What’s It to Be, Austerity or Economic Populism?

Dec 14 2013Republicans are savoring the opportunity in the 2014 elections to bludgeon Democrats with the Obamacare debacle. Of the 33 Senate seats in play next year, 21 are currently held by Democrats. Republicans need a shift of only six seats to

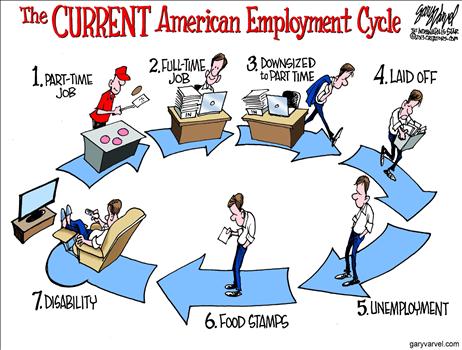

Gary Varvel, Indianapolis Star

win majority control, and seven of those Democratically held seats are in states won by Mitt Romney last November.

Democrats have dim prospects of toppling the 234 to 201 Republican majority in the House, with so many locked in place by gerrymandering. But Democrats can point to the Republicans’ own debacle of shutting down the government in October and can lambaste the 144 House Republicans who voted to default on the nation’s debts — unless that infamy continues to be eclipsed by Obamacare missteps.

There is, however, an undertow that may gather enough force to sweep both these campaign denunciations aside: the difficulties so many Americans are experiencing with an economy stuck in neutral. Public awareness of the enormous disparity between the 1% and the 99% is acute and has led to the angered view that the system is rigged, especially among young voters, two-thirds of whom said in 2012 election exit polls that the American economic system favors the wealthy. An unfair economy in which a few haves take it all and leave the crumbs for the have nots may become the larger issue in next year’s elections. “Economic populism” is on the rise.

the new mathThe financial collapse of 2008 led to the realization that America had developed a false prosperity based on credit card debt and the belief that the ascent of home values would never cease. Instead, the median income of American households plunged 8.3% to $51,017 at present from its peak in 2007. That was no higher than a quarter century ago. And the net worth of the median American family actually fell 6% over those years.

Five years on from the crash of 2008 there is little sign that household income will return to former levels. The income of the bottom quarter of U.S. families has actually fallen since the 1970s. For the average American male, income adjusted for inflation has essentially flatlined since the then, according to the Census Bureau. Women have done better, experiencing an increase of 29%, but none of that increase was in the past decade, and it comes largely from moving to higher status jobs compared to the years when women were relegated to fetching coffee for the boss.

Two years ago, when the media began taking notice of income disparity, we learned that the top 1% of Americans earned 1/5th of all income and controlled 1/3rd of all wealth, a share not seen since 1929. The top 10% of earners hauled in 1/2 of total income, and owned 2/3rds of the nation’s wealth. The bottom 90% was left with just 27%.

The imbalance has only grown worse. In contrast with the decline suffered by everyone else, the wealthiest recovered nicely from the fiscal collapse. The top 5%, who own 82% of all stocks, has just seen the stock market set all-time highs. The top 1% took in 1/5th of all the income earned by the entire country in 2012. They’ve captured 95% of all income gains since the recession supposedly ended.

While they sip champagne at art auctions and watch the bidding for a single artwork reach $142.4 million, they may not have noticed the latest government estimate of Americans living in poverty ratchet upward again to 49.7 million– almost one in six. More than three-quarters of us say they are living paycheck to paycheck. In a survey of a thousand adults, fewer than 1 in 4 said they had enough money to cover six months of expenses. Half said they have less than a three-month cushion. A quarter said they have no savings at all.

A quarter of Americans say they had trouble putting food on the table in the past twelve months, a gain of 50% since 2007 before the Great Recession began. Three quarters of Americans nearing retirement in 2010 had less than $30,000 stashed away — one medical emergency away from bankruptcy. Nearly half of American die with less than $10,000 in financial assets.

So much for any notion that beneficence would trickle down from the top, a self-justifying dodge if there ever was one. “Things just don’t trickle down”, says Sheldon Danziger of the Russell Sage Foundation. “If the full-time, full-year male workers aren’t benefiting from economic growth, why should we expect the poor to be?”. Even if so inclined, the rich can’t spend their money fast enough to make a difference. And they are not inclined. Their preference is wealth accumulation. Their claim that they are the source of enough job creation to matter is the other self-serving myth.

opposite polesOn one side of the battle line of 2014 is Republican austerity — their belief that shrinking the deficit and the debt is paramount if the United States can hope to retain its power in the world. Their belt-tightening is literal. The House passed a bill that would cut $40 billion from the food stamp program over ten years. Spending cuts, in their view, combined with reduced regulation and still lower taxes will lead to growth and well-paying jobs.

But we did reduce taxes. The Bush tax cuts were quite severe — 20% on average, and still deeper on capital gains and dividends. If tax cuts spawn growth, how do we account for arriving at today’s dismal economy? Instead the favored tax treatment of investments helped create the 1% to 99% divide.

