It’s been so long since Americans figured their own income taxes (and no wonder, the instructions for form 1040 have grown to 100 pages — and that’s without forms) that we are unaware of what the tax rates and tax brackets are — and more important, as we go over the cliff — what the tax rates were.

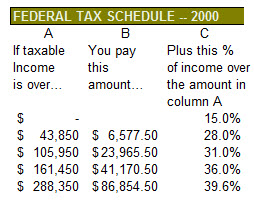

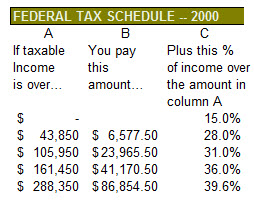

With the sunset of the Bush tax cuts, the income tax bracket schedule reverts to what was in force in 2000. The table shows what we paid then.

The Bush cuts, perpetuated by Obama and Congress these last four years, were severe. They explain a good chunk of the current $1 trillion a year deficits the government has been running up because, as a percentage of the size of the U.S. economy (Gross Domestic Product, or GDP), the low rates have reduced federal revenues from income taxes on individuals to their lowest since 1950. Our personal income taxes came to just 7.3% of GDP last year (and a full percentage point less in the two years prior).

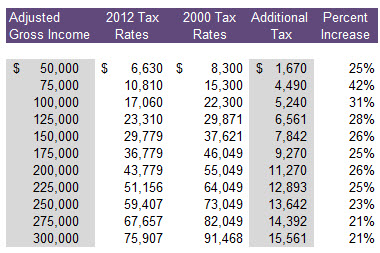

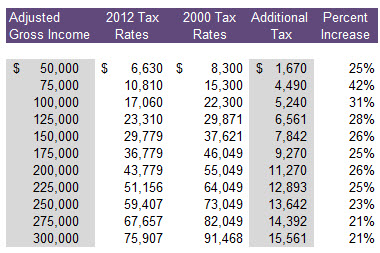

If Congress doesn’t take action and we revert to the year 2000 rates, they will come as more of a shock than people realize. And because the cuts were deepest for the middle class tax brackets back then, that group will experience the steepest increases now. The table shows for each level of adjusted gross income what the rates are for 2012 and what they would be next year if the cuts are allowed to expire.

This assumes that we will revert, literally, to the same schedule as 2000. But the brackets — the cutoff levels that begin each higher percentage — rise every year to adjust for inflation. Will those 2000 thresholds be ratcheted upward, or left the same? No one mentions.

The President is a bit fuzzy on the finer points as well. He wants all the current brackets to stay the same and to raise the rate only for income above $250,000. Except, there is no $250,000 bracket. There’s the $217,450 level, income above which is taxed at 33%; and there’s the $388,350 level, above which the tab is 35%. What exactly does he mean?

It would be nice to know, but politicians don’t concern themselves with details affecting the hundreds of millions of us.

Dec 28 2012 | Posted in

Taxes |

Read More »

Dec 20 2012 | Posted in

Law |

Read More »

National Rifle Association Executive Vice President, Wayne LaPierre, declared this past election “the most dangerous … in our lifetime”. The NRA’s fund-raising promotions said it “could mean the difference between the survival or destruction of our Second Amendment freedoms”.

Their alarm was puzzling. Four years ago the President pledged to fight for renewal of the assault weapons ban, but during his presidency Obama stayed away from the issue. He made a moving statement when Trayvon Martin was killed in February, triggering controversy over the “stand your ground” laws sweeping the nation, but no call to action. When Congresswoman Gabrielle Giffords was shot along with eighteen others in Tucson, six of them killed, he said, “We cannot and will not be passive in the face of such violence”. But passivity followed.

But then came Newtown. The murder of 20 children struck home with the father of two young daughters. Having now announced that changes in gun controls will be a “central issue” of his second term, Obama has committed himself to do battle with the NRA and its backers in Congress and will be reminded of his renewed pledge incessantly if he drifts off the mark.

Who can say whether the passage of months will again — as it always has — erode resolve and see the nation’s leaders drift away from action, if not by the President, then by a Congress that did nothing even when one of their own was shot. The question this time is whether public pressure will be sustained enough to outweigh the gun lobby and its money. The second question is whether gun controls will make any difference.

packing heat

LaPierre’s first move was to propose that there be more guns; he petitioned Congress to appropriate funds for armed guards for every school in the nation.

His NRA has become a formidable force over the decades. Membership has risen from 2.4 million members in 1982 to 4.3 million today, who give it an arsenal of money. They send the organization more than $100 million in dues annually. Corporate sponsors and advertisers in its publications pump in $80 million more. In election years, the NRA spends even more than that — $244 million in 2010 — to make sure beholden lawmakers in Washington and throughout the country win or keep their seats.

