Runaway Debt? Inflation? Tariffs? Where Is This Economy Headed?

Apr 3 2018The austerity of the last decade — remember the 16-day government shutdown over the debt ceiling, spending of almost a trillion dollars "sequestered" over 10 years, expenses needing to be matched by savings elsewhere? — has suddenly been turned on its head, the doctrines of the political parties flipped in parallel. Republicans, who have long argued for a balanced budget, have become the big spenders while the Democrats they have always accused of profligacy are now the deficit hawks.

In December, Republicans passed tax cuts that will cost $1.5 trillion across 10 years without a single Democratic vote. Shortly thereafter Trump signed a bipartisan deal that will boost spending another $300 billion over just two

years. And now he has signed a 2,400-page omnibus spending bill that will cost $1.3 trillion more. Where will all this lead?

On several occasions Donald Trump boasted of balancing the budget. “We can balance the budget very quickly …I think over a five-year period", he said to Sean Hannity of Fox News in January, 2016 and went on to tell The Washington Post that April that he would get rid of the national debt “over a period of eight years”. Once president, Trump put forth last July a 10-year budget for 2018 that ended in 2027 with a surplus of $16 billion. (The Congressional Budget Office — CBO — scored it differently, however, coming up with a deficit of $720 billion.)

Reality has proven to be different. In December the tax reform act was signed into law. In February, the president unveiled his proposed budget for fiscal 2019. It foresees a deficit of $984 billion next year, and that's without the $300 billion signed after the budget was developed (Trump's budget does overlap some of the defense spending increase). In a memorable understatement budget director Mick Mulvaney said the president had — for now — given up on his July plan to balance the budget. Instead of eliminating the $20.35 trillion nation debt, the Trump budget would add $7 trillion over 10 years, and that assumes growth of 3% every year.

The likelihood that the 9-year expansion will continue at that pace, uninterrupted by set back or recession for another 10 years, is close to nil. In contrast, the Federal Reserve estimates that the economy will grow by 2.5% this year and then subside to 1.8% for the long run. The president disagrees. He thinks 3% is the minimum. Last fall he said , "I don't see why we don't go to 4%, 5%, even 6%". Treasury Secretary Steven Mnuchin is taken in by the notion that growth would pay the entire cost of the tax cuts. As recently as the end of January he claimed once again that that if growth could be sustained at 3% a year, the entire "revenue hole would be filled ". And not just filled. "This plan will cut down the deficits by a trillion dollars", he had earlier said.

buying votes?The Trump and Republican plan is supposedly about growth. Apart from lower taxes being what some say is the reason for the Republican Party's existence, we are told that tax cuts are needed to spur greater expansion of an economy already in possible danger of overheating. It's illogical to think that several hundred billion of extra money dumped into the economy will have no effect (although that's what Republicans insist about the $787 billion of the Obama stimulus), but the benefits of the sales pitch do not necessarily match up with what actually happens.

The cut in the corporate tax rate from 35% to 21% is meant to serve the double purpose of keeping companies from leaving the United States as well as encouraging them to to invest. The law provides instant write off against taxes of capital expenditures for a few years, which investment should cause productivity to increase, which will yield higher profits, which should flow through into employee paychecks. Skeptics remembered George W. Bush's no-strings tax holiday of 2004 in which corporations spent the money repatriated from abroad on stock buybacks and dividends. The naysayers' more jaundiced assumption has been that corporations will do the same.

Critics also take note that as part of the deal to reduce the rate to 21%, Congress had pledged to close loopholes that had reduced 35% to an actual rate of of only 18.1% of taxes on profits on average, but that was all but abandoned. Unseen therefore is that corporate taxes have been effectively cut far further — as low as 8% after loopholes still in place according to one estimate. And the multinationals have been given discounted tax rates — 15.5% for cash and 8% for less liquid assets — for returning to the U.S. the estimated $2.6 trillion of profits held overseas. America's corporations find themselves flooded by a tsunami of cash.

Very quickly after the tax plan was signed into law, a long list of companies announced $1,000 bonuses to their employees. Others raised wages, a more appreciable and ongoing commitment. Congress and the president were justifiably pleased that their intentions were playing out, although it is too soon to know how durable will be this trend. And signs are that the skeptics have not been proven wrong. A Morgan Stanley survey, conducted by its analysts across all the industrial sectors they monitor, found that barely one in five corporations would pass even some of the tax savings on to workers, and that companies plan to spend 43% of their surplus on stock repurchase. Another poll said banks will distribute 75% of their tax windfall not to investment in their companies or employees but to shareholders. The Wall Street Journal reported that companies are buying back their stock "aggressively". Whereas some 300 companies had announced benefits for 3 million employees by mid-February, $3 billion of that in bonuses and $5.6 billion overall, that amount is dwarfed by the money going into stock buybacks — $171 billion announced by that same date according to research firm Birinyi Associates.

In a buyback, a company spends its money to reduce the number of shares out there which boosts the value of the remaining stock outstanding: the unchanged value of the company is divided among fewer shares, increasing the value of each share. The money spent into the economy for those repurchased shares? Some 80% of all stock is owned by the top 10% of highest income earners, so this is spending that stays with the top tier of the wealthy, benefiting few in the middle class.

