There was once a time when criminals like John Dillinger and Willie Sutton made headlines and won fame for robbing dozens of banks. This last decade has seen a reversal of roles. Now dozens of banks have been robbing us.

They played a major role in triggering the worst recession since the Great Depression by selling mortgages that could never be repaid and bundling them into putrescent securities peddled around an unsuspecting world. They have been caught reporting false interest rate data for years to rig LIBOR — the overnight interbank lending rate used around the globe as a basis for every transaction with an interest component. And most recently a passel of banks have been caught laundering billions of dollars for Mexican drug cartels and in violation of sanctions against Iran.

And yet, as the media keeps reminding us, not a single bank executive has gone to jail. They must be laughing all the way to their banks. The authorities tell us nothing to see. Just move along.

Attorney General Eric Holder said that the Obama Administration’s “record of success has been nothing less than historic”. What he failed to clarify was that he didn’t mean criminal prosecutions. Instead, the Justice Department, the Securities and Exchange Commission (SEC) and other regulators have acquired a pronounced preference for money. Prosecution is too complicated.

And they’ve been bought off cheap. The amounts sound staggering, but they usually represent just a month or two of profits for the behemoth banks, which find it effortless to write checks that make the problem go away.

It doesn’t make for thrilling reading, but we thought to present something of scorecard of all the more recent bank malefactions, in rough chronological order. Here goes:

In July of 2010 Goldman Sachs agreed to pay what was then a record $550 million to settle SEC charges related to a subprime mortgage collateralized debt obligation (CDO) known as Abacus. Hedge fund Paulson & Co. was allowed to design the security, deliberately choosing the worst mortgages. Goldman sold the junk to trusting customers while at the same both Goldman and and Paulson placed huge sure-thing bets that the portfolio would fail.

Wells Fargo, in a quarter in which the bank’s revenues were $20 billion, was fined $85 million in July of 2011 and was ordered to “compensate customers it had unfairly — indeed illegally — taken advantage of during the subprime bubble” but, as had become standard practice by the Obama government, was not required to admit guilt.

Washington Mutual collapsed in 2008 — the largest bank failure in U.S. history. In December of 2011 a settlement was reached between the Federal Deposit Insurance Corporation and three former executives for $64.7 million. Most was paid from the bank’s directors and officers liability insurance. But the FDIC required that the three pay something. One of them, for example, had to pony up $275,000 in cash and give up $7.5 million of his retirement account. Not to worry about him: he was paid $88 million across eight years and, of course, there were no criminal charges.

A $25 billion settlement was struck in February of 2012 that forced five of the nation’s largest banks — Ally, Bank of America, Citigroup, JPMorgan and Wells Fargo –to reduce loan balances for many borrowers who owed more than their houses were worth. The banks had had used assembly line practices to speed foreclosures, most infamously signing documents with fake names in a practice that became known as “robo-signing”.

Deutsche Bank agreed in May 2012 to pay above $200 million to the U.S. government to quell accusations that it deliberately misled the Department of Housing and Urban Development (HUD) about the quality of mortgages one of the bank’s traders described as “pigs”. The mortgages would later default, costing taxpayers about $368 million.

June saw Dutch bank ING pay a $619 million fine to the Treasury Department for altering records and secretly transferring more than $2 billion on behalf of entities trading with sanctioned countries Iran, Cuba, Myanmar, Sudan and Libya prior to 2007. The Justice Department has signed similar agreements with Wachovia, Union Bank of California, Lloyds, Credit Suisse, ABN Amro Holding, Barclays and Standard Charter to quash accusations that they facilitated prohibited financial transactions.

Also in June, Barclays the U.K.’s 2nd largest bank, admitted that between 2005 and 2009 it had deliberately fabricated the borrowing costs it reported to influence the nightly setting of LIBOR, the benchmark that reports the composite rate at which banks lend to each other and which influences the continuous valuations of the approximately $450 trillion in derivative contracts around the world. Barclays was fined $450 million and secured what is called a non-prosecution agreement, guaranteeing that no one would face criminal charges, because of what the Justice Department called its “extraordinary” cooperation. It was then discovered that in 2008, when Timothy Geithner was its chief, the Federal Reserve Bank of New York had been told of interest rate manipulation by a Barclay employee, but nothing was done about it.

Standard Charter, a British bank, agreed in August to pay New York’s regulator $340 million for laundering hundreds of billions of dollars in tainted money for Iran.

Also in August, Citigroup was forced to pay $590 million for deceiving investors by hiding from them the extent of its dealings in the toxic subprime market. Citi denied the charge. They were settling solely “to eliminate the uncertainties, burden and expense of further protracted litigation”.