“With the exception of America’s richest 1%, no other income group rates the U.S. budget deficit among the country’s biggest threats, according to polls. The remainder rank unemployment and stagnant incomes as bigger problems”, observed Ed Luce in the Financial Times.

On the other side, might we see a full bore outbreak of economic populism in retaliation for an economy so heavily skewed in favor of the wealthy? An early outcrop that it might become the dominant thread in 2014 was the flurry of notice paid to an essay in the New Republic by Noam Scheiber. Its thesis is that the already-presumptive Democratic candidate for the presidency, Hillary Clinton, has a problem. She and Big Dawg Bill are associated with the megamoney of Wall Street and Hollywood at a time when the public grows increasingly hostile toward the power élite, and when most Democratic voters “are angrier, more disaffected, and altogether more populist than they’ve been in years”. The article cites a Pew Research poll showing that socialism has a slight edge over capitalism with voters under 30. Scheiber contemplates who might better swim in a rising tide of populism than the establishment Clintons:

“The candidate would almost certainly have to be a woman, given Democrats’ desire to make history again. She would have to amass huge piles of money with relatively little effort. Above all, she would have to awaken in Democratic voters an almost evangelical passion. As it happens, there is precisely such a person. Her name is Elizabeth Warren. ”.

Populism essentially stands for defending the people from deprivation of their rights, their well-being and their voice in society by an oligarchic elite. But if economic populism translates as expanding the safety net by taxing the rich and giving to the poor, that does not create a robust economy. The question is where would a new prosperity for the underclass come from? What if the painfully slow recovery has run its course? A number of economists and commentators have been coming around to the view that we may be looking at a “new normal” without much prospect for further growth. “What if depression-like conditions are on track to persist, not for another year or two, but for decades?”, asks Paul Krugman at The New York Times. Almost next Federal Reserve chairman Larry Summers, once deeply involved in the deregulation of banks that led to the crash, now worries that the U.S. might be stuck in chronic "secular stagnation" with only stimulus or bubbles capable of increasing jobs.

The globalization that has enriched multinational corporations has created an oversupply of cheap labor and the exodus of much of U.S. manufacturing to other countries. Corporations here, aided by rising productivity and robotics, have found they need fewer workers. Job gains tend to be low wage and part time, the latter close to 20% of all jobs. All attempts — the $812 billion 2009 stimulus (36% of which was tax relief), the Fed pumping $85 billion a month into the economy — have lessened but failed to cure persistent unemployment.

The first step in a turnaround is for government and society to turn their attention to the problem rather than to perennially distracting sideshows. For Republicans the answer does not lie in government action. Their view is that if we reduced government, regulation, and taxes we would see growth occur on its own. But that is theory without empirical proof.

Democrats would act directly to create jobs, putting people back to work tackling the nation’s vast infrastructure problems, repairing the outdated electrical grid and converting away from oil to alternative forms of energy. But with a nation already $17 trillion in debt, where would the money come from?

One way or another, this nation needs to decide which road to take.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.

Firstly, insidious and overpriced as it is, credit card debt is not the only cause of the 2008 GFC. It can also, in part, be attributed the irresponsible indulgence in credit of all types, combined with an uncontrolled urge for immediate gratification, coupled to the rapacious greed of banks and markets, fostered by apparent laissez faire regulation that led to the financial s**t storm which, had the populace and governments of the developed economies been more responsible in their collective actions, should never have happened.

Secondly, the follow-on to this is the inability of government and societal leaders to agree on an objective, comprehensive solution for the resultant crippled condition of the economy. This lack of collective action is, to a significant degree, due to the short sighted, self-aggrandising positions taken by so many of the members of congressional, executive and, most unfortunately, judiciary branches of government. This result is exacerbated by an untoward imbalance of influence from political and commercial interests upon the functioning and, critically, the continuing viability of this nation.

Of these two it is the second which represents the greater threat to the country. What is required is a review of our processes of government, not the re-writing of the constitution, but a review of how we put some of its codicils into practice:

• How do we share power between the various levels of government, from federal to state to city and county?

• How do we fund government, how is the requisite revenue raised, from whom and in what proportion should the various beneficiaries (citizens, residents, corporations, statutory bodies, etc.) contribute to the maintenance of the levels of government?

• Should we continue to allow congressional and judicial careerists or should we have term limits (as we do with the presidency) in order to allow a wider participation in congress and, possibly, the judiciary?

• How do we fund elections and restrict undue influence from special and/or single issue interests?

• What is/should be our nation’s role in the world be?

It is the presentation of either/or propositions, such as in the preponderance of such articles in the media, that serves us ill. We need to understand the whole of the problem in order to formulate a viable solution to the national problems, one which utilises the best aspects of all of our various options. You need a plausible strategy before you can address tactics.