The Rich Make Off with the Middle Class Tax Plan

Nov 25 2017For fiscal 2017 the nation's deficit reached $666 billion, the sixth highest on record. The Congressional Budget Office projects that, if no countering action is

taken, the deficit 10 years out will reach almost $1.5 trillion. That's for the single year 2027. And it doesn't count the added $1.5 trillion leeway the House and Senate have awarded themselves in a budget resolution to give their tax reform plan running room.

"These numbers should serve as a smoke alarm for Washington, a reminder that we need to grow our economy again and get our fiscal house in order".

That was White House budget director Milk Mulvaney's reaction to the 2017 deficit announcement. His remedy? Cut taxes! Cut revenue by sharply reducing individual and corporate tax rates. That doesn't make matters worse, you see, because tax cuts will spur growth — so much growth in paychecks that the added taxes thereon will plug the hole caused by the cuts. That's the conservatives' theory that refuses to die despite there never having been any direct correlation in the wake of past tax cuts.

company picnicThe biggest cut would be the drop in the corporate rate from the world's highest at 35% to 20%. There's bipartisan consensus that this should be done — Obama proposed it in 2012 — in order to compete with other countries that have been slashing their own rate to attract corporations to their shores. But the quid pro quo for the steep drop in the tax rate was to be the elimination of scores of loopholes that corporations use to reduce their effective tax rate well below the posted 35% to an actual 18.1%. Getting rid of the myriad of loopholes that lobbying has inserted into the tax code was to be a big part of "simplification". What's happened to that? Instead, under the proposed plan, corporations would apparently still have loopholes to reduce their taxes below even the new 20%.

A number of other provisions make the plan a bonanza for business. Multinationals will be enticed to repatriate their accumulated $2.6 trillion in foreign profits at a 12% tax charge. Their future foreign profits would face a maximum tax of only 10%, less whatever the foreign country charges. To spur capital spending for plant and equipment in the U.S., those costs can be expensed against profits immediately, reducing the tax bill. The Senate plan agrees but delays the changes for a year

These major changes are bound to find their way into paychecks in support of Mulvaney's claim. The question is how much (and how soon). The notion is that with so much extra cash sloshing about, businesses large and small will share it with employees. Wages will rise leading to higher tax revenue to fill the deficit hole.

That would have greater credibility had we seen this phenomenon during the last few years when large corporations in the U.S. were piling up cash without any need for the proposed changes. Instead, corporations have preferred dividends and stock buybacks, boosting the stock price, witness market indexes posting records almost daily. Stockholders have been the prime beneficiaries, not employees. Wages have largely been kept flat.

But a 20% tax would certainly be a boon for small businesses, helping them to hire more workers or raise pay, while, not incidentally, undercutting their fight against poverty-level minimum wages.

blowing smoke

"The Democrats will say our tax bill is for the rich, but they know it's not and what they will do…they immediately say it's for the rich, it's for the rich, because it's the right thing to say for them, but [that] doesn't work, and they know that."

That was President Trump in a meeting with industry representatives just before the tax plan was presented. Far to the contrary, the plan contains huge gifts for the rich, Trump among them as we outlined in "A Bespoke Tax Plan for the Trump Family". We cited:

![]() the doubling yet again the value that can be transferred out of an estate tax-free to $10 million per person, and the intention to eliminate what Republicans call the "death tax" altogether after six years;

the doubling yet again the value that can be transferred out of an estate tax-free to $10 million per person, and the intention to eliminate what Republicans call the "death tax" altogether after six years;

![]() the elimination of the alternative minimum tax, a second computation that rolls back heavy use of deductions (as in 2005, when Trump would have paid just $5 million instead of $38 million had there been no AMT);

the elimination of the alternative minimum tax, a second computation that rolls back heavy use of deductions (as in 2005, when Trump would have paid just $5 million instead of $38 million had there been no AMT);

![]() the switch to a maximum tax rate of 25% for businesses that are set up to pass income through to personal tax returns instead of that income being subject to as much as the 39.6% maximum tax rate for individuals (Trump has over 500 businesses structured as "pass-throughs");

the switch to a maximum tax rate of 25% for businesses that are set up to pass income through to personal tax returns instead of that income being subject to as much as the 39.6% maximum tax rate for individuals (Trump has over 500 businesses structured as "pass-throughs");

![]() the giant corporate tax cut that will save corporations some $2 trillion over the next decade, profits that will accrue to the wealthy; the richest 10% hold 40% of all equities.

the giant corporate tax cut that will save corporations some $2 trillion over the next decade, profits that will accrue to the wealthy; the richest 10% hold 40% of all equities.