Come October of last year, the U.S. accused Bank of America of “brazen” mortgage fraud. Federal prosecutors in New York sought at least $1 billion for the mortgage pump and dump scheme operated by its subsidiary Countrywide Financial. Before BofA bought it in 2008, Countrywide had churned out mortgages for years without regard for whether borrowers could repay, and then resold them, principally to Fannie Mae, thus forcing taxpayers to guarantee billions in bad loans. Angelo Mozilo, the former chief executive of Countrywide, paid $67.5 million to settle a civil fraud case brought by the SEC but he never faced criminal charges.

Bank of America is required to reimburse Fannie Mae $11.6 billion over loans sold them by Countrywide.

Last November JPMorgan Chase and Credit Suisse agreed to a settlement of $417 million with the SEC for bundling troubled mortgages into complex securities to conceal their poor quality and then selling them to investors.

Swiss bank UBS was given a deferred prosecution agreement in December for conspiring to defraud the U.S. with its stash of 17,000 secret accounts for Americans to hide income to avoid taxes. A repeat offender, UBS in 2011 admitted employees had repeatedly conspired to rig bids in the municipal bond derivatives market over a five year period. In 2008, it had had to agree to reimburse clients $22.7 billion over charges that it had defrauded them by misrepresenting auction rate securities as ultra-safe cash equivalents at the same time the market for them was collapsing. Add to that a $100 million fine for felony wire fraud committed by its Japan subsidiary.

Britain’s HSBC Holdings, one of the world’s largest banks, was found, in a multi-agency investigation by the Justice Department, the Manhattan district attorney’s office, bank regulators and the Treasury Department that spanned years, to have been laundering money linked to terrorism and drug trafficking. Despite flagrant criminal activity, in December a settlement of $1.92 billion in return for another deferred prosecution agreement was the outcome. HSBC was deemed too big to indict on the theory — or so we are asked to believe — that criminal charges against the bank could destabilize the global financial system. The laundering was no accident. HSBC had even instructed a bank in Iran how to format payment messages so that transactions would not be blocked by the U.S.

A dozen U.S. banks — Bank of America, Citigroup, Wells Fargo, JPMorgan Chase, MetLife Bank, PNC, Sovereign, Sun Trust, U.S. Bank, Aurora, Morgan Stanley and Goldman Sachs — agreed this January to pay $8.5 billion in a complaint brought by the Comptroller of the Currency. The banks will pay $5.2 billion in mortgage loan reductions and $3.3 billion in direct payments to borrowers who went through foreclosure in 2009 and 2010 at t he hand of the banks, guilty of employing shady practices such as robo-signing foreclosure papers. Originally, regulators had vowed a minimum of $125,000 to each homeowner foreclosed on the basis of violations. Instead, they settled with the banks because case-by-case review of foreclosures “had proven too cumbersome and expensive”. But how to identify a wronged borrower if they abandon review? Their difficult to believe solution was to make everyone eligible, wronged or not, which comes to a paltry $875 each.

A late January report said that Goldman Sachs is in settlement talks with the U.S. Commodity Futures Trading Commission, which regulates U.S. futures and options markets, about an $8.3 billion position that one of the investment bank’s traders had concealed five years ago.

HSBC again. It will pay $249 million for its part in the foreclosure scandal to settle federal complaints that its U.S. division used wrongful practices to foreclose on homeowners.

These deals announced this month are separate from a $25 billion settlement struck last February with five major banks by the federal government and 49 states.

It’s quite a roster. And quite a change from several years ago when we saw the Justice Department prosecute Kenneth Lay of Enron and send Enron’s Jeffrey Skilling to jail, as well as Bernard Ebbers of WorldCom and Dennis Koslowski of Tyco. That was the Bush Administration. They had a policy of punishing the bad guys with prison terms. Bankers have learned that with the Obama Administration, it’s only a matter of money.

And as for money, one other point. These fines won’t cost what the numbers say. Some or all are tax deductible, considered “business expense”.

Jan 27 2013 | Posted in

Law |

Read More »

Jan 16 2013 | Posted in

Law |

Read More »

Entitlement spending is following an unsustainable trajectory. It consumes 65% of the federal budget, up from 21% in 1955, and 20% of the entire economy, says Robert Samuelson of the Washington Post. Such facile comparisons can be asymmetric, however; a closer look might show 1955’s safety net to be unacceptably Dickensian.

But popular though they are, the big three — Medicare, Medicaid and Social Security — swallow 46% of federal funds and with 10,000 baby boomers retiring every day, they are slated to consume 61% by 2030. Herb Stein, chairman of the Council of Economic Advisers under Nixon and Ford said, “If something cannot go on forever, it will stop,” but with government factions at loggerheads years on end, we’re left to wonder how Stein’s law will play out.

