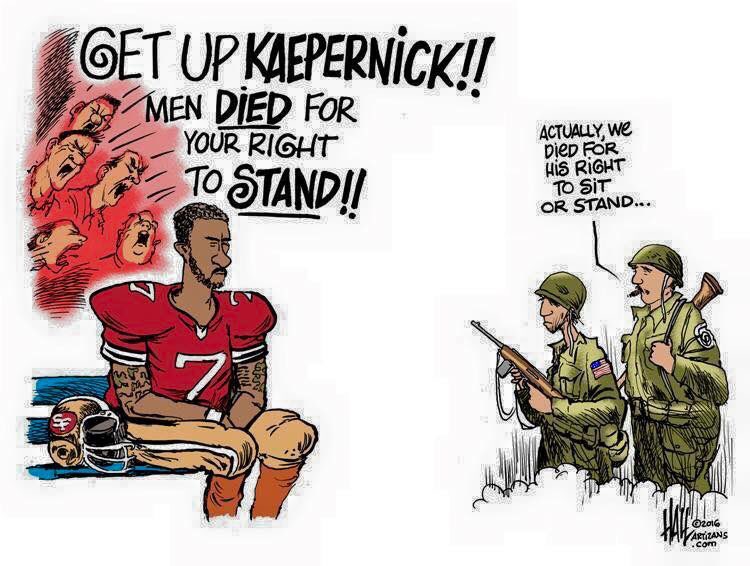

The anger of the less-educated white males that Donald Trump has mined like a coal seam and brought to the surface is attributed mostly to

Clockwise from top left: Cook,

Ellison,Zaslav, Schwarzman

jobs lost to immigrants or shipped overseas. But it also results from years of public disgust over income inequality made so apparent by the multi-million dollar paychecks of corporate chieftains reported in the media. Those paychecks and the lavish bonuses paid to Wall Street “fat cats” are an in-the-face reminder that the system is rigged.

They see Tim Cook in 2011, in just his first year as Apple’s CEO, handed $376 million in stock and options. In 2012 Larry Ellison of Oracle was almost modest in comparison, taking top honors as highest paid with $96 million. He repeated in 2013 with $78.4 million (that’s $37,692 an hour). David Zaslav of Discovery Communications received total compensation worth $156 million 2014. Blackstone Group co-founder and CEO Stephen Schwarzman collected $799.2 million in 2015, up from about $689.3 million in 2014. It didn’t matter that the firm’s stock was battered last year.

And by the way, Cook just got another $135 million in stock.

Currently in the news, 93-year-old Sumner Redstone and his daughter finally wrested control of Viacom Inc. from CEO Philippe Daumon after a lengthy court battle. Since taking the top spot in 2006, the ousted Daumon has been paid on average $40 million a year to preside over the company’s rapid decline and will now receive a severance package of $72 million. That’s $72 million for doing nothing and simply going away. Giant severance giveaways have become commonplace.

Meanwhile, the U.S. Congress refuses to even consider raising the minimum wage from $7.25 an hour, even as inflation has cut that to $6.46 in buying power since the rate was last adjusted.

Huge income disparities stoke the anger of social injustice and eat away at the tenons that hold a democracy from coming apart. At one end is the $15.00 an hour minimum wage, which would make a tangible difference in people’s lives. At the other end, only a gesture in the so-called Dodd-Frank law that requires a public corporation to report the ratio of its chief executive’s pay to that of the company’s median worker. It has taken six years since the law’s passage for the sclerotic S.E.C. to come up with the rule for how the ratio is to be calculated — fought all along by business, feigning the overwhelming complexity of coming up with the (embarrassing) number from their fully computerized payrolls. And the law still doesn’t go into effect until next year.

In the meantime, we have only estimates. Back in the 1980s management guru Peter Drucker warned that a 20-1 multiple of CEO pay over the average worker was bad for morale, and that when the ratio was thought to be more like 40-1. Such innocent times. Today, depending on what is counted as compensation, the multiple is somewhere between 140-1 and 335-1.

