A joke among Russian workers in the Soviet Union under Communism: “We pretend to work and they pretend to pay us”. Something similar is afoot with President Obama proposing corporate tax reform and Congress pretending to be interested in doing something about it. There’s no chance of that, with 7/8th of Congress concerned with nothing more this year than raising money and campaigning for re-election.

Still, it’s a vital subject. The tax code — corporate or individual — hasn’t been overhauled in a quarter of a century and has become riddled with loopholes, exceptions, subsidies and other means of tax avoidance that result in corporations, even those in the same industry, paying wildly different rates. The tax code, in a word, is a mess.

The spur for reform is that the nominal 35% tax rate for large corporations is second only to Japan’s as the highest in the world, therefore hurting the competitiveness and growth of U.S. companies, so goes the argument. In fact, those loopholes and exceptions result in U.S. multinationals paying 26% on average, not 35%, only slightly above the global average of 25%.

But the averages mask the inequities in the system. Companies whose business is solely in the U.S. — food chains, retailers, railroads, truckers, for example — are exposed to the full 35% (more, counting state and local taxes), whereas companies with extensive foreign operations or transferrable intellectual property such as pharmaceutical patents and software have a wealth of devices to evade U.S. taxes. Thus we see General Electric (G.E.) pay a tax rate of 3.6 percent over the past three years, while retailer Wal-Mart was saddled with 33.6 percent.

The subject of tax disparities breached the national consciousness when an exposé of G.E. appeared in this New York Times article a year ago. It revealed that an army of 975 was deployed in G.E.’s tax department to make sure the company paid no U.S. taxes at all on worldwide profits of $14.2 billion in 2010. A year before, Exxon-Mobil paid no U.S. income tax on profits of $19.3 billion, receiving instead a $156 million credit. Foreign governments, though, took in $15.2 billion in taxes from the oil giant. Examples of companies paying very low U.S. taxes are many. How do we justify to struggling businesses in the U.S. why they should pay full rate when so many of the largest corporations pay so much less, thanks to major tax concessions bought from Congress?

just take a little off the top

Obama would cut the rate from 35% to 28% in return for eliminating the loopholes. But his requirement that the result be revenue neutral — that it bring the same amount of revenue into the Treasury’s coffers as the present tax scheme — means that all tax breaks would have to be eliminated, according to Congress’s nonpartisan Joint Committee on Taxation. It’s not just the President’s oft-cited litany of ending subsidies for oil and gas exploration and corporate jets, which don’t come anywhere close to making up the revenue lost by dropping the tax rate. It’s also jettisoning creditable tax breaks, such as accelerated write-offs of equipment purchases, intended to stimulate investment and job creation. The President’s plan is vague about what perks to kill, saying only that “consideration” would be given to a number of options. It’s hard not to view such lack of specifics as simply a token to be on the record as doing something other than campaigning in 2012, because what is needed is sweeping reform.

taxes on overseas profits

The U.S. taxes profits earned by corporations in other countries. The tax is deferred, however, until the companies bring the cash home (taxes paid to other countries are at that point credited against U.S. taxes due). One argument is that taxes on overseas profits should not be deferred; deferral gives companies an incentive to use accounting legerdemain to maximize profits in countries or offshore havens that have low or no corporate taxes. The opposite argument says that the U.S. is virtually alone in the world in taxing profits earned in other countries and that we should adopt a “territorial” tax scheme whereby profits earned abroad not be taxed at all.

It’s arguable that a state has no justification for taxing that portion of a business’s sales and profits that are generated entirely in another country. But apart from depriving the government of any hope of tax receipts from foreign profits, that radical move would give corporations all the more incentive to move key operations to other countries to minimize domestic taxes.

the transfer pricing dodge

Which corporations already do. A common maneuver is for a U.S. company to sell its patents or technology, usually at a bargain price relative to the investment that created the asset, to a shell or small operating company set up for that purpose in a low tax country. The offshoot company then licenses the use of the asset back to the U.S. company at a stiff rate, banking the profits offshore ever after.

Take the example of Google, that quintessential American technology triumph that grew partly out of publically funded research by the National Science Foundation at Stanford University. It turns out that Google’s motto of “don’t be evil” is aimed at someone other than themselves, judging from their tax contrivances, as analyzed in aBloomberg BusinessWeek article. Here’s how it works:

Almost 90% of the company’s $12.5 billion overseas sales flow into the 2,000-employee company in Ireland. But Ireland has a 12.5% tax rate, so to avoid even that cost, the overseas rights to Google’s search and advertising technology are held by its Irish subsidiary in Bermuda, where there are no corporate taxes. But Ireland would tax a direct payment to Google’s Bermuda company, so Google first routes the money through the Netherlands, because Ireland does not tax payments to other European Union countries. The Dutch shell, which has no employees, imposes no tax, only a modest transfer fee, when Google sends the money to Bermuda. Result? The company’s overseas tax rate since 2007 has been 2.4%.

Thus does Google, which would not exist were it not for a miracle created by the U.S. government and taxpayer money called the Internet, keep its profits offshore safe from U.S. taxes. Another beneficiary which believes it owes as little as possible to its birth country is Facebook, which has its foreign headquarters in Ireland and reportedly has set up the same artifice. They join other multinationals — behemoths such as Pfizer pharmaceuticals and I.B.M. —, which incorporated mailbox companies in the Cayman Islands in which to park overseas profits.