We pay for Medicare and Social Security — nowhere near enough as it turns out, given increased longevity and other factors — and hence we think we are entitled to those benefits, but entitlements encompass numerous other government programs that are outright transfers of taxpayer money to others. Medicaid, unemployment benefits, the Earned Income Tax Credit and food stamps are major examples.

food fight

Food stamps come in for particular ire from some. Over 46 million Americans pay for their groceries with federal food stamps. Half of the mouths that food stamps feed belong to children. It is a 40-year-old program (renamed “Supplemental Nutrition Assistance Program” or SNAP) but only in recent years has it ballooned to one in seven people, currently costing taxpayers $72 billion a year.

The rapid increase owes partly to the weak economy that has followed the financial crisis of 2008, but also to a loosening of the eligibility rules to assist the victims of that economy. It is no longer required that a family sell off all its assets and belongings to qualify, for example.

But Congress sees only the cost. Food stamps are part of the perennially stalled farm bill, which comes up every five years. Congress has repeatedly passed temporary bills with sunset clauses. A mare’s nest of subsidies from crop insurance energy, telecommunications, forestry — you name it — the current extension expired last September 30. Since then we have therefore technically reverted to the last permanent bill passed as law — in 1949. You read that correctly.

It may be a farm bill but food stamps make up 79% of the near trillion dollar ten-year bill the Senate passed last June. (Yes, June, and it is now January with nothing having been passed). They cut $4.5 billion from food stamps. House Republicans want to cut $16.1 billion, which would drop about three million Americans out of the program. but their bill has never made it to the floor for vote because of those who say cuts are not deep enough.

The swelling numbers in people and dollars says to conservatives that the program is out of hand. The Wall Street Journal’s editorial page is representative. An op-ed piece said about food stamps, “thanks to Obama’s stimulus, [the cost] doubled again between 2008 and 2012”, without mentioning that the stimulus aid was brought about by millions thrown out of work by the 2008 financial crisis that took food off their tables. Another is entirely about the military but has the gratuitous title “Defense vs. Food Stamps: What Would You choose?”. Or the editorial titled “Food Stamp Nation” which called food stamp recipients those “who who depend on taxpayers to buy one of life’s most basic responsibilities. It’s a good thing breathing air is free”.

Even these parsimonious scribes might soften their critiques were they simply to divide the annual cost by the number of recipients — cited as $71.8 billion and 46,670,373 in that very same editorial — and then the result by 52 and they would discover that the amount per person per week is to die for — literally — $29.59.

Cory Booker, the mayor of Newark, NJ, a city of 277,000 with 74,000 on food stamps, tried living on them for a week to see what his constituents were experiencing. And true to our math experiment, he got a meager $29.78 for a week of groceries. It was a week of nothing but salad, beans and broccoli, hunger pangs and fearing he would run out.

cause and effect

Here’s a hypothetical. If you think too many people are on the food stamp dole, wouldn’t their ranks diminish if those with low-paying jobs made more money? Yet all too often those same people who harangue about food stamps are those who inveigh against raising the minimum wage.

Now, it is true that the minimum wage would have to be raised quite a bit for someone to no longer need food stamps, although it is more of a possibility for a family with two wage earners. And where not possible, it only reflects on how far below the cost of living is the minimum wage. Even after successive raises in 2007 to 2009 it is only $7.25 an hour.

No one can live on that. It comes to $15,080 a year (less if no pay for holidays, 40 hour weeks, no docking for sick days, and of course no vacation). Somehow, less than $1,300 a month is supposed to pay for rent, food for children, light, heat, getting to work — and let’s hope no one gets sick. Our legislators are seemingly content to leave on the books a minimum that for a single mother with two kids is $4,000 below what is considered the poverty level by that same government. It is a wage that approaches slavery. If you find that an outrageous statement, consider that slaves, while paid nothing, were given shelter and food, which the minimum wage earner must pay for.

Yet whenever the issue is raised in Congress a chorus of business lobbyists descend on the Hill with money and dire predictions of calamitous job losses. They rely on numerous surveys of economists who, schooled by a canon that says when anything goes up, something must come down, have reflexively agreed that a minimum wage’s mere existence increases unemployment among low-skilled workers.

But those are just surveys of opinion. Actual studies say otherwise. Economists at the University of Massachusetts-Amherst “compared employment levels in contiguous areas with disparate minimum-wage levels over a 16-year period and concluded in a 2010 paper there are ‘strong earnings effects and no employment effects of minimum wage increases,’” according to commentary at Bloomberg/BusinessWeek, and studies before that have found employment effects to be slight.

If so, and employment remains stable after increases in the minimum wage, then opponents can legitimately make the case that prices must rise for all of us in order for businesses to recoup the cost. What’s wrong with that? Should our pockets be subsidized by holding the pay of those who produce the goods and services that we buy at a misery level?

downhill since 1968

Last June Representative Jesse Jackson Jr. (D-Illinois) proposed boosting the wage to $10 an hour, and linking it finally to inflation, but there has been no progress in a Congress so ill-attuned to the people that its approval rating is no 9%. A Zogby Analytics poll found that 70% of Americans (and 54% of Republicans) support raising the minimum above $10 an hour.

