Are Republicans About to Blow Their Big Chance?

The calendar threatens reform hopes Jun 17 2017When Donald Trump stunned the Democrats by winning the White House, Republicans awakened to the impossible dream: control not only of both houses

of Congress but a president who would sign their legislation. It is their chance to reform the government, steering it on a rightward course.

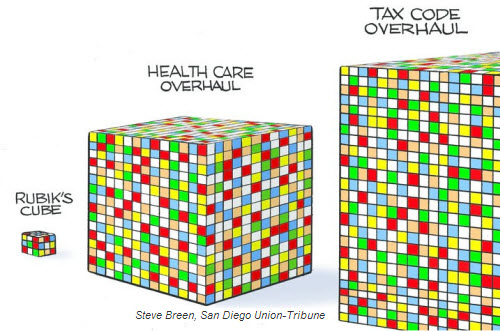

There are three interlocking pieces. Tax reform means tax cuts, corporate and individual, but they dig a crater in the government's revenue. Repealing Obamacare and replacing it with a far less costly program could fill that hole, so the healthcare piece is needed to pay for tax cuts. The third piece is the budget. It needs to know what will happen to healthcare and taxes before it can plan for everything else.

Trouble is, all three have gone off in different directions and the clock is running.

the poles apart partyThe first bill drafted by the House to repeal and replace the Affordable Care Act was pulled for lack of votes. The 30-or-so members of the Freedom Caucus found Speaker Paul Ryan's plan too liberal. Caucus leader Mark Meadows, from far west North Carolina, wanted to strip away the tax credit that would help people pay for insurance — even though far more modest than Obamacare's — and cancel the federal government-funded Medicaid expansion. Together, that would leave around 20 million subscribers with nothing.

The second attempt passed by the thinnest of margins, 217 to 213, winning Freedom Caucus votes by allowing states to obtain waivers exempting them from the bill's requirements. The bill went to the Senate, where it sits largely ignored because the senators are developing their own. A panel of 13 carefully chosen conservatives — all men — is working on replacement in secret. (By comparison, the Affordable Care Act underwent 79 hearings over a year and a half). This earlier article spelled out the steep cutbacks of the House version and said:

If the Senate is able to pass a bill, it will likely be substantially different from the House offering. The next step is for both bills to be handed to a joint Senate/House committee to work out differences. If they cannot come to agreement, the Republican reform of healthcare dies right there.

If a compromise does survive, both House and Senate must approve the result unchanged. With its waiver concession undoubtedly stripped, will we then see the Freedom Caucus revert to its obstructionist "no", killing repeal and replace? That will leave Obamacare the law of the land.

As late as end-March Trump said to a group of senators at the White House, "I know we're all going to make a deal on health care. That's such an easy one".

the mandatory budgetBudgets — the President's, the Senate's, or the House's — usually end up as more an expression of what each hopes to accomplish before they arrive in the dustbin. In 8 out of the last 15 years, Congress didn't even bother coming up with one. Instead, lawmakers come up with a dozen often last-minute appropriation bills to keep the various departments of the government running. That haphazard process somewhat accounts for the perennial annual deficit that has brought us to a $20 trillion national debt.

But this time — for Republican purposes, anyway — there must be a budget for fiscal 2018, which starts October 1. That's because congressional budgeting rules say that an approved budget is prerequisite to passing laws by simple 51-vote majorities called "reconciliation", and that's what Republicans need to do to avoid the certain Democratic filibusters against tax cuts.

budget befuddlementThe 10-year budget set out by President Trump and budget director Mick Mulvaney was met with broad condemnation, those on the left shocked by the deep cuts in government departments and social programs in favor of beefing up the military, those on the right aggravated by Trump sticking to his promise not to touch Social Security or Medicare.

What drew extra attention was fakery of the numbers and what that said about its authors. Trump had insisted he will balance the budget by 10 years out. Spreadsheets can perform miracles, so he has annual revenue increasing by a preposterous 65% by then in order to squeeze out a $16 billion surplus in 2027 and declare victory. The smooth, ever-upward progression in the Trump budget expects 10 more years of prosperity tacked onto an economic expansion that is already among the longest in American history. As David Stockman, budget director for Ronald Reagan, says about the budget, "It assumes you're going to go 206 months without a recession, which has never happened".

What is there to possibly make this happen? Trump and Mulvaney assume increased growth from the less than 2% a year of the last decade to a steady 3% every year in the decade to come. That growth comes from the tax cuts, the perennial myth from Reagan days forward that tax cuts won't reduce government revenue, as the uninformed might assume. They will generate such an explosion of growth that the government will reap more revenue, not less.