And what about "carried interest"? Trump campaigned against this special privilege loophole ("hedge fund guys are getting away with murder") that lets hedge fund and private equity chieftains call their paychecks capital gains, taxed at 24% rather than a likely 39.6%, even though none of their own money is at risk. That fix is nowhere to be found in the tax plan.

So when House Republicans claim that their plan does not tilt heavily to the benefit of corporations and the rich, and for Donald Trump to say "it's not good for me, believe me", no, only a fool would believe you or them.

don't look there, look hereTheir tactic is to trumpet steep tax cuts for individuals and families to distract from the benefits showered on corporations and the wealthy. “This plan is for the middle-class families in this country who deserve a break,” says House Speaker Paul Ryan. “It is for the families who are out there living paycheck to paycheck, who just keep getting squeezed”.

Few in the public can be expected to navigate the effect of the welter of proposed changes: The tax plans double the standard deduction to $24,000 but take away the $4,050 exemption for each member of the family, replacing it with a $300 credit for adults, but only for five years. It increases the child credit from $1,000 to $1,600. State and local taxes can no longer be deducted except for property taxes up to $10,000. But the Senate takes away that as well. Mortgage interest continues to be deductible, but would now be limited to $500,000 houses in place of $1,000,000 houses in the House plan. The Senate bill makes no mortgage interest changes. Interest on student loans would no longer be deductible. Charitable contributions still are. But the deduction of medical costs, including health insurance, already applicable only to costs beyond 10% of adjusted gross income, is taken away altogether. That will be a major tax increase for those with steep medical bills or chronic conditions and is easily the most obscene place to find money to fund tax cuts for others.

What sort of thinking says that money given to others out of charity is commendable — no argument there — but money spent on one's own health and survival is not? Or that interest expense, a subsidy to the housing industry that economists regularly view as distortative for favoring owners over renters, is a worthy deductible, but huge medical bills in a system allowed to charge crippling costs are not? How is it defensible to subsidize the housing industry while penalizing those trying to get an education — the student loan interest takeaway — and in that system, another with runaway costs?

middle class mendacityBut we are told that it all adds up to tax cuts across the board. On the day the Senate plan was released, Ryan at a House press conference said "all the analysis, whether it's TPC [Tax Policy Center], JCT [Joint Committee on Taxation] or Tax Foundation, they all tell you that the average families in all income groups see a tax cut".

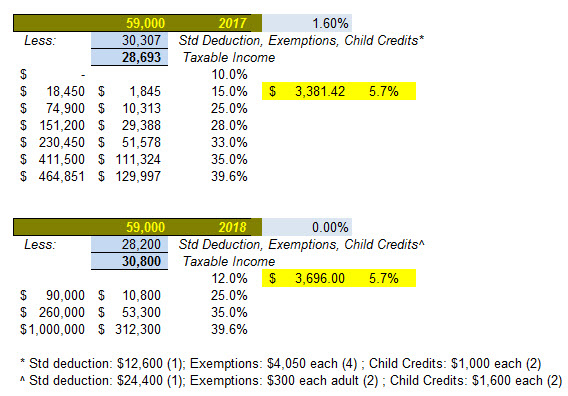

This claim comes apart when data is laid against the actual tax brackets. Kevin Brady, the House bill's chief architect, said on the day his plan was announced that the plan would deliver a tax break of $1,182 a year to a typical family of four earning $59,000 a year. Paul Ryan repeated that claim in his press conference. When we set up a prototypical family of four earning that gross income of $59,000, reduced by the standard deduction, exemptions and child tax credits as they are for this year versus the House plan were it installed next year, here's what we got:

The tax bill based on the new rules is higher by over $300 than the previous year. The $1,182 tax savings doesn't exist. If fact, we show that taxes are higher under the House plan for all households earning $75,000 or less. That should have been obvious to the plan's promoters if only because the plan raises the minimum tax rate — from 10% to 12%. (The Senate keeps all seven levels including 10%).

