Mitt Romney has been accused of being very cagey about what he would specifically do as president other than on his busy first day in the Oval Office repealing laws created during Obama’s years. But in New Mexico he delivered a major campaign speech that left no doubt of what he will do about energy.

“Three million jobs come back to this country by taking advantage of something we have right underneath our feet. That’s oil, and gas, and coal,” he said, announcing a plan that is entirely about hydrocarbons with barely a mention of or support for alternative forms of energy .

Both in the talk and in a white paper titled “The Romney Plan for a Stronger Middle Class: Energy Independence” found here, he said he will deliver North American energy independence by 2020 and that lower energy costs brought about by his all-out campaign of exploration, drilling and extraction would return manufacturing jobs to the United States.

His multi-faceted plan would hand over to the states the permitting and oversight of “development and production of all forms of energy on federal lands within their borders”; set up 5-year plans for drilling off the Virginia and Carolina coasts and force their meeting “minimum production targets”; expedite drilling in the Gulf; forge partnerships with Mexico and Canada to “share best practices and technology” and fast-track pipelines between the countries; and re-assess the reserves of the northern half of the hemisphere, which he believes are understated.

There is no question that the last few years have brought about a stunning realization of energy abundance in the U.S. Directional drilling techniques, fracking technology that is making the U.S. the Saudi Arabia of natural gas and has unlocked the Bakken shale in North Dakota — all have enormously increased the nation’s energy reserves. Mr. Romney attributes too much credit to his plan achieving energy independence, though, as we are on course for North American energy independence anyway. And North American independence means we will still be importing oil; it will continue to come from Mexico and Canada. The Energy Information Administration (EIA) projects that imports will be down to 38% by 2020. A 3rd of that will still come from outside North America.

President Obama’s auto efficiency standards are a big contributor to how we get there. The EIA forecasts that his CAFE standards will reduce daily oil consumption by 2.2 million barrels by 2025. But Romney said last December that he would overturn the CAFE rules.

The intention to turn management of federal lands over to the states jumped to the top of most news accounts of the New Mexico speech. Federal lands belong to the country, no matter what state. They belong to us. Yet Romney believes they are his to give away; his attempt would undoubtedly face law suits. The federal government controls oil, gas, coal and mineral permits on federal lands. It at least balances a conservation mandate, as when at the beginning of the year it banned for 20 years the issuance of any additional uranium mining permits in lands near the Grand Canyon.

States are in difficult straits, badly in need of revenue. It is not outlandish to imagine them going overboard issuing permits to industry — and with a Romney administration cheering them on. That’s apparent from the latitude of the language in the white paper which assures us that “Federal agencies will certify state processes” but those processes need only be “adequate, according to established criteria that are sufficiently broad, to afford the states maximum flexibility”.

There is similar language in Romney’s pledge to “Guarantee that state-of-the-art processes and safeguards for offshore drilling are implemented” but that would be done “in a manner designed to support rather than block exploration and production”. The fact is that we have no way to assure that state-of-the-art processes and safeguards work, because we have no way of knowing what went wrong with the blowout preventer in the BP oil “spill”.

Both speech and manifesto dwell entirely on expanding production of hydrocarbons. There is no stated concern for the problems of greenhouse gas emissions or the climate. There is slight mention of alternative forms of energy such as solar and wind, other than to lump them together with oil, gas and coal in treating topics such as rolling back regulations, and in citations to sources elsewhere that question their feasibility.

That’s in keeping with Romney and Ryan intending to shut down the green energy program of grants and government guaranteed loans — a George W. Bush initiative — to ensure that the “playing fie…remains level” with the same policies applying to wind, solar and hydropower as apply to oil, gas and coal development. They will have to stand or fall on their own. Romney has already called for ending deductions for electric cars and green home improvements.

Instead, the Romney plan prefers “basic research” to demonstration projects, which he would evidently shut down, considering them more likely to “yield benefits in excess of costs”. Demonstration projects are essential to finding whether research works in practice and can be scaled. Saying only basic research is needed returns us to George W. Bush’s eight-year stall to avoid action against the threat of global warming: more research was always needed.

Unable to compete on price without developmental subsidies, with all the support going to hydrocarbon industries (Romney has pledged to continue the $40 billion in subsidies the oil companies receive from Uncle Sam), we can expect alternative forms of energy to be snuffed out.

Except for the ethanol mandate, the worst of the alternatives, which Romney supports so as to draw votes from the farm belt.

Romney accuses Obama of sending “billions of taxpayer dollars to green energy projects run by political cronies”. Before dismissing that as baseless slander, one must consider the book “Throw Them All Out”, by the Hoover Institution’s Peter Schweizer (it was the source of the “60 Minutes” report on congressional insider trading, which we covered, and which led to a restrictive law”). Obama has said that funding of green energy companies was “based solely on their merits”, but Schweizer says 71% of the Obama Energy Department’s green subsidies went to “individuals who were bundlers, members of Obama’s National Finance Committee, or large donors to the Democratic Party”. They raised $457,834 for Obama’s campaign and were rewarded with grants or loans of almost $11.35 billion, says Schweizer.

