Funding the Government on the Backs of Students

May 14 2012It seems inconceivable, but Senate Republicans have blocked debate on a bill that would prevent the interest rate on government student loans from doubling to 6.8% on July 1.

Republicans want to compensate for the lost interest income from students by cutting $5.9 billion of preventive care from the Obama health care law.

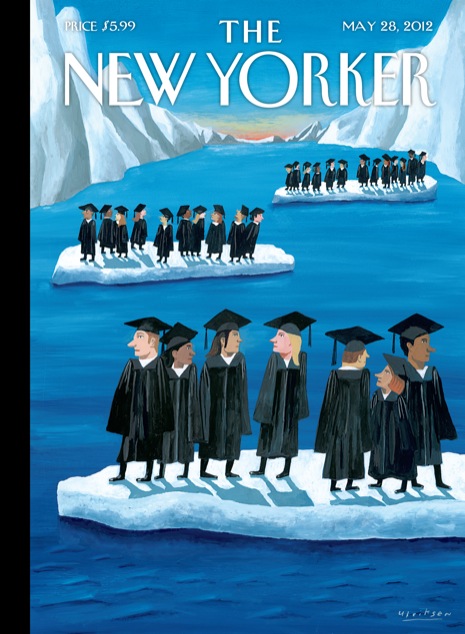

Graduates' prospects: This says it all

Democrats want to raise money by changing a law that would subject a type of income enjoyed by certain wealthy individuals to Social Security and Medicare taxes which they currently avoid by classifying the income as dividends.

Current students or recent graduates are held hostage in the crossfire.

The doubling of the rate would end a moratorium of five years that had reduced the rate to 3.4% beginning in 2007 to help students with their crushing debt. This page has been covering this subject since last September, first with ”The Next Financial Crisis: Student Loans” about the crisis in student debt that, at $1 trillion, is now higher than credit card debt, and then in “Why Are We Making a College Education Unaffordable?” about the disgrace of burdening our young with such high interest charges

while at the same time allowing banks to borrow at near 0% (which they then use to make money from the government by buying Treasury notes paying 2% or so).

The House and Senate bills are the polar opposite ways that Republicans and Democrats have come up with to pay for the loss of interest income at a rate that should never have been charged in the first place and which asks the question of whether any interest should be charged at all. Should the government really be subsidizing the banks with their sweetheart deal while trying to profit from our youth just starting out in life? Additional to raising the interest rate, Paul Ryan’s plan would slash funding for Pell grants and Stafford loans.

At the same time that it is generally agreed that we need a college-educated work force to compete economically in the world, Congress is so far doing all it can to make a college education more expensive and out of reach. Need we any greater proof of how onerous is the student debt burden than that it took the President of the United States and his wife until eight years ago to pay off their college loans, as he told students at the University of North Carolina in late April.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.