What Have We Got Against Students?

Sticking our young with 6.8% interest in a 1% interest world Jul 10 2013At a time when the United States has slipped to second tier status in so many categories, a time when the nation desperately needs a better-educated workforce, why are we making it as difficult and costly as possible for students to get a college education?

A number of factors, not least of which is the rise of tuition charges by our irresponsible colleges, have created the crushing burden of debt borne by those who wanted a college education. Exacerbating the problem is a whopping 6.8% interest rate on Stafford loans imposed by Congress. That rate may have been defensible at the time, but the wise solons didn't think to build in flexibility to reflect fluctuations in the market place, so in the new era of 0% interest rates, students and grads are stuck with comparatively usurious interest charges.

Congress' solution was to cut the rate in half — to 3.4% — for two years running, and kick the can down the road. Once again, we've caught up with the can. The year has expired, and Congress went off for a their two week 4th of July vacation, allowing the rate to revert to 6.8% on July 1 for 7.4 million university students. Counting graduates and borrowers from other sources — commercial and government — the debt load has passed $1.1 trillion, the fastest growing of all debt sectors.

many approaches. no agreement The Republican-controlled House has passed a bill, 221 to 198 on party lines, that Democrats say would raise the cost of loans. The House bill would reset the rate annually to match the future interest rate of the 10-year Treasury note, plus 2.5%. The CBO projects that would come to 5% next year and 7.7% ten years hence. The bill caps the rate at 8.5%.

The President wants certainty. He prefers a fixed rate at the time the student takes down the loan, with a maximum of 10% interest should inflation break out.

The Democrat-controlled Senate wanted to kick the can two years further down the road, simply extending the 3.4% rate again. But close to the deadline, a bipartisan group of five — three Republicans, a Democrat and an Independent — came up with a compromise solution that would peg the rate to the 10-year Treasury note, plus 1.85%. That rate on the Friday before this was written was 2.52%. With the surcharge added, that would make today's cost of student loans 4.37%. But Democrats and Majority Leader Harry Reid shot that down, and job not done, Congress went off for yet another vacation — their 4th of July lasts a full week. It helps explain why, in the most recent Rasmussen poll, Congress' approval ratings have dropped to 6%.

Democrats balked because they want a cap — a maximum interest rate to protect student borrowers should inflation run the table. But the real question is, why does the government think of students as a profit center. This op-ed by Lamar Alexander (R-Tn), Tom Coburn (R-Ok) and Richard Burr (R-NC) says that the rate reduction to 3.4% “cost taxpayers nearly $6 billion”, as if it is students’ job to prop up a government that, says the Congressional Budget Office (CBO), will make a profit on student loans of $51 billion this year. That’s more than the profits of ExxonMobil, or of Apple, or the combined profits of the four largest banks. Why are students charged even 3.4% when those banks can borrow from the government at less than 1% and interest rates in general are near the vanishing point?

In the interest of the nation’s future, which needs an educated public, the government should set student loan rates as close as possible to what it costs the government to borrow that money, so that a college loan is no longer a crippling burden. This is social policy; it is not meant to be the government-owned business it has evidently become.

Rookie Senator Elizabeth Warren (D-Ma) had that in mind when she put forth her first bill. It would charge students the same rate as the banks can borrow from the Federal Reserve, currently .75%. It attracted 385,000 signatures from various Internet petitions, but it was another kick of the can that would obtain for only a year, to provide “a window for Congress to find a fair, long term solution”.

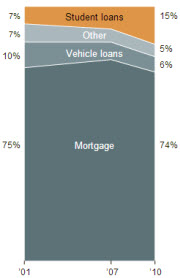

So students are caught in Congressional gridlock, this time over seemingly minor differences. Their trillion-plus debt exceeds car loans, credit card debt, and every category other than mortgage loans as the chart shows. This has produced a significant drag on both the economy and the society. Graduates cannot afford to start a family, buy a car, buy a house, even move out from their parents’ home. If they ever do make it to family status, they are likely still to be paying off their government loan when they face paying for their children’s education. Just ask a family with the last name Obama. They say they just finished paying off their student loans nine years ago.

Speaking of corporations, at a time when students desperately need money to start paying off those loans, firms have hugely expanded the practice of paying nothing to summer and post-grad interns, exploiting their need to show some experience on their résumés. Those with wealthier parents have the advantage of being able to take intern assignments, an imbalance that broadens the social gap between themselves and the less privileged. A federal district court judge in Manhattan just ruled that unpaid internships are a violation of the minimum wage law.

the collegesStudent debt is so high because of the venality of our colleges. One faction says the government is to blame for that and should get out of the loan business altogether. The argument is that by the government handing out loans indiscriminately, colleges have found they can raise tuition charges stratospherically. Evan Feinberg of Generation Opportunity, which inveighs against the generations that created the economic problems that the young will inherit, makes the point saying, if the government gave everyone $100 to buy an iPhone, Apple would raise the price because they'd know everyone has $100 to pay for an iPhone. As the ultimate beneficiaries of the loan proceeds, colleges have spent lavishly on amenities, built football stadiums, lured superstar faculty (who often teach hardly at all), and joined what has been called an “arms race” for higher rankings in the U.S. News & World Report rankings. Caught in this vortex of tuition extortion, but needing a college education for a job, 94% of students are forced to borrow, Department of Education statistics say. In 1993, half that — 45% of students — borrowed toward earning a bachelor’s degree.

the studentsAnd then there is the student contribution to the problem, with so many believing they have enough intelligence for college yet contradicting themselves by brainlessly signing up for loans with no knowledge of how they will pay for them, and then embarking on a curriculum that confers few employable skills, only to find themselves, once out in the world, under mountainous debt that a lower level paycheck cannot surmount. Currently, nearly 40 million people owe an average of $26,000 after graduation, with every year’s interest on the unpaid portion greatly increasing the ultimate obligation. No surprise that average default rate is 11.7% and rising.

But the average masks the much greater problem of for-profit colleges. Wall Street has rushed to invest in them, infatuated by their steep course charges and their hard sell tactics which have led to 57% of their graduates owing more than $30,000, versus 25% of the graduates of non-profit private colleges owing that much. That partly explains why their loan payment default rate runs to 23% — double the average and half of all defaults. The other explanation is that employers don’t think much of the for-profit schools. and do not recognize the certificates of most of the 2,000 “schools” that entrepreneurs have rushed to create.

The worst cases are the dropouts. At the for-profit colleges, few complete to take a degree. The all too easily government money is wasted for its lack of qualifying criteria. Only 9% of students who sign up for Phoenix, for example, the one that spends heavily to advertise its alleged success stories on television, stay to earn a degree. The dropouts come away with nothing but their debt, little means of repaying it, and may someday discover that, because this is taxpayer money, not even bankruptcy gets rid of it.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.

Why do these discussions always leave out graduate students? I’m a grad student and our loans are 7.9%. It’s ridiculous when you can get a car loan for under 3% and a home mortgage for under 4%. And grad school costs more than undergrad, so me and my fellow students have much higher debt than the “average” numbers given in this article. It is a punishing system. Please, let us actively seek to set all our loan (undergrad and grad) to the same national average as home mortgages, and we would all benefit.