Its message that guns equal freedom sits well with the American public. Back in 1959, Gallup found that 60% of us favored a ban on handguns. By 2011 that had

Gun proponents say teachers should be issued firearms as in Israel

dwindled to 26%. Small wonder, considering that over 70 million Americans are estimated to have guns and that there are now 88.8 guns per 100 persons, far in excess of any other country, as this table shows.

The NRA lobbies to expand the freedom to bear arms and vigorously fights any attempts at its curtailment. The most important restriction — the 1994 ban on manufacture of semi-automatic assault weapons and magazines holding more than ten bullets — was allowed by legislators, always fearful of the repercussions of going against the NRA, to expire in 2004. That law prohibited the AR-15, equipped with a 100-bullet magazine, that the shooter in the Aurora, Colorado, movie theater used to kill 12 people and wound 58, a massacre that would have been worse had the gun not jammed.

One after another attempt to put limitations on guns has been thwarted since the Clinton administration, which had enacted a number of restraints. Guns are anathema to cities with their concentrated populations, yet even in New York state a bill was defeated that would have required a unique code to be etched onto a gun’s firing pin to stamp shell casings with the gun’s identity. Massachusetts couldn’t pass a law limiting an individual’s purchase of guns to one a month. Virginia overturned its one-gun-a-month rule.

Instead, rights were enhanced. Every state now permits carrying a concealed weapon of some sort — some with, some without a permit. A dozen states are considering doing away with the need for those permits. Oklahoma became the 25th state to permit “open carry” — guns worn visibly on the person, even in bars. The House of Representatives in 2011 passed a law requiring all states to honor the concealed carry laws of a visitor’s state, irrespective of the states’ own laws. A major step forward for the NRA was the 2005 Protection of Lawful Commerce in Arms Act that blocks any federal law suit that attempts to hold a gun manufacturer liable for bloodshed from the use of its weapons.

the best defense

LaPierre, on the NRA website, says, “It’s time to acknowledge what we know in our hearts to be true, that the best way to stop a bad guy with a gun is a good guy with a gun”. That’s the ready response of those who argue that crimes would be throttled if all were allowed to carry weapons — and in full view, to cause the bad guy to cool his temper and switch the safety back on. What if the teachers in Newtown had guns in their desks and had been trained how to use them? How many lives might have been saved, they ask?

But in other cases, this is a solution that doesn’t work. In Tucson there was a good guy with a gun, but he could do nothing. In a crowd, it was too dangerous for him to fire. Two unarmed people wrestled Jared Loughner to the ground when he stopped to reload. And how many would have died in Aurora if a firefight had broken out in a darkened movie theater?

As to whether renewal of the ban on assault weapons would work, the 1994-2004 law only banned continued manufacture; it did not call for confiscation of guns already in circulation. A University of Pennsylvania study concluded that many loopholes lessened the ban’s effectiveness, not least because there were already 1.5 million assault weapons in circulation and 25 million large-capacity (i.e., more than 10 bullets) magazines. As Washington Post columnist Charles Krauthammer pointed out, “A reservoir that immense can take 100 years to draw down”.

game over?

Even if there are changes around the edges, the NRA has won the war for guns. Even the well-to-the-left magazine The Nation says, “it’s no wonder that gun control has shriveled into a Worthy Cause”. Massachusetts Senator Daniel Patrick Moynihan knew that years ago, pointing out that even if the sale of all new guns were forbidden, there were already guns enough out there to last 200 years. “These mostly simple machines last forever”, Moynihan said. “On the other hand, we have only a three-year supply of ammunition.”

The NRA is imbued with a “slippery slope” mentally which is why they open fire when even sensible steps are proposed. This is why so little stands in the way of a mentally disturbed person equipping himself for a rampage. There is no excuse for assault rifles, other than stored at gun clubs. These are weapons that have no use other than to kill as many people as possible, but the NRA pressures Congress to do nothing. A ban on high-capacity clips and magazines that hold more than a few bullets would at least render a gunman vulnerable while reloading. They are unrestricted. Ammunition can be bought over the Internet; Aurora’s James Holmes had amassed 6,000 rounds that way. Moynihan’s answer was to heavily tax ammunition. “Guns don’t kill people; bullets do”, he said.

