Congress Kicks Another Can Down the Road

Anything to avoid fixing the gas tax Jul 22 2014 In their rush to take their five-week August vacation (on top of their weeklong 4th of July break), the House finally voted the funds needed for roads, bridges and mass transit but only enough to last through May of next year, when they can look forward to arguing all over again the larger issues of a long-term transportation bill.

In their rush to take their five-week August vacation (on top of their weeklong 4th of July break), the House finally voted the funds needed for roads, bridges and mass transit but only enough to last through May of next year, when they can look forward to arguing all over again the larger issues of a long-term transportation bill.

The Highway Trust Fund was about to run entirely out of money, putting in jeopardy some of the 117,000 projects and 700,000 construction jobs underway.

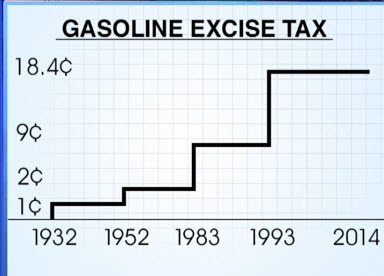

The federal government covers a quarter of the nation’s spending on roads and mass transit and has always paid for it with an excise tax on gasoline and diesel fuel first enacted in 1932. But in recent years the tax has fallen short of needs.

That’s because the gas tax was last raised in 1993. In that year it went to 18.4 cents a gallon (diesel 24.4 cents) and, lacking indexing to inflation, has remained unchanged since. But inflation has not remained unchanged, and the buying power of the tax has therefore plunged almost 40%. For the tax to have the same buying power today, it needs to be 30 cents a gallon. Congress refuses even to consider that fix. The elegantly symmetrical principle that the more one drives the more one should pay for the use of the nation’s roads is unclear to a House of Representatives lacking in such analytical acumen.

Actually, a raise to 30 cents that would still not be on a par with 1993’s 18.4 cents in yield. Americans are driving less and are driving more efficient cars, which means less gas consumed and tax paid per mile traveled. That’s Obama’s fault, says a The Wall Street Journal editorial: his “mandate for more fuel-efficient cars is already a major cause of falling highway fund revenue”. And an op-ed, which would have been approved by those editors, says, "By encouraging the use of vehicles that burn little or no fuel, the federal government has made its funding shortfall worse." We should burn more hydrocarbons to raise taxes.

The result is that repair of our highways cannot keep pace with their wear and tear. The Department of Transportation gives the nation’s infrastructure a grade of “D”. We may individually be

driving less but there are far more of us. Since the tax reset in ‘93, 55 million more of us have been pounding on those roads, bridges and tunnels. Some 65% of roads in the U.S. are deemed as less than in good condition. There are about 63,000 bridges in need of repair. Evidently there need to be bridge collapses and loss of life to prompt Congress to move — although that is questionable, considering that school killings have failed to spur action on who should be permitted to buy guns.

Governors from both parties had been “incredulous” that Congress hadn’t acted. They are of course for an increase in a tax that brings money into their states. But a spectrum of interests want the tax adjustment. The head of the U.S. Chamber of Commerce, a business lobbying group, said “Shippers are for it. Truckers are for it. The construction industry is for it. Labor is for it”. Apparently the word hadn’t gotten through to House Speaker John Boehner. "I've never supported raising the gas tax", he said. It is an election year, and there is no priority greater for politicians than keeping their jobs by not upsetting voters with reality.

freeloadersThe chiefly Republican abhorrence of any form of tax has led to a wealth of avoidance schemes most of which are preoccupied with redressing the unfairness of hybrids and electrics enjoying the roads while paying less or not at all at the pump. Except that gas sippers and teetotalers account for only a little more than 3.% of vehicles sold per year and are a problem for which there is plenty of time before they become an actual problem.

Yet we read of ideas of changing to a tax on how many miles vehicles travel. With today’s miraculous technology we could follow their movements using GPS — a truly awful idea idea that makes privacy complaints about NSA’s phone metadata collection seem quaint, and is staggeringly impractical, as is any proposition that entails retrofitting our 250 million registered vehicles with any form of mileage meter or tracking device. Yet Oregon is about to test just that.

But those who hatch that idea realize they have a problem requiring another level of complexity. Heavier vehicles have a greater impact on roads; different types of vehicles must be charged more (which the gas tax handles well enough: heavier vehicles consumer more gas and therefore pay more gas taxes).

Let’s do this, says an op-ed in the New York Times: pay for highways and bridges from general tax funds instead, dedicating “part of the income tax revenue that corresponds to transportation’s contribution to gross domestic product”. Seriously? And who decides that?

The Wall Street Journal’s op-ed page proposes a mileage-based plan, but this one is based on tolls. “Electronic tolling technology would allow the change to be implemented without delay-inducing toll booths”. With variable pricing “motorists could save money by driving during off-peak hours or by choosing other travel means”, the latter being an option available to us now, incidentally. Again, it is the unfairness of the gas abstemious that rile the authors. Their system — which, even if they don’t mean all roadways, would call for retrofitting 47,000 miles of the federal highway system — would put an end to “offering a select few a free trip”.

All these fanciful schemes, ready only far in the future and at horrendous cost, are to swap out a gas tax mechanism that is in place, has been working for almost three quarters of a century, and addresses the need for infrastructure rehabilitation — which is right now.

the no-tax payment planAs for the just-enacted stopgap. Republicans insist that everything be somehow paid for and the $10.8 billion patch for the next ten months is no exception. By labeling even the adjustment of the gas excise to repair inflation’s erosion as a forbidden tax increase, House members had to seek absurd funding alternatives. They were joined by Democrats, given the election year, who feared a backlash if they asked the public to pay for what they use. Instead, to pay the tab, House members hit upon “pension smoothing”, a term meant to deflect us from translating it as “let the future pay for it”.

The maneuver delays requirements for corporations to pay into their employees’ pension funds. Reduced payments result in higher profits. The higher taxes on those profits is what Congress expects will match about two-thirds of the cost of the highway funding. Of course, companies will need to make those pensions whole in future years, which will lead to reduced profits and lower tax collections. Hence, the future pays for today’s transportation funding.

The Senate wanted a funding band-aid that would run out in December to force this Congress to deal with the highway bill, rather than the incoming Congress. And its lesser fending didn't need "pension smoothing". President Obama, who has repeatedly urged Congress to fund infrastructure repair, showed his irritation at the House “kicking the can down the road” and “careening from crisis to crisis” but he's short on political courage as well. In April he sent Congress a transportation proposal to spend $302 billion over four years that skirted raising the gas tax and instead proposed a hodgepodge of charges to fill the gap — tolls on the interstates, increased safety violation fines for automakers — and let’s go after those who are entirely uninvolved: “We pay for the transportation project [sic] in part by closing tax loopholes for companies that ship jobs overseas and avoid paying their fair share of taxes".

fits and startsFunding by last minute spasms demonstrates congressional ignorance of how actual work is performed. Roads and bridges are long-term projects entailing planning, engineering and years of work. Congress leaves states guessing until the last minute whether any infrastructure money will be forthcoming. States now know no further than next May what monies will be available (and that’s about when the fight over the debt ceiling will be rejoined). Beyond that date, states cannot plan, as they watch Congress endlessly punt problems down the calendar. They are left to lurch like a car out of gas.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.