Exiting the World: Trump Gutting the State Department

“The talent being shown the door now is not only our top talent, but also talent that cannot be replicated overnight. The rapid loss of so many senior officers has a serious, immediate and tangible effect on the capacity of the United States to shape world events.”

When Rex Tillerson took the reins at the State Department, the first order of business was clearly the threats the world presents — nuclear missiles from North Korea, the growing belligerence of Russia and China, the perpetual turmoil of the Middle East. It was therefore bewildering that his priority instead seemed to be cutting costs and reorganizing the agency. He announced the intention to cut the 75,000 person department by 30%, a White House goal that undoubtedly originated with Steve Bannon’s goal of “administrative deconstruction”. That approach seemed to resonate with Tillerson, the corporate chieftain, as if the agency should be handled like the business he’d just run, ExxonMobil. He seems most enthusiastic talking about… “organizational redesign…the organization chart itself, the boxes, and who reports to whom…The most important thing I can do is to enable this organization to be more effective, more efficient”.

The most important thing? Hardly. Certainly not now. But not entirely outlandish. In a New Yorker profile of Tillerson, a former State Department negotiator told author Dexter Filkins, “No one will tell you this, but there’s a lot of dead wood around here”. There are 75,000 people in Washington and in almost 300 embassies and consulates around the world, numbers that might need review, or at least some rebalancing. There are more consulates in France than in China, for example. Pressed upon the agency by Congress and the White House are some sixty-six special envoys and representatives that were created at various times. They are given ambassadorial rank which overlaps and can stir conflict with the actual ambassadors of the countries to which they are assigned. “No one, starting over, would design something like this,” says Bill Burns, a former Deputy Secretary of State.

But the department deals with a plethora of matters in addition to diplomacy. Proposed budget cuts of $6.6 million can only heavily undercut these missions, which range from humanitarian aid to the promotion of democracy, protection of the oceans to HIV/AIDS programs in Africa, disaster relief to refugee survival — work by the State Department that projects America’s benevolence to the world. Barack Obama, promoting the Trans-Pacific Partnership of 12 nations, often said that if we are not in the Pacific to set the rules of trade, China would set them instead. Filkins quotes a retired diplomat saying much the same, that if there’s no one to show up at meetings to represent the U.S., whether the subject is… “…the oceans, the environment, science, human rights, broadband assignments, drugs and thugs, civil aviation — it’s a huge range of issues on which there are countless treaties and agreements that all require management. And, if we are not there, things will start to fall apart.” exeunt omnes

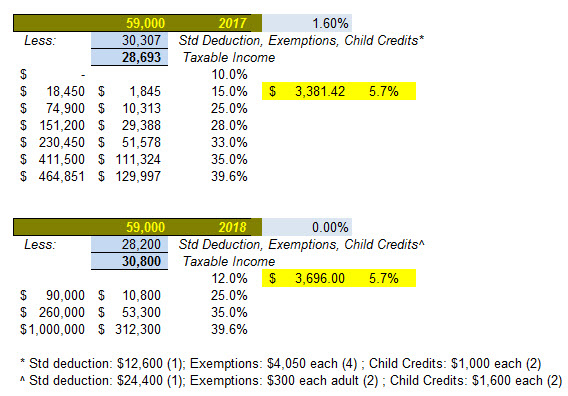

One would expect that a deep cut — wise or not — would be of lesser staff well down the stack. Not so, as Ambassador Stephenson makes plain in an interview on the PBS News Hour. State Department regulars have ranks, she tells us: We had five four-stars at the beginning of the year. So they are called career ambassadors. We now have two career ambassadors left at the four-star rank. And then we had 33 at the beginning of the year that were at the three-star rank. We call them career ministers. And they’re down to 20. Few were fired. As civil servants, State Department personnel have strong protections against summary dismissal, but Tillerson’s scorched earth policy is causing those at the top — those with the most experience, those who have come to know deeply the countries that were their stations, who have learned to speak their languages, who know over a long term their leadership class — to become discouraged enough to leave the agency. Given President Trump’s America First pronouncements, many in the foreign policy ranks were averse to serving in a Trump administration. Some three hundred career diplomats departed during the transition. Scores more left after Tillerson was appointed. Some quit when their jobs were eliminated or they were removed from their posts without being reassigned. Stephenson goes deeper: “Our two-star ranks were 431 on the day after Labor Day, which is when the promotions were added in for the year. And they had fallen to 369”, enforcing the point that the Tillerson policy is not to trim out the lower levels, but to watch idly as those with the most knowledge of the world go out the door.