To its credit, the document if filled with external sources in support of its claims, presenting a burden to the Obama administration to come up with counter-arguments. As an example, fair enough to single out because the main text refers to it, Romney tells us that the Obama administration is “actually being held in contempt of federal court for illegally imposing a moratorium on drilling in the Gulf of Mexico”. Not mentioned is that this was a ruling by a New Orleans judge in February 2011 who recklessly decided that drilling should continue after the worst oil spill in U.S. history while also deciding that expanded safety rules for offshore drilling imposed by the Interior Department violated federal law.

Romney would greenlight the Keystone XL pipeline that would bring oil from Canada to Texas refineries. He expresses no concern for the environmental damage that the viscous, strip-mined tar sands cause, both in heightened emissions during extraction, which uses natural gas to separate the bitumen from the sand, and the 10% to 30% greater emissions when the oil is ultimately burned. We covered the Keystone XL controversy in this article last fall. That same article predicts that Obama, too, long ago made up his mind to OK the pipeline. He just wants to sweep in the hopeful votes of the environmentalists before turning his back on them after the election.

There is no mention of Alaska in the white paper, but elsewhere — for example in his book, “No Apology” — Romney has shown that he is for drilling in the highly controversial Arctic National Wildlife Refuge, whereas Obama is not. He doesn’t need to champion drilling in the Beaufort and Chukchi Seas off northwest Alaska because Obama has already given Shell the go-ahead, despite significant risks, even after warnings to Congress by the commandant of the Coast Guard last August that the service has an inadequate presence in the area should there be a major spill or accident.

Romney’s position on coal comes to light early on in the white paper when he says, “President Obama has intentionally sought to shut down oil, gas and coal production in pursuit of his own alternative energy agenda”. Development of coal, too, on federal lands would be part of the package turned over to the states and the white paper sends us to several sources that blame regulations for harming the coal industry and preventing the further building of coal-fired power plants. Again there is the qualifying language whereby the Romney plan would “strengthen environmental protection” but “without destroying jobs, paralyzing industry, or barring the use of resources like coal”.

Comedian Bill Maher says that “Republicans believe that putting the word ‘clean’ next to the word ‘coal’ creates something named ‘clean coal’. Romney doesn’t go that far, but Obama, from a coal-producing state that helps fund his campaign, has spoken the oxymoron repeatedly, even on the campaign’s website.

Aug 28 2012 | Posted in

Energy & Climate |

Read More »

Which shall it be, a budget that pretends there are no icebergs and steers the ship of state steady as she goes, or a budget that turns the ship around and founders on the shoals of…okay, enough of the over-wrought metaphor, but the point is that both the Obama and Romney-Ryan budgets never extract the country from ever-mounting debt, so which snake oil salesman shall we put in the Oval Office this time?

President Obama would collect more taxes from the wealthy, allow the sequester to cut military and other expenses for him so he can blame Republicans, and eliminate oil and gas subsidies, but ignore the bankrupting cost of entitlements, content to run a deficit averaging $866 billion a year over the next 10 years.

Paul Ryan’s plan, heartily embraced by Governor Romney, would repeal “Obamacare”, privatize Medicare and make deep cuts in discretionary spending (although not on the military), but by sharply reducing taxes will run deficits until after 2030, says the Congressional Budget Office (CBO)..

But while the two budgets would operate the government in very different ways, they both lead to much the same result.

obama placid

The budget for 2013 that the Obama administration put forth in February, heedless of piling on debt unto the horizon, “whistling a happy tune while they drive us off the fiscal cliff”, as Chris Christie quipped in his Republican Convention keynote. The budget was immediately derided and subsequently voted down 414-0 in the House and 99-0 in the Senate. It has no mention in the tables of the cost of the Affordable Care Act (“Obamacare”), presumably because the CBO estimates that it will save $210 billion over the decade. (An incendiary Ryan rabid

In contrast, Paul Ryan encourages the view that his radical budget plan will save the country. His “Path to Prosperity” (pdf), was hailed last year as “bold” and “brave” for confronting Medicare head on and for slashing government spending on social safety net programs. He saves Medicare by turning it over to private insurers, leaving Medicare simply to print and mail out vouchers — scrip with which to partially pay the insurers. Ryan’s turning Medicare inside-out proved so unpopular — the CBO ascertained from the single Medicare line item in the sketchy “Path” that seniors would have to pony up an average of $6,400 of their own by 2022 to buy coverage equivalent to Medicare — that Romney decided on retaining regular Medicare as an option.

In Ryan’s plan, almost $1.6 trillion would be saved by repealing Obamacare; no substitute plan is budgeted to take its place. His budget converts the federal portion of Medicaid to block grants to states and cuts $1 trillion in the process, leaving to the states what to do with a minimum of 14 million people who would be denied health care. Outlays for food stamps, housing, job training, Pell grants to students — all would be cut. Ryan’s budget — and it is Romney’s as well — he called it “excellent” and “consistent with what I put out earlier” — slashes outlays by $5.3 trillion from the Obama budget over 10 years.

