Y2K Panic Redux:

The Return of 2000’s

Tax Rates

Dec 28 2012 It’s been so long since Americans figured their own income taxes (and no wonder, the instructions for form 1040 have grown to 100 pages — and that’s without forms) that we are unaware of what the tax rates and tax brackets are — and more important, as we go over the cliff — what the tax rates were.

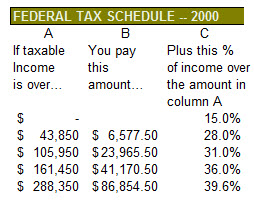

With the sunset of the Bush tax cuts, the income tax bracket schedule reverts to what was in force in 2000. The table shows what we paid then.

The Bush cuts, perpetuated by Obama and Congress these last four years, were severe. They explain a good chunk of the current $1 trillion a year deficits the government has been running up because, as a percentage of the size of the U.S. economy (Gross Domestic Product, or GDP), the low rates have reduced federal revenues from income taxes on individuals to their lowest since 1950. Our personal income taxes came to just 7.3% of GDP last year (and a full percentage point less in the two years prior).

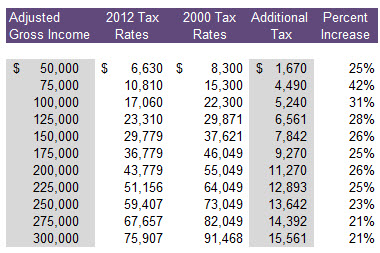

If Congress doesn’t take action and we revert to the year 2000 rates, they will come as more of a shock than people realize. And because the cuts were deepest for the middle class tax brackets back then, that group will experience the steepest increases now. The table shows for each level of adjusted gross income what the rates are for 2012 and what they would be next year if the cuts are allowed to expire.

This assumes that we will revert, literally, to the same schedule as 2000. But the brackets — the cutoff levels that begin each higher percentage — rise every year to adjust for inflation. Will those 2000 thresholds be ratcheted upward, or left the same? No one mentions. The President is a bit fuzzy on the finer points as well. He wants all the current brackets to stay the same and to raise the rate only for income above $250,000. Except, there is no $250,000 bracket. There's the $217,450 level, income above which is taxed at 33%; and there's the $388,350 level, above which the tab is 35%. What exactly does he mean? It would be nice to know, but politicians don't concern themselves with details affecting the hundreds of millions of us.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.