There have been efforts, most recently by Senators Carl Levin of Michigan and Kent Conrad of North Dakota, to tighten the rules. What are clearly needed in reform laws are metrics that invalidate the separateness of offshore companies that have no employees, or outsized profits per employee as in the Google example, and consolidate them as part of the U.S. parent for tax purposes.

we need to go further

In his first two state of the union addresses, the President wanted to

“restore a sense of fairness and balance to our tax code by finally ending the tax breaks for corporations that ship our jobs overseas” (2009)

and

“slash the tax breaks for companies that ship our jobs overseas and give those tax breaks to companies that create jobs in the United States of America” (2010)

In 2011 he was angry that

“a parade of lobbyists has rigged the tax code to benefit particular companies and industries”

and asked

“Democrats and Republicans to simplify the system. Get rid of the loopholes. Level the playing field. And use the savings to lower the corporate tax rate for the first time in 25 years — without adding to our deficit”

This past January he said,

“Right now, companies get tax breaks for moving jobs and profits overseas. Meanwhile, companies that choose to stay in America get hit with one of the highest tax rates in the world. It makes no sense, and everyone knows it. So let’s change it.”

So it is disappointing that his recently announced plan is so unspecific. We must go much further than simply lowering the tax rate and “considering” removing tax breaks. Like it or not, justifiable or not, if we are to keep companies from shipping jobs overseas, then we need to continue to go it alone as the only nation that taxes overseas profits and, what’s more, end tax deferral. Allowing corporations to hold profits abroad tax free encourages them to invest abroad rather than in the U.S. as well as game the system to reduce taxes at home by inflating overseas profits with transfer payments and accounting maneuvers.

The risk is that this could drive some American countries offshore altogether, but the added revenue of current taxation of overseas profits, combined with thorough loophole elimination, could fund a deeper cut in the tax rate beyond Obama’s 28%, and that would make the U.S. an attractive tax country, rather than the world’s most avaricious. That could entice foreign corporations to set up operations here, and that means jobs.

But it’s all just a thought exercise for as long as Republicans vow to block any such reform, even the elimination of a loophole, as being in violation of their lock-step pledge never to raise a tax. They want just the rate cut. In fact, Paul Ryan thinks the rate should be zero. That’s one sure way to get rid of loopholes.

Feb 28 2012 | Posted in

Taxes |

Read More »

For decades now, first with Japan and to a much greater extent with China, we have allowed globalization and notions of free trade to permit cheating countries to hollow out American industry and contribute to an American future that looks increasingly bleak. It will only worsen on our present course. With China it began with clothing and household goods, then electronics, the green industries that we were supposed to pioneer, and over the horizon it will be autos and planes.

Xi Jinping’s visit to the United States gives an added boost to increased attention to the China problem. The Chinese presidential dauphin may find it politically expedient to show his toughness when he takes office and raise the volume of retaliatory threats against the United States lest we take any actions to restrict trade.

In this series we cover our troubled relations with the emerging eastern superpower. America needs to re-focus. Our preoccupation with the Middle East and Central Asia has been a costly distraction from the most important determinant of this country’s future in the world: China.

dumbing down the yuan

Underpinning all is currency manipulation, our topic in this post. Artificially low price is built into everything exported to the United States. Over the last decade it is the most pervasive cause of disequilibrium between the two trading partners. China has kept the yuan anchored to the dollar, keeping its value well below and preventing it from finding its true market value. That way a dollar buys more Chinese goods. Even when the value of the dollar dropped in the crash, the yuan falsely rode down with it in parallel. That has led us to buy that much more and beggar our own industries, while the Chinese built a huge reservoir of claims against the dollar, currently estimated at $1.2 trillion.

Until recently, China has made only a few grudging upward adjustments to the value of the yuan despite a chorus of protests from many nations. A recent New York Times article says that over the years there has been a 40% rise in the yuan’s nominal value. But the Peterson Institute has said the yuan has been undervalued by as much as 40% during the period; a 40% rise from that low point would still leave it 15% to 20% undervalued. And so much damage has already been done to the U.S. economy.

Our leaders cower in fear of how the Chinese might retaliate if we declare that they manipulate their currency and erect tariffs to arrive at the correct value of their goods. By law, the Treasury Department twice a year identifies countries that manipulate their currency to create an unfair trading advantage. But with China, year after year, Treasury has pretended not to see the obvious and come short of making an accusation. In his 2009 confirmation hearing, now Treasury Secretary Timothy Geithner said that President Obama believed China was manipulating its currency, but quickly walked that back. We haven’t heard that from him since.

He has company. Last October, the Senate passed a bill 63 to 35 to require Treasury to order the Commerce Department to impose tariffs on a mix of Chinese products if Treasury finds that China is improperly valuing its currency. Despite 16 Republicans crossing the aisle on that vote, Senate Majority Leader Mitch McConnell was strongly against the bill, even to the extent of attempting to subvert it by cynically attaching to it another bill he knew would not pass.

In the House, which passed a similar bill a year earlier, and where there were more than enough co-sponsors to assure passage of last fall’s bill, the Republican leadership said it would not allow it to come to the floor. John Boehner called it “pretty dangerous”.

No bill has found its way to any president’s desk for signing and the current White House would rather it not. Obama is reluctant, not wanting a combative bill to roil the currency markets in an election year, no matter the continued damage to the nation’s economic health.

The International Monetary Fund (IMF) has more spine. Since 2007 it has produced reports showing which countries undervalue their currencies to create jobs at home and unemployment in trading partner countries. But the reports can be published only with the permission of the cuntry in question, and China has always denied the right — until just recently, which some take as indication that it has learned it can get away with currency manipulation. The IMF has said the Chinese renminbi (the name of the currency; the yuan is its basic unit) is “substantially undervalued”, which is its descriptor for a currency at least 20% below its fair market value.

