Trump and Musk Scheme to Destroy the IRS

Mar 21 2025On February 20th, termination letters were sent to 7,000 probationary employees at the IRS just as over 200 million tax returns were about to descend on the agency. In an e-mail sent this Wednesday, Acting IRS Commissioner Melanie Krause reinstated them. Why? ProPublica uncovered that a top IRS lawyer warned the administration the letter, which fired the employees for poor performance, was “a false statement” that amounted to a phony predicate the Trump administration would claim in court, "an anticipatory fraud on tribunals of jurisdiction over these employment actions” in attorney Joseph Rillotta's words.

The performance of those dismissed had never been considered. To the contrary, many had received laudatory reviews.

Krause had to back down. The cohort would continue to be paid but were not to return to work, never mind tax season.

President Trump may have instructed Elon Musk to start using a scalpel rather than a chainsaw, to keep good people and eliminate the “bad ones”, but the 7,000 remain unchanged as an arbitrarily chosen group with no attention given to individual merit.

larcenyOn top of that, the "continuing resolution" passed by Congress a week ago — a Republican plan with deep cuts in social programs grudgingly acceded to by a few Democrats to avoid a government shutdown — contained a little noticed line item that docked the IRS $20 billion in funding. And it's not the first time.

Nothing so clearly illuminates the Republicans’ fiscal irresponsibility than their repeated actions to hobble the IRS. Nothing makes it more obvious that Republican policy is to convert the U.S. into an oligarchy, to create a billionaire class that rules the country, than their repeated actions to stymie the pursuit of tax cheats and tax collection in general.

resuscitationIt was salvation far too long in coming when the Democratically-controlled Congress passed in 2022 President Biden’s Inflation Reduction Act (IRA) which included $80 billion across 10 years to revive the IRS. It provided a stable flow of funding that would enable the agency to increase its seriously depleted headcount; eliminate interminable waits for phone support; upgrade ancient computer systems; and go after the wealthiest in pursuit of tax evaders. It’s the last of these goals that Republicans always want most to prevent with the threat to their mega-dollar election campaign donors uppermost in mind.

And so, no sooner had Republicans regained legislative control in the 2022 midterms than they resumed their decades-long practice of beggaring the IRS. In a continuing resolution (CR) in the fall of 2023, they grabbed the first $20 billion of the $80 billion. Why? To give $14.3 billion of it to Israel for them to buy munitions to flatten Gaza and begin the slaughter of its civilian population.

In another CR this past fall – the substitute for Congress repeatedly failing to do its job of passing the dozen departmental appropriations bills — Republican lawmakers took a second $20 billion, just as no-longer IRS Commissioner Danny Werfel had used the new funding to finally reach a needed 100,000 threshold in personnel. It is not clear whether the CR just passed carries forward the fall’s $20 billion or is yet another theft, which would mean $60 billion of the $80 billion — gone.

on deaf earsIn February, five previous IRS commissioners — including the just-departed Werfel — joined to write an opinion piece in The New York Times titled "Trump Just Fired 6,700 I.R.S. Workers in the Middle of Tax Season. That’s a Huge Mistake". As the commissioners pointed out, most of the 7,000 (the count adjusted as it became known) "are directly involved in collecting unpaid taxes". We can be cefrtain of that because it assures the American oligarchy that the agency will lack the expertise to seek out tax cheats.

Their argument should be viewed as incontrovertible, but there has been no indication that Trump and Musk will yield to those with actual knowledge. Far from it. The 7,000 are just the beginning. We will see billionaires Trump and Musk drive the IRS to the brink using budget cuts as their weapon to drive further layoffs and guarantee that only the ordinary taxpayers with their simple accounts will be audited.