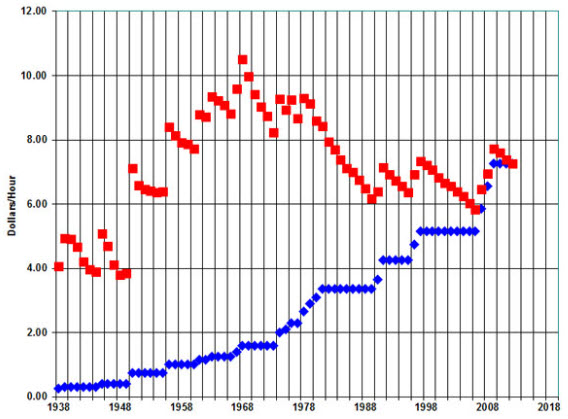

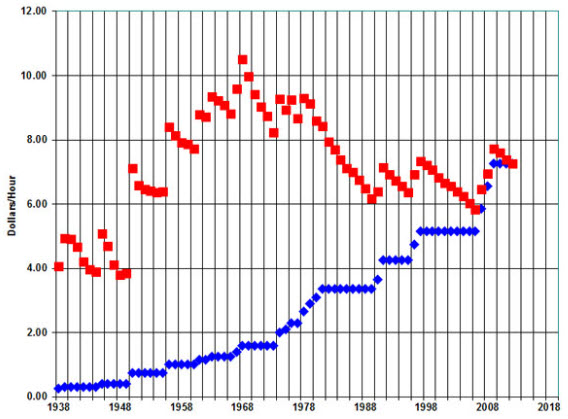

Jackson — who has since resigned for mental health reasons — titled his bill the “Catching Up to 1968 in 2012″ Act because, adjusted for inflation, the minimum wage has only declined since 1968, when it was $10.51 an hour, as this chart from the University of Oregon shows.

The blue shows the nominal minimal wages across the years since

the first law passed in 1938. The red data points show those same rates

adjusted for inflation, with 1968 equal to $10.51 an hour and both series

arriving at today’s $7.25.

In reaction to Jackson’s bill, Fox Business refuted its need by indirectly citing a study by economists at Miami and Florida State Universities who found that two-thirds of those hired at the minimum wage get a raise in their first twelve months, as if to say there is nothing wrong with a year at poverty wages and without mentioning whether the average raise was enough to lift them out of poverty.

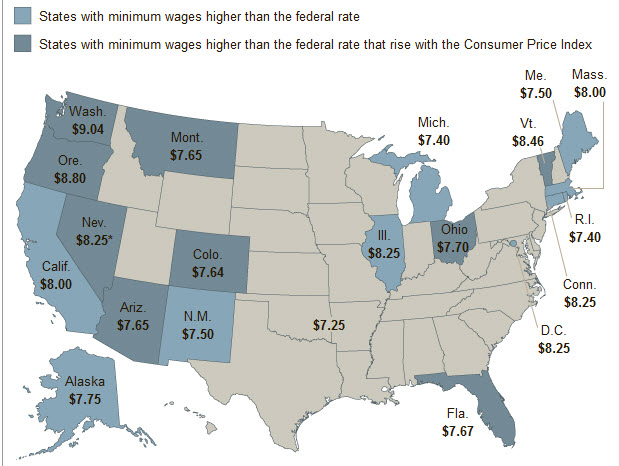

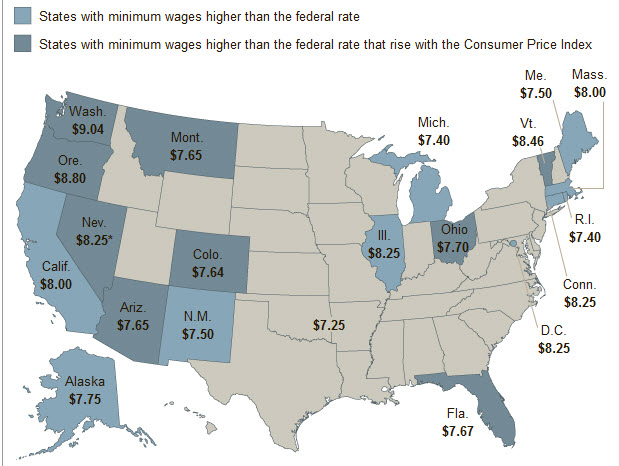

Eighteen states have broken with the federal government and raised the minimum beyond $7.25, but the increases are mostly slight, and the highest is $9.04 in Washington State .

