With Control of Congress in Sight, Republicans Float New Policy for the Poor

Sep 16 2014Republicans realize they have a problem arising from their seeming indifference to those on the lower economic rungs. Since the 2012 election they

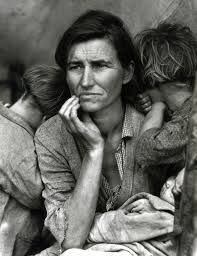

Dorothea Lange's iconic

face of the poor

have been looking for ways to moderate their disdain for programs that deal with poverty while not ruffling the more extreme elements of the Party that advocate deep cuts.

Which explains the proposal put forth by Rep. Paul Ryan, at once the Party’s fiscal guru and a victim as vice-presidential candidate of those very same non-inclusive policies. In a Wall Street Journal op-ed describing his plan, Ryan says “I've learned I was wrong to talk about 'makers and takers'”.

Simultaneously, Arthur Brooks, the president of the right-leaning American Enterprise Institute, acknowledged the problem in a New York Times op-ed and asked members of either party to give reasonable consideration to the ideas of the other before segueing into an introduction of the Ryan plan.

With Republicans looking ever more likely to gain control of the Senate in the upcoming election, and thus control of the entire Congress, in Ryan’s plan we may be looking at reforms the Party actually intends to make.

Ryan wants to replace 11 sources of aid to those in poverty — those that deliver food stamps, housing assistance and cash welfare, for example — with a single payment stream. If he were to stop right there, it would be the fulfillment of a libertarian’s dream — leaving it to the individual family to decide how to allocate a single sum of money according to priorities it gets to set. And the efficiency of getting rid of multiple layers of bureaucracy, each duplicating the other in vetting a given family’s applications for aid, each maintaining its own records and processing its own payments, has great appeal.

But instead, Ryan goes well beyond. Hewing to the conservative creed of shrinking the federal government, the funding would go to the states to allocate as they see fit. The federal role would be reduced to oversight to make certain that the money is not re-routed to purposes other than aiding the poverty-stricken.

Ryan's idea would have state case workers meet with individual families to work up what he calls an “opportunity plan” that provides for a household's needs and delivers financial counseling meant to put aid recipients on a path to self-sufficiency through work. The session concludes with a contract that a family must sign that offers incentives to achieve stipulated goals and sanctions should they fail. This follows the conservative belief that there are jobs out there for the asking if only people would make the effort.

How then to explain the contradiction of Ryan denouncing the “liberal progressive mindset that seeks a larger, more active government and lets bureaucrats decide what's best for everyone instead of allowing citizens to govern themselves” in that Journal op-ed just before he introduces a plan which does just that. He goes on to say that the liberal “response to every social problem is more government, more bureaucracy and more taxpayer money”, at the same time proposing a plan that would create 50 bureaucracies, spread all across each state, and needing the creation of 50 separate payment systems to issue the (assumed) monthly checks. This would surely aggregate to a size greater than the federal government counterpart owing to the hugely time-consuming family-by-family consulting essential to his plan.

Reagan’s favoriteRyan’s plan is an outgrowth of ideas proposed earlier by Marc Rubio and others that would expand the Earned Income Tax Credit. The EITC is a formula-base benefit paid to low-income individuals and families that phases out as income rises. Meant to encourage people to seek work, it was passed during the Reagan administration (he called it the “best anti-poverty, the best pro-family, the best job creation measure to come out of Congress”) and is paid only to those who work. There’s bipartisan agreement that those with children benefit disproportionately, and Ryan’s plan would double the benefit to the childless to fix that. But those on the right would like to see the EITC increased as a means to do away with the minimum wage in the belief that more jobs would be created if wages were free to sink lower. This page has viewed that as an astonishing gift to low-wage businesses that asks the taxpayer to make up the difference. (Our entirely different view of the minimum wage can be found here, here and here.)

Democrats waryDemocrats are skeptical of block grants to states, especially Ryan’s that would wrap what are now 11 programs into a single bundle, because the grants would be too easy to cut en masse, with devastating effects on millions of people, whereas 11 different programs at least require 11 congressional struggles. And block grants are fixed, in contrast to food stamps, for example, which flex according to need.

There is also concern for the inequitable policies that would arise in the different states. Would the unfortunate be treated well in some and poorly in others? Nearly every Republican-controlled state has rejected the Affordable Care Act’s offer to pay 100% of Medicaid expansion leaving some five million adrift. How would those states be allocating Ryan’s “Opportunity Grants” were they the law today?

austerity budgetsThe proposal is a significant departure for Ryan. In April he issued a budget harsh enough to barely pass in the House, 219 to 205, with no Democratic votes, 12 Republican defections and no possibly of consideration by the Democrat-controlled Senate. It was perhaps more a statement of conservative principles that Republicans could tell the folks in home districts they had voted for. But it does signal what fiscal policy could become if Republicans win control of Congress.

Ryan promises a balanced budget after ten years through spending cuts of $5.1 trillion (but an increase in military spending of almost $500 billion). To get there he would repeal Obamacare, channel new generations of seniors away from Medicare into buying their own insurance with a government check, slash the tax rate for the top bracket from 39.6% to 25%, cut $732 billion from Medicaid and $791 billion from other social programs from education to food stamps. Even so, to reach its goal, Ryan’s assumptions rely on a supposed burst of economic growth from these cuts that lead to vastly increased tax revenues, a persistent yet discredited Republican theory that has never proven true.

That budget is his seventh, all similarly severe, which makes his anti-poverty proposal suspect to Democratic eyes. But it at least shows that Republicans are stirring with the prospect of controlling Congress on the near horizon and are exploring new ideas. Democrats, on the other hand, show no inclination to explore fresh approaches to deflate the bloat of overlapping social programs — Ryan says there are 80 overall — and they refuse to budge on Social Security and Medicare entitlements that are on course to break the economy, if not dealt with.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.