A Changing World Says Inflation Is Here to Stay

Apr 4 2022"Make no mistake, inflation is largely the fault of Putin”, blurted President Biden. Perhaps he meant only gasoline. "These are not Putin gas prices. They are President Biden gas prices", retorted House Minority Leader Kevin McCarthy, as if the president controls world oil

markets. "These really are Putin gas prices", insisted Nobel laureate economist New York Times columnist Paul Krugman, unmindful of the rise from $20 a barrel to $80 before the war. Back and forth goes blame, verging on infantile.

Inflation's causes are many, of course. The pandemic played a major role. Sheltering at home from the scourge, unable to spend on services — restaurants, movies, travel — people shifted to homelife improvements — electronics, appliances, furnishings. But quarantine lockdowns made production sporadic. Accustomed to finding just what we look for on well-stocked shelves, we learned about supply chains and what happens when they are disrupted.

Industry discovered that just-in-time inventory control, a quantum leap in efficiency, could have drawbacks; shortages developed and prices were bid up when trucks didn't show up at unloading docks. The shortage of semiconductors periodically shut down auto assembly lines. Used car prices shot up 37%. Lumber costs became prohibitive, adding $35,000 to building the

average house. The median home sales price went to $346,900 in 2021, up 16.9% from the year before.

stimulantsAll those forces are still in effect as supply chain snags continue to be worked out, but they do not account for why inflation in the U.S. has exceeded the rate in other normally stable countries. The difference is that the U.S. government flooded our economy with money in reaction to the pandemic.

In March of 2020, Congress passed and President Trump signed the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act) with no thought to how to pay for it. He signed off on another $900 billion that December. Joe Biden promptly added the $1.9 trillion American Rescue Plan Act in early 2021.

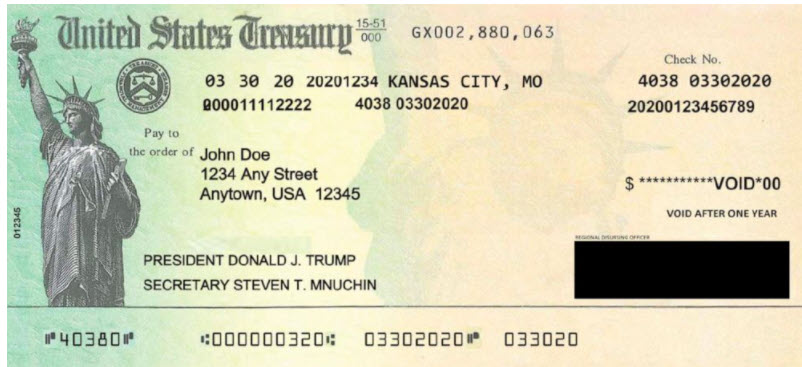

![]() Direct cash payments to individuals were part of all three. Out went $1,200 checks (with Trump's name on them — unprecedented) to every adult (and dependent) who earned less than $75,000 for singles and $150,000 for marrieds,

Direct cash payments to individuals were part of all three. Out went $1,200 checks (with Trump's name on them — unprecedented) to every adult (and dependent) who earned less than $75,000 for singles and $150,000 for marrieds,

Check with Trump's name as first proposed. Final version had names side-by-side in smaller size

the amount scaled down for those earning higher. Trump sent another $600 in January 2021. He had lobbied for $2,000 per person before the election. On taking over, Joe Biden made up the difference with $1,400 checks in March 2021.

Three times over the program sent checks to people irrespective of whether they continued to be employed. Checks also went to however many of the 69 million receiving Social Security even though they were no longer working and suffered no income loss from the pandemic. A $3,200 gift. Cash totaling $817 billion was pumped into America's pockets.

![]() The CARES Act provided $600 a week in unemployment payments spanning four months from April through July in 2020. But the program was extended repeatedly, not ending until the day after Christmas 2021. The Treasury Department under Steven Mnuchin had quickly decided it was too complex to figure the amount 50 ways so as to pay only the differential between $600 and the varied amounts and months of eligibility of each state. The Treasury simply paid the full amount to everyone, which came to $678 billion.

The CARES Act provided $600 a week in unemployment payments spanning four months from April through July in 2020. But the program was extended repeatedly, not ending until the day after Christmas 2021. The Treasury Department under Steven Mnuchin had quickly decided it was too complex to figure the amount 50 ways so as to pay only the differential between $600 and the varied amounts and months of eligibility of each state. The Treasury simply paid the full amount to everyone, which came to $678 billion.