Source: U.S. Department of Labor

Every dollar paid to a minimum wage earner is spent; it goes back into the economy. At that level, nothing goes under the mattress. Every cent is needed for the necessities of life. Every dollar of increase to that wage adds close to $2,000 per worker of further spending into the economy. And studies have also found that a minimum wage increase tends to push up wages of those earning more than the minimum, as business owners try to maintain hierarchies of pay grades.

Yet our lawmakers continue along two separate and conflicting tracks, holding the minimum wage at a brutish level while wondering why so many need food stamps. Were Congress to make that connection, they might find that forcing pay increases would cut the need for the food stamps that some so dislike. Or is that asking for logic beyond their pay grade?

Jan 15 2013 | Posted in

Reform |

Read More »

If everyone stands by what they’ve been saying, then the United States is heading for default for the first time in its history.

No sooner had a deal been struck to avoid toppling over the “fiscal cliff” when Treasury Secretary Timothy Geithner announced that the country has already reached its statutory borrowing limit of $16.4 trillion — the limit set a year and a half ago by Congress after a contentious battle with the White House. There are accounting maneuvers by which Geithner can scrounge for funds, but around the end of February, if Congress doesn’t raise the debt ceiling yet again, the United States is out of money to pay its bills.

But as the nation’s “Full Faith and Credit” guaranteed by Article IV of the Constitution is at stake, surely this will be resolved amicably, will it not?

All indications so far point to the contrary. President Obama has said he will not accept any conditions attached to the debt ceiling issue, which is precisely what Republicans in the House intend to do. Obama has washed his hands of the problem this time:

“I will not have another debate with this Congress over whether or not they should pay the bills that they’ve already racked up through the laws that they passed”, he said. “Let me repeat: We can’t not pay bills that we’ve already incurred. If Congress refuses to give the United States government the ability to pay these bills on time, the consequences for the entire global economy would be catastrophic — far worse than the impact of a fiscal cliff.”

House Speaker John Boehner has said there won’t be any one-on-one negotiating with the President this time. Nor with Senate Majority Leader Harry Reid, it would seem. Encountering Reid on arrival at a White House meeting, CNN and Politico both reported that Boehner told Reid to “Go f— yourself”. Reid had characterized Boehner’s management of the House as a “dictatorship”.

Mitch McConnell will step back as well. He faces re-election in 2014 and is taking heat for being co-conspirator with Vice President Biden in crafting the tax increase deal that skirted the cliff. So he has declared that the Senate will now follow its formal procedures of committees and debate rather than private deals.

Republicans are furious that the cliff deal raised taxes while spending cuts disappeared and the mounting costs of Medicare and Social Security were untouched. The debt ceiling affords them the opportunity for revenge and they lie in wait.

obama’s runaway spending?

We suspect that most in the general public think that Congress’s zeal in keeping the debt limit from rising is to prevent the Obama administration from spending uncontrollably. To the contrary. It is Congress, in its appropriation bills, that decides how much the various departments of government may spend each year. So if Republicans decide to keep the lid on the debt limit, they will be refusing to pay for what Congress itself has already told the government to spend. One could say that Congress will be refusing to pay its own debts.

not to forget the sequester

Republicans in the House are expected to use the sequester as well to force the administration to collapse at the bargaining table. The sequester is the mandate by law to cut $1.2 trillion in spending across ten years that took effect when a joint Republican-Democrat committee could not come up with a deal last November for how the cuts would be apportioned. The cuts — half from defense, half from other discretionary spending — were supposed to kick in automatically this January 1, making it one of the items poised at the edge of the cliff. But, instead, it was pushed down the calendar a couple of months where it will compound problems by coinciding with the debt ceiling farrago. Republicans will demand that the sequester’s cuts of defense spending be eliminated in return for raising the debt ceiling, and some want the defense cuts to double up the cuts to social programs.

the fire this time

Even though the debt ceiling was raised in 2011, the fallout from the dispute was acute. Stock prices tanked and the nation’s AAA rating was downgraded, with Standard & Poor’s specifically citing the government’s dysfunction as the primary cause. But that first downgrade had little effect, as money worldwide continued to flow into the American safe haven. An actual default, however, would be a of different order of magnitude.

Most Democrats and Republicans realize this, but their preventive demands are polar opposites. Republicans, especially, have indicated that they must have their way and get spending cuts this time or they will let default happen. The Moody’s rating’s service has already signaled that it would lower the nation’s credit rating again. New York Times financial reporter Binyamin Appelbaum said it well:

“The belief that lending money to the U.S. government is virtually risk-free is a basic tenet of the global financial system. The risks of other investments are measured by comparison, and priced accordingly”.

Jeopardizing trust in the dollar is an insane way to run the government.