Above $75,000, taxpayers begin to pay less income tax in the House plan, ranging from breakeven at that level to a million dollar earner enjoying a 12% cut of $39,400. It is the "middle class" group earning from about $500,000 to $1 million that benefits the most because the 39.6% would not kick in until $1 million whereas it currently begins at $464,851.

the pitch unravelsRyan says, "This is about fulfilling our promises to the American people". Our question: When was it that the American people extracted that promise? Was there a general outcry that taxes are too steep? Or is this simply Republicans chasing their perennial goal of minimal taxes that will "starve the beast" of Big Government. George W. Bush and Congress already cut taxes 18%, a deep cut that led to steep deficits in parallel with those of the war costs. How can we keep doing this without the country falling apart?

Only intention to eliminate what Republicans call the "death tax" altogether after six years;

![]() the elimination of the alternative minimum tax, a second computation that rolls back heavy use of deductions (as in 2005, when Trump would have paid just $5 million instead of $38 million had there been no AMT);

the elimination of the alternative minimum tax, a second computation that rolls back heavy use of deductions (as in 2005, when Trump would have paid just $5 million instead of $38 million had there been no AMT);

![]() the switch to a maximum tax rate of 25% for businesses that are set up to pass income through to personal tax returns instead of that income being subject to as much as the 39.6% maximum tax rate for individuals (Trump has over 500 businesses structured as "pass-throughs");

the switch to a maximum tax rate of 25% for businesses that are set up to pass income through to personal tax returns instead of that income being subject to as much as the 39.6% maximum tax rate for individuals (Trump has over 500 businesses structured as "pass-throughs");

![]() the giant corporate tax cut that will save corporations some $2 trillion over the next decade, profits that will accrue to the wealthy; the richest 10% hold 40% of all equities.

the giant corporate tax cut that will save corporations some $2 trillion over the next decade, profits that will accrue to the wealthy; the richest 10% hold 40% of all equities.

Only half of Americans polled think the tax plan is a good idea and support has been dropping now that there is greater understanding of who will benefit the most and the write-offs that will be taken away. The fact is that Americans have plenty of ways to minimize taxes. The standard deduction, per person exemptions, and child tax credits exempt the first $30,800 of income for that standard family of four. In the 2012 campaign the "discovery" was made that some 47% of American pay no income tax. These hefty deductions are the reason why. For those with costs beyond the standard deduction there are state and local taxes, property taxes, charitable contributions, health costs, student loan interest — readily accessible data in any household to simply enter on a form or into software, but now called complications in need of simplification. Actually, it is now the deductions that are the tax "loopholes". That's what Ryan called them. The intent would seem to be to disguise the fact that nothing is being done about the actual loopholes such as "carried interest".

So, yes, it's burlesque, a prank to fool the working class into thinking the cuts are for them. At the White House, economic adviser Gary Cohn gives it away: "The most excited group out there are big CEO's", he said in an interview. Asked what happens if Republicans are unable to pass the tax reform package, Sen. Lindsey Graham (R-SC) answered in part, "Financial contributions will stop". New York Republican Congressman Chris Collins told The Hill, "My donors are basically saying, 'Get it done or don't ever call me again'". From the other side Bernie Sanders said, "You have members of Congress saying that if we don't pass this, our billionaire friends are not going to contribute to our campaigns. That is what this whole tax bill is about."

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.

Even at 20% corporate taxation would still represent double taxation on the shareholders – once on the corporate profits, and then again on any dividends which are declared from those after tax profits.

The real problem is government spending. Unfortunately, the political calculus mitigates against getting spending down.

The fact is that political ambitions will always expand to fill the revenue available, and then some more.