The published ratio will be inert; it triggers no changes. The Wall Street Journal‘s Holman Jenkins, an arch conservative who wants no such invasion of corporate privacy, calls the rule an “arbitrary and uninformative mathematical exercise of no value to investors” that is destined to have zero effect. Perhaps, except we can count on the media to publish rankings of which corporations and CEOs sport the most egregious ratios, much as the media now does with rankings of CEO compensation. Could public shaming have a tempering effect? Possibly. As word of the gluttony in the C-suite spreads among employees, will they ask themselves why work so hard, and will the demoralizing effect damage a corporation’s productivity? But given today’s staggering ratios and the reluctance of corporate leaders to take corrective action for the good of their companies, good luck with that.

superstars

The colossal take-home pay of CEOs has no shortage of admirers in the media. We regularly hear that the CEOs of major corporations are worth the big paychecks because they have to make the “tough decisions”. They face “the constant pressure…to adapt to increasingly dynamic markets in an increasingly global environment”, says Jenkins. Just why someone should be paid millions for making a decision goes unquestioned. In April, when Google’s chief executive, Sundar Pichai, was given a pay award that could come to $200 million, a columnist at The Economist argued if he makes decisions that add just 1% to the market capitalization of Alphabet, Google’s parent company, that would be a $5 billion gain to shareholders. This is a common “tough decision” argument. But will he make such a decision? And if he does and it results in a $5 billion loss, will he be charged a huge amount for his poor judgment? Of course not. So why only a huge upside?

Many business-school professors are on board with the superstar argument. Lesser executives can help a company prosper, but a great CEO is leagues beyond, and worth the millions, they contend. The size of the paycheck is immaterial. Just take the example of Steve Jobs and the unparalleled transformation he wrought at Apple; that’s the example they all quickly turn to. “Salary is moot if the chief executive is creating many multiples of their pay in shareholder value…Steve Jobs rescued Apple…when it was near bankruptcy, and turned it into one of the most valuable companies ever”, says this New York Times article. A Journal op-ed titled “Misguided Political Attacks on CEO Pay” (everything is political, of course) says, “The achievements of…Jobs help[s] explain why CEO pay is so high”.

Except the rest are not Steve Jobs and so many of them fail. Having to resort to the most unique case (what others are there?) voids their general argument.

Besides, high pay does not necessarily pay off. A 2014 study from the University of Utah found that “The more CEOs are paid, the worse the firm does over the next three years, as far as stock performance and even accounting performance”.

Most objectionable is that one would assume from the apologists for stratospheric pay that the corporate chieftains who made that “tough decision” went on to do it all; that it wasn’t the legions of employees who went to work every day following through on developing whatever was decided — developing a new product line or starting a new division or managing a post-merger integration; that they weren’t the ones who actually did the work of making it happen.

At least a great many corporations have tied pay to performance in their employment contracts, so huge payouts are becoming less automatic. But this, too, shows the same mentality; that it is the CEO who does all the performing. All those who work the company every day apparently have nothing to do with it. No performance pay scales for them.

wolves at the door

The big corporations have no choice other than to pay extravagantly, goes a standard argument. There is vigorous competition for top talent. Whopping pay packages are needed to keep prized executives from jumping ship. Except the Conference Board, a research outfit, found in a study of the S&P 500 across the years 2001 to 2014 that most CEOs — presumably offered bigger paychecks elsewhere in keeping with the vigorous competition claim — nevertheless stayed home. The average tenure was nine years and almost half of those who did leave their companies did so for retirement.

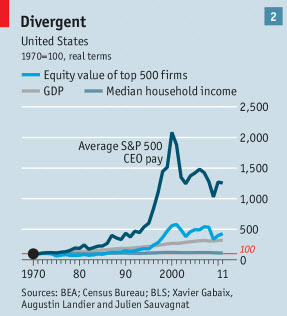

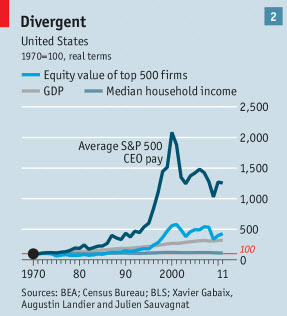

What is clear is that the cult of CEOs is protected by a trove of such fables to excuse their outlandish pay and the insupportable rise we see in this chart from The Economist.

CEO pay had soared over 1200% by 2011 while the value of the 500 companies they ran rose less than 500% and median household income flatlined across the entire 40-year period. Are CEOs today that much better? You know the answer.

high maintenance, layers deep

The median CEO pay package of the top 200 American companies last year was just shy of $20 million, with $8.7 million at the median taking the form of stock grants and options. That cost is an expense that reduces profit and therefore taxes paid to federal and state governments. The paychecks are ultimately paid by shareholders, whether in cash or in dilution.

