Obama Seeks to Cut College Costs

But government and the education industry love the money Sep 12 2013 His plan to attack the runaway cost of a college education sounded grand on its first hearing in a speech in late August, but it then came clear that President Obama must intend for it to never happen — or so a glance at its timetable indicates. The scheme would award more government funding to those institutions that deliver greater value to their students according to a national rating system that the government would develop. But the criteria making up

the ratings won’t even be decided until 2015, and his plan is to ask Congress to link them to student aid wouldn't take effect until 2018, after he has left office.

Over the last 30 years, the cost of a college education has risen by three times the rate of inflation while household income rose only 16%. The sticker price last year averaged $39,520 for private non-profit colleges and $17,860 for public colleges. The net cost of tuition, fees and room and board after financial aid and tax credits were deducted reached an average of $12,110 for in-state students at public four-year colleges and $23,840 at private non-profit institutions. In the last decade that has meant a rise from 23% of a median family’s income to 38%.

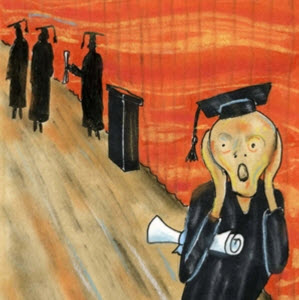

So students have had to borrow. Debt per student doubled over the last 15 years leaving the average student owing $26,000 on graduation day. A decade from now over 50% of them will still have outstanding loans when they enter their early 30s.

spending spreeColleges have spent lavishly to compete in rankings, particularly the most prominent (and controversial) published by U.S.News & World Report to add to prestige and attract students. They have been on a building spree adding "amenities" that would stun a college student of fifty years ago: student unions with movie theaters and wine bars, dining halls designed on the food court model, workout facilities with climbing walls, even dormitories that have single rooms with their own private baths.

More damaging from an education standpoint, spending on instruction has been far outpaced by spending on non-faculty. Whereas in 1978 there were 55 administrative and other employees for every 100 in faculty, that ratio has risen to almost 1 in administration for every 1 on the faculty, says The Economist. That growth rate is 10 times that of tenured faculty according to Bloomberg.com. And administrative paychecks have soared, even at public universities. Penn State’s Graham Spanier was drawing down $2.9 million a year when forced out by the sex abuse scandal in the athletic department (and he got an additional $1.2 million in severance and $1.2 million in deferred compensation on the way out the door). Deadspin.com reported that in 41 states the highest paid state employees are college sports coaches. And did our building spree list forget the expanded football stadiums and skyboxes?

All this in the face of the 2008 downturn that has caused states to cut back on college funding severely and contributions to drop some 40% during the last decade until a recent rebound, according to Moody’s, the rating service, which says that has caused colleges to double their debt between 2000 and 2011. The cost, of course, is passed on to students.

anyone else to blame?It has been a slow awakening, but the government is increasingly held responsible for feeding the cost spiral. Its direct aid to education, paired with its Pell grants and Stafford loans to students, have caused something of a feeding frenzy by colleges. The government, in its zeal to encourage everyone to get a college education, is not selective about who can get a loan, nor are a multitude of the over-4,000 colleges in the U.S. selective about whom they admit, in their equal zeal to get that student money.

To make sure the money keeps on coming, the education industry poured between $88 million and $110 million into lobbying the government in each of the past six years. With all that money for the taking colleges raise their tuition and other charges to get more of it. “Tuition is set at the level to suck up all the aid that students are able to get”, writes the Wall Street Journal. Evan Feinberg of Generation Opportunity makes the point that if the government gave everyone $100 to buy an iPhone, Apple would raise the price because they'd know everyone has $100 extra to pay for an iPhone. There hasn’t been enough research but a limited study at the National Bureau of Economic Research bears that out in its findings that tuition was 75% higher at for-profit schools where students receive federal aid than at for-profit counterparts where students do not receive aid.

The for-profit colleges are the worst offenders, as we reported in this exposé a year ago. They accept virtually all comers, and charge almost four times what public colleges charge, according to a Senate study. Large corporations and hedge funds have piled into the education business, starting online “colleges” to get at those federal dollars. Of those students enticed to spend their government loans at third-rate for-profit websites, few complete their courses. At Phoenix U., which gets almost all its revenue from the government and is the largest of the for-profits, two-thirds leave before earning their associate degree, and less than 9% of its bachelor degree candidates graduate. The rest of the students have left still owing the government for their loans which their lack of a college education will have difficulty paying back.