That still leaves the gaping “gun show loophole”. Guns can be bought and sold with no waiting period and no background check otherwise required by federal law — and there are some 5,000 of these swapmeets a year across America. Adam Gadahn, an American-born member of Al Qaeda, put out a video that said, “America is absolutely awash with easily obtainable firearms. You can go down to a gun show … and come away with a fully [semi, actually] automatic assault rifle, without a background check, and most likely, without having to show an identification card”. He spurred fellow terrorists to carry out attacks with, “So what are you waiting for?”

It is a “system” so full of such holes that 247 people on the terrorist watch list legally bought guns in 2010. A bill that would prohibit that was defeated along party lines in May 2011. With a Congress like that, why do we have a Department of Homeland Security?

Dec 20 2012 | Posted in

Reform |

Read More »

The interpretation of the Second Amendment of the Constitution that sidesteps the word “militia” to allow everyone to bear arms is fairly recent. The Constitution was preceded by the Articles of Confederation, drafted some ten years earlier in 1776. It didn’t work out, but its language on the subject clearly shows that militias, rather than individuals, were very much the intent, requiring that

“every state shall always keep up a well regulated and disciplined militia, sufficiently armed and accoutred, and shall provide and constantly have ready for use, in public stores, a due number of field pieces and tents, and a proper quantity of arms, ammunition and camp equipage”.

The Constitution that replaced the Articles reduced that intent to ambiguous brevity that we have argued over ever since. It wasn’t until the 1970s that the NRA began the long march that would change a country that had up until then essentially limited weapons. It would be a transformation of the Second Amendment that in 1990 former Chief Justice Warren Burger would denounce on the MacNeil/Lehrer News Hour as “one of the greatest pieces of fraud, I repeat the word ‘fraud,’ on the American public by special-interest groups that I have ever seen in my lifetime”. A few decades on we would see another justice, Antonin Scalia, arrive at the opposite conclusion, that “The Second Amendment protects an individual right to possess a firearm unconnected with service in a militia”.

But that reading of the Second Amendment wasn’t always so. The National Firearms Act of 1934 and a follow-up in 1938 required licensing for gun dealers and banned “machine guns” and their constitutionality was upheld by the Supreme Court in 1939. Solicitor General Robert H. Jackson argued that the Second Amendment is “restricted to the keeping and bearing of arms by the people collectively for their common defense and security”. That’s the militia interpretation.

But gun restrictions were commonplace were more the rule than the exception before that. “Gunfight: The Battle Over the Right to Bear Arms in America”, is a history of the subject by Adam Winkler, a constitutional-law scholar at U.C.L.A. He recites a number of laws passed by the states, beginning with Kentucky and Louisiana in1813, that banned concealed weapons. Even Texas followed suit. As excerpted by Jill Lepore in The New Yorker, Winkler says the governor of Texas admonished his citizenry in 1893 that the “mission of the concealed deadly weapon is murder. To check it is the duty of every self-respecting, law-abiding man.”

Those old enough to remember westerns (they were movies) will also remember the requirement that everyone check their revolvers at the door of the saloon, but Winkler says it went further. “New arrivals were required to turn in their guns to authorities in exchange for something like a metal token”. A Wichita, Kansas, sign in 1873 read, “Leave Your Revolvers at Police Headquarters, and Get a Check”. So much for the Wild West. A law like that even caused the shoot-out at the O.K. Corral, Winkler tells us. The city council of Tombstone, Arizona, had passed an ordinance against the “Carrying of Deadly Weapons”. Wyatt Earp confronted Tom McLaury because McLaury had failed to deposit his gun at the sheriff’s office.

Dec 18 2012 | Posted in

Politics |

Read More »

Dec 15 2012 | Posted in

Law |

Read More »

Immigration reform had been one of Barack Obama’s campaign pledges in 2008, but he had in mind something quite different from what voters assumed. He has made no push for legislation, and his administration instead proceeded to deport 1.2 undocumented immigrants in the last three years, more than any president before him.

But Obama has supported the DREAM Act and following its defeat in the Senate — and with the election approaching — signed an executive order just this summer deferring for two years any deportation action against those brought into the United States when children, an end-run around the legislature that was viewed by his opponents as blatantly political and even illegal.