That should work wonders to bring down the debt, except that both Ryan and Romney intend to slash revenue as well. They want to cut individual taxes by 20% across the board; corporate taxes from 35% to 25% (to 0% on profits earned abroad); and eliminate the alternative minimum tax, the estate tax, taxes on capital gains, dividends and interest for couples earning $200,000 or less (Ryan prefers eliminating capital gains taxes for all).

We calculate that all those cuts would short government revenue by $475 billion in 2015 — and given assumptions of rising revenue in later years — by almost $5.6 trillion over the decade to come.

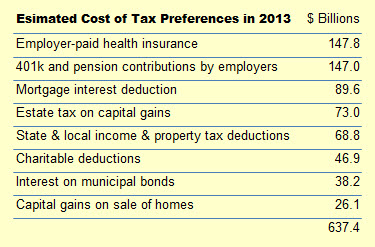

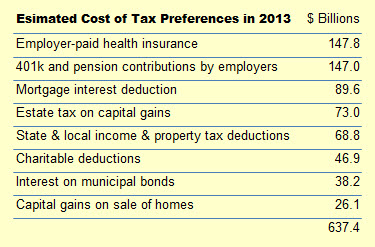

But both Romney and Ryan insist that their transformations will cost the government zero dollars, that they will be “revenue neutral”. This will be accomplished by reducing or eliminating “loopholes” and deductions, but neither will specify which. The Wall Street Journal waves this off saying “no campaign ever does”. which is not true, but if the candidates did tell you which, you wouldn’t vote for them.

The table at left shows the annual cost of the major items that are either excluded from taxable income or deducted from it. It shows that the Republican reformers have no hope of making up the $475 shortfall we cited for 2015 without wiping out almost all these “tax expenditures”. There are nowhere near enough smaller cost “loopholes” at the margins for Romney-Ryan to make up revenue lost to their tax cuts. The public, which will be shocked post-election when they find out that these benefits are on the chopping block, will be outraged. Congress would not dare cancel them.

The blithe assumption that Romney and Ryan will be able to eliminate these taxpayer indulgences and “broaden the tax base” (by exposing more income to taxation) is what leads to the Ryan budget bringing in only $2 trillion less in revenue than the Obama budget over 10 years, rather than the $5.6 trillion revenue reduction of the tax cuts. That leads in turn to Ryan’s 10-year deficit of “only” $3.1 trillion for the coming decade.

But if Congress won’t take away those taxpayer benefits, that deficit rises to $6.7 trillion. That’s getting close to Obama’s $8.7 trillion. So much for saving the country.

Don’t ask, don’t tell

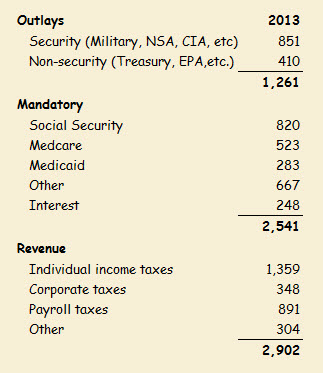

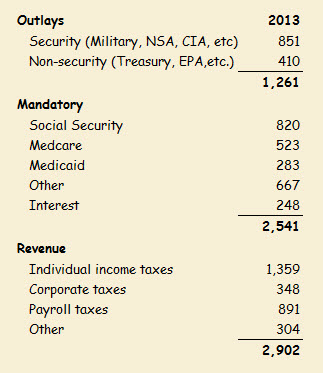

The reality is that either team’s budget runs deficits because neither faces reality. As the nation’s finances are presently constituted, it is impossible to balance the budget.

Here’s a quick exercise:

In the table, expenditures for mandatory programs and interest on the debt come to $2,541 billion in 2013. That amounts to almost all revenues collected — $2,902 billion. After paying mandatories, only $360 billion is left to pay for government itself, which costs $1,261 billion. There’s no money to pay for 70% of that. To balance the budget, we would have to get rid of chunks of government for which there’s no money — the presidency, congress, the military, all the departments, and so on.

We could raise taxes, of course. But, back-of-the-envelope, we would need to raise taxes by 50% — for everyone. Sound preposterous? It’s just arithmetic.

That won’t happen, of course. You can be certain that neither the President nor the Republican candidates nor Congress will bring up the subject. So no matter who is running the ship of state, we are headed for the rocks.

Aug 27 2012 | Posted in

Politics |

Read More »

The President doggedly campaigns for raising the rates of the top tax brackets. He would keep all the “Bush” tax cuts for the “middle class”, but raise two top rates: from 33% to 36% for income above $250,000 for marrieds ($200,000 for singles) and from 35% to 39.6% for the top bracket, which for 2011 was $379,150 for couples. This would be their “fair share”, but that is not our argument.

Mitt Romney, who wants to make all the Bush tax cuts permanent, responded with “54% of American workers work in businesses taxed as individuals. So when the president wants to raise taxes on individuals…he kills jobs.” Others joined the chorus in what is a favorite Republican meme. “I used to run a small business” said House speaker John Boehner. “I would have been affected by this tax increase that the president’s calling for. This is not going to help our economy.”