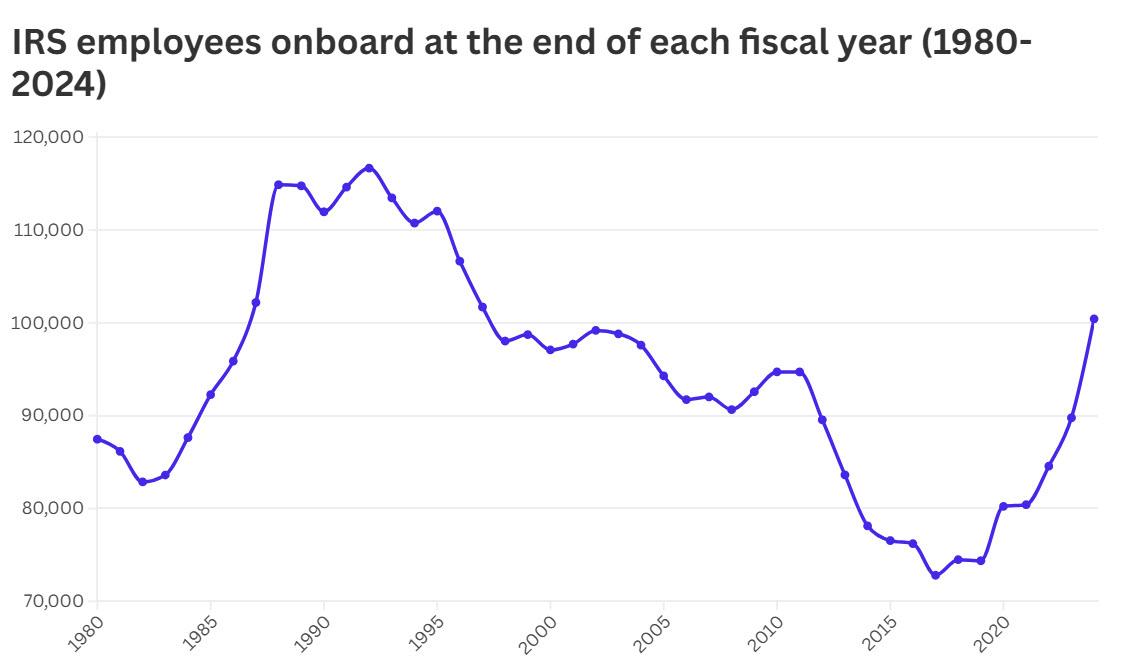

You can see that strategy by tracing rightwing policy over the years. The chart shows the severity of staffing cuts, a drop of 38%

between the peak hires of 1992 and the record low count of – no surprise — Trump's four years, assuring that audits would be cut to a minimum. As if 38% fewer employees were not bad enough, the taxpaying U.S. population rose by 29% during that timespan, cutting the ratio of IRS staff to population by well more than half.

The fewer the personnel count, the fewer the audits, but it is not proportional. Audits of the wealthy drop far more because their complex returns require more agent hours than staff shortages can afford. Here’s a snapshot: Audit rates of individuals making over $10 million a year dropped from 21.5% in Obama’s 2010 administration to 5.8% in 2017 when Trump took over, and fell to 2% by when he left office. Then came the 10-year $80 billion infusion of Biden’s IRA and the increased staffing brought the rate back up to 8.7% by May of 2022.

dumping groundCongress with no aforethought burdens the IRS with work extraneous to collecting taxes (and then finds fault with the agency’s inability to do its basic job). With the pandemic raging, the IRS was called upon to mail checks to just about everyone in America — and three times over, twice under Trump and once under Biden — a colossal job accomplished despite a staff reduced still further by the virus’s ravages. That was compounded by Congress passing in 2020 the Employee Retention Credit (ERC) and the similar Payroll Protection Plan (PPP) that gave businesses funds to keep paying their employees during the months the pandemic had driven away customers. Here again, the job was given to the IRS to process the deluge of applications and issue the money. Compelled to do so at speed, the agency could not investigate the validity of millions of applications. American businesses, having no interest in the ethics called for in a national health crisis, responded with staggering fraud. The U.S. Government Accountability Office (GAO) estimated that the federal government made $528 billion in improper payments in 2021 and 2022.

And, of course, it's been left to the IRS and other agencies to deal with a mess of Brobdingnagian proportions to clean up, to investigate who was truly eligible and who was cheating. This is slow going, “one of the most complex tax administration provisions we’ve ever had,” said Commissioner Werfel. But DOGE thinks efficiency lies in firing the people needed to track down fraud and recover billions in taxpayer money.

profit centerThe IRS collects virtually all the receipts of the U.S. government. It is the only agency or department that makes money; all others cost. For Musk and his DOGE cadets to trim the agencies’ ability to bring in money exposes the fraud of Musk's claim of eliminating waste, fraud, and abuse. Indeed, Musk and members of Trump’s staff have spoken of doing away with the IRS altogether. Their definition of efficiency.

There is an enormous gap every year between the amount taken in and the estimated amount owed. The number had grown to be an astonishing $600 billion annually the last time we looked and it's $700 billion every year now, say the five commissioners. To close the gap, the IRS needs thousands of accountants to go up against the highly paid tax lawyers and accountants hired by the richest Americans and corporations to turn their tax returns into inscrutable thickets. The IRS must in turn attract accountants sophisticated in the intricacies of global tax havens, interlocking partnerships, and intricate loopholes in a disastrous tax code that invites evasion. Agents can take weeks, months, longer to prove and collect tax liabilities.

But it is worth it. The agency calculates that every $1 spent on enforcement brings in $6. That is what Trump and Musk don't want to happen.

With the national debt racing beyond $36 trillion,

in a time when the IRS should be staffed to the fullest to go after all malefactors of fraud and tax dodges, to collect as much as possible of what is owed, we instead see Republicans in Congress making off with the $80 billion funding of the IRS, robbing $20 billion at a clip, while at the same time proposing a financial plan to please Donald Trump that will send the U.S. reeling.

As we detailed a few weeks ago here, the House will move to raise the debt ceiling by $4 trillion, retain the 2017 tax cuts set otherwise to expire next year at a cost of $4 trillion over 10 years, and allow for a flurry of new tax cuts that will come to another $4.5 trillion over the coming decade – staggering additions to the debt all while minimizing tax enforcement.

Timid words like “irresponsible” do not suffice. Trump and henchman Musk and their frightened, tremulous sycophants in Congress are treasonously out to drive the country into bankruptcy and in turn eliminate its standing as the world’s leading nation. It should be clear that disaster lies ahead.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.