![]() The Paycheck Protection Program (PPP) provided $835 billion in loans to businesses, self-employed workers, sole proprietors, nonprofits — loans that needn't be repaid provided the funds were used to cover payroll, rent, interest, and utilities. PPP's intention was to keep entities out of bankruptcy and people in their jobs, "But as the pandemic dragged on, Congress weakened those requirements, allowing companies to keep the cash even if they made deep staffing cuts", the New York Times reported in a 2022 analysis of where all the government largesse went.

The Paycheck Protection Program (PPP) provided $835 billion in loans to businesses, self-employed workers, sole proprietors, nonprofits — loans that needn't be repaid provided the funds were used to cover payroll, rent, interest, and utilities. PPP's intention was to keep entities out of bankruptcy and people in their jobs, "But as the pandemic dragged on, Congress weakened those requirements, allowing companies to keep the cash even if they made deep staffing cuts", the New York Times reported in a 2022 analysis of where all the government largesse went.

As much as $80 billion — almost 10% — went to what prosecutors are calling the biggest fraud in U.S. history. That’s on top of the $90 billion to $400 billion believed to have been stolen from the unemployment relief program — at least half taken by international schemers — as NBC News reported last year. Investigators are finding examples of fraudsters buying "Lamborghinis, Ferraris, and Bentleys, and Teslas, of course, lots of Teslas" as well as mansions, vacations, and private jets flights to those vacations.

![]() A ban on evictions to protect renters left some 11 million households with that much extra cash every month. The moratorium was extended several times by Congress and Biden all the way to November, 2021, when it was finally ended by the Supreme Court ruling that the Center for Disease Control and Prevention (CDC) did not have the authority to order it as a health measure.

A ban on evictions to protect renters left some 11 million households with that much extra cash every month. The moratorium was extended several times by Congress and Biden all the way to November, 2021, when it was finally ended by the Supreme Court ruling that the Center for Disease Control and Prevention (CDC) did not have the authority to order it as a health measure.

All totaled, $5 trillion flooded the economy, creating an inevitability of inflation.

take this job and…Republicans took especial issue with both the $600 unemployment payments and their extensions despite the pandemic somewhat subsiding. Combined with state unemployment insurance, people in many states were making more than their jobs had paid, giving them an incentive not to return to work. It has become a widely reported national phenomenon — people flush with cash, albeit temporarily, re-examining their lives, what they feel are pointless jobs, and staying out of the labor market — a cohort of some 2.5 million thinking things over. Those who do return are demanding higher wages which companies have to recover with price increases.

Others attribute inflation to a different cause. Democratic Senators Sherrod Brown of Ohio and Elizabeth Warren of Massachusetts, and President Biden in his State of the Union address, see soaring meat prices and point out the monopolistic confluence of only four companies controlling 85% of the meat market. Brown points out that "profit at the biggest U.S. corporations shot above $3 trillion" in 2021. Warren: "Corporations are exploiting the pandemic to gouge consumers with higher prices on everyday essentials, from milk to gasoline".

A final cause of inflation is ourselves. We pay the asking price. The expectation of rising prices sets in. Not everything is an essential (as is gasoline for commuting to work or shuttling the kids between house and school) but we express our annoyance and shell out anyway rather than cut back or say no.

jerome powell & the fed

Fedferal Reserve Chairman Jerome Powell

On March 18 of 2020, a Wednesday, the Dow plunged some 2,000 points.

“We didn’t know there was a vaccine coming. The pandemic is just raging. And we don’t have a plan. Nobody in the world has a plan.”

… recalled Federal Reserve Chairman Jerome Powell in a Wall Street Journal piece that lauded the Fed's performance in a moment of panic. The Fed board worked through the weekend and Powell went on:

“My thought was — I remember this very clearly — ‘O.K. We have a four-or-five-day chance to really get our act together and get ahead of this…and we were going to do that by just announcing a ton of stuff on Monday morning.”

That comes across as a moment of brilliance, for the "ton of stuff" reassured the markets that the Fed was taking immediate and extensive action to preserve liquidity and keep the economy from a full-on depression. It dropped the interest rate (the federal funds rate) to zero and began buying trillions of dollars of debt to send cash into the economy.