But that was immigration lite. Now the bill has come due for Obama’s full-scale action: One can make the case that the 71% of Hispanics who voted for him — 5.4% of his total — forestalled the moving van pulling up to the White House come January. The share of Latinos that voted Republican dropped from the 40% who had voted for George W. Bush to 27% for Mitt Romney. It’s not all that surprising considering what Romney said while seeking his party’s nomination — that he would repeal the DREAM Act if enacted and encouraged “self-deportation” by illegal Latinos. The illegals can’t vote but those compadres legally in country were bound to take that as something of an ethnic slur and bestow their votes elsewhere.

shifting sands

What augurs well for immigration reform in Obama’s second term is not just that he owes it to those millions of supporters, but that the Republican Party realizes that it could face growing extinction if it doesn’t drop its combative stance against immigrants and instead cultivate that growing voting bloc. The Republican posture has determinedly been to erect border fences, enforce deportation laws, and resist any legislation that would create a path to citizenship for the estimated 11.5 million already here illegally. The party platform even institutionalized self-deportation as policy at the Tampa convention in August, ruling out “any forms of amnesty” and endorsing “humane procedures to encourage illegal aliens to return home voluntarily”.

George W. Bush was the exception, setting forth a broad plan for immigration reform that balanced heightened border enforcement with a guest worker program and a path to citizenship for the millions of undocumented. And it incorporated the provisions of the DREAM Act, which would have conferred legal residence to those who have been in the U.S. five years or more, and have completed two years of college education or served in the military.

To defeat it, foes hit upon the simplistic catchword “amnesty”, irrespective of the word’s definition, namely, a no-strings pardon for offenses. There were strings aplenty. Bush’s path to citizenship was quite rigorous, calling for learning English, the payment of fines, and going to the back of the line behind those from other countries who followed the legal route to immigration, a process that can run to ten years. It is only fair, though, to acknowledge that many found granting residence or citizenship in any form to be deeply unsettling, viewing it as a reward to lawbreakers and an affront to those who patiently waited on line in their home countries. That 2007 bill failed in the Senate, with conservative Republicans breaking with Bush.

The inability of Congress across decades to come to a solution has had the effect of converting a problem of illegality into a humanitarian issue. Millions of Latinos who entered illegally have settled in, are part of their communities, have jobs, and have raised thoroughly American kids.

Both the DREAM Act — thwarted in Congress repeatedly since its introduction in 2001 — and Obama’s executive order benefit those who were brought to the U.S. at a young age through no fault of their own and are otherwise penalized for what their parents did. Neither is a path to citizenship, but without this reprieve, these now grown people cannot find financial aid to attend college nor — if they do manage to get an education — legal employment or even a driver’s license.

Failure by Congress has led states to establish their own foreign policy, first the law passed by Arizona, with all but one provision since struck down by the Supreme Court, and then an even more severe law enacted by Alabama. It should be clear that some national path to legal status must be developed. Those who mindlessly advocate deportation of the millions need to realize that such a “final solution” is not only absurdly impractical, but that such harsh treatment has become outright immoral with the passage of time. By allowing the issue to languish interminably, Congress has only itself to blame.

policy going forward

As for those who seek legally to emigrate to the United States, our country’s policy is turned on its head. Two-thirds enter the country via our overly lenient family unification policy. One family member enters, then applies to bring in all other family members. Other countries base their quotas on skills and criteria pertaining to national needs.

One need look no further than Canada, which has a point system — so many points for technical skills, education level, work history, etc. Time cited a revealing example — a cluster of high-tech companies in Vancouver where the likes of Microsoft have set up research labs to tap a pool of skilled immigrants, almost all of them graduates of U.S. universities. Degrees awarded, we denied them visas and sent them packing — to just over the border, where “they will pay taxes, file patents, make inventions and hire people in Canada” instead of in the U.S. Well done, America.

In contrast, a mere 13% of those granted green cards are admitted to the U.S. on the basis of ability and experience. Despite the outcries of American industry and Silicon Valley, the one program that does bring in people for their skills — H1-B visas — is capped at a level that has been cut in half over the last decade. The ignorati in Congress say these interlopers are taking American jobs, failing to grasp that companies cannot find in the U.S. people qualified for those jobs. Demand runs so high that the annual limit is reached just days after the April 1 quota is posted.

The canard about taking jobs from Americans was put to the test in Alabama where tomato growers watched their crop rot on the vine as pickers fled for home. Americans hired to take their place typically quit after just one day in the fields.

Both for the millions of undocumented already here and for those applying legitimately to come here, everything to do with immigration is broken, perpetuated by wrong-headed members of Congress who refuse to be influenced by reality and who prevent any movement forward.

