. He was pandering to the service workers in a swing state which has many in that job description.

“For those hotel workers and people who get tips, you’re going to be very happy, because when I get into office, we are going to not charge taxes on tips.”

Tips are income, and yet Trump would make those workers a favored class of citizens with tax-free income.

It’s an idea that didn’t deserve to be considered, yet pundits were quick to point out that employers would figure ways to reclassify wages as tips to dodge the added cost of employer-paid withholding taxes. And imagine the coming societal rift caused by the growingly ubiquitous card readers that compel us to choose a tip percentage when it will be to donate our tax-reduced incomes to this newly privileged class.

But why stop there? Trump has been saying that he would impose a 10% tariff on every good coming into this country. He has grown exceptionally fond of tariffs since using them in his first term, even though they failed badly as policy. He repeatedly tells his supporters at his rallies a colossal lie:

"Nobody ever took money out of China like me. I took hundreds of billions of dollars out in the form of tariffs and taxes."

China, of course, paid nothing. Americans paid his hundreds of billions. That’s how tariffs work. Those who import are penalized for doing so by paying the extra tax. Importers recover the cost by inflating prices charged to Americans. We pay the tariffs.

And now, a week ago, Trump lofted the idea of doing away with income taxes entirely and substituting tariffs to finance the government. After all, that’s how the government funded itself originally. Hoist on its history and tradition-minded petard, the originalist Supreme Court could hardly say no.

It is a harebrained idea right up there with drinking bleach as a cure for Covid. It would take a wrecking ball to our economy. Robert Reich, who worked in four administrations and was Bill Clinton’s labor secretary, says that for tariffs to equal the same amount of money raised by taxes, tariffs of 120% to 130% on top of the import value of goods would be required.

It’s a total inversion of progressive taxes. As Washington Post columnist Catherine Rampell noted, there are tens of millions of low-income Americans who, through the standard deduction and other exemptions, owe no taxes, yet they would now be taxed through paying the higher prices of the tariffed items they need. Whereas the rich, whose purchases are but a tiny fraction of their wealth, would see their taxes wiped out altogether.

Economist Lawrence Summers, who was the first to raise the alarm about possible inflation from excessive Covid pandemic relief programs, calls Trump’s tariffs-replacing-taxes idea "the worst macro-economic policy proposal in U.S. history".

The bigger fight: corporate taxesThe Tax and Jobs Act cut the corporate tax rate from 35% to 21%, a whopping 40% reduction, and it does not expire. The 2017 tax bill made it permanent. At the time, the U.S. rate was the fourth highest in the world, exceeded only by the United Arab Emirates, Comoros, and Puerto Rico. Corporations were fleeing the U.S. to domicile in lower tax countries. Republicans point to there being not one migration since the rate reduction.

President Biden wants to roll back Trump's cut by half, raising the tax to 28% which would bring gin $2.7 trillion across 10 years. That would be above the worldwide average statutory corporate income tax rate across 180 jurisdictions of 23.37%.

Trump wants to cut corporate taxes further — from 21% to 20% he told some 80 corporate chiefs who had convened a couple of weeks back as the Business Roundtable. When asked why that number, he allegedly answered: “Well, it’s a round number.” He has also spoken of dropping the rate to 15%.

As it stands, because of the many deductions and exemptions by which corporations can trim their taxes, their effective tax rate declined in 2018, the first year of the Trump tax cut, to only 9% according to the Government Accounting Office. Profits today are at record highs, and yet corporations’ taxes amount to only 1.6% of GDP and provide a meager 8% of government revenue. In stark comparison, income taxes on individuals account for 45%.

Democrats were at least able to pass as part of the Inflation Reduction Act a 15% minimum tax on those corporations whose net income, with numerous adjustments across a three-year period, exceeds $1 billion.

drifting toward the abyssBoth candidates avoid the menacing future. Trump would beggar the government with continuance of his tax cuts and a promise for more. Biden would raise taxes but only on the wealthy and do so not to deal with the annual deficit, but to pay for sweeping new spending programs.

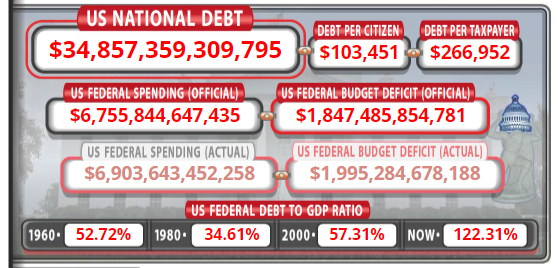

At the same time as their wishes revealed their irresponsibility, the CBO was telling us on the inside pages of newspapers that, even with the Trump tax cuts reversed per existing law, U.S. debt, now at almost $35 trillion, is on pace to top $56 trillion 10 years from now. The government spends a million dollars more than it takes in every 30 seconds.

Dynamic debt clock at usdebtclock.org.

There is no sign of controlling spending by either party. Trump added roughly $8 trillion to the debt, half of it Covid relief. Biden is adding $1.9 trillion to the debt this year alone, $300 billion more than last year, inflated by his student loan cancellations. Deficit borrowing feeds on itself in the form of interest, which is expected to exceed $1 trillion next year, well beyond the $850 billion request for defense.

It’s all a spending problem, says a Journal editorial in reaction to the CBO forecast. Democratic spending, of course. “It’s not because Americans aren’t paying their fair share in taxes”. Really? Three Republican tax cuts in this still young century, and the editorial suggesting what Trump might do for a fourth, have made no contribution to the ballooning debt?

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.