Most do not appear likely to be replaced. At the end of October, forty-eight ambassadorships were still vacant. Save for two filled slots, the entire level of twenty-three Assistant Secretary positions were empty. These are the most senior stations in the diplomatic service; Congress isn’t helping by failing to confirm however many have at least been appointed to fill them. Finding replacements has not been easy for Tillerson for reasons already cited and for the additional problem of White House interference. Anyone who spoke out against Trump during the campaign is blackballed by the White House. That stopped Eliot Abrams, who Tillerson wanted as Deputy Secretary of State. Someone as competent as Susan Thornton, a career diplomat who speaks Chinese who Tillerson wanted as Assistant Secretary of State for East Asian and Pacific Affairs was nixed by Bannon for not having been tough enough on Chinese trade. That Bannon could overrule the most important member of the cabinet says much about this administration. The Oval Office is not at all upset by an eviscerated State Department. National security adviser, H.R. McMaster, thought those people who are leaving are those who won’t get on board with the Trump administration’s policy. As for Donald Trump himself, on Laura Ingraham’s radio program he defended the lag in hiring by saying “I’m the only one that matters”. It brings to mind Iraq. Tillerson may not be aware that he is copying the blunder of the self-exonerating, ego-inflated J. Paul Bremer, who expelled from the Iraqi government several levels deep of Baathist party functionaries — the people who knew how to run the country, keep the lights on, pump the oil — bringing about the chaos of years of insurrection. the singularity

At Exxon, Tillerson was not the sort to take lunch in the company cafeteria. His management style became increasingly withdrawn, operating along with a chosen few executives from a cloistered area at headquarters that earned the name “the God pod”. He has brought that culture to State, an organization whose ethos is the opposite, whose reason for being is outreach, of extending itself the world over, a reflex made apparent when nine hundred State Department employees signed a petition protesting the White House ban on travelers from seven Muslim countries.

In contrast, Tillerson has met with few legislators and has generally been accessible to few foreign emissaries. The foreign minister of a top European ally canceled a visit to the U.S. when Tillerson, having failed for weeks to respond to requests for a meeting, offered only 20 minutes. As head of Exxon, he has traveled the world negotiating deals, and the media makes that seem to be his current practice, yet he has so far traveled less than half as much as John Kerry or Hillary Clinton the same number of months into their service. It was “Where’s Waldo” during the early days of his tenure, guided by the Exxon credo that any day you wake up and are not in the media is a good day. That’s no longer possible, but Tillerson is bewildered by news reports that morale has hit bottom at his agency. “I walk the halls, people smile,” he says in a recent interview. “If it’s as bad as it seems to be described, I’m not seeing it, I’m not getting it.”

Some say Tillerson is overwhelmed by the number of decisions he is called upon to make. His budget cuts would heavily reduce the number of American diplomats working abroad, pushing still more deciding to the top. He doesn’t seem to be getting that. losing it

Stephenson explained what few of us know: The Foreign Service is like the military. You move up through the ranks to official designations such as FS2 and FS1 (Foreign Service 2 and 1) but which are spoken of internally as military ranks, lieutenant colonel and colonel in this example. It’s an up-or-out system. There are big cuts along the way to “getting that very first star to be a counselor of the Foreign Service”, ambassador Stephenson explains. “And only 35, 40 percent make that cut of the officers. And then it’s cut further. That’s how we actually grow senior Foreign Service officers, by bringing them in at the beginning and actually training them on how to be diplomats. We’re not alone in this. The military does it this way. So does essentially every diplomatic service of every major Western country.”

And yet Tillerson scuttled the hiring of new Foreign Service officers, effectively telling those who had been granted fellowships to go home, although he has since allowed two classes to move forward.

Nick Burns, a former Under-Secretary of State, told The New Yorker‘s Filkins, “The Foreign Service is a jewel of the United States. There is no other institution in our government with such deep knowledge of the history, culture, language, and politics of the rest of the world.”

And no other institution is so connected to that world, a world that still looks to the United States for leadership, that still wants to talk to us, but is finding no one to talk to. “These cuts will decimate the Foreign Service,” says Burns. Adds David Rank, the Deputy Ambassador to China, who decided to resign, “Maintaining our network for foreign relations is hard. It requires constant attention, a lot of people, a lot of work…But rebuilding it? Not a chance.” Once lost, we will never rework our way back into our former position of influence.

“There is simply no denying the warning signs that point to mounting threats to our institution and to the global leadership that depends on us”, writes Ambassador Barbara Stephenson, a career diplomat with the U.S. State Department for over 30 years, in a letter to a foreign service publication: