Food Stamps, Meet the Minimum Wage

One high, the other low. Congress never makes the connection Feb 24 2013Food stamps come in for particular ire from some. Over 46 million Americans pay for their groceries with federal food stamps. Half of the mouths that food stamps feed belong to children. It is a 40-year-old program (renamed “Supplemental Nutrition Assistance Program” or SNAP) but only in recent years has it ballooned to one in seven people, currently costing taxpayers $72 billion a year.

The rapid increase owes partly to the weak economy that has followed the financial crisis of 2008, but also to a loosening of the eligibility rules to assist the victims of that economy. It is no longer required that a family sell off all its assets and belongings to qualify, for example.

But Congress sees only the cost. Food stamps are part of the perennially stalled farm bill, which comes up every five years. Congress has repeatedly passed temporary bills with sunset clauses. A mare’s nest of subsidies from crop insurance energy, telecommunications, forestry — you name it — the current extension expired last September 30. Since then we have therefore technically reverted to the last permanent bill passed as law — in 1949. You read that correctly.

It may be a farm bill but food stamps make up 79% of the near trillion dollar ten-year bill the Senate passed last June. (Yes, June, and it is now January with nothing having been passed). They cut $4.5 billion from food stamps. House Republicans want to cut $16.1 billion, which would drop about three million Americans out of the program. but their bill has never made it to the floor for vote because of those who say cuts are not deep enough.

The swelling numbers in people and dollars says to conservatives that the program is out of hand. The Wall Street Journal’s editorial page is representative. An op-ed piece said about food stamps, “thanks to Obama’s stimulus, [the cost] doubled again between 2008 and 2012”, without mentioning that the stimulus aid was brought about by millions thrown out of work by the 2008 financial crisis that took food off their tables. Another is entirely about the military but has the gratuitous title “Defense vs. Food Stamps: What Would You choose?”. Or the editorial titled "Food Stamp Nation" which called food stamp recipients those “who who depend on taxpayers to buy one of life's most basic responsibilities. It's a good thing breathing air is free”.

Even these parsimonious scribes might soften their critiques were they simply to divide the annual cost by the number of recipients — cited as $71.8 billion and 46,670,373 in that very same editorial — and then the result by 52 and they would discover that the amount per person per week is to die for — literally — $29.59.

Cory Booker, the mayor of Newark, NJ, a city of 277,000 with 74,000 on food stamps, tried living on them for a week to see what his constituents were experiencing. And true to our math experiment, he got a meager $29.78 for a week of groceries. It was a week of nothing but salad, beans and broccoli, hunger pangs and fearing he would run out.

cause and effectHere’s a hypothetical. If you think too many people are on the food stamp dole, wouldn’t their ranks diminish if those with low-paying jobs made more money? Yet all too often those same people who harangue about food stamps are those who inveigh against raising the minimum wage.

Now, it is true that the minimum wage would have to be raised quite a bit for someone to no longer need food stamps, which reflects on how far below the cost of living is today’s minimum wage of only $7.25 an hour.

No one can live on that. Assuming a 40-hour work week (and no vacation), it comes to $15,080 a year — less if no pay for holidays and sick days. Somehow, less than $1,300 a month is supposed to pay for rent, food for children, light, heat, getting to work — and let’s hope no one gets sick. Our legislators are seemingly content to leave on the books a minimum that for a single mother with two kids is $4,000 below what is considered the poverty level by that same government. It is a wage that approaches slavery. If you find that an outrageous statement, consider that slaves, while paid nothing, were given shelter and food, which the minimum wage earner must pay for.

Yet whenever the issue is raised in Congress a chorus of business lobbyists descend on the Hill with money and dire predictions of inflation and calamitous job losses. When the rate was raised from a truly Dickensian $5.25 an hour in 2007 to today’s $7.25, was there inflation? Those opposed rely on numerous surveys of economists who, schooled by a canon that says when anything goes up, something must come down, have reflexively agreed that a minimum wage’s mere existence must increase unemployment among low-skilled workers.

But those are just surveys of opinion. Actual studies say otherwise. Economists at the University of Massachusetts-Amherst “compared employment levels in contiguous areas with disparate minimum-wage levels over a 16-year period and concluded in a 2010 paper there are ‘strong earnings effects and no employment effects of minimum wage increases,’” according to commentary at Bloomberg/BusinessWeek, and studies before that have found employment effects to be slight.

If so, and employment remains stable after increases in the minimum wage, then opponents can legitimately make the case that prices must rise for all of us in order for businesses to recoup the cost. What’s wrong with that? Should our pockets be subsidized by holding the pay of those who produce the goods and services that we buy at a misery level?

downhill since 1968The President, in his State of the Union, wants to raise the minimum wage to $9.00 an hour (down from the $9.50 he once proposed). A Zogby Analytics poll found that 70% of Americans (and 54% of Republicans) support raising the minimum above $10 an hour.

And that still leave us short of the adjusted for inflation $10.51 an hour minimum of 1968, from which we’ve fallen short ever since. We have the lowest minimum wage of any major western nation. In Australia it is over $15, France over $11, and most of those countries pay for health care.