But their debt lives on. About 96% of students at for-profit schools take out loans, versus about 13% at community colleges and 48% at four-year public universities. Those at the for-profits may be only 13% of the national student body but they account for 47% of student loans defaults. Yet the government does not make distinctions about job outcomes or default rates, which is what the president wants to fix.

rating weightingA rating index using different criteria would certainly be welcome. The rating that has most fueled an arms race of college spending and debt to improve their competitive rank — the annual U.S. News & World Report rankings — has long been criticized for basing its grading in part on such self-fortifying factors as a school’s reputation and admission exclusivity. So no surprise to see Harvard, Princeton and Yale at the top of the heap.

But what happens when different criteria are used — criteria that consider value or “bang for the buck”? One example is Washington Monthly’s annual survey, now in its 9th year. Its emphasis uses criteria such as how many low-income students are enrolled, are students helped to graduate on time, is tuition kept low, does a healthy percentage of graduates go on to earn PhDs, and even how much community service participation students are engaged in? When those yardsticks are used, the results turn out quite differently. Leading their pack are Amherst College in Massachusetts, Queens College of the City University of New York (CUNY), Baruch College (also part of CUNY), California State University in Fullerton, and the University of Florida in Gainesville.

The White House already has an interactive College Scorecard on its website which finds colleges that match the searcher’s criteria, or shows on dials how a requested college compares with the average in a number of parameters such as cost, graduation rate, average amount borrowed and loan default rate. Obama has the U.S. Department of Education working on how to add information about the average earnings of former undergrads. That’s particularly difficult and has been met with criticism. How many years after graduation would the income snapshot be taken? What happens when a school that’s a farm team for Wall Street is compared with, say, Oberlin, where music is paramount? Or is money all that should matter? And how will the data come to hand? Does the government expect to snoop into tax returns?

Actually, the government does have default rates on its own student loans, which may be virtually as good an proxy of how well a college prepares its students for making their way in the world.

The President’s proposals have some good features, if we can imagine Congress ever passing them. Currently, the federal government’s $150 billion in annual student aid is mostly allotted uncritically to colleges in proportion to the number of students enrolled. Under Obama’s rankings, money would gravitate to schools where a higher percentage of students stay to graduate and to those that enroll more students from lower income families.

government greedBut this does nothing to cure the deeper problem — a system in which the federal government has become addicted to the money made from the student loan programs. When one considers that the goal is to create an educated America to compete in the world, the interest rates in the deal finally struck this summer are appallingly high. At a time when banks can borrow from the government at less than 1%, the rates are 3.9% for undergraduates, 5.4% for graduate students and 6.4% for parents. In future years interest rates will follow the market. There are caps beyond which the rates will not go, but consider how prohibitive an education would become at those caps of 8.25% for undergraduates, 9.5% for graduate students and 10.5% for parents. Such rates could easily double the debt for the typical payer.

This is all very lucrative for the federal government. Over the past five years, the Education Department has generated nearly $120 billion in profit off student borrowers, per the Huffington Post, "thanks to … the agency's aggressive efforts to collect defaulted debt". Under the new rates, estimated earnings from students is estimated at another $184 billion over the next 10 years.

Those “aggressive efforts” are what make the government’s student loan program a disgrace. To begin with, as we have reported, it was the banks that practically wrote the student loan law and saw to it that they are not “dischargable” under bankruptcy. Students are thus singled out with harsher bankruptcy rules than anyone who defaults on mortgages, car loans, credit card debts, etc. Those debts are eligible for dismissal in bankruptcy court, but student loan debt stays permanently attached.

Loans in default are turned over to an army of debt collectors. Paid a percentage of what they bring in and armed with the power to confiscate wages, they are accused of regularly misrepresenting the law by pressing for maximum payments and not advising debtors of more lenient options that the law provides. Elizabeth Warren, in campaigning for creation of the Consumer Financial Protection Bureau, said in 2005, “Student-loan debt collectors have power that would make a mobster envious”.

Unlike debt owed to credit card companies or mortgagors, there is no escaping the federal government. A Rolling Stone article reveals that the government’s own projections expect more than full recovery of defaulted loans, thanks to added fees and penalties — 109.8% for one type of Stafford loans, for example, and still 95.7% after the debt collectors’ cut.

In its student loan program, the government has found a red hot money maker, encouraging the young to burden their lives with loans they may not be able to repay and acting as a ruthless predator when they don’t. It’s just one example, but this from the Rolling Stone piece probably speaks for thousands:

“Talk to any of the 38 million Americans who have outstanding student-loan debt, and he or she is likely to tell you a story about how a single moment in a financial-aid office at the age of 18 or 19 — an age when most people can barely do a load of laundry without help — ended up ruining his or her life. "I was 19 years old," says 24-year-old Lyndsay Green, a graduate of the University of Alabama, in a typical story. "I didn't understand what was going on, but my mother was there. She had signed, and now it was my turn. So I did." Six years later, she says, "I am nearly $45,000 in debt. If I had known what I was doing, I would never have gone to college."

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.