China is more than prickly when threatened by accusations of currency manipulation. Its officials counter with outrage at American economic profligacy. A Xinhua News Agency editorial scolds us with the hope that the U.S., as the printer of the international reserve currency, recognizes its responsibility to assure the value of other countries’ dollar holdings. The debt ceiling battle of last summer and our political parties’ willingness to flirt with default was, for People’s Daily, “a warning to China that the United States will ignore the interests of creditors for the sake of domestic political battles”.

a paralysis of fear

America’s inaction year after year fear is twofold: that tariffs would set off a trade war, or the Chinese would cease propping up the U.S. government by refusing to buy our Treasury notes with the dollars it earns from exports — or both. So from all fronts we hear timidity.

A former president effectively says do nothing: threatening China with tariffs won’t solve any problems, says Bill Clinton. “When was the last time you got tough on your banker”? Joseph Nye at Harvard’s Kennedy School says the best way to make an enemy of China is to treat it like one.

And there are those who want us to believe that that the renminbi is undervalued by only a few percentage points because inaction benefits their business interests in China.

The head of the U.S.-China Business Council told the International Herald Tribune that if the Senate’s anti-manipulation vote “is a jobs bill, it is a jobs bill for Vietnam”, because as costs rise owing to revaluation of the yuan, companies would simply move their factories to even cheaper countries. Translation: no point in doing anything. The council represents 250 companies doing business in China. They lobby to not rock the boat even if Chinese imports are beggaring the United States.

The Wall Street Journal feared that tariffs — “countervailing duties” — would unleash a wave of protectionism, reminding us that “in 1930, Smoot-Hawley and the retaliation it spurred contributed to a collapse of world trade and deepened the global depression”. Tom Friedman fairly swooned from the vapors, sputtering, “But, Lord in heaven, do not let the House pass this bill. That would trigger a trade war in the middle of our Great Recession. We tried that in 1930. It didn’t end well”. But then was the reverse of now. Then, the U.S. was the world’s China, its leading exporter. Now, curbing imports would hurt China more than their retaliatory tariffs levied again us.

Vice President Joe Biden at least took a sterner tack in his welcoming speech to Xi Jinping, listing the many ways that China cheats, but the Chinese must be amused by such bluster, because the United States takes so little action.

As for the second fear, China knows that if it started a selloff of dollars, it would drive the value of the dollar to new lows, much as happens to any commodity when an oversupply is pushed into the market. Their dollar investment would take a beating and the end result would leave the U.S. with a weak dollar incapable of continued buying of so much Chinese product. China would be hurt two ways.

So how do we get out of this trap?

Why not incremental steps? What would happen if we declared, say, a 5% tariff across the board for all Chinese imports. Actually, we did that in 1971, confronting undervaluation by imposing a temporary 10% percent surcharge on imports. It worked. It was rescinded a few months later when Germany, Japan and other nations raised the dollar value of their currencies. China’s reaction could be more incensed, but is it likely that they would risk their advantageous trade relationship with the U.S. over what would have no greater effect than boosting the heavily undervalued yuan by 5%?

And if that goes well, we could threaten 10% if China does not redress a number of iniquities that we will take up in this series.

As Mitt Romney, the one candidate who wants to face up to China, said

in this Washington Post op-ed:

“China is selling us $273 billion per year more than America is selling China — why would it possibly want a trade war? And what is the alternative to confronting China? It is allowing the Chinese to take by trade surrender what we fear to lose in trade war”.

But no one dares take the risk. For certain, the repercussions with China could be greater, but once they saw the U.S. had some backbone, they could as well decide that fighting their best customer tit for tat would be unwise. Too fearful to take that risk plays straight into China’s hands. As Romney said, “Who can blame the Chinese for ignoring our timid complaints when the status quo has served them so well?

The question is: are we ever going to confront the problem? To borrow from (of all people) Grover Norquist, who was speaking of the federal government, it at times seems that by drifting ever onward toward the drain, our “leaders”’ policy for this country is to “shrink it down to the size where we can drown it in the bathtub”.

Feb 27 2012 | Posted in

World |

Read More »

Update: Mar 1: The Israeli Prime Minister heads to Washington to interfere with American foreign policy by drumming up support from Congress and addressing AIPAC to demand American military action against Iran, with the Republican presidential hopefuls following close on his heels a day later at the pro-Israel lobby, all of them baying that Obama let loose the dogs of war.The Israeli military is coming to the belated conclusion that it doesn’t have the power to deal a decisive blow against Iran’s widely scattered nuclear facilities. It has no aircraft carriers and 100 planes would be needed, according to a Pentagon estimate, flying 1,000 miles to the targets and needing to refuel in the air from a limited arsenal of transports. “I think a modern air force like the U.S. air force can deal with it easily”, said a former senior Israeli security official with a smile, quoted in Time magazine.

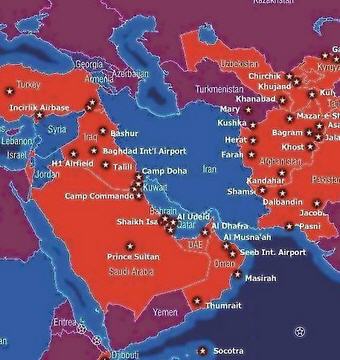

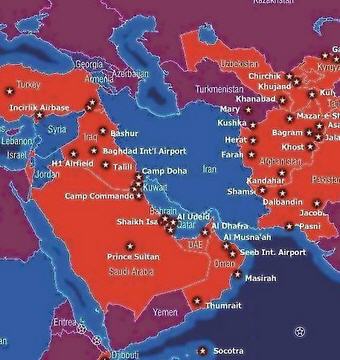

U.S. military bases surrounding Iran.