“They’re completely ignoring the facts” was the President’s ready response. “We know what those who are opposed to letting the high-end tax cuts expire will say. They’ll say that we can’t tax ‘job creators’ ”. Obama claims that “97% of small businesses fall under the $250,000 threshold” and would therefore be exempt from the tax hikes.

Who’s right?

The President’s claim is supported by Congress’s Joint Committee on Taxation, which estimates that only 3.5% of small business owners would be affected by the tax hike. Romney is also correct that some 54% of owners merge themselves and their business come tax time. They file as sole proprietors or have Subchapter S corporations, where the net profit (or loss) of the business flows through to their personal tax return — their 1040. Only that group of owners is potentially subject to the 4.6% added tax — it is a tax on personal income, not on businesses themselves — and only to the extent that their income exceeds Obama’s desired $250,000 cutoff.

The Republican argument is that these are the “job creators”, that owners of small businesses are the engine of growth. But we’re here to obliterate the claim that the 4.6% increment would be a “job killer”. Consider this:

The increase from 35% to 39.6% comes to $46 on every additional $1,000 of income. (For the bracket that would go from 30% to 33%, still less — $30). A minimum wage employee earns (an unlivable) $15,000 a year, and we’ll ignore any attendant costs so as to keep the number as low as possible for our example.

How many thousands must that small business owner be taking home for those $30 and then $46 nicks to add up to one such employee’s paycheck? The answer: $371,000 (for the math, see sidebar) — and that pertains only to earnings above the $250,000 bracket subject to the tax increments.

|

Here’s the math:

The $129,150 of income between Obama’s $250,000 floor and 2011’s top bracket of $371,150 would have an added tax of 3% (the increase from 30% to 33%) or $3875 (rounded). For that tax bill to become the $15,000 needed to claim that a minimum wage employee had to be fired to pay it, one would have to earn an additional $241,850, which, taxed at the 4.6% increment, is $11,125 ($3,875 + $11,125 = $15,000). The added income incurring $15,000 in added taxes is therefore $129,150 plus $241,850, or $371,000. |

So a small business owner would have to be taking home $621,000 ($250,000 + the extra-taxed $371,000) to claim that in order to pay the added tax burden he or she would have to fire one minimum wage employee. And, by extension, that owner would have to be taking home almost $1,000,000 to claim it cost two such jobs. And so on, for every additional job to be killed.

Another point: We ask why is the owner allowing so much income to flow into his or her form 1040 where it is subject to personal income taxes? The 4.6% tax applies only to money taken out of the business, so the claim that it is a “job killer” is backward. If the money is instead spent in the business, it isn’t taxable. The 3% of small businesses that Obama cites as yielding more than $250,000 to their owners per year — possibly much more — could avoid his tax if they plowed the money back into the business. One could even say that the proposed tax added to personal income is an incentive to leave the money in the business where it might even be a “job creator”.

So much for calling the tax increase a “job killer”. Yet Republican leaders — McConnell, Boehner, Cantor, etc. — are schooled to insert the “job killer” phrase into every sentence — a standard propaganda technique, of course. The bet is that if people hear it enough, they will think it true. In fairness, the same technique is employed by Democrats and by Obama, with their unceasing appeal that the wealthy pay their “fair share”. Who is to say that 35% is not a fair share or what, precisely, would be a fair share?

But the math above certainly shows how bogus the small business claim is. With this argument invalidated, Republicans or Democrats alike should all recognize this to be a craven tactic to deflect us from the real strategy of protecting wealthy campaign donors from paying an extra $46,000 on each added $1,000,000 of earnings.

Aug 21 2012 | Posted in

Taxes |

Read More »

By succumbing to conservative pressure, Governor Romney could find that choosing Paul Ryan may have passed fiscal control of his presidency to his running-mate. If they are elected, Ryan may wind up defining Romney. The latter has embraced Ryan’s budget, saying last March, “I’m very supportive of the Ryan budget plan” and elsewhere calling it “excellent work”. “I think it’d be marvelous if the Senate were to pick up Paul Ryan’s budget and adopt it and pass it along to the President,” Romney said after the House had voted for Ryan’s plan. Those accolades will make it difficult for Romney to walk back some of Ryan’s Draconian prescriptions; to do so would risk accusations of betrayal, much as liberals became angry with Obama for not pressing for the ”change” he promised.

Ryan is a devoté of Ayn Rand, saying in 2005, “if I had to credit one thinker, one person, it would be Ayn Rand” as the reason he entered public service. Rand celebrated success, championed the individualism of each of us providing for self and looked upon those unable to stand on their own as “parasites”. “And the fight we are in here, make no mistake about it, is a fight of individualism versus collectivism,” Ryan has said. Recently, politics has dictated that he retrench from these views somewhat. The problem is that Rand was an atheist.

But “unplugged”, as he once called what he would do were he free of political accommodations, Ryan would roll back social programs to the vanishing point. His first foray into budgeting was to draft a counter to the Democrats’ budget in 2007, but as Ryan Lizza’s profile in the New Yorker tells us, it was so extreme that 40 Republicans broke ranks and voted against it.

That was before the Tea Party.