The dollar would drop sharply in value, affecting all Americans. Another drop in the nation’s credit rating means higher interest costs for business and all levels of government, as well as a drop in the value of all debt outstanding. (Current debt will be worth less because new debt will be paying higher interest.) The loss of the Triple-A rating last year cost the government an additional $1.3 billion in interest costs in 2011 and is projected to cost $18.9 billion over 10 years. So there is the paradox of Republicans zealously advocating cost cutting yet their actions add to the government’s interest costs when they cause rating downgrades.

shifting sands

After all year insisting that those earning more than $250,000 pay a higher tax rate he called their “fair share”, President Obama smoothed over that line in the sand and yielded to a $450,000 cutoff.

Instead of yielding, one strategy was to go over the cliff, letting tax rates rise for everyone, in the belief that, in their ardor for low taxes, Republicans could be forced to raise the debt limit as part of any deal to restore the “Bush” tax cuts. Second thoughts probably said that, even though most of the public would blame the Republicans for letting everyone’s taxes rise, a sizable percentage would fault the president for his obstinacy in refusing anything less that his demand to raise taxes for all earning over $250,000 a year.

But the threat of letting all Bush tax cuts expire was his leverage. His tax deal gave that leverage away, leaving him holding no cards to counter the debt ceiling threat in the Republicans’ hand. Democrats fear that, much as he relented on the $250,000 demand — which had been his pledge as far back as his 2008 election campaign — he will fold yet again when the debt ceiling brawl verges on crisis, which this time will mean caving to Republican demands for cuts in the entitlement programs. The Democratic base continues to resist any change in Medicare and Social Security and gives no sign of ever facing up to their unsustainable futures.

strategy

This time around President Obama may be signaling that, if Congress doesn’t work out a deal that he is willing to sign, he’ll rule by fiat, using the 14th Amendment as grounds. Deep in that long 1868 amendment, more renowned for its due process clause, are these words: “The validity of the public debt of the United States…shall not be questioned”. Its use would be a stretch, though, as the elided words in that phrase and much of the amendment are really concerned with guaranteeing in the wake of the Civil War the payment of pensions to those who aided in suppressing insurrection. Its authors did not have saving the trust in the nation’s credit in mind.

Jan 13 2013 | Posted in

Policy |

Read More »

Americans are almost entirely unaware that, a year ago, President Obama signed into law an act that contained the most brazen trespass upon our civil rights in modern history.

This was a budgetary law, the National Defense Authorization Act (NDAA), that primarily funded the military and defense expenditures for the coming year, but it added a frightening provision: the president could could turn over to the military anyone, including American citizens, merely suspected of being a terrorist or associating with terrorist groups for indefinite detention without due process, without the right of habeas corpus, without trial. Stripped of our system’s legal safeguards of individual freedom, a person could effectively disappear.

It was an extraordinary action by any president, as we reported then, and stunning by a former professor of constitutional law at the University of Chicago. It was not surprising that he chose a moment to sign the law when no one was looking: New Year’s Eve. Obama then said he would not not use the law to imprison a U.S. citizen, but this from the man who had also promised to close Guantanamo. And the law is on the books for any future president to apply.

At the end of this December, Congress had the opportunity to fix the law, as it voted for the 2013 NDAA. An imprecise amendment from Diane Feinstein (D-Cal) explicitly barred placing U.S. citizens in military custody without a trial, but that left the door open for civilians to be transferred to a military prison after a trial. It was at least an attempt to temper the law, but astonishingly, it failed. Here is a law which, as we will see, was enjoined in federal court as unconstitutional, yet that deterred Congress not at all from blessing it again, unchanged. Feinstein’s amendment was removed from the bill in a House-Senate conference committee led by John McCain (R-Ariz).

Section 1021 of the NDAA that allows the President to turn over to the military even American citizens suspected of being a terrorist, further includes anyone who has had contact with a terrorist, or contact with “associated forces” or is suspected of giving “substantial support” to a terrorist organization. None of the quoted terms is defined in the law.

That led to a challenge. Pulitzer-winner war correspondent Chris Hedges, the outspoken public intellectual Noam Chomsky, and Daniel Ellsberg, best known for exposing the secret Pentagon history of the Vietnam War — three of a total of eight journalists and activists, with lawyers working without fee — sued the government on constitutional grounds. What would prevent reporters from disappearing into military prisons for making contact with whatever the government decided to term “associated forces”? What if you (yes, you, reader) gave innocently to a charity that proved to be a conduit to a terrorist organization? What would prevent your being swept away into the system for years — or for good — for “substantial support”?

In mid-May of 2012, a federal judge appointed by Obama, Katherine Forrest of the U.S. Eastern District in New York, ruled that the law is “facially unconstitutional”, that its vague terms would “chill” the most penetrating work of journalists and interfere with First Amendment freedom of the press (more here).