The United States gives Israel $3 billion a year in military assistance, but now Israel is saying, let Americans risk their lives and declare war on Iran while Israel observes from the sidelines.

The latest development was preceded by weeks of everyone’s saying “nothing’s off the table”. Defense Secretary Leon Panetta has said, “the United States will not tolerate the blocking of the Strait of Hormuz”, which Iran threatens to do if President Obama applies further U.S. sanctions; “That’s another red line”. Israel’s Defense Minister, Ehud Barak, says “time is running out”. In a Senate Intelligence Committee meeting, California Senator Diane Feinstein let slip that she met with the head of Mossad, Israel’s intelligence agency. So had CIA Director David Petraeus. At that same hearing, U.S. Director of National Intelligence James Clapper told us, “Iranian officials… are now more willing to conduct an attack in the United States”. And the Wall Street Journal reported that Iran is assisting al Qaeda operatives.

Those last items, that the Iranians are linked to al Qaeda and are plotting in our midst, triggered alarm bells with several members of the contrarian punditry, who heard such intimations as the sequel to the orchestrated fear mongering that was used to sell Americans on invading Iraq.

In contrast, the Obama administration is firmly against a third war in ten years and strongly urges Israel not to attack, insistent that we first see whether sanctions force Iran’s leaders to climb down from their increasingly isolated position.

The President is hamstrung by a new set of sanctions imposed by the Senate in a nearly unprecedented 100-to-0 vote. They require him by the end of June to penalize any entity — corporations, central banks, etc. — that does business with the Central Bank or Iran, which they must to purchase Iranian oil. And in a still more severe move, the Senate Banking Committee now wants to expel Iranian banks from the Belgium-based SWIFT telecommunications system that handles all interbank transfers, the effect being to bring all Iranian financial activity to a paralyzing standstill.

Threatened by the collapse of their economy, Iran would most certainly act. Its officials have vowed to block the Strait of Hormuz, through which 20% of the world’s oil is transported daily ( see our earlier story). The U.S. will not allow this crippling of the world’s economy, so Panetta assures us that “we would take action and reopen the strait” by the 5th Fleet on station in the Persian Gulf. In other words, if this scenario comes to pass, the Senate will have effectively declared war.

The original bill, crafted by Senators Mark Kirk (R-IL) and Robert Menendez (D-NJ), offered the President no leeway, an example of Congress’s wanton disregard for the consequences of its actions as it heedlessly does the bidding of lobbyists and their campaign contributor clients. It is a bill that even penalizes our own allies if they do not obey.

After intense lobbying it was amended to allow the President to not penalize countries that cannot get by without Iranian oil or if our national security is threatened by oil shortages. The administration might also choose to flout the bill on the grounds that it unconstitutionally interferes with the Executive’s right to conduct foreign policy.

But the sanction clock winds down to zero at the height of election season. If Mr. Obama loosens the chokehold on Iran by use of the waivers added to the bill, his opponent will relish portraying him as weak. Incredibly, presidential politics could push us into another war.

The wild card is Israel

Leon Panetta thinks Israel is likely to attack in April or May. They are already factoring in the likely casualty count wrought by rockets lobbed over their northern border by Iranian proxy Hezbollah in Lebanon. Panetta’s Israeli counterpart, Ehud Barak, worries that there is a “zone of immunity” that Iran will enter after six to nine months when they will have enough enriched uranium for a bomb. Israel fears that, given Obama’s disinclination to rush to war, if the sanctions do not work, the United States may not attack even then, and Israel will have missed its narrowing window of opportunity at least to delay Iranian progress.

That other alternative we mentioned?

That Iran has conducted its nuclear development in tunnels dug deeply into mountains is taken as strong indication that it is enriching uranium for other than benign purposes. What is known from the International Atomic Energy Agency is that in a virtually impregnable mountain bunker near Qom, they are enriching uranium to a level that could be turned into fissile material for a warhead — in other words, poised to build a bomb quickly if they decide to. But the fact is, we do not yet know if Iran has decided to build a bomb and a premature attack short of their taking that final step would be the Iraq “weapons of mass destruction” blunder all over again.