Ryan has since bent to political reality enough to become the standard bearer for conservative Republicans’ quest to rid the country of Roosevelt’s hated Social Security and Johnson’s Medicare and Medicaid. Ryan had gained enough ground to — along with Eric Cantor — pressure President Bush, right after his re-election, to campaign in 2005 for allowing Social Security payroll taxes to be diverted into private accounts. That was so unsuccessful that Bush, thinking he had a mandate for just such changes, instead saw his poll ratings collapse.

Lesson learned, if only for the moment, Ryan issued his “Path to Prosperity” in early 2011, the basis for the budgets that the House has voted and for Romney’s applause. In “Path”, Ryan veered away from Social Security changes. But there is no sign that he thinks any differently, and if he takes the seat of the nation’s #2, we can expect him to challenge Social Security again.

The end of Medicare

What drew the most attention in “Path to Prosperity” is Ryan’s plans for Medicare. Entirely replacing the current system, seniors would be issued coupons toward buying health coverage from private insurers instead of automatic coverage by the government. Made to shop for best plans, the theory goes, oldsters would instill competition that would drive insurance costs down and medical costs in turn, although that effect is not at all in evidence after decades of rising premium costs from those same private insurers currently serving the non-Medicare age groups. For this reason, Ryan’s notions of competition as justification is viewed by liberals as simply a subterfuge to mask his real intent of destroying Medicare.

An analysis of Ryan’s budget projections immediately revealed that seniors would have to pay an estimated average of $6,000 a year from their own pockets — the estimate by which the cost of policies would exceed the “premium support” coupons paid by Medicare — and that the value of the coupons would decline over the years, relative to expected medical costs, leaving seniors to pay an ever higher portion of the insurance bill.

The Ryan proposal immediately brought to mind the specter of the elderly, their mental acuity often in disrepair, trying to sort out the tangles of insurance plans. Republicans faced acrimonious town hall confrontations when they went home to their districts a year ago spring after “Path” was released. Polling ran 58% to 35% against.

There was also the question of why there should be an enormous windfall for private insurers, who will add a layer of marketing and administrative costs, hefty executive paychecks, and profit to their premiums — costs that do not exist in Medicare.

The proposal compares to the Obama administration’s having done nothing — not even discussing — the looming bankruptcy of Medicare. Obama ignored the recommendations of the Simpson-Bowles commission which dealt with the Medicare crisis, even though it was a study he had asked for. Apparently, the White House is averse to bringing up the uncomfortable subject called reality. That could cost votes among those who somehow think nothing should change, which is irresponsible and self-serving by Obama, placing Medicare at risk of the certain bankruptcy that awaits on the current trajectory.

repeal

Both Ryan, Romney and Republicans in general would begin by repealing the Affordable Care Act, which Democrats view as Obama’s principal achievement. The House has let us know that there is no uncertainty in their resolve by voting for its repeal 31 times. The mantra Is “repeal and replace”, but in the over two years since passage of “Obamacare”, no alternative plan has been put forth by Republicans.

Romney/Ryan would also repeal the Dodd-Frank reforms, the safeguards intended to avoid another financial collapse.

Taxes

Both Romney and Ryan want still more tax cuts. They would reduce the tax schedule to just two brackets, 10% and 25%, in place of brackets that now range to 35%. Their claim is that the government would sustain no loss because the revenue shortfall would be offset by the elimination of loopholes and deductions. But neither candidate will specify which. We have here shown that the only specifics Romney once mentioned do not come anywhere near to offsetting his proposed tax cuts. Romney’s and Ryan’s only hope of making the tax rate cuts “revenue neutral” requires an end to the two biggest “tax expenditures”, thus raising taxes for the middle class: elimination of the mortgage interest deduction, and taxing the value of company-paid health insurance plans. Both are apparently deemed unmentionable.

Corporate tax rates would be cut from 35% to 25% and shift to a “territorial” scheme. Companies would pay taxes only on profits earned in the United States, They would pay no taxes on profits derived from foreign operations.

Ryan would also cancel Medicaid outright, replacing it with block grants to states to do with as they judge. His sharp reductions of government income would make deep cuts to safety net programs such as food stamps — which seem to be a particular bête noire for him — as well as job training and Pell grants to students.

Ryan is regularly spoken of as the nicest of guys, which makes the severity of his policies puzzling to some. A New York Times profile in April quoted David Obey, a Wisconsin Democrat who retired from the House in 2010: “What amazes me is that someone that nice personally has such a cold, almost academic view of what the impact of his policies would be on people.”

election calculus

Instant pundits were quick to say that Romney’s choice would doom his chances in Florida, where the prospect for seniors of shopping for private company insurance plans with Ryan coupons holds little appeal. But the Romney camp might do well targeting the young, who have little conception of what awaits decades ahead and can easily be stirred to anger over hefty percentages taken from their paychecks — the Social Security and Medicare payroll taxes that pay the benefits to generations decades apart from them.

Aug 13 2012 | Posted in

Politics |

Read More »

Update: October 21:

Citing declining applicants, the Univesity of Phoenix will close 115 physical locations, 25 of them main campuses. Growing revelations in the media, such as the article that follows, have made the public aware of Phoenix’s and other “universities'” aggressive recruiting, and poor post-grad employment that leaves alumni deep in unpayable debt.

