There’s Bait and Switch in Republicans’ Tax Reform

For years we have heard, from left and right alike, of the need to simplify the confoundingly complex and grotesquely bloated tax code. The Republican resolve born of control of both Congress and the presidency told the party the moment has finally come.

Not quite yet, it turns out. Not simplification. As ever, protests have greeted attempts to eliminate each “loophole”, deduction or exemption whose elimination is needed to pay for the tax rate cuts, with other high-minded goals sidelined. Doing away with state and local taxes as a deduction has riled high-tax states. the bracket racket

But what happened to simplify? That great and noble goal immediately vanished, lost to the usual Republican mania for cutting taxes again, the seeming core reason for the Party’s existence. We are not hearing any talk about hacking away at complexity. But we forgot, didn’t we, that in the Trump/Republican plan, tax brackets will be “collapsed” from seven to three. When the president unveiled the plan in September, a Wall Street Journal editorial heralded “the party’s blueprint for tax reform”, saying, “The good news is the blueprint would fold seven brackets into three -12%, 25%, 35%”. The New York Postpraised the plan as “the most pro-growth” since Reagan, that collapsing the tax brackets from seven to three would simplify our “messy tax system”. Michigan Republican and now-retired chairman of House Ways and Means, Dave Camp, labored long on a sweeping plan that led off with the same magical three brackets to replace the seven in 2014. The Journal called that “the heart of the plan”. Too many brackets seems to be where all the complexity lies.

What’s going on? Bracket reduction always tops the list of every Republican tax proposal. It’s their show pony for simplification, as if to say, “Those seven brackets are just too mind-boggling, so look what our plan we’ll do. We’ll collapse them to only three!”. The actual complexity of the tax code causes everyone to use software or a preparer like H&R Block, so few have been near a Form 1040 for a couple of decades. So it’s easy to hoodwink the public. They’ll never realize there is no simplification at all in reducing the number of brackets — you still find which one matches your taxable income and make the calculation. Nothing changes. the swamp

So much for reform, leaving in place and unattended the 70,000-plus page tax code — “10 times the size of the Bible”

That’s what needs simplification. Camp and Rep. Sandy Levin, also of Michigan, had 11 bipartisan working groups tackling different parts of the tax code, coming up with proposals to condense overlaps and throw out excess baggage (15 different tax breaks just for education, for example). What became of all that effort? the rich need incentives

The reduction from 39.6% to 35% is branded by the Left as a tax cut for the rich, who instead should pay their “fair share”. Fair is for them always an increase, never a decrease. The Right argues that the higher the tax, the greater the disincentive to work. Conservatives are fond of this rule because it justifies tax cuts. It comes from economists, for whom the inviolable rule is, if something goes down, something else must go up — and vice versa. If you lower taxes on the wealthy, they will rise up, work harder, start businesses, grow the economy.

In the real world populated by non-economists, the notion seems silly. If taxes are raised on someone earning millions, does he or she really begin to neglect the job, come in later every morning, take Friday’s off, let the company go to hell because the take-home dollars have declined? That says only money motivates people.

Marcus Ryu, a Silicon Valley entrepreneur who started in 2001 what became a $5 billion company, said in a New York Times op-ed that, among the many reasons for starting a company, he had never heard anyone say “I would have started a company, but tax rates were too high, but then George W. Bush cut tax rates, so I did”. That’s akin to Warren Buffet’s well-known comment that “I have yet to see [anyone] shy away from a sensible investment because of the tax rate on the potential gain”.

Those three rates — the 12%, 25%, 35% — are the same as in the one-page plan that Donald Trump rushed to deliver in April so he could claim action on taxes before his 100 days were up. Yet, given all that time, Republicans have not figured out to what level of income each of those rates apply, so the effect on revenues and costs and each year’s deficit cannot be assessed. Put more bluntly, they have deliberately not come forth with those levels to make sure the Congressional Budget Office (CBO) and various groups such as the Tax Policy Center cannot make 10-year projections. White House oracles

That frees the administration to make claims that may prove false, another likely bait and switch in the making. On “Good Morning America”, Gary Cohn, Trump’s chief economic adviser, proclaimed, “Wealthy Americans are not getting a tax cut”. When still a nominee for Treasury Secretary, Steven Mnuchin pledged, “Any reductions we have in upper-income taxes will be offset by less deductions, so that there will be no absolute tax cut for the upper class”. This October he is still saying, “The objective of the president is that rich people don’t get tax cuts”.

But in addition to the reduction to 35%, the Republican plan would repeal the 3.8% surcharge on investment income, as well as the alternative minimum tax, which will be a huge windfall for wealthy taxpayers such as Trump himself, as explained in “A Bespoke Tax Plan for the Trump Family“. Repeal of the inheritance tax is also on the blueprint, although that may be dropped as too obvious a giveaway to the rich.

As for Mnuchin’s deductions, the plan would keep the mortgage interest and charity deductions, and jettison the others on Schedule A. But one of the key deductions intended for the chopping block and needed to pay for tax cuts is state and local taxes (given the acronym SALT). Those on the right enjoyed that one, because at least it does the most damage to filers in the big blue states, New York and California. But cancelling that deduction is drawing fire from other states; many have significant SALT levies as seen in this list. Add to that, property taxes. Removing those taxes for those who itemize their deductions hurts the middle class and, it could be said, augurs the odious prospect of paying taxes on taxes, on income never received.