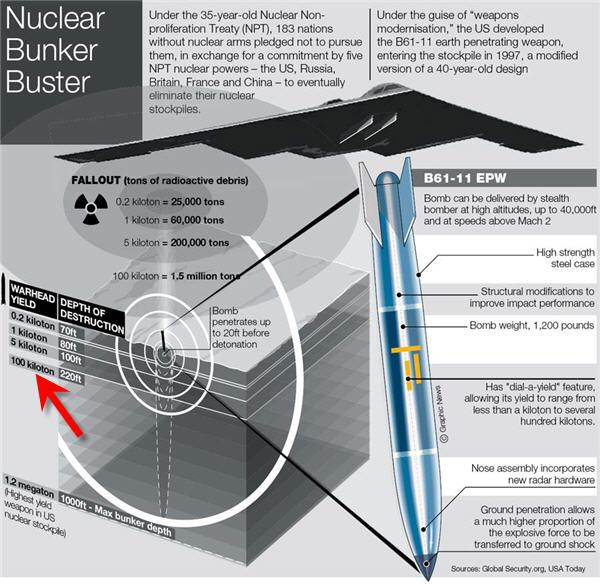

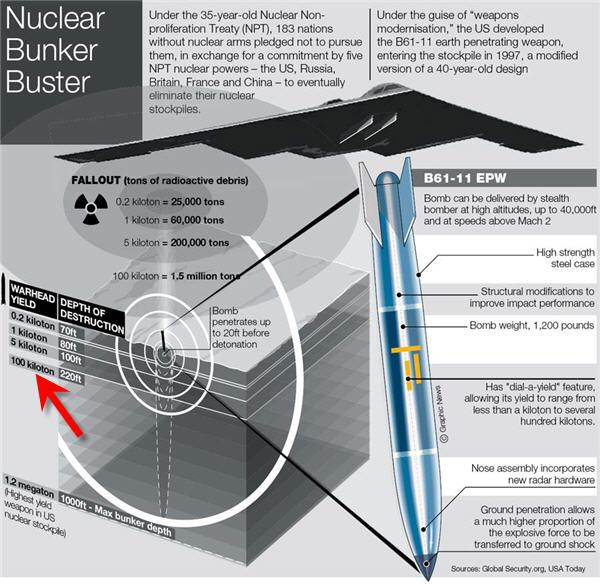

Only a nuclear bunker buster of 100 kilotons could reach the 220 foot depth of the tunnels at Qom

(see red arrow at lower left). Use of nuclear would have disastrous consequences, releasing massive

amounts of radioactive fallout as this video from the Union of Concerned Scientists shows.

Iran has been clever to conduct all work deep underground. Are we being intelligent to think only of blasting away at mountains with bunker busters in what seems most likely to be a vain attempt to end their program?

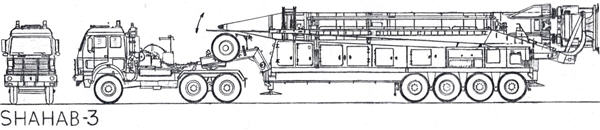

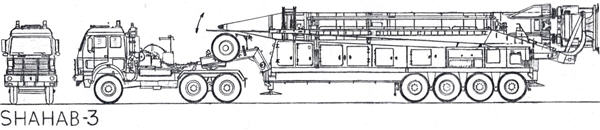

To use a weapon, Iran needs to bring it out in the open. To pose the threat that is the principal fear of Iran’s gaining nuclear warhead capability, they then have to mount it on a rocket, and that would be a Shahab-3, capable of reaching Israel. With satellites and stealth aircraft reconnaissance and possibly even drones, that setup activity can be monitored. Tracking Saddam Hussein’s Scuds on mobile platforms proved difficult in 1991, but surveillance technology has vastly improved over twenty years. Once either convinced that Iran has a weapon or persuaded by their continued non-compliance over a long enough interval for them to have developed one, the West would impose what is analogous to a no-fly zone — warning that any rocket transports or launchers will be destroyed. There are hazards to this strategy. Iran might choose the moment of setting up a rocket launch for simultaneously attacking our naval forces in the hope of disrupting our counterstrike. But the question is: why is there no hint that this strategy is even being considered?

With satellites and stealth aircraft reconnaissance and possibly even drones, that setup activity can be monitored. Tracking Saddam Hussein’s Scuds on mobile platforms proved difficult in 1991, but surveillance technology has vastly improved over twenty years. Once either convinced that Iran has a weapon or persuaded by their continued non-compliance over a long enough interval for them to have developed one, the West would impose what is analogous to a no-fly zone — warning that any rocket transports or launchers will be destroyed. There are hazards to this strategy. Iran might choose the moment of setting up a rocket launch for simultaneously attacking our naval forces in the hope of disrupting our counterstrike. But the question is: why is there no hint that this strategy is even being considered?

Feb 25 2012 | Posted in

Defense |

Read More »

If America is to compete successfully in the global economy, it must have a better educated workforce. One would expect we are doing everything possible to make a college education available universally.

Not quite. The federal government does much to make that happen — Pell grants, Perkins loans, Stafford loans — but does so in conflict with unrelenting tuition increases by our colleges and universities that pull in the opposite direction. Combined with a reduced economy that has caused states to cut back aid to their schools, the one-third of students who had to borrow to pay for an education a decade ago has risen to two-thirds now. The class of 2011 left school owing on average $27,300, the highest debt level ever.

President Obama, in the State of the Union address, called attention to one unhelpful burden that government does place on students — interest on those loans. He sounded the alarm that the interest rate is about to double on July 1 if Congress does not act.

On that date the original 6.8% rate will be restored. In 2007 it was reduced by half with a 5-year sunset clause. If that cutback is not renewed, some 8 million students will see an average of $5,000 added to their 10-year debt, and about $11,000 if their loan term is 20 years.

As the midyear date approaches, we can expect banks and other lending institutions that issue private loans to lobby for a return to the higher rate. The reason there are any interest charge at all is that the banks practically wrote the student loan law and saw to it that the government not compete with the private sector by demanding that it, too, charge interest.

Fast forward to the recession. Banks now borrow from the Fed at near 0% interest (and then buy treasuries rather than making loans to help businesses), whereas students borrowing from the government are saddled with interest rates far above what the rates have become. So the question in a zero-interest recession is, why are we making it more difficult for students by adding interest charges?

The banks also saw to it that even the private loans are not “dischargable” under bankruptcy. Of all classes of consumers, students are thus singled out with harsher bankruptcy rules than anyone who defaults on mortgages, car loans, credit card debts, etc. Those debts are eligible for dismissal in bankruptcy court; student loan debt stays permanently attached. That’s your Congress at work.

In an employment market in which graduates cannot find work to repay the debt, there is the growing risk of widespread default, as we reported in September in this article (which spells out the Draconian consequences that rain down should someone fail to repay a student loan).

The Obama administration has softened the blow somewhat with special provisions. If a graduate’s debt exceeds his or her starting salary, monthly payments are reduced to 15% of discretionary income and anything still owed after 25 years will be forgiven. Borrowers who remain a teacher or in another public service occupation are eligible for forgiveness after 10 years of payments.