Dec 15 2012 | Posted in

Reform |

Read More »

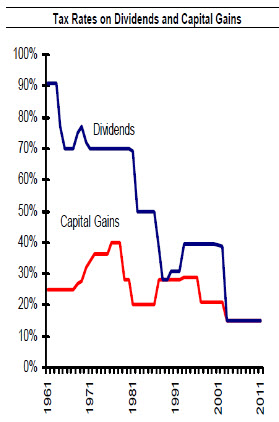

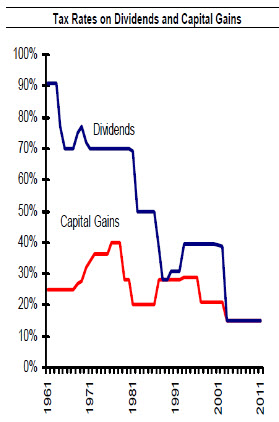

In the standoff between Obama’s edict that the top tax rates must be increased to reduce the deficit versus Boehner & Co’s insistence that unspecified deductions and “loopholes” be reduced instead, taxes on capital gains and dividends have been a comparative afterthought, even though their special rates cost the government $91 billion a year according to Bloomberg.

Instead of a tax rate that could then go as high as 39.6%, the Clinton administration reduced the rate on capital gains to 20% and President Bush cut further to a flat 15% for both capital gains and dividends. We have since seen a pronounced widening of the disequilibrium between those at the top of the income scale and everyone else. How else other than these sharply lower rates can one explain why a stunning 93% of income growth went entirely to the top 1% in the first two years of what for everyone else has been a snail’s pace recovery.

The President has proposed that capital gains taxes be restored from today’s 15% to the 20% of the Clinton years and that dividends be taxed the same as ordinary income — that is, as highly as the 39.6% rate he hopes to reinstate for top earners. But if true tax simplification and reform is the objective, we ask: what should tax policy be?

First comes fairness. Taxpayers are rewarded with the 15% rate because investment in the securities of corporate America is what creates jobs and makes the economy grow. So goes the doctrine, although supporting empirical evidence is lacking. The fact is that the money for close to 100% of all stock and bond trades does not go to the companies themselves except in rare new offerings of securities. Once issued, securities are traded endlessly back and forth between outsiders — individuals, funds, corporate holdings, and so on.

If true investment in industry is to be encouraged, the special tax rate — or even a tax rate as low as zero — could be reserved for only security buys certified as having gone direct to companies: new offerings of stock and debt. For tax purposes that would sort investing into two classes: one that funds growth, the other where we trade amongst ourselves. It’s an alluring idea but unworkable, as we once explored.

Since virtually all investing activity does not go to the benefit of the companies we trade in, what then is the rationale for the special tax treatment? It results in an inversion of principle where labor is taxed fully by payroll and progressive income taxes but the gains from letting money do the work is not.

Reagan thought capital gains should be taxed at the same rate as income. The successful bipartisan tax restructuring under his administration in 1986 reduced the top rate on capital gains and raised the rate on dividends — both to 28%, the same as the tax on ordinary income. The irony is that today’s Republicans place a halo above Reagan’s head, whereas some of his policies have become heresy.

the short and long of it

Another anachronism — and did it ever make sense? — is that we only gain that special 15% tax rate on profit if we hold a stock for a year or more. What’s the good of that? If we were back in yesteryear, when corporations had to deal directly with investors by swapping stock certificates in and out, there would be a rationale for rewarding people for not swamping companies by churning. But almost all stock is now traded electronically and held in street name by brokerages or funds. So the next step in cleaning up the mess is to get rid of this pointless and cumbersome extra layer of complexity.

Indexing

The tax code rewards us for holding onto securities over a year. It then penalizes us the longer we hold on. Imagine paying $100,000 for stocks, holding them through thick and thin as gurus told us to do, and selling 10 years later for, say, $135,000. You would find yourself paying taxes on a capital gain of $35,000 even though with as little as 3% inflation, you would not have made a dime. You’d be getting back depreciated dollars worth no more than the $100,000 you invested 10 years before. And the tax you pay makes it a loss.

You could call it the government’s dirty little secret. It is not in their interest that we make this discovery. The public might rise up and demand indexing — which would be a simple bit of arithmetic whereby we mark up the cost basis of each sold block of stock or bond according to the inflation percentage the government had caused (or failed to prevent) over the intervening period. Nothing unusual here. We already index Social Security taxes and payouts according to a cost of living allowance (COLA).

Incidentally, if capital gains is to be taxed as ordinary income, the quid pro quo calls for doing away with the government’s confiscatory practice of taxing profits in full at the moment of sale while only allowing a deduction of $3,000 if a year’s net trades produce a loss — and only $3,000 a year thereafter for as long as the carry-forward produces a net loss. Not even that amount is indexed to inflation. Incredibly, it hasn’t changed since 1978. Fully taxed profits should be matched with fully deductible losses.

dividend duress

Older couples of the Harry and Louise stripe (the duo who helped sink Hillary’s health care overhaul in 1993-4) are bleating in television commercials that raising taxes on dividends would crimp the retirement they had counted on.

