As Deadline Approaches, Congress Holds Students Hostage

Sticking our young with 6.8% interest in a 0% interest world Jun 20 2012On July 1st the interest rate on certain classes of government loans to students will double to 6.8%. After months of acrimonious stalemate that shows why

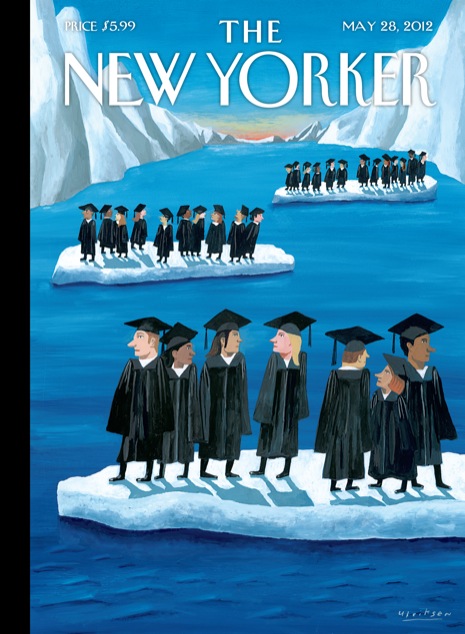

Graduates' prospects: This says it all

Congress is held in such contempt by the American public, the Senate had still not resolved the issue a week before the rate ratchets upward, although a deal is reportedly close at hand.

On July 1 the moratorium expires that reduced the rate to 3.4% since 2007 to help students with what has become crushing debt. The unending recession, helped along by the irresponsible yearly rise in college tuition that far outstrips inflation, rising even faster than health care costs, has combined to cause student borrowing to cross the $1 trillion mark, more than the nation’s credit card debt. In 1993, 45% of students borrowed toward earning a bachelor’s degree. Now, 94% are forced to borrow, Department of Education statistics say.

Interest rates set by the Federal Reserve have enabled banks to borrow at near 0% (which the banks then use to make money from the government by buying Treasury notes paying 2% or so). Yet, despite the radical drop in interest rates, Congress has so far insisted that our students, struggling to get a leg up in a disastrous economy in which half of recent graduates can’t find a job, must pay the exorbitant 6.8%.

The hang-up is that Republican dogma insists that a reduction in the interest rate be paid for with offsetting savings elsewhere. Somehow they were apparently counting on making money from students over the coming years to fund the government.

With the help of Democrat crossovers, the House passed a bill that would compensate the lost interest by eliminating the fund for preventive care in the Obama administration’s health care law. Republicans in the Senate pin the blame for not resolving the interest rate deadlock on Democrats for not accepting the House deal. Knowing that they must offer some offset for student relief to pass, knowing that their preference to simply do away with interest on student debt will not fly, Democrats want to offset the lost interest by classifying certain forms of income as pay to make it subject to Social Security and Medicare withholding. Republicans have blocked this from consideration with their 21st filibuster since January. With neither side yielding in all the months since President Obama alerted Congress to the July 1 deadline in January's State of the Union address, the Senate has apparently come up with entirely different means to "pay for" the lost interest.

While the Senate dithered, the crisis in student loans (which this page began covering last September) grows worse. Education Sector, a Washington research outfit, published this study earlier the year which found that the default rate on loans to students who drop out is four times higher than those who stay for a degree. They leave themselves strapped with a loan to repay with less of a chance to find a job, or a job that pays enough to cover the debt.

The most notorious contributor to that category is the plague of for-profit colleges that aggressively lure our youth into expensive courses of a quality looked upon with scorn by employers and for which certificates of completion are usually not even accepted elsewhere, should the students ever want to transfer to a four-year college for a more reputable degree. And very few do complete. Phoenix, the biggest of the non-profits, which is advertising its success stories on television, graduates less than 9% of its bachelor degree candidates, even allowing six years before taking the measure.

It is as if the for-profits learned from subprime mortgage lenders, signing up students who they know will not be able to repay their loans. But no matter. The colleges collect from the government, which guaranteed $24 billion of such loans in the 2010-11 academic year in addition to almost $9 billion in outright grants. The money keeps on flowing even as the national scandal metastasizes.

For profit colleges now account for 12% of all college students (up from 3% just a decade ago), yet they account for fully half of loan defaults. Meanwhile, four-year private and state colleges, and two-year community colleges, are starving for funds in the economic downturn.

The Department of Education is working on a rating scheme to expose those colleges which fail to deliver, hopefully revealing which have the poorest job outcomes, not just feeblest graduation rates. But how have they been so slow off the mark? And any action will be slower still. The plan is that none of the 2,000 boiler-plate, for-profit schools will lose taxpayer financing before 2014.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.