The reputation of American universities, long viewed as the best in the world, is being befouled by the cancerous growth of for-profit colleges that saddle students with crushing debt in return for very little of marketable skills.

At a time when our youth are told that a college education is indispensable to their hope of ever finding a job, the for-profit colleges pursue the young like gulls following fishing trawlers, encouraging them to take on debt they cannot afford to pay. This predation takes the form of eating our young.

The schools do not issue that debt; they just cash the checks, which is what has caused a stampede to create some 2,000 colleges that now account for 13% of all students, up from 3% ten years ago, most by large corporations and even private equity and hedge funds. The loans — about 80% of them — are from the federal government. And if the student cannot pay? The U.S. taxpayer will eventually pick up the tab.

The government in the 2010-11 academic year issued $24 billion in loans and $9 billion in grants to students at for-profit schools. A study of 30 such colleges just issued by a Senate education committee chaired by Iowa Democrat Tom Harkin says that these institutes do not behave like the usual accredited institutes of higher learning. They spend on average 22.4% of that revenue on marketing and recruiting and only 17.7% on teaching. Keeping down the costs of actually educating students made certain that profits would be a heady 19.4% — that is, after paying the CEOs of these colleges an average of $7.3 million that year. One CEO — Robert Silberman of Strayer Education — was paid $41 million including stock options. (The president of Harvard was paid $700,000).

The colleges make such handsome profits by charging far more. The Harkin study schools charge almost four times as much as community colleges and public universities for

associate degree and certificate programs. For four-year degrees the industry-wide average tuition is $31,000 a year, almost double the cost of public universities. For-profit colleges have been found to ratchet up their tuition to match the maximum amount a student can borrow from the government.

And the students?

Schools find it in their interest to be unclear about the real costs of enrolling. There is a newsletter that advises marketing technique called Enrollment Management that counseled admissions personnel to “avoid bad words like ‘cost,’ ‘pay’, ‘contract’ and ‘buy’”. These are “direct marketing ‘words’ that can make or break” the pitch. Letters to students often refer to “financial aid” without clarifying that the aid takes the form of loans.

What results? Few at for-profit colleges complete their courses. At Phoenix University, the largest in the field — it took in $4.9 billion in 2010, almost all from the government — two-thirds of associate-degree students leave before earning their degree, and less than 9% of its bachelor degree candidates graduate, even allowing them six years before taking the measure.

But the students’ debt lives on. About 96% of students at for-profit schools take out loans, versus about 13% at community colleges and 48% at four-year public universities. Those at the for-profits may be only 13% of the national student body but they account for 47% of the defaults on student loans.

The few that do complete courses get little help finding employment. The Harkin report found that while there was the astonishing total of 32,496 recruiters for the 30 studied colleges, there were 3,512 staff members to assist graduates in finding jobs. One of them, Ashford College, wth 78,000 online students and $216 million in profits, had 1,700 recruiters, but just 1 job placement officer.

Others who do complete coursework and seek to transfer to a different school then find that their credits are not accepted elsewhere. ITT Educational, for example, has 148 locations in 39 states and 71,000 students enrolled. At the end of its ad small type reading ”Credits earned are unlikely to transfer” appears for a moment. In contrast, credit for a two-year associate degree from a community college will almost certainly transfer to a four-year college toward completion of a degree.

The $1 trillion in student debt, now greater than credit card debt, caused us to report almost a year ago on student loan defaults posing “The Next Financial Crisis” (restored to our Education page or here). It is the dropout group which poses the greatest threat. Education Sector, a Washington research outfit, published this study earlier the year which found that the default rate on loans to students who drop out is four times higher than those who stay for a degree. They leave themselves strapped with a loan to repay with greatly diminished chances to find a job, much less jobs that pay enough to cover the debt.

Most insidious is the targeting by the for-profits of U.S. armed services personnel. There is a federal regulation that the for-profit colleges must derive (a mere) 10% of their revenue from sources other than the Department of Education. In an unaccountable loophole, even though the post-9/11 GI Bill benefits come from the federal government, they qualify toward the 10% requirement. So the for-profits aggressively promote GIs to use up their benefits on their worthless courses.

Congress Objects

One would think that Republicans would cheer the Harkin report for outing the waste of government funds and, therefore, taxpayer money. Instead, Republicans on the committee that issued the report called it a hostile partisan work that should have investigated nonprofit colleges as well. That puzzling reaction may be explained by the for-profit college sector spending $8 million a year on lobbying in 2010 and again in 2011.

The Courts Help Out

To stem the hemorrhaging of money to the for-profits, the Obama administration devised a rule that would cut off funds to those that failed in (a) three of four years to meet (b) just one of the three requirements that (1) at least 35% of recent graduates are repaying loans or (2) that their payments do not exceed 12% of their income or (3) 30% of discretionary income. Despite the several ways a college could pass, the rules — a test of whether a college produced employable graduates rather than wasting tax money — were struck down by a judge of the U.S. District Court of D.C. as being “arbitrary and capricious”, as if any threshold along a path of 0% to 100% could have a concrete premise.