Maximum tax rates of capital gains and dividends

. First, it is their mistake to count on today’s rate, especially since dividends have historically been taxed at the same rates as ordinary income (see chart). Second, as with capital gains, if we invest money (trading among ourselves, remember), why should we expect rentier income to be taxed less than the income from labor?

This is the sort of statement that drives conservatives batty, but our exercise here is to consider the ethical principles of how various forms of income should be taxed. To make the case that these special tax rates are justified — that certain elements of society should be favored over others — requires concrete counter arguments, and without the usual intangibles about capital formation, liquidity, and so forth.

Incidentally, for the middle class, elevated tax rates on dividends won’t be much different from the 15% they pay now because their other income puts them in the middling tax brackets anyway. To be affected by high rates on dividends, one has to be enjoying bountiful income and is really not in need of our compassion. Dividends and interest go overwhelmingly to the top 2% of taxpayers, and that money is not invested in the sort of striving, entrepreneurial businesses needed to fuel growth. Only the most mature companies pay dividends.

of interest

Raising the dividend rates to those of ordinary income would erase the inexplicable disparity between the tax treatment of dividends and interest income. At present, with dividends taxed at 15% and interest as high as 35%, because it is combined with ordinary income, the dice are loaded in favor of stock investing. Why? Anyone?

And, of course, what never gets fixed is the indefensible double taxation of dividends. Corporations cannot take them as an expense, and that results in higher profits subject to tax. Recipients of the dividends are then taxed as well. If corporations could take dividends as an expense, they would probably be inspired to return more capital to their shareholders, for whose benefit they unfailingly claim to be working, and that would allay the anguish we are hearing in these Harry and Louise commercials.

Dec 13 2012 | Posted in

Taxes |

Read More »

Dec 12 2012 | Posted in

Taxes |

Read More »

You’ve probably had quite enough of the tortuous proceedings between the White House and Congress over the “fiscal cliff” and don’t need to hear from us, too. For that matter, we signaled back in April that January’s perfect storm was on the horizon.

But there is one part of the debate that rankles and needs debunking: the claim by Republicans that the 4.6% tax increase (to 39.6%) for top earners that the President insists is his due for winning the election would cause job losses for small businesses.

As exemplar, there was Rep. Tom McClintock (R.Ca) just recently talking to Erin Burnett on CNN, telling us that those affected will mostly be “small businesses filing a Subchapter S” tax return and if we raise the taxes on them,

“according to the Congressional Budget Office, that’s going to mean that about 200,000 American families will be out of work next year and that’s the low estimate. Ernst & Young estimates 700,000 more unemployed as a result of these tax increases on job creators”.

He earnestly believes what he is saying, we are persuaded, but, like the other members of the chorus who sound this alarm, he has evidently never pushed a pencil to see if he is right and an outbreak of hysteria has even panicked the CBO and Ernst & Young.

Now, you may disagree with raising taxes, but it shouldn’t be for this bogus reason because it doesn’t make mathematical sense. Everybody calm down while we demonstrate.

First, Obama claims that “97% of small businesses fall under the $250,000 threshold” and would therefore be exempt from the tax hikes. His claim is supported by Congress’s Joint Committee on Taxation, which estimates that only 3.5% of small business owners would be affected by the tax hike. Some 54% of owners file their taxes as sole proprietors or have Subchapter S corporations, where the net profit (or loss) of the business flows through to their personal tax return — their Form 1040. Only that group of owners would be subject to the 4.6% added tax increase — it is a tax on one’s personal income, not on the business itself — and only to the extent that an owner’s passed through income exceeds Obama’s targeted $250,000 cutoff.

So it is difficult to determine why the few affected would result in so much job loss. And even within the over-$250,000 group that merges business profits into their personal taxes, there’s not enough difference to have an effect. Let’s have a look at the arithmetic.

^tax time

The increase from 35% to 39.6% comes to $46 on each additional $1,000 of income. On the way there, the next lower bracket increases from 33% to 36%, which comes to $30 per $1,000. A minimum wage employee earns (an unlivable) $15,000 a year; we’ll ignore any attendant outlays so as to keep the cost of hiring as low as possible for our example.

How many thousands must that small business owner be taking home for those $30 and $46 nicks to add up to one such employee’s paycheck? The answer: $621,000 (for the math, see sidebar).

|

Here’s the math:

To be able to claim that the 4.6% extra tax would be so great as to displace the hiring of a single $15,000 a year minimum wage employee, a “job creator” would have to be a $621,000 income earner. Here’s why: First, there’s no extra tax on the first $250,000 of earnings. Obama’s plan calls for a tax rise from 30% to 33% for earnings between his floor of $250,000 and 2011’s top bracket of $379,150 (married filing jointly). This 3% tax hike on the $129,150 difference equals $3,875 (rounded). Our income earner would then need to bring in $241,850 on top of the $379,150 — the amount of income that, taxed at 4.6%, comes to the $11,125 needed to bring the total extra tax to $15,000 ($3,875 + $11,125). So, beyond the $250,000 threshold, someone must have added income of $371,000 — $621,000 in total — for the proposed tax to wipe out enough money to forego hiring a single minimum wage employee. |

So a small business owner would have to be taking home $621,000 for the added tax burden to displace what would otherwise have paid for a minimum wage employee for a year. And, by extension, that owner would have to be taking home almost $1,000,000 to claim that the added taxes would cost two such jobs. And so on…ever higher income levels in huge increments for the taxes to equate to each additional job that our job creator says will not happen.

what’s with the big take home pay?

Why would an owner, complaining about this tax preventing job creation, take so much income into his or her Form 1040 where it is subject to personal income taxes? The 4.6% tax applies only to money taken out of the business, so the claim that it is a “job killer” is backward. If the money is instead spent in the business, it isn’t taxable. The 3% of small businesses that Obama cites as yielding more than $250,000 to their owners per year — possibly much more — could avoid his tax if they plowed that much more money back into the business. So much for calling the tax increase a “job killer”. One could even say that Obama’s proposed tax is an incentive to leave the money in the business where it might be a “job creator”.

Yet Republican leaders — McConnell, Boehner, Cantor, etc. — have schooled the Republican legions to insert “job killer” into every sentence. The bet is that if people hear it enough, they will think it true. In fairness, the same technique is employed by Democrats and by Obama, with their unceasing appeal that the wealthy pay their “fair share”. Who is to say that 35% is not a fair share or what, precisely, would be a fair share?

But the math above certainly shows how bogus the small business claim is. That is just meant to steer the public away from the real strategy of protecting wealthy campaign donors from paying an extra $46,000 on each added $1,000,000 of earnings.

Dec 12 2012 | Posted in

Taxes |

Read More »

America preaches to the world that its peoples should be free of oppression and have the right of self-determination, yet in the vote at the United Nations this past week, our country has sided with Israel that the Palestinians should not even have “nonmember observer status” at the international body. Standing out in stark relief, our vote, disagreeing with 138 countries that voted “yes”, gives the lie to what this country purportedly stands for.

The U.S. and Obama’s position has been that recognition of a Palestine in the wake of Arab Spring could spur uprisings. But that was made obsolete by the conflict in Gaza that has raised Hamas’ stock in the Arab world compared to the more peaceful approach at the U.N. of the West Bank’s Palestinian Authority. By hoping that the petition fail, by saying just days before the vote that his administration opposes the Palestinian bid, what is Obama trying to do, deliver a mortal blow to Authority Prime Minister Mahmoud Abbas, for whom a failed diplomatic approach would have looked feeble compared to rocket-throwing Hamas.

So aligned with Israel is The New York Times that it agreed with the Obama administration’s action in an editorial the next day, citing as reasons that Israel might retaliate by withholding tax payments needed by the Palestinian Authority, might even oust Abbas and dismantle that organization, might encourage the U.S. to withhold funds as well. No mention that these actions would be reprehensible. Only a concern that the Palestinians might try to join the International Criminal Court to bring actions against Israel.

For years now, the U.S.-funded security forces of the Palestinian Authority have kept a tight lid on violence against Israel, but the Palestinians have seen nothing in return for making life comfortable for Israel. The “peace process” is moribund and the last two American presidents have done nothing across a dozen years to press the two sides. Instead, Palestinians see Israeli Prime Minister Benjamin Netanyahu using the their quiescence to appropriate ever more land in the West Bank for Israel’s metastasizing settlements.

A hard-liner in a coalition with right-wing and ultra-orthodox parties, Netanyahu is increasingly thought to be subverting the two-state solution. Abbas and the Palestinians call for suspension of settlement building as a precondition to talks.

Israel’s West Bank settlements

That Netanyahu refuses shows that Israel regards usurpation of Palestinian lands as its right and its cessation as a concession. Israel uses the precondition to blame Palestinians for unwillingness to negotiate, conveniently buying time to continue its land grabs.

The confiscation of land exposes the unspoken racism of those Israeli factions that have always wanted all of the West Bank, which they refer to by the Biblical name of Judea and Samaria, the homeland of 2,000 years ago that God promised them, a risible notion that land permanently belongs to whoever lived on it however many millennia ago (and that there is a God that makes promises to people). They long for what is euphemistically called “the transfer”, the desire that all Palestinians be rounded up and bussed into Jordan.

Settling in for Good

Netanyahu’s moves are in that direction. Obama and the United States implore him to suspend further settlement construction without which no peace talks can proceed, but he has repeatedly defied these requests. Stunningly, one day after Obama had the U.S. vote against Palestinian recognition in the U.N. in support of Israel, Netanyahu betrayed him by announcing a major development in East Jerusalem that would connect the settlement town of Maale Adumim and seal Jerusalem off from the West Bank.

It is clearly Netanyahu’s intent to so impact the West Bank with settlements — some 160,000 now live outside the settlement blocs that the two-state solution would annex to Israel in a trade for equivalent land — that their removal will soon be beyond consideration.

This is met with docile acquiescence by the United States. We frown upon such moves, we even use strong words like “condemn”, yet we continue to send Israel its annual $3 billion in aid year after year that helps buy the weapons that flatten Palestinians towns. The U.S. gets nothing in return, only demands, such as insisting we draw a red line beyond which any Iranian move would obligate this country to fight a war for Israel.

lapdogs

To get what he wants, Netanyahu simply sidesteps the Obama and previous administrations by going straight to an adoring U.S. Congress, thoroughly converted by the Israel lobby, the American Israel Public Affairs Committee, and by paid-for trips to the Holy Land. In May 2011, Congress applauded 56 times and gave Netanyahu a standing ovation for a speech in which he called “indefensible” Obama’s proposal that Israel revert to the 1967 borders before that war as the fundamental basis of the two-state solution. So in thrall to Bibi is Congress that a year ago the White House had to enlist him to sell Congress on approving $50 million in aid to the Palestinian Authority, telling them that its use was to train their police would benefit Israel by keeping the peace among the Arabs. The New York Times quoted a Congressman as feeling “more comfortable receiving the explanation from the prime minister than from Obama administration officials”.

Those are the politics, but the more serious question is whether America and Americans are remotely aware of what Israel has become. It is a lengthy subject having to do with the growing strength of the ultra-orthodox, but for now, consider Gaza.

the world’s largest open-air prison

The military may have evacuated Gaza under Sharon, but that has distracted the world’s attention from the constant surveillance, the drones, and the blockade imposed by Israel since 2007 that deprives the 1.6 million inhabitants of the densely populated sliver of land of essentials and has shut down 95% of industry for lack of raw material. To prevent reconstruction of the buildings destroyed in Israel’s 2008 assault, and by the latest bombardment, concrete imports are embargoed. Border patrols have cordoned off 35% of the Strip’s arable land as a buffer, thus limiting food production. A carefully calculated number of trucks is allowed to bring in food based on the minimum number of calories the population needs, reports Noam Chomsky, a linguist professor become activist, who calls Gaza “the world’s largest open-air prison”. He points us to Mideast scholar Juan Cole of the University of Michigan, who informs us that the result of the food blockade is that

“about ten percent of Palestinian children in Gaza under 5 have had their growth stunted by malnutrition” and that “a recent report by Save the Children and Medical Aid for Palestinians found that…anemia is widespread, affecting over two-thirds of infants, 58.6 percent of schoolchildren, and over a third of pregnant mothers”.

Chomsky, who visited Gaza in October, said that, sitting in his hotel, he could hear the machine gun fire of the Israeli Coast Guard warning Gazan fishing boats to stay within Israel’s 3-mile limit. That forces fishing in waters that are polluted because of Israel’s disallowed reconstruction of the sewage and power systems they destroyed.

It’s enough to inspire some to fire rockets at an oppressor that has occupied Palestinian lands for an appalling 45 years. Barack Obama has said,

“There is no country on earth that would tolerate missiles raining down on its citizens from outside its borders. So, we are fully supportive of Israel’s right to defend itself from missiles landing on people’s homes and workplaces and potentially killing civilians.”

Well, yes, but does our country give any consideration to the reasons for Gazans resorting to violence?

We cheered when Tunisians rose up, applauded the Egyptians in Tahrir Square, helped Libyan rebels gain independence, but, well, you see, the Palestinians are different, because our support for Israel is “ironclad” — Obama’s word — no matter its human rights violations.

Dec 5 2012 | Posted in

World |

Read More »