But take note of that: students potentially still paying for their education 25 years later. It says how we are impacting the lives of our best educated. If they bring debt to a relationship, how does that forestall or even foreclose marriage (it’s been called the anti-dowry)? That in turn postpones having children, embarking on a normal life. How many will still be paying for their education when their own children need money for their education?

runaway tuition

The root cause of the problem is the rate at which college tuition, room and board has risen unchecked — 538% over the last 30 years, four times faster than consumer prices, twice as fast as even health care.

Because states are strapped, schools dependent on their state’s support understandably had no immediate recourse from increasing the annual tab at a record pace in this recession — 8.3% last year to an average of $17,000.

But for the most part colleges have given no thought to the damage they have done by constantly raising tuition to pay for heedless spending, competing to make themselves attractive to students who in turn seem mindless about what the cost of those attractions will do to their future. Colleges were once rather austere, with under-heated rooms, double-deck beds and dreary food, but our youths now expect all the comforts of the homes they just left. So the colleges pile on “amenities” from food courts to sports palaces with olympic-size pools to recreation centers (climbing walls seem to have become a metaphor for this excess).

Worse still is the competition for star professors, who are lured with huge paychecks and minimal teaching requirements. Stanford’s professors now get paid sabbaticals every fourth year that hand them $115,000 for not teaching. College presidents are paid in the millions, with compensation of the administrative echelons beneath them similarly elevated. Prestigious research is pursued even if not funded by grants. And it’s the students who pay for all of this.

Mr. Obama also threatened that federal aid would be reduced to those colleges that continue to increase tuition, and proposed a number of yardsticks to test the post-graduation success rates of their students in finding employment after graduation. Much of this, though, depends on approval by an uncooperative Congress. Even if it comes to little beyond rhetoric, the bully pulpit at least serves to turn the spotlight on the runaway tuition problem.

clueless students

Students are at fault as well, naïvely taking on more debt than they will be able to handle, and then taking degrees in subjects that are not needed in the marketplace. So we frequently read of young graduates who are unable to find work, and a paragraph or two later learn that they were English majors, or studied French literature, or “communications” or anthropology or film-making. There are jobs out there, but employers are looking for degrees in science, engineering, math, electronics, software.

We don’t much hear anymore the cherished notion that a liberal arts degree produces someone of an intellectual breadth well-equipped to quickly learn on the job whatever skill is needed. That sounds quaint in the new world the nation faces.

Feb 16 2012 | Posted in

Education |

Read More »

Just in time to add ammunition to the class wars, along comes a book that says income inequality isn’t caused by Wall Street bonuses, outsized corporate CEO paychecks or even a tax code skewed to the wealthy.

The book is “Coming Apart, The State of White America”, by Charles Murray of the American Enterprise Institute, who claims it is not the 1% vs. the 99%; rather it is the 20% at the top vs. the 30% at the bottom. The 20% is made up of educated achievers who raise their children to strive for excellence, press them to vie for entrance to the top schools, and see them graduate into the best jobs, marry other smart people, and raise the next batch of bright children to propel the 20% still higher. Meanwhile, the 30% drift ever downward and further apart.

Those in favor of the status quo, eager to deflect Occupiers’ claims that the system is rigged in favor of the wealthy, have embraced Murray’s evaluation of the 30%. Murray says it’s a values thing.

The lower social strata are ordinarily held up as the exemplar of family values, but that’s mythology. Murray says it is the upper stratum that has retained what he calls the key “founding virtues” — industriousness, honesty, marriage and religion — that the lower stratum has forsaken. The latter marry less, have higher divorce rates when they do, and bear far more children out of wedlock. They drop out of high school, are uninvolved with their communities — they even go to church less than the 20%. They lack ambition, they watch television all day, they subsist on one or another welfare program, and fall further behind. They don’t have jobs because they don’t want to work, says Murray.

The cause? He says it was the ‘60s culture and alludes vaguely to “a whole set of reforms” that “élites put in place… which I think fundamentally changed the signals and the incentives facing low-income people and encouraged a variety of trends that soon became self-reinforcing”.

Aha. So it’s not the worsening educational system, outsourced jobs to other countries, the decline in manufacturing, the collapse of unions, the sheer lack of jobs because corporations are not hiring — these are not the reasons for the economic decline of the bottom 30%. No surprise, then, that conservatives, who oppose taking action with fiscal stimulus and social programs, have clambered on board in praise of Murray’s worldview.

Niall Ferguson of Harvard, who writes a column for Newsweek proclaims Murray has come yp with “by far the best available analysis of modern American inequality … a blessed relief”. He even works in the canard that President Obama wants to “make America more like Scandinavia”.

David Brooks, the conservative columnist at The New York Times, gushes in this piece that “I’ll be shocked if there’s another book this year as important as Charles Murray’s ‘Coming Apart’”. He goes so far as to say, “the liberal members of the upper tribe latch onto this top 1% narrative because it excuses them from the central role they themselves are playing in driving inequality and unfairness”, an accusation that we are struggling to make sense of. As a card-carrying member himself of the out of touch élite, he says:

“It’s wrong to describe an America in which the salt of the earth common people are preyed upon by this or that nefarious elite. It’s wrong to tell the familiar underdog morality tale in which the problems of the masses are caused by the élites.”

What’s wrong is his determination. The problem of the masses is that they would like to see opportunity restored in this country and instead see a plethora of advantages conferred on the wealthy while their world stagnates. In a final head-scratcher Brooks says what we need is a national service program.