The Obama administration does not want penetration. What was remarkable was the urgency with which government lawyers appealed Judge Forrest’s permanent injunction preventing the law from going forward. They asked for and got a temporary stay in return for a promise that they would not jail the plaintiffs or American citizens under the law pending hearings in January and a ruling by the appeals court.

Hedges, writing of the group’s case against the government at Truthdig, suspects the government rushed to restore parts of the law because it is already in use — in Afghanistan. That dovetails with the curious struggle between American officials and Afghan President Hamid Karzai about hanging onto the American-built Bagram prison where, according to this CBS report, there were a year ago more than 3,000 inmates, five times the 600 Obama inherited from the Bush administration. Former detainees reported to the International Committee of the Red Cross that they had been held in 35-square-foot cages, at times in isolation, subjected to the cold, deprived of sleep and mistreated in other ways.

Karzai ordered the transfer of the prison to Afghan control, but a two-month extension negotiated by Obama has expired without U.S. compliance. A New York Times article cites “57 prisoners held there who had been acquitted by the Afghan courts but who have been held by American officials at the prison for more than a month in defiance of release orders” and Karzai’s office says hundreds of new prisoners are held by American forces in a closed-off section called the Detention Facility.

It is a government that likes secret and indefinite detention, wherever.

Mr. Obama seems to like New Years for getting things done when no one is looking. On the Sunday the day before New Year’s Eve, he signed a 5-year extension of illegal wiretapping begun by the Bush administration that was later sanitized by amendments to the Foreign Intelligence Surveillance Act (FISA).

The act authorizes wiretapping without a warrant of Americans who communicate with overseas “targets” enumerated by agencies such as NSA and CIA, removing without due process the Constitution’s Fourth Amendment protection from those persons’ rights. Civil liberties proponents have always assumed that the eavesdropping dragnet pulls in the phone and e-mail traffic of vast numbers of other Americans. Senators themselves made three attempts in this renewal of the act to insert some oversight and privacy protections, but all were turned back by large margins.

Not just the Obama administration but the legislature as well likes secret surveillance powers over the public. Congress has routinely renewed laws, once thought to be temporary, that trample the Constitution in the guise of national security, laws that have taken on a permanence even though we are eleven years on from 9/11.

Jan 9 2013 | Posted in

Law |

Read More »

<|156|700|The Fed's emphasis on jobs puts the squeeze on seniors>

Sharia law prohibits charging interest for loans of money. Capitalism has a rather different view. It says that if we manage to accumulate money through our efforts, we should earn something if we give someone else the use of that money.

Ben Bernanke and his Federal Reserve seem to prefer Sharia law. The Fed has forced down interest to the vanishing point — driven to virtually zero since late 2008 when the Fed moved to counter the crash.

Americans are notorious for saving next to nothing, but those seniors had had listened to advice about saving and had carefully tucked away money for their retirement in the expectation that those funds would earn them interest income to live on have been harshly disappointed. Bernanke decided to reward the banks instead — those financial institutions whose risky behavior had played an instrumental role in igniting the 2008 financial panic.

The Federal Reserve has kept interest at 0% or thereabouts so that the banks can borrow money from the government at next to no cost. The idea is that they will then have cheap money to loan to businesses and homeowners who in turn will use it to re-start the U.S. economic engine.

Funny thing happened, though. The banks had already used bailout money to swallow other banks or buy back their own stock rather than make loans. Now they simply use the 0% money to buy Treasury notes that pay higher interest than the interest cost of the money they borrowed from the government. Or they bet the money in the worldwide casino of the derivatives market. Trading is what banking has become. That has proved much more rewarding than the mundane business of loaning to businesses, financing car loans or writing mortgages.

money for nothing

Zero interest isn’t working all that well to regenerate the economy, but the Fed won’t give it up. So retired people who place their money in the safety of Treasuries are, as we’ve said before, loaning money to the government for free. They get nothing back, nothing to pay their bills. Fed policy effectively asks them to to risk their money elsewhere — exactly what older people are told not to do.

If a lack of consumer demand is one cause for stalled hiring by businesses, the irony is that the Fed program has been somewhat self-defeating, especially among seniors. With less money to spend, they’re spending less money, scrimping on everything. Of the 78 million baby boomers, each new batch of 10,000 who retire every day are hanging onto what money they have in a feedback loop that helps keep demand from rising.

opening the hydrants

Because zero interest isn’t working, the Federal Reserve has tried a second approach — pumping huge sums of money into the economy in the hopes that might turn over the sputtering economic engine. The program is shrouded behind the bewildering name of “quantitative easing” (QE) but a valid enough translation is “printing money”.

There have been two such surges — $600 billion injected into the economy beginning in November 2008 after the September crisis, and another $600 billion starting in August 2010.