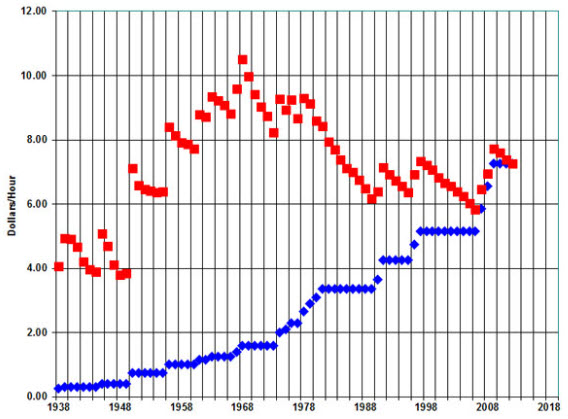

The blue shows the nominal minimal wages across the years since

the first law passed in 1938. The red data points show those same rates

adjusted for inflation, with 1968 equal to $10.51 an hour and both series

arriving at today's $7.25. The chart is from the University of Oregon.

Fox Business refuted the need for an increase by indirectly citing a study by economists at Miami and Florida State Universities who found that two-thirds of those hired at the minimum wage get a raise in their first twelve months, as if to say there is nothing wrong with a year at poverty wages and without mentioning whether the average raise was enough to lift them out of poverty.

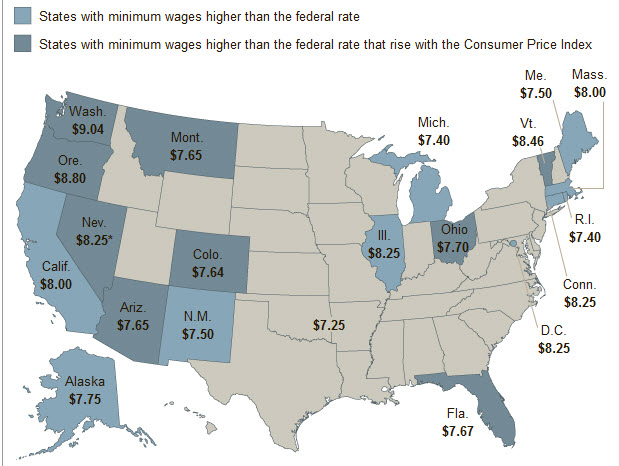

Eighteen states have broken with the federal government and raised the minimum beyond $7.25, but the increases are mostly slight, and the highest is $9.04 in Washington State.

Source: U.S. Department of Labor

Every dollar paid to a minimum wage earner is spent; it goes back into the economy. At that pay level, nothing goes under the mattress. Every cent is needed for the necessities of life. Every dollar of increase to that wage adds close to $2,000 per worker of further spending into the economy. And studies have also found that a minimum wage increase tends to push up wages of those earning more than the minimum, as business owners try to maintain hierarchies of pay grades.

Yet our lawmakers continue along two separate and conflicting tracks, holding the minimum wage at a brutish level while wondering why so many need food stamps. Were Congress to make that connection, they might find that forcing pay increases would cut the need for the food stamps that some so dislike. Or is that asking for logic beyond their pay grade?

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.

This article makes two capital mistakes. The first is the belief that the government should be in the charity business; it shouldn’t. Charity should be returned to the churches, which have done very well at it for centuries. Related to this is the idea that those who oppose the Food Stamps program are parsimonious; in fact, they simply believe in being generous with their own money instead of taxpayers’ money.

The second mistake is the idea that raising the minimum wage will not have any negative effects on the rate of employment. You cite some studies that show that there is not much of an effect; other studies show that there is indeed a pronounced effect. What it comes down to is whom you wish to believe. In this case, if something made economic or social sense people would not need the government to require it; therefore the minimum wage does not make economic or social sense.

– John F. Fay

You stated…….

“If so, and employment remains stable after increases in the minimum wage, then opponents can legitimately make the case that prices must rise for all of us in order for businesses to recoup the cost. What’s wrong with that?”

How do you not call a rise in prices inflation?

You also stated……..

When the rate was raised from a truly Dickensian $5.25 an hour in 2007 to today’s $7.25, was there inflation?

Well….yes, quite a bit actually

I suggest you take a study course in basic economics……You do have a good handle on Obamanomics which defies reality. Pennies from heaven.

About “prices must rise for all of us in order for businesses to recoup the cost. What’s wrong with that?”, you say, “How do you not call a rise in prices inflation?” Really, your Big Mac costs a bit more and that’s what you call “inflation”? You evidently missed the next sentence: “Should our pockets be subsidized by holding the pay of those who produce the goods and services that we buy at a misery level?” And you missed, “.. today’s minimum wage of only $7.25 an hour. No one can live on that”. Keep them in penury !! Right?

And to “When the rate was raised … in 2007 to today’s $7.25, was there inflation?” your reaction which was “Well….yes, quite a bit actually”. You are incorrect. Inflation has been historically low for years — an avergae of 2.18% a year since 2007. Here’s a table for your economics study: http://www.usinflationcalculator.com/inflation/historical-inflation-rates/

i am a general dentist in a semi-rural community of the East Bay (San Francisco). I start my new employees at $12 – 15 / hour depending on their prior business experience; more if they are a licenced dental assistant. Paying my employees a decent living wage is cheaper and more satisfying (especially since it reduces my tax burden) than using minimum wage as a guideline for compensation. I know I wouldn’t want to try to survive on 7 or 8 dollars an hour.

I start my new employees at $12 – 15 / hour depending on their prior business experience;

This is really very good of you. One question……..

What do you pay for he/she who has no experience, but is willing to let you train them?

Frank