Dueling Budgets Fail the Reality Test

Why they are works of fiction Aug 27 2012Which shall it be, a budget that pretends there are no icebergs and steers the ship of state steady as she goes, or a budget that turns the ship around and founders on the shoals of…okay, enough of the over-wrought metaphor, but the point is that both the Obama and Romney-Ryan budgets never extract the country from ever-mounting debt, so which snake oil salesman shall we put in the Oval Office this time?

President Obama would collect more taxes from the wealthy, allow the sequester to cut military and other expenses for him so he can blame Republicans, and eliminate oil and gas subsidies, but ignore the bankrupting cost of entitlements, content to run a deficit averaging $866 billion a year over the next 10 years.

Paul Ryan’s plan, heartily embraced by Governor Romney, would repeal “Obamacare”, privatize Medicare and make deep cuts in discretionary spending (although not on the military), but by sharply reducing taxes will run deficits until after 2030, says the Congressional Budget Office (CBO)..

But while the two budgets would operate the government in very different ways, they both lead to much the same result.

obama placidThe budget for 2013 that the Obama administration put forth in February, heedless of piling on debt unto the horizon, "whistling a happy tune while they drive us off the fiscal cliff", as Chris Christie quipped in his Republican Convention keynote. The budget was immediately derided and subsequently voted down 414-0 in the House and 99-0 in the Senate. It has no mention in the tables of the cost of the Affordable Care Act (“Obamacare”), presumably because the CBO estimates that it will save $210 billion over the decade. (An incendiary cover story at Newsweek by Harvard’s Niall Ferguson is drawing fire for claiming it will cost $1.2 trillion). But there is an ominous line item labeled “Other Mandatory” that totals $6.9 trillion over 10 years that is never explained.

While the Obama budget assumes current law for revenue, meaning that the Bush tax cuts expire, it counts not only on that but on new laws that haven’t happened — and are unlikely to, at least in the present climate — for more revenue; namely, passage of the President’s proposed 30% minimum tax on anyone earning over $1 million in a year, restoration of gift and estate taxes, and taxing dividends and capital gains at ordinary income rates rather than 15% for marrieds earning over $250,000 a year.

These would raise revenue from $2.8 trillion in 2013 to $4.85 trillion in 2022. The budget needs to count on this optimistic boost — possibly something of a fudge factor — to offset the soaring costs of Social Security, Medicare and Medicaid that will rise by $1.5 trillion from a projected $2.3 trillion in 2013 to $3.8 trillion in 2022 when the full demographic tide of baby boomers will have become seniors.

It’s all borrowed, of course, as the rise in interest cost from $246 billion to $915 by 2022 makes apparent. The administration assumes a benevolent lender out there somewhere who will accept our increasingly worthless dollars as it watches the Obama budget add almost $8.7 trillion to the national debt across the next 10 years.

Ryan rabidIn contrast, Paul Ryan encourages the view that his radical budget plan will save the country. His “Path to Prosperity” (pdf), was hailed last year as “bold” and “brave” for confronting Medicare head on and for slashing government spending on social safety net programs. He saves Medicare by turning it over to private insurers, leaving Medicare simply to print and mail out vouchers — scrip with which to partially pay the insurers. Ryan’s turning Medicare inside-out proved so unpopular — the CBO ascertained from the single Medicare line item in the sketchy “Path” that seniors would have to pony up an average of $6,400 of their own by 2022 to buy coverage equivalent to Medicare — that Romney decided on retaining regular Medicare as an option.

In Ryan’s plan, almost $1.6 trillion would be saved by repealing Obamacare; no substitute plan is budgeted to take its place. His budget converts the federal portion of Medicaid to block grants to states and cuts $1 trillion in the process, leaving to the states what to do with a minimum of 14 million people who would be denied health care. Outlays for food stamps, housing, job training, Pell grants to students — all would be cut. Ryan’s budget — and it is Romney’s as well — he called it “excellent” and “consistent with what I put out earlier” — slashes outlays by $5.3 trillion from the Obama budget over 10 years.

That should work wonders to bring down the debt, except that both Ryan and Romney intend to slash revenue as well. They want to cut individual taxes by 20% across the board; corporate taxes from 35% to 25% (to 0% on profits earned abroad); and eliminate the alternative minimum tax, the estate tax, taxes on capital gains, dividends and interest for couples earning $200,000 or less (Ryan prefers eliminating capital gains taxes for all).

We calculate that all those cuts would short government revenue by $475 billion in 2015 — and given assumptions of rising revenue in later years — by almost $5.6 trillion over the decade to come.

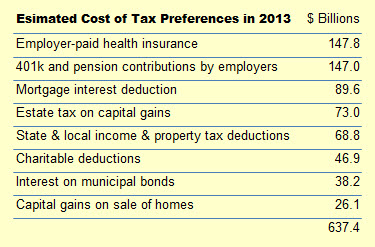

But both Romney and Ryan insist that their transformations will cost the government zero dollars, that they will be “revenue neutral”. This will be accomplished by reducing or eliminating “loopholes” and deductions, but neither will specify which. The Wall Street Journal waves this off saying “no campaign ever does”. which is not true, but if the candidates did tell you which, you wouldn't vote for them.

The table at left shows the annual cost of the major items that are either excluded from taxable income or deducted from it. It shows that the Republican reformers have no hope of making up the $475 shortfall we cited for 2015 without wiping out almost all these “tax expenditures”. There are nowhere near enough smaller cost “loopholes” at the margins for Romney-Ryan to make up revenue lost to their tax cuts. The public, which will be shocked post-election when they find out that these benefits are on the chopping block, will be outraged. Congress would not dare cancel them.

The blithe assumption that Romney and Ryan will be able to eliminate these taxpayer indulgences and "broaden the tax base" (by exposing more income to taxation) is what leads to the Ryan budget bringing in only $2 trillion less in revenue than the Obama budget over 10 years, rather than the $5.6 trillion revenue reduction of the tax cuts. That leads in turn to Ryan's 10-year deficit of "only" $3.1 trillion for the coming decade.

But if Congress won’t take away those taxpayer benefits, that deficit rises to $6.7 trillion. That’s getting close to Obama’s $8.7 trillion. So much for saving the country.

Don’t ask, don’t tell

The reality is that either team’s budget runs deficits because neither faces reality. As the nation’s finances are presently constituted, it is impossible to balance the budget.

Here’s a quick exercise:

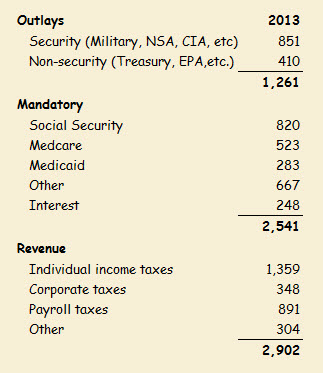

In the table, expenditures for mandatory programs and interest on the debt come to $2,541 billion in 2013. That amounts to almost all revenues collected — $2,902 billion. After paying mandatories, only $360 billion is left to pay for government itself, which costs $1,261 billion. There's no money to pay for 70% of that. To balance the budget, we would have to get rid of chunks of government for which there's no money — the presidency, congress, the military, all the departments, and so on. We could raise taxes, of course. But, back-of-the-envelope, we would need to raise taxes by 50% — for everyone. Sound preposterous? It's just arithmetic.

That won't happen, of course. You can be certain that neither the President nor the Republican candidates nor Congress will bring up the subject. So no matter who is running the ship of state, we are headed for the rocks.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.