Privy to Policy Secrets, Congress Trades on Insider Information

They want to be in the 1% (many already are) Nov 16 2011Will Congress Mend Its Ways Now? Not a Chance Dec. 9: Fearful that a bill to ban insider trading by members of Congress was making progress, with a committee vote scheduled for next week, House Leader Eric Cantor ordered a halt to allow "additional time to study this issue", said the scolded committee. Expect to see the 6-year old initiative disappear. After all, how else can Congress get rich?

Congress could see its approval rating drop still lower than the 9% score in an October Rasmussen poll after a "60 Minutes" report revealed a pattern of stock trading by members that benefited from knowledge of pending legislation. The airing was based on the findings of Peter Schweizer, a research fellow at the Hoover Institution, who learned that there are no restrictions enjoining members of Congress from trading on insider information. That prompted him to look into the financial transactions of a mere dozen members of Congress, yet he found examples of suspect trades in even that small sampling — trades that he says “would send the rest of us to prison.”

"The people that make the rules are the political class in Washington and they've conveniently written them in such a way that they don't apply to themselves", Schweizer said in the "60 Minutes" interview.

Senator John Kerry, on the health subcommittee of the Senate Finance Committee, was in a position to know in advance about prospects for the prescription drug feature of the 2003 Medicare act, a bonanza for pharmaceutical companies. Schweizer found 111 Big Pharma trades in Kerry's and his wife's account. Gains on these investments were reported as from $500,000 to $2 million (Congress members require themselves only to cite dollar ranges rather than precise numbers).

Schweizer then found that Kerry's wife had in 2007 unloaded holdings of drug company Amgen worth between $500,000 and $1 million just a week or so before the government announced it would discontinue Medicare reimbursement for certain anemia drugs. Shares in Amgen then fell 15%.

While House minority leader, John Boehner invested tens of thousands of dollars in the stocks of health care companies during the 2009 debates on the health care bill, companies whose stock price would show gains if a public option were defeated, which it was. “There are laws and there are rules of the House, and they should be followed,” a Boehner spokesperson tells Newsweek. “The speaker does not make those trades himself. He has a financial adviser in Ohio”. Evidently that was meant as proof that there is no communication between them.

Spencer Bachus of Alabama was briefed as a member of the House Financial Services Committee by Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke in the summer of 2008 that the economy was about to collapse. On September 19th he bought into an index fund that shorts the market — that is, bets the market will drop — and nearly doubled his money.

He did it again in early 2009 when briefed on the details of TARP, the bank bailout, this time buying a fund that would rise.

Not so much trading on insider information as being treated favorably as an insider, Nancy Pelosi and husband Paul were let in on between $1 million and $5 million of Visa's initial public offering, access normally reserved for the best clients of the underwriting investment banks. There are legions of buyers for IPOs of solid companies. They will bid up the prices in order to get in on the action, and the favored few who get the original shares usually flip their stocks into the broad market within days. The Visa price rose from the initial offering price of $44 a share to $65 in just 48 hours.

An indignant Ms Pelosi answered "60 Minutes"'s Steve Kroft's question about her accepting a favorable stock deal with "Well we didn't. It's not true and that's that". Kroft said that the Pelosis had benefited from eight such IPOs.

Ms Pelosi's spokesman said the allegation of favored treatment was a “preposterous idea” hatched by “a right-wing hack”, as if her actions are only suspect because they were uncovered by a researcher from the conservative Hoover Institute. He said that several other members of Congress benefited from the sweetheart deal, which tells us that the practice is more widepsread than Schweizer's limited study revealed.

Peter Boyer at The Daily Beast tells us that Roll Call, a newspaper that covers Capitol Hill, in a "study of congressional financial disclosures revealed that the net worth of members of Congress had grown by 25 percent since 2008, during a period in which the average American household has lost as much as 20 percent of its net worth".

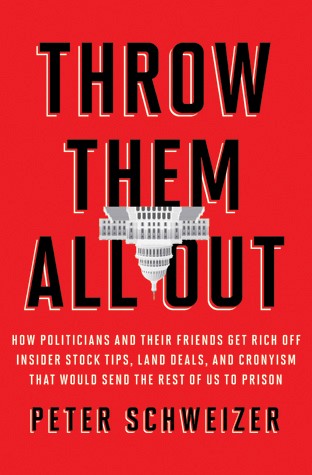

Conservative himself, Schweizer has given up on the lot of them. His book

is titled "Throw Them All Out" with a Capitol building symbolically turned upside-down. Schweizer points out that there are no rules, that the Senate’s ethics manual has a full chapter on the proper use of Senate stationery and mail, but says nothing about insider trading.

is titled "Throw Them All Out" with a Capitol building symbolically turned upside-down. Schweizer points out that there are no rules, that the Senate’s ethics manual has a full chapter on the proper use of Senate stationery and mail, but says nothing about insider trading.

Within days, Massachusetts Senator Scott Brown introduced legislation named Stop Trading on Congressional Knowledge, or STOCK Act, stating that "members of Congress should live under the same laws as everyone else. If they trade on inside knowledge to line their own pockets, they should be punished". It seems to be a recycling of the bill introduced in 2004 by Congress members Brian Baird and Louise Slaughter, given that it has the same STOCK name. So whatever happened to that bill — HR 1148? Baird, on "60 Minutes" said, "We didn't get anywhere. It just flat died".

Will it be any different this time?

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.