At least David Frum, a conservative once a speechwriter for George W. Bush now writing at The Daily Beast/Newsweek, disagrees. Murray, he says, in a multi-part piece, ignores that the decline in wages and living standards is pervasive in the western countries as jobs have moved to low-paying countries in the East. What sense is it therefore to conclude that, whereas economics is the cause there, moral collapse uniquely is the cause here?

Murray is renowned for deploying reams of data but seems guilty of the sin of twisting them to fit his preconceived beliefs. Much more persuasive is how he marshalls data to present the sweeping social changes that support his “Coming Apart” title.

Whereas once those of different economic levels were commingled in smaller towns, living on the same streets or close by, chatting on the church steps after the Sunday service, the long-term trend has been for people to seek out those of their own economic level and political outlooks and cluster into communities of only their own kind. Murray is not the first to make this observation. Most recently there was “The Big Sort”, the 2008 book by Bill Bishop subtitled, “Why the Clustering of Like-Minded America Is Tearing Us Apart”.

Murray says we need to merge again if we hope to stem this fragmentation, and has taken that step himself, moving his family to a small, rural Maryland town. Bill Clinton, after reading “The Big Sort”, sounded the same theme, saying, “Some of us are going to have to cross the street, folks”. That way the 20% would be in place to transfuse their values to the 30% because “the new upper class just need to start preaching what they practice”, says Murray.

Feb 15 2012 | Posted in

Zeitgeist |

Read More »

A Silver and Bronze Star former Navy SEAL has criticized the Obama administration for exploiting the SEALs for politcal aggrandisement, jeopardizing its operations in the process.

In this piece in the Wall Street Journal, Lt. Leif Babin wrote that after the rescue of hostages in Somalia U.S. officials provided

…extensive details of who conducted the raid and how…Our special operators do not welcome this publicity. In fact, …it’s clear they are dismayed by it…If the enemy learns details and can anticipate the manner and timing of an attack, the likelihood of success is significantly reduced and the risk to our forces is significantly increased.”

Last May, after the bin Laden raid, we had much the same reaction. In this post, titled “Did Obama’s Rush to Boast Bin Laden’s Killing Help Al Qaeda?”, we reported that “We even blurted out to the al Qaeda underworld details of our operational methods as if there will be no further need for such missions”. We were additionally stunned that we announced details of the intelligence cache found in bin Laden’s lair, which told al Qaeda how much we had found out about their activities and plans.

Babin also also accused former SEALs and others with operational knowledge of violating their non-disclosure agreements.

But most invective was reserved for Defense Secretary Leon Panetta, whom he

accused of endangering the life of a confidential Pakistani source, and Obama:

Do the president and his top political advisers understand what’s at stake for the special-operations forces who carry out these dangerous operations, or the long-term strategic consequences of divulging information about our most highly classified military assets and intelligence capabilities? It is infuriating to see political gain put above the safety and security of our brave warriors.

Feb 13 2012 | Posted in

Defense |

Read More »

At least Mitt Romney’s tax returns have had the salutary effect of making the public more aware of the 15% capital gains provision in general and “carried interest” in particular. More than any other factor, it is this privileged treatment of income that has made the gap between the 1% and the rest a chasm.

Everyone but accountants and tax lawyers has always been for tax reform, but it never happens. You will find entreaties for reform in all four of President Obama’s state of the union addresses. For corporations he recognizes that the 35% rate is uncompetitive but has taken no action; for individual taxpayers he has not pressed Congress for anything beyond raising the rate for the top bracket, temporarily trimming the payroll tax again, and is now pushing for the “Buffet Rule”.

Whether or not you believe the wealthy should be taxed more, that last is a vote-getting populist maneuver by the President. It makes for a strange outcropping in the tax table. The Buffett Rule says that anyone earning $1 million or more a year should pay a minimum of 30%. We find no mention of this being a new bracket, whereby only the income above $1 million is taxed at 30%. Which raises the question: What about someone who earns less, and entirely from investment income taxed at 15%? Everyone up to $1 million would pay 15%; then suddenly the rate doubles for one’s entire income for a person who earns more than $1 million?

This idea just adds to the clumsy inequities of our tax policy. The patchwork of the Buffett Rule fails to confront the principal reason the wealthiest pay a lower rate than Buffett’s secretary: the 15% applied to capital gains.

It also distracts from the needed reform of a tax code grown impossibly complex. With nearly everyone long ago driven to use tax software, a tax service, or an accountant to avoid the tax code’s thickets, few of us have been anywhere near the 179-page (and that’s without forms) 1040 instruction booklet in years. Most are unaware that the tax rate schedule is simple — just a few lines long (and only one of those lines pertains to you). It’s the page after page of worksheets in the instructions, with their inscrutable step-by-step calculations, their barnacles of special exemptions, exceptions and dependencies on other calculations, and the entire extra layer of the Alternative Minimum Tax that are the cause of the complexity.

And that doesn’t begin to cover the gallimaufry of rules and statutes and declarations that led to the gargantuan return of 547-pages the Romneys had to file.

It is Congress that has brought us this mess, ever adding to the pile to reward special interests while giving not a thought to the brambles of tangled instructions that are the consequence of their actions. Nothing is ever removed. The federal tax code is now almost 72,000 pages; it has grown some 20,000 pages in just the years since before the Bush tax cuts were introduced.

Sweeping and sensible reform is what is needed. But how does one go about unraveling the hairball of self-referencing articles, sections and clauses in 72,000 pages — and then moving each through Congress for repeal? That tells you it won’t be done. It says that the only sensible approach is to jettison the whole thing and start fresh. Which most certainly won’t be done.

So what can be done?