The third QE began a few months ago when the Fed declared that, rather than huge dollops of occasional money, it would buy $45 billion in Treasuries every month from the banks that routinely invest in them. As payment, the Fed issues credits to the selling banks — effectively printing new money because the credits are money that doesn’t exist. But these IOU’s from the Fed are treated as increases to bank reserves, which frees up money for them to lend.

Or so goes that theory which doesn’t seem to be working. And because it hasn’t, the Federal Reserve has now doubled its outlays, adding $40 billion a month of mortgage purchases to the $45 billion a month in Treasuries.

The idea is to reduce the supply of Treasuries and mortgages so that sellers of those instruments can dictate still lower interest payments to buyers, who still need to place America’s vast sums of money somewhere, anywhere that at least pays something. That’s how the Fed puts its foot on the throat of interest rates to pin them to the floor.

new game plan

The Federal Reserve has by long tradition held a monthly meeting followed by announcements of deliberations limited only to the moment. This time, though, Bernanke and Company have made public their long term plan. Their mandate to stem inflation has succeeded; their mandate to spur employment has not. The new emphasis is therefore on jobs. The central bank has announced that it will continue the program of interest rate suppression however long it takes for the jobless rate to drop to 6.5% (it is now 7.7%) or until inflation rises to 2.5% (it now runs at less than 2%).

Setting goals for the first time is called “lead targeting”. It comes from the Fed board finally listening to other than their own counsel. A little known University of Chicago-trained economist named Scott Sumner, living in Newton, Mass., has been blogging about this approach for nearly three decades, according to this Bloomberg account. His thesis is that a central bank should increase the money supply until a specified target is reached. As a by-product, that gives a clear signal to industry what to expect and watch for, the better to be able to plan.

Sumner’s work was gradually noticed by better known economists such as Tyler Cowen and Christina Romer. Central banks in Sweden and the British government made contact. The Fed seemed the last to hear about it, whereupon Ben Bernanke found himself having to answer questions at a press conference about the theories of someone named Scott Sumner.

squeeze play

So why do we say that the Federal Reserve has now doubled down against retirees? The U.S. has enjoyed an extremely long period of low inflation. Heavy injections of new money is the recipe for disrupting that stability. With hundreds of billions more dollars floating through the system, producers can finally get away with raising prices. With rising prices, those fixed savings of seniors will buy less.

But a 2.5% limit on inflation doesn’t sound all that bad. Except that, if inflation does start rising to the 2.5% point, it will not obediently stop. Once set in motion, it will keep rising until tightening of interest rates brings it again under control, by which time those retirees may find that their nest egg — for years having suffered the blow of no earned interest — could be dealt a second blow by inflation reducing the value of their savings by appreciably more than 2.5%.

And now a possible third blow, with President Obama making a fiscal cliff offer to trim Social Security’s annual cost of living increases. The message from New Normal seems to be: forget about retiring.

Jan 8 2013 | Posted in

Economy |

Read More »

They’ve known for a year what was coming, because a year ago it was they who set the timer for everything to explode. It was they who extended the Bush-era tax cuts to detonate New Year’s Eve, they who contrived for the payroll tax reduction to go off simultaneously, they who rigged the blast caps of the sequester for the same moment, and it is they who then did nothing all year to defuse their misdeeds once they realized the wreckage that would be the consequence.

Or should we liken them to irresponsible college kids who wait until the night before to cram for the finals. They could have worked throughout the year on the true tax reforms they themselves recognize as so badly needed and so often speak of, but far more important than cleaning up the nation’s messes was their own re-election.

If it’s not obvious, we are referring to the Congress of these United States, enjoying their lowest public approval rating ever (11%). And all they finally did was tweak the tax rates on income, capital gains, dividends and inheritance for top earners. All those ideas about trimming deductions and “loopholes”? They vanished. In fact some limits were applied to the higher income group but in the form of new intricacies to complicate the tax code still more. Think how rapidly the code would be simplified if there were a law for Congress members to figure their own taxes.

And the sequester? The $1.2 trillion in cuts across ten years split half-and-half between defense and other spending, made mandatory a year ago because our so-called “leaders” couldn’t get the job of sensible apportionment done then, either? The cuts were to start now, but the Senate agreement has instead planted that IED two months down the road where it will discharge just about when Congress and the White House will be in a firefight about the debt ceiling.

The tax plan passed resoundingly in the Senate, 89 to 8, but 151 Republicans in the House voted against it, angered over the lack of spending cuts. The strange irony is that these avid tax cutters preferred to go over the “fiscal cliff” and see taxes rise for everyone rather than taxes rising only for the wealthiest.

The Congressional Budget Office estimates that the permanent low rates will add $4 trillion to the deficit over ten years in comparison to letting the 2000 rates resume. Looked at the other way, compared to continuance of 2012 rates, revenue from increases for the top income groups will cut the deficit by $650 billion over the ten years.

Jan 2 2013 | Posted in

Policy |

Read More »