Tax Reform’s Priority: Restore Balance Between Taxpayers

Reform shouldn't consist of merely tweaking numbers Dec 13 2012In the standoff between Obama’s edict that the top tax rates must be increased to reduce the deficit versus Boehner & Co’s insistence that unspecified deductions and “loopholes” be reduced instead, taxes on capital gains and dividends have been a comparative afterthought, even though their special rates cost the government $91 billion a year according to Bloomberg.

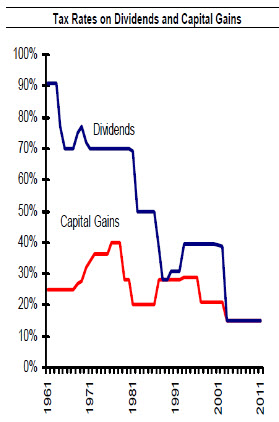

Instead of a tax rate that could then go as high as 39.6%, the Clinton administration reduced the rate on capital gains to 20% and President Bush cut further to a flat 15% for both capital gains and dividends. We have since seen a pronounced widening of the disequilibrium between those at the top of the income scale and everyone else. How else other than these sharply lower rates can one explain why a stunning 93% of income growth went entirely to the top 1% in the first two years of what for everyone else has been a snail’s pace recovery.

The President has proposed that capital gains taxes be restored from today’s 15% to the 20% of the Clinton years and that dividends be taxed the same as ordinary income — that is, as highly as the 39.6% rate he hopes to reinstate for top earners. But if true tax simplification and reform is the objective, we ask: what should tax policy be?

First comes fairness. Taxpayers are rewarded with the 15% rate because investment in the securities of corporate America is what creates jobs and makes the economy grow. So goes the doctrine, although supporting empirical evidence is lacking. The fact is that the money for close to 100% of all stock and bond trades does not go to the companies themselves except in rare new offerings of securities. Once issued, securities are traded endlessly back and forth between outsiders — individuals, funds, corporate holdings, and so on.

If true investment in industry is to be encouraged, the special tax rate — or even a tax rate as low as zero — could be reserved for only security buys certified as having gone direct to companies: new offerings of stock and debt. For tax purposes that would sort investing into two classes: one that funds growth, the other where we trade amongst ourselves. It's an alluring idea but unworkable, as we once explored.

Since virtually all investing activity does not go to the benefit of the companies we trade in, what then is the rationale for the special tax treatment? It results in an inversion of principle where labor is taxed fully by payroll and progressive income taxes but the gains from letting money do the work is not.

Reagan thought capital gains should be taxed at the same rate as income. The successful bipartisan tax restructuring under his administration in 1986 reduced the top rate on capital gains and raised the rate on dividends — both to 28%, the same as the tax on ordinary income. The irony is that today’s Republicans place a halo above Reagan’s head, whereas some of his policies have become heresy.

the short and long of itAnother anachronism — and did it ever make sense? — is that we only gain that special 15% tax rate on profit if we hold a stock for a year or more. What’s the good of that? If we were back in yesteryear, when corporations had to deal directly with investors by swapping stock certificates in and out, there would be a rationale for rewarding people for not swamping companies by churning. But almost all stock is now traded electronically and held in street name by brokerages or funds. So the next step in cleaning up the mess is to get rid of this pointless and cumbersome extra layer of complexity.

IndexingThe tax code rewards us for holding onto securities over a year. It then penalizes us the longer we hold on. Imagine paying $100,000 for stocks, holding them through thick and thin as gurus told us to do, and selling 10 years later for, say, $135,000. You would find yourself paying taxes on a capital gain of $35,000 even though with as little as 3% inflation, you would not have made a dime. You’d be getting back depreciated dollars worth no more than the $100,000 you invested 10 years before. And the tax you pay makes it a loss.

You could call it the government’s dirty little secret. It is not in their interest that we make this discovery. The public might rise up and demand indexing — which would be a simple bit of arithmetic whereby we mark up the cost basis of each sold block of stock or bond according to the inflation percentage the government had caused (or failed to prevent) over the intervening period. Nothing unusual here. We already index Social Security taxes and payouts according to a cost of living allowance (COLA).

Incidentally, if capital gains is to be taxed as ordinary income, the quid pro quo calls for doing away with the government’s confiscatory practice of taxing profits in full at the moment of sale while only allowing a deduction of $3,000 if a year’s net trades produce a loss — and only $3,000 a year thereafter for as long as the carry-forward produces a net loss. Not even that amount is indexed to inflation. Incredibly, it hasn’t changed since 1978. Fully taxed profits should be matched with fully deductible losses.

dividend duress

Older couples of the Harry and Louise stripe (the duo who helped sink Hillary’s health care overhaul in 1993-4) are bleating in television commercials that raising taxes on dividends would crimp the retirement they had counted on.

Maximum tax rates of capital gains and dividends

. First, it is their mistake to count on today’s rate, especially since dividends have historically been taxed at the same rates as ordinary income (see chart). Second, as with capital gains, if we invest money (trading among ourselves, remember), why should we expect rentier income to be taxed less than the income from labor?

This is the sort of statement that drives conservatives batty, but our exercise here is to consider the ethical principles of how various forms of income should be taxed. To make the case that these special tax rates are justified — that certain elements of society should be favored over others — requires concrete counter arguments, and without the usual intangibles about capital formation, liquidity, and so forth.

Incidentally, for the middle class, elevated tax rates on dividends won’t be much different from the 15% they pay now because their other income puts them in the middling tax brackets anyway. To be affected by high rates on dividends, one has to be enjoying bountiful income and is really not in need of our compassion. Dividends and interest go overwhelmingly to the top 2% of taxpayers, and that money is not invested in the sort of striving, entrepreneurial businesses needed to fuel growth. Only the most mature companies pay dividends.

of interestRaising the dividend rates to those of ordinary income would erase the inexplicable disparity between the tax treatment of dividends and interest income. At present, with dividends taxed at 15% and interest as high as 35%, because it is combined with ordinary income, the dice are loaded in favor of stock investing. Why? Anyone?

And, of course, what never gets fixed is the indefensible double taxation of dividends. Corporations cannot take them as an expense, and that results in higher profits subject to tax. Recipients of the dividends are then taxed as well. If corporations could take dividends as an expense, they would probably be inspired to return more capital to their shareholders, for whose benefit they unfailingly claim to be working, and that would allay the anguish we are hearing in these Harry and Louise commercials.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.