Both Obama’s Bowles-Simpson commission and a similar tax reform panel under George W. Bush in 2005 proposed reducing or eliminating major deductions and income exclusions so as to broaden the tax basis — which would in turn allow reduced and simplified rates applied to that base. Neither went anywhere, and Obama has been roundly criticized for missing a signal moment for reform by ignoring his own commission’s report at the end of 2010.

Deductions should be reviewed for the value of the purpose they serve. People should be encouraged to insure their health rather than burden society’s emergency rooms, and continue to be rewarded with a deduction for so doing. We want people to set aside money for self-sufficiency in old age for the same reason, so income parked in 401k plans for taxing much later makes sense. A well-educated workforce has become urgent in the face of global competition, so deductions for tuition are key (except they are paltry, are denied outright beyond a too-low income level, and are continuously eroded by irresponsible college tuition increases).

So with that in mind, what can be done for a government that is starved for money. Those who howl at the deficit choose to ignore that the Bush tax cuts, which left rates for the individual taxpayer near their all time low, combined with the recession have reduced the sum of all the revenue collected by the federal government to just 14.8% of our gross domestic product, the lowest in about 50 years.

The cost of deductions

Two “tax expenditures” for individuals that stand out for the amount they cost the government are those that Bowles-Simpson recommended changing: the mortgage deduction and health insurance paid for by corporations.

The deduction of mortgage interest from taxable income is effectively a subsidy to the housing industry helping to reduce the effective cost of buying a house. What is indefensible is the generosity of the subsidy; you can deduct the interest on not just one, but two houses, and on loans up to $1 million, thus pointlessly encouraging the building of outsized houses for the fairly well off who deserve no help from the rest of us.

Because it figured into the affordability calculus for those who bought a house, the deduction cannot fairly be yanked summarily from those already locked into mortgages (apart from the above-named undeserving). Its elimination would have to be staged over, say, a 10-year period. But that should be done, and most economists agree. We have seen the fiasco of what the social policy of encouraging home ownership has brought us. There is no rationale for continuing to subsidize this particular industry.

But not to worry if that gores your ox. As we said, nothing changes. Getting elimination of the mortgage deduction in any form through Congress, which would be showered with money from the housing industry, would be close to impossible.

The largest tax break in the code by far is that company-paid health insurance does not count toward an individual’s income. The average family premium for company-sponsored insurance runs about $12,000 a year with $9,000 of that paid by the employer. The company takes it as an expense, reducing profit on which it pays taxes. The employee sees nothing of this on his or her W-2. So the government takes a hit twice over. By not taxing the employee for what is effectively compensation, the government in 2010 forfeited $264 billion in revenue.

To double the inequity of this arrangement, the self-employed and anyone working for a company that does not provide health insurance are fully taxed on all income and thus buy their health insurance with after-tax dollars. They have only the medical deduction, and that only to the extent that medical and dental exceed the high hurdle of 7.5% of their income. Nothing is ever proposed to redress this unfair treatment.

If employees had to pay taxes on the value of company-paid insurance, they would insist on less lavish packages. Any attempt to make this change would bring torrents of money from the insurance companies to buy off Congress. So, short of driving money from politics, we are here again just entertaining ourselves by contemplating what ought to be done.

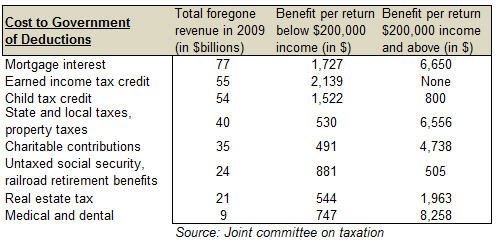

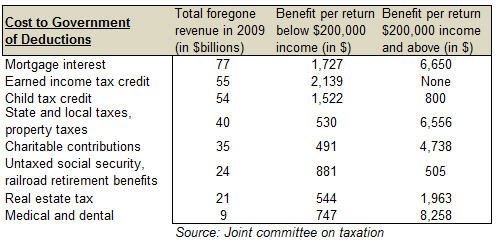

Which goes for the rest of the principal deductions. As information, below is table showing by how much each costs the government. This is over and above the “standard deduction” taken by millions. Health insurance’s cost — the $264 billion cited above — is not in the table because it is not a deduction. Taxes are, of course, a much bigger subject than the narrow focus of deductions. Fixing this intolerable monstrosity should be an abiding cause for us all and a continuing subject in these pages.

Feb 1 2012 | Posted in

Reform |

Read More »

With satellites and stealth aircraft reconnaissance and possibly even drones, that setup activity can be monitored. Tracking Saddam Hussein’s Scuds on mobile platforms proved difficult in 1991, but surveillance technology has vastly improved over twenty years. Once either convinced that Iran has a weapon or persuaded by their continued non-compliance over a long enough interval for them to have developed one, the West would impose what is analogous to a no-fly zone — warning that any rocket transports or launchers will be destroyed. There are hazards to this strategy. Iran might choose the moment of setting up a rocket launch for simultaneously attacking our naval forces in the hope of disrupting our counterstrike. But the question is: why is there no hint that this strategy is even being considered?

With satellites and stealth aircraft reconnaissance and possibly even drones, that setup activity can be monitored. Tracking Saddam Hussein’s Scuds on mobile platforms proved difficult in 1991, but surveillance technology has vastly improved over twenty years. Once either convinced that Iran has a weapon or persuaded by their continued non-compliance over a long enough interval for them to have developed one, the West would impose what is analogous to a no-fly zone — warning that any rocket transports or launchers will be destroyed. There are hazards to this strategy. Iran might choose the moment of setting up a rocket launch for simultaneously attacking our naval forces in the hope of disrupting our counterstrike. But the question is: why is there no hint that this strategy is even being considered?