Where in the budget do we see the tax plan that is supposedly to deliver this growth? It's not there. There is nothing to account for the rapidly rising revenue the budget expects will get rid of deficits.

Confronted with this omission, Mulvaney said the tax program was left out of the budget because it will be "revenue neutral". The growth that the tax cuts generate will tidily increase government revenue enough to offset their cost. With no net effect on the budget, no need to include them. But didn't we just see all that growth in the budget's revenue assumptions? The 3%-plus growth in the top line? Trump and Mulvaney were quickly called out for their magic trick. They had counted growth in both the tax plan and the budget. Whether fuzzy math or three card monte, we're talking about trillions of dollars here.

Further, with tax cuts assumed, how to explain the budget showing tax receipts from individuals almost doubling from $1.660 trillion to $3.058 trillion between now and 2027 and from corporations zooming from $324 billion to $497? And what's with counting on $328 billion in estate and gift taxes over 10 years? With his family in mind, hasn't Trump said that estate taxes are to be eliminated altogether?

deus ex deductionsCaught ou about tax cut growth already usurped by the budget, Mulvaney told a Senate committee that the administration’s tax plan doesn’t count on revenue from faster economic growth after all. That was contradicted by Treasury Secretary Steven Mnuchin before a different Senate panel, and then by Mulvaney himself at yet another hearing, where he spoke of other unspecified measures.

Possibly he meant raising the tax take by getting rid of deductions. The administration has spoken of keeping only mortgage interest and contributions to charity. That would wipe out the deduction for medical expenses — which already must top a high hurdle — increasing the shameful inequity between those who pay for their own insurance versus those who get it free from employers. Republicans momentarily considered trimming that favored status of employer-sponsored health insurance, but apparently that sounded too much like real reform.

The deduction for state and local taxes would be nixed. Republicans might enjoy seeing residents in high tax blue states pay taxes on income they never received. Also mentioned has been taxing 401k contributions, exactly the wrong approach when longer-living Americans need to be encouraged to sock away every possible dollar.

a few words about growthMulvaney used Trump's favorite word to describe the CBO's projection of long term growth at only 1.9%, calling it "a pessimism about America" that is "sad". "We believe that we can get to 3% growth and we don’t believe that’s fanciful". But who is going to produce that growth? In the decades between 1950 and 2000 that produced growth of 3% and more, the labor force grew 1.2% a year. But with the baby boomers retiring and the birth rate having fallen to its lowest rate ever, the labor force is expected to grow by only 0.3% a year over the next decade, says the CBO.

The administration believes that less-generous social programs could prod people back to work, all those people on phony disability, for example — although the Wall Street Journal remarked that "experience suggests getting existing recipients off is almost impossible". And millions not in the work force are missing for a reason. With only a high school education for the most part, they don't qualify for today's more technical jobs that companies are finding so difficult to fill. The Congressional Research Service reports that in manufacturing, the number of workers with graduate degrees grew by 35% between 2000 and 2016. The percentage of workers with only a high school diploma fell by more than a third.

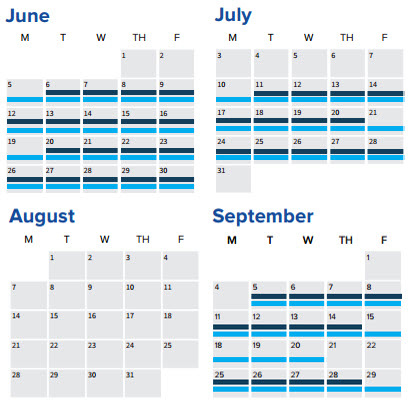

Blue bars show days the Senate is in session.

Black bars show when the House is in session.

time's a wasting

June should see the House and Senate releasing their budget proposals. Speaker Ryan is sure to advance changing Medicare from its open-ended commitment to pay for healthcare, replacing it with a fixed contribution for each beneficiary to "inject market forces and competition into the system". That will ignite another furor and we'll see if promise-keeper Trump will stay with his hands-off pledge.

The tax plan so far exists only as a list on a single sheet of paper, containing no details, and rushed to the public a day or so before Trump's 100th day so he could claim that as progress. It's already June. After returning from their week-long Memorial Day vacation, Congress has only seven weeks [caldndar] until they take off for 34 days embracing the entire month of August. So the question is, with all the contradictions and disparities and voids, how will all three — healthcare, tax reform, and a budget, all agreed to by the President and both houses of Congress — cohere into the ambitious and integrated reform that Republicans seek. So far there is little to make that seem likely.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.