47% of Americans Pay No Income Taxes

Politicians have found this message useful for whipping up a crowd’s outrage at the injustice of the tax system, and there’s a good chance it’s been one of those anonymous screeds that has arrived in your e-mail inbox at some point. It’s a claim that’s been around at least since John McCain said it during the 2008 campaign (when it was 40%, before the economic downturn destroyed still more income), and there it was again on the very first day of Rick Perry’s presidential campaign when he said in his speech, “we’re dismayed at the injustice that nearly half of all Americans don’t even pay any income tax”. True. But the injustice is the other way ’round. First, 47% do not pay income tax because they make too little income, and that’s according to the rates put in place by fellow Texan George W. Bush, so there’s not a little irony to the governor’s complaint. Taxes are due on virtually every dollar of every American’s taxable income (click ‘Read More’ to see table), so no one should assume reading the 47% claim that there are income groups that go Scot free. But after the standard deduction, exemptions and application of the earned income tax credit, there are that many people in the United States who make so little that their income is entirely offset leaving nothing subject to tax. Many of them, remember, are the retired who, after paying taxes on their income all their lives, are now living on the Social Security payments that they also paid for all their lives. And then there are the millions of unemployed today who have no income.

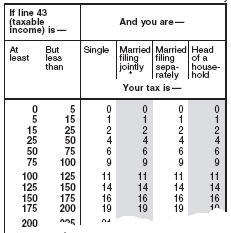

First rows of 2010 tax table. If you earn only $5 of taxable income in an entire year, The 47% claim amounts to willful deception by all who spread it. Those same people at the bottom of the income scale pay plenty in taxes: other than whatever state and local income, sales and property taxes they pay, there are federal excise taxes on a list of categories such as gasoline, telephone, alcohol and so on, but those are dwarfed by the hefty bite taken from the top of their paycheck no matter little they’ve earned: 6.2% for Social Security (4.2% in 2011) and 1.45% for Medicare. The burden is so significant that the independent Tax Policy Center reports that 74% of filers pay more in these payroll taxes than they pay as income tax. We said that the injustice is the other way ’round. The 6.2% payroll tax for social security stops at $106,800. No tax is paid on income above that line, making Social Security the most regressive tax in the nation and handing the wealthy 6.2% more than the typical wage earner. But the injustice gets far worse as we move up the wealth scale, where people tend to make most of their money on capital gains. If that’s how you make all your money, you pay no Social Security taxes, and your income is taxed at only 15%. Warren Buffet, in an op-ed piece in the New York Times revealed that he paid only 17.4% on 2010 income of almost $7 million whereas the 20 people on his office staff paid an average of 36%. So while the governor from Texas was complaining that “the liberals out there are saying that we need to pay more”, Mr. Buffett was saying the opposite. He titled his government-directed essay, “Stop Coddling the Super-Rich”.

you still owe income tax