The Education Department said that 48% of for-profit institutions failed the 35% test. As it stands, they will go on getting full funding.

That’s OK With Romney

One would expect the disgust from Governor Romney with the scandalous waste of government money sent to the for-profits and even the alarming burgeoning of student debt they are causing. Yet he has said, “I just like the fact that there’s competition. I like the fact that institutions of higher learning will compete with one another, whether they’re for-profit or not-for-profit”. He believes they “hold down the cost of education”. Given what we have cited, he seems unaware of the facts. Either that or unduly influenced by friend Bill Heavener who is the head of the private equity fund that owns Full Sail University, a college in Florida, and is co-chair of Romney’s fund raising in that state, and who gave $45,000 to a SuperPAC set up by former Romney aides.

As for holding down costs, Full Sail, which specializes in the entertainment field, charges $81,000 for a 21-month program in video game art. It graduates just 14% of students.

Aug 12 2012 | Posted in

Education |

Read More »

Aug 9 2012 | Posted in

Policy |

Read More »

<|204||>

Update: August 21: In this article from early August we had said, “Netanyahu’s strategy is to use the U.S. election for leverage….Were Israel to attack now, an American president running for re-election would not risk losing the Jewish vote by withholding the support of the U.S. military”.

Newsmax today reports, “Israeli Prime Minister Benjamin Netanyahu is determined to launch an attack…before the presidential election in November. He believes President Barack Obama would have no choice but to back the Israeli decision in the weeks before he has to face the nation at the polls, according to a report in the Times of Israel”.

Getting that right does not please us. Instead, that action should provoke outrage from Americans at this brazen attempt to entrap this country.

Mitt Romney drew the wrath of even

those on the right for undercutting U.S. foreign policy in his trip to Israel, virtually promising old friend and Israeli Prime Minister BiBi Netanyahu (they worked for the same company in Boston in 1976) that he would back Israel without reservation if it launched an attack on Iran.

Simultaneously, Defense Department chief Leon Panetta was also in Israel for two days, doing his utmost to persuade Netanyahu to do the opposite — to let the sanctions take full effect, and asking Netanyahu to back away from increasing intimations that Israel is contemplating an attack. “I want to reassert again the position of the United States that with regards to Iran, we will not allow Iran to develop a nuclear weapon. Period.”

Netanyahu was having none of it. Even with Panetta standing at his side, Netanyahu said, “Right now the Iranian regime believes that the international community does not have the will to stop its nuclear program”, he said. “Neither sanctions nor diplomacy has yet had any impact on Iran’s nuclear weapons program”.

working our country

Netanyahu’s strategy is to use the U.S. election for leverage. What else explains his unwillingness to wait for the effect of the tougher sanctions that were put in effect only 30 days previous on July 1? And with overwhelming votes, both the House and the Senate just passed another serving of sanctions — these to affect Iran’s shipping, energy and financial institutions — which says that sanctions still have more to run.

Why other than to manipulate the U.S. election would Netanyahu have invited Romney to Israel in the midst of the campaign? A naïf in the hands of the crafty prime minister, Romney as champion of Israel’s cause might as well have been scripted. With one candidate in his pocket, Netanyahu’s bet may even be that, were Israel to attack now, an American president running for re-election would not risk losing the Jewish vote by withholding the support of the U.S. military.

The Obama administration clearly wants to avoid yet another war in the Middle East, sapping our military strength still further and at a moment in history when we are better advised to pivot to the rising threat in the Pacific. But not Romney. “If Israel has to take action on its own in order to stop Iran from developing that capability, the governor would respect that decision…No option would be excluded. Gov. Romney recognizes Israel’s right to defend itself and that it is right for America to stand with it.”

Those comments were from Romney’s close friend and advisor on Israel Dan Senor, briefing reporters in Israel on what Romney was about to say in a speech later the same day. Pat Buchanan, a well to the right pundit, although isolationist, asked what “stand with” means? If it means U.S. air cover while Israeli planes strike Iran, “this would make America complicit in a pre-emptive strike and a co-belligerent in the war to follow”. And if Romney would leave it to Israel to decide when to strike and bring the U.S. into war, “this country has never done that before”.

Senor is hardly neutral; he wrote the book about Israeli entrepreneurial culture that is presumed to have inspired the Romney comments that were interpreted as a slur against the Palestinians. Senor’s sister runs the Jerusalem office of AIPAC, the powerful lobbying group for Israel in D.C.

The governor’s choice of advisors skew toward the interventionist policies of the neo-conservatives that brought us the Iraq War. The Nation is a magazine well to the left, but this article which lists Romney’s foreign policy advisors makes clear that he is attracted to the preemptive policies of the George W. Bush years.