Not to be forgotten is how much of a company's stock and options are owned by the CEO, upper management and board members, who are voting to use the money for their own gain, both to increase their stock's value and pay themselves dividends on those same shares. Politicians in Congress will remind the public come the elections about the gift of lower taxes they have bestowed on us, not mentioning the price to be paid in the future, and will expect rich rewards from big business to help fund their re-election campaigns.

what about growth?We've said that growth is the supposed objective of tax reform. But there's the question of how the economy will find the room to grow even if corporations do decide to spend on new hiring. With only an eye-popping 4.1% unemployed, businesses will have to turn to those who some time back, as far back as the recession, dropped out of the labor force, perhaps found a way to get on disability, and haven't looked for work since. In 2000, nearly 82% of Americans between the ages of 25 and 54 were in the work force. Today the figure is 79%, which doesn't sound like much of a difference, but it comes to 3.7 million potential workers who sit idle while corporations can't find people with the ability to fill increasingly technical jobs. Widen the age brackets and you can get to a whopping 20% of adults in prime working years neither working nor trying to find work.

Businesses may find themselves bidding for the already working, offering bigger paychecks, and — with more money percolating through the economy — pushing up consumer prices. This has not been in evidence so far. February added 313,000 jobs and the fact that unemployment stayed at 4.1% suggests that roughly that many have begun to look for work. And pay rose almost not at all — 0.1%. But one month is not the future and with so much money added to the economy worries of inflation have caused much of the recent turbulence in the stock market — the fear that, after a remarkably long stretch of minimal inflation, things are about to be different. Reading the tea leaves, the Federal Reserve is already considering tightening the interval between the interest rate hikes it plans for this years to slow the economy sooner.

Inflation brings about higher interest rates. Investors won't part with money unless interest is high enough to cover the loss in the value of their money that inflation will inflict. The near-zero low interest rate of the past decade has enabled the government to borrow cheaply. The interest cost on the debt was $263 billion or 6.8% of the 2017 federal budget and has been fairly constant over the last nine years. But the much larger deficits set in motion by the tax cuts; the ballooning Social Security, Medicare and Medicaid outlays as the full complement of baby boomers move through their later years; and everything compounded by inflation, they are a problem for the government, which lives on borrowed money. Even without some expensive calamity such as war, the government will need to pay ever higher interest rates to attract buyers of its treasury bills and notes. The CBO expected interest costs to reach $818 billion in 2027 — almost triple 2017. And that forecast was from before the tax cuts and the spending increases were voted in. That's more than the budget for defense.

The government paying whatever it must in interest and sucking so much money out of the economy will be a problem for the private sector. The cost of money will become too great for businesses to borrow, homebuyer hopefuls will not be able to afford mortgages. We will see the economy slow and very likely slide into recession.

summing upSo, combining all elements — tax cuts, increased spending, portents of inflation, steep deficits, tripled interest on borrowed money — what does it all lead to? And, because it has just occurred, the following calculations do not include the just-signed $1.3 trillion spending bill!

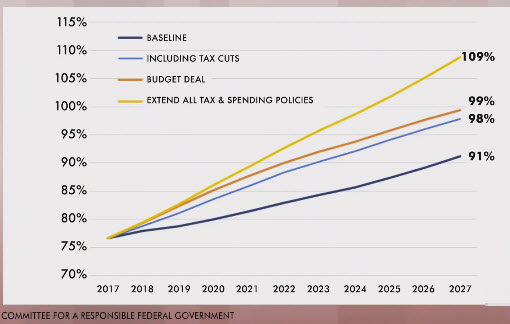

The Trump administration inherited a deficit of $666 billion for 2017. Had nothing changed, that would have taken the national debt from 77% of GDP to 91% ten years down the road as seen in the baseline above. Then came the tax cuts, which elevated the projected debt in 2027 to 98% of GDP. The $300 billion extra spending took that to 99%. The tax cuts for corporations are permanent, but they are taken away from the citizenry eight years from now as prescribed by the tax law. That contrivance was a deceit necessary to hold its cost to $1.5 trillion and prevent the plan from coming out of the 10 years still running a deficit, a requirement for passing the law under "reconciliation" by a simple majority of votes, not one of them from Democrats.

But Congress will never let the tax cuts expire. They'll be be extended, as will the defense spending boost which was authorized for only two years. Everything will be extended — that's how Washington works — meaning that the cost of tax reform will zoom past $1.5 trillion. All is deception. Extending all will take the debt to 109% of GDP by the end of 10 years as seen in the top line of the graph.

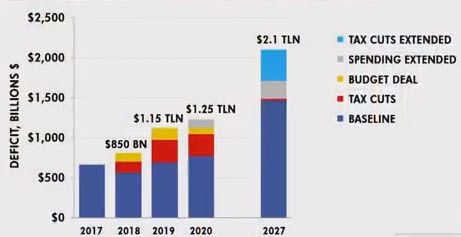

How does that translate in dollars per year? The following chart is the mate of the one above and says that the 109% would derive from an annual deficit of a stunning $2.1 trillion in 2027. Let's say that again: $2.1 trillion. Clearly, the country is reeling out of control.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.

I think it’s fair to say that Trump got as much as he could out of this Congress for restoring our military readiness, the Navy and the rest of the military branches.

And the Dems extracted a high price – unconscionable increases in domestic spending. High ranking military officers have testified that our ballooning debt will adversely impact our military capabilities in the long term. They are absolutely right!

It’s often said that Republicans now control the Senate, the House, and the presidency – they should rule. That’s 2/3 correct. What is constantly ignored is that you need 60 votes in the Senate to get most legislation passed. Republicans don’t have that majority, so they need to get some bi-partisan support for any initiative they need to get approved by Congress.

Republicans won’t ‘rule’ until they have a 60-vote majority in the Senate.

Cheeto Head and the republican party in charge of the Treasury and tax cuts remind me of the old joke “when is the best time to rob a bank? Answer: “when you’re in charge of it”