And so are the never mentioned pay of the tier of executives one step down the pyramid whose hiring bonuses, pay and severance pay packages are ratcheted upwards along with the boss to keep them happy.

And then there are the directors. Their role is to look after the interests of shareholders, but the CEOs have a heavy hand in their selection, which makes for boards appreciative of the CEOs who burnished their résumés and fattened their incomes. Handsome compensation arrangements encourage board members to ally with CEOs and vote for their continuance in the job. Median compensation for board members was $263,500 in 2015 at the largest 500 companies. Excluding CEOs who sit on boards, that’s a 50% increase since 2006. They, too, are paid about half in stock options. Nevertheless, the pay — which can be as much as the $594,000 paid to each Goldman Sachs Director (mostly in restricted shares) — is extravagant for what a The Wall Street Journal article estimates involves five hours a week and and USA Today says is an average of only eight meetings a year.

(It needs be said that if the corporation’s stock price drops over time, the options for both the CEO, his lieutenants and the directors end up worthless. However, the frequent practice is to cancel the original options and replace them with new ones at the now lower stock price. That amounts to a reward for failing, it also needs to be said).

Beyond pay packages, corporate CEOs of the top 100 corporations have retirement accounts equal in value to the entire retirement savings of 41% of American families. Their customized plans provide sizable payments for the rest of their lives even though the rest of the company’s employees may have no pension plan at all.

hold up

CEOs helping themselves to runaway pay packages; the unseen commensurately fattened pay they in turn award to the next next level of executives; the generous payout to directors — all of it insulated from shareholder action by the impracticality of mounting a challenge makes it possible for these cabals to take from shareholders at will, with neither permission nor repercussion. Tantamount to theft, the gaping income disparity to which this contributes between the 1% and the rest has created a broad and unhealthy rift in what Americans think of their country, a towering resentment that society has been rigged by an élite that is taking it all for themselves, holding down the 99%.

The one public body that is in a position to demand change — the stockholders — doesn’t seem to care. They ignore CEO looting as long as the share price is going up. Dodd-Frank instituted a “say-on-pay” rule that gives investors in public companies a vote every three years on executive pay, but the vote is non-binding. Just another gesture. Since 2013, British investors have that same law, but theirs is binding. So is a Swiss law, with jail terms for execs who flout it.

Not even the big fund managers show much interest in using their large stock holdings to coerce companies to reign in executive pay. The Shareholder Forum, a research group aligned with investor interests, found that a median level of 94.9% of them supported proposed or existing pay levels at the Standard & Poor’s 500 companies. This is not surprising; a given fund holds positions in dozens of companies. How can they spend the time and money to turn activist on so many fronts?

government takeover

That leaves governmental action as the only force for change. The tax code offers possibilities. Corporations could be denied deducting as an expense all compensation, no matter its form, paid to any executive that exceeds a certain ratio to that paid the median employee. That would increase taxable profit which might put pressure on management. The ratio could be tightened year-to-year. A second, still higher ratio could be set; public corporations paying in excess of that second ratio could be fined for looting shareholder property. Because that’s what they’re doing.

How about a federal law that caps top executives’ pay to a maximum ratio? If they want to earn more, they would need to raise the pay of the rest of the company’s employees to increase the median amount enough to reduce the ratio below the cap to allow higher pay. That very proposition was put to the Swiss in 2013 — a law that would have held executive pay to no more than 12 times what the lowest employee earns on the principle that no one should earn more in a month than someone earns in a year. The referendum was soundly defeated, but with 38% in favor. Might it have passed had the ratio not been so severe? The Swiss did ban signing bonuses and golden parachutes. They were outraged that the departing chairman and CEO of drug giant Novartis had demanded a severance payout of $78 million.

No such problem here for Mr. Daumon.

Those reading this who are indoctrinated in unfettered, laissez-faire, free-market capitalism have probably recoiled in disbelief at any such idea, but that says ideology is so embedded that consideration of any new ideas meant to cure a serious societal problem is banned from discussion.

That sounds like one of our political parties that wants to keep society structured just the way it is — at risk of the structure itself.

Sep 13 2016 | Posted in

Zeitgeist |

Read More »