George Friedman, at Stratfor Global Intelligence, concurs. In comparison to what he says is Obama’s preference for allowing regions to work out their own balances of power, Romney favors “active balancing”. Romney has said that Russia is “without question our No. 1 geopolitical foe” and Friedman interprets that to mean that Romney “requires U.S. action on a substantial scale”. Romney would take action in the Syrian conflict, has spoken out strongly against China, as in this Wall Street Journal op-ed piece, and — as we have seen — he has said he would raise the defense budget a staggering 20%. How he would somehow finance America’s new virility by at the same time cutting personal taxes 20% and reducing corporate taxes from 35% to 25% has not been explained.

whatever became of congress ?

The question is, are we ever going to return to the Constitution that reserves to the Congress the power to declare war rather than allow the single individual that sits in the Oval Office to act on his own?

Where would either Obama or Romney find the right to enter into a war against Iran? Immediately after 9/11 Congress authorized George W. Bush — and until rescinded, other presidents in turn — to:

“use all necessary and appropriate force against those nations, organizations, or persons he determines planned, authorized, committed, or aided the terrorist attacks that occurred on September 11, 2001, or harbored such organizations or persons, in order to prevent any future acts of international terrorism against the United States by such nations, organizations or persons [emphasis added].”

A nation supposedly developing nuclear weapons is what many nations — including Israel — have done and does not fit the definition of “terrorist”. A nation that has threatened some other nation is not a threat “against the United States”. So while Mr. Romney’s prepared remarks about Iran developing WMD said, “Preventing that outcome must be our highest national security priority”, that is not our highest priority. It is Israel’s.

“We will not allow Iran to develop a nuclear weapon. Period” sounds absolute, but Panetta’s words are actually careful. Our reading is that the U.S. is saying it will require actual evidence of Iran’s developing a nuclear weapon before taking action or aiding in Israel’s doing so. And that’s the right policy. We cannot be dragged into another war based only on speculation about WMD, nor by the bullying of the leader of another country. We’ve just seen Romney make promises to Israel to win Florida’s Jewish vote, and if Obama counters with the same, we will be watching both of them put self before country.

Aug 4 2012 | Posted in

Defense |

Read More »

States that wanted to require identification cards with photos to allow citizens to vote needed a reason. They came up with that threat to democracy, voter fraud.

Republicans believe that fraud is standard practice by Democrats for winning elections; they cite Acorn as an example. To whatever extent such accusations were true for that organization, their transgressions were improper attempts to register voters, not fraud committed by individuals pulling the levers in the voting booth.

Nevertheless, the fable of fraud persists. Interviewed by ThinkProgress, a Wisconsin Republican state legislator named Glenn Grothman said, “I think we believe that insofar as there are inappropriate things, people who vote inappropriately are more likely to vote Democratic…we believe the people who cheat are more likely to vote against us”.

Kansas now requires proof of citizenship to “ensure the sanctity of the vote”, says Governor Sam Brownback. By making voting problematic for an estimated 620,000 in the state, Kansas will ensure itself from recurrence of the single case of election fraud over the last six years.

Pennsylvania has one of the most restrictive laws in the country. The Justice Department is investigating whether the state is disenfranchising voters in violation of the 1965 Voting Rights Act, against which the state will need evidence that there is a problem warranting those laws. Yet the state admits:

There have been no investigations or prosecutions of in-person voter fraud in Pennsylvania; and the parties do not have direct personal knowledge of any such investigations or prosecutions in other states.

Well, no, of course not. This lengthy study by the Brennan Center for Justice shows that the claims of voter fraud most often derive from the media’s penchant for “agitated headlines” such as “Hundreds Might Have Double Voted” or political programs such as Sean Hannity on Fox News who said, “Allegations of voter fraud continue to pop up all across the country”. But the many cases examined by Brennan have proved false. Clerical errors, similar names, matching names crossed with one another, address changes — these proved to be the most common reasons for mix ups, not fraud.

Claims that dead people had cast ballots are popular, only for it to be discovered on audit that the unfortunate individuals had died after the election. Of the many reports of fraud probed by Brennan, claims of irregularities in Ohio resulted in a statewide survey of votes cast in 2002 and 2004. Out of 9,078,728 votes, “four instances of ineligible persons voting” were found — a factor of 0.00000044%. Ridiculing the threat to our elections, Stephen Colbert warned, “Folks, our democracy is under siege by an enemy so small it could be hiding anywhere”.

“By throwing all sorts of election anomalies under the ‘voter fraud’ umbrella…advocates for such laws [as requiring photo IDs] artificially inflate the apparent need for these restrictions” is the Center’s view in its report that runs down one after another bogus claim of voting abuse. “The voter fraud phantom drives policy that disenfranchises actual legitimate voters”. Bluntly stated, portraying voter fraud as justification for laws that disenfranchise citizens is the real fraud.

the dumbest way to throw an election

The real absurdity is that voter fraud makes no sense. An attempt by an ineligible individual to vote — the sort of fraud called “impersonation” — is a decidedly ineffective way to influence an election as the percentage example above makes clear. How many would you have to pay off to vote for your candidate in order to tip an election your way — all the while running the risk that any one of them would blow the whistle. How many would go along once word got around how singularly foolish is the risk, carrying as it does a five year prison term and a $10,000 fine — even deportation, if that applies.

Aug 2 2012 | Posted in

Policy |

Read More »