So that has left Mnuchin repealing his guarantee, what had been called the “Mnuchin Rule”, now saying, “It’s very hard not to give tax cuts to the wealthy”. forget frugality

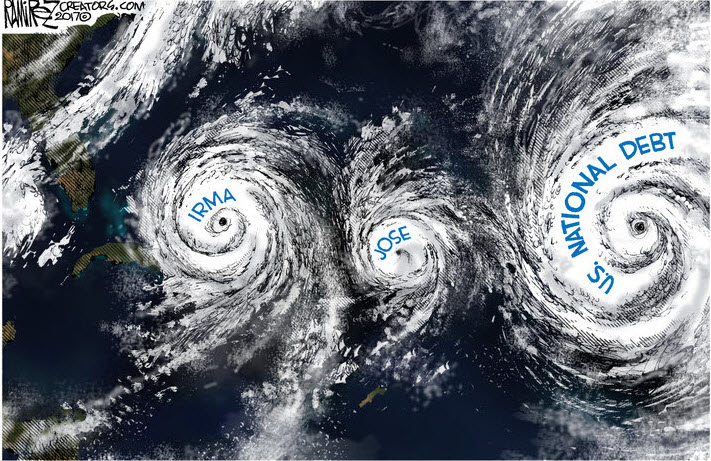

Senate Republicans have passed a budget that allows them a deficit of $1.5 trillion over the next 10 years. That’s drawn a lot of comment: The party that for the last six years demanded of Obama that the cost of every proposal be matched by savings elsewhere, has thrown that precept aside and is happy to spend with abandon on its own policies.

Passing a budget is a prerequisite called for by the Senate’s own rule that allows passage of tax bills by 51 votes rather than face a Democratic filibuster requiring 60. The rule says the budget cannot end in a deficit after those 10 years. But the Trump-Republican plan looks (with those income brackets levels guessed at) likely to produce deficits of $2.6 trillion or so over the coming decade, according to the Tax Policy Institute, with similar estimates by other think tanks. So the budget that erases the deficit by 10 years out is a sham. down is up

But that troubles Republicans not at all. Since economist Arthur Laffer drew a diagram on a napkin at a D.C. restaurant — a yarn we relate in “Have Republicans Finally Abandoned the Laffer Curve?” — Republicans have had a magical incantation that makes deficits disappear, albeit in their imagination. They tell us that tax cuts lead to a growing economy that yields enough new tax revenue to fill the revenue hole the tax cuts have dug. Tax cuts pay for themselves! There has never been an instance where this has proven true, yet it is taken as a given. A Journal editorial says, flat out, “The revenue hole would be filled by faster economic growth”, so CBO’s estimate can be ignored because they underestimate such “feedback”. And not just filled. “This plan will cut down the deficits by a trillion dollars”, said Mnuchin. Reagan cut taxes, but revenues plunged and he had to raise taxes part way back. Clinton raised tax rates and the economy soared until the dot.com plunge in 2000. Bush cut taxes but the economy limped along and improvement only came later. Obama’s tax increases were in his second term, and that’s when the economy did best. A correlation between tax cuts and amped up revenue is lacking. North Carolina politicians claim the miracle just happened there, which awaits validation by someone other than a Republican from North Carolina, but their claim is offset by Kansas, where tax cuts led to huge revenue losses necessitating drastic cuts in public services. The French economist Thomas Picketty — noted for the stir his book caused for showing the troubling reason why inequality has been increasing — together with colleagues at Harvard and the University of California, Berkeley, analyzed tax cuts from 1970 to the years before the 2008 financial collapse in a number of industrialized countries. They found no meaningful correlation to growth. For those on the right who claim tax cuts are needed to spur growth, why are going unnoticed the records set every other day by stock indexes that reflect corporate profits, by unemployment at an extreme low, and by a million or so jobs going begging? Where is this growth going to come from to pay for their tax plan? Hasn’t it already happened in one of the longest — at eight years plus — recoveries ever? And with the economy surging ahead and so much needing to be done, such as repairing the nation’s infrastructure, why do we need these tax cuts? Simplification, please.

Michael Ramirez

Health costs, from insurance to drugs, must already surmount a percentage-of-income hurdle to be deductible; now the proposition is to disallow health expenses altogether. The standard deduction would double, but personal exemptions would be taken away. But nothing tops this: it’s not enough that mortgage interest will be retained as a deductible. Real estate industry lobbyists don’t want you to have that doubled standard deduction. Why? Because less people would itemize, with the result that tax savings from subtracting mortgage interest would become less of an inducement to buy more expensive houses.

says Camp. Americans spend over six billion hours and about $170 billion every year on their returns, says the IRS. The instructions for the primary fill-in form for individuals — Form 1040 — is 106 pages filled with tangles of rules that branch to other rules, worksheets to fill out to see if you qualify for this or are subject to that, references to IRS publications you need to download if your case isn’t covered in 1040’s instructions. And then there are the other forms to fill out — interest and dividends, deductions, capital gains and losses, etc. — each with its own instructions.