It was a decisive Fed barely recognizable from the languorous pace of the agency today. At the first sign of inflation, Chairman Powell called it "transitory", a word echoed by the president that hung in the air for the few months that mocked it. Powell seemed only to be looking at supply chain bottlenecks that would work themselves out. An awareness of all the money flowing into the economy somehow didn't register.

In March of 2021, inflation nosed over 2% for the first time since the original pandemic shock of a year before. By May, prices for all goods and services were 5% above the same month a year earlier, then up 6.2% in October year over year. Six months of sustained inflationary numbers and Powell only then began to speak of a quarter-point rise in the interest rate — but not for months to come. Finally it was realized that a series of quarter point increases would be needed, but not starting juntil this March. The Federal Reserve had waited a full year since inflation began to rise to take any action.

With inflation registering a 7.9% gain in February over the year previous, the fed-funds interest rate is further below the inflation rate than in any period in history. "We're going to use our tools and we're going to get this done", Powell said in a Senate hearing. Finally, on March 22, the solons at the Fed came to the realization that a series of quarter point increments wouldn't cut it. They will double-down with half-point increments each time they meet "if we think it's appropriate", Powell announced.

"Hindsight says we should have moved earlier", he had confessed on March 3rd. His hindsight, certainly not others'. The pivot to combat inflation has taken an eternity. The Fed, "by its passivity in the last year may have executed the most significant failure of monetary policy in most Americans’ lifetimes", wrote Gerard Baker, in the Journal, where he was editor-in-chief for five years.

On a parallel track, Powell had early last November said the Fed would trim its $120 billion monthly "asset purchases" by $15 billion. That is, with a roaring economic recovery emerging from the pandemic that had driven unemployment down to 4.6% (spectacularly 3.6% now), the Fed was still pumping cash into the economy rather than the opposite anti-inflationary move of sucking cash out of the economy by starting to sell the almost $5 trillion of debt it had bought since the pandemic's onset.

And just a $15 billion cutback. Awakened to reality, the Fed would only two months later cut the monthly debt-buying in half, and then "taper" downward. Fed officials are only now — a year into inflation — planning to come up with a strategy to about face and unload their vast holdings of debt even as they now continue to buy more! It's like discovering you've driven the wrong way but deciding why not drive a few more miles before turning the car around.

riding the tigerInflation will go on rising, although no one expects to the extent that required Fed chief Paul Volker to break the 1979-1980 surge with interest rates close to 20%. But taming today's will be nonetheless be difficult.

![]() There's all that pent-up money in the system stemming from the relief programs reviewed above. And some $400 billion is yet to be spent! In early February, checking-account balances were 350% of their pre-pandemic level. Personal savings are estimated to exceed $2 trillion more than before the pandemic's arrival. Cash equivalents such as money in deposit accounts (e.g., CDs) exceed pre-pandemic levels by $6.2 trillion, up 40%. Folks are only too willing to spend now, no matter prices, in the expectation of future price rises, which leads to a self-fulfilling cycle.

There's all that pent-up money in the system stemming from the relief programs reviewed above. And some $400 billion is yet to be spent! In early February, checking-account balances were 350% of their pre-pandemic level. Personal savings are estimated to exceed $2 trillion more than before the pandemic's arrival. Cash equivalents such as money in deposit accounts (e.g., CDs) exceed pre-pandemic levels by $6.2 trillion, up 40%. Folks are only too willing to spend now, no matter prices, in the expectation of future price rises, which leads to a self-fulfilling cycle.

![]() States are awash in money, having saved much of the $500 billion they received from the CARES Acts and American Rescue Plan. They hold $660 billion in U.S. Treasuries more than pre-pandemic, and $1 trillion in infrastructure spending will start to move off drawing boards.

States are awash in money, having saved much of the $500 billion they received from the CARES Acts and American Rescue Plan. They hold $660 billion in U.S. Treasuries more than pre-pandemic, and $1 trillion in infrastructure spending will start to move off drawing boards.

![]() The Fed's interest rate plan is timid, inching to only 2% by year-end against inflation almost 8% already.

The Fed's interest rate plan is timid, inching to only 2% by year-end against inflation almost 8% already.

![]() The rise in housing costs has yet to be fully felt for renters, there being a lag until new pricier leases are signed.

The rise in housing costs has yet to be fully felt for renters, there being a lag until new pricier leases are signed.

![]() The war will result in shortages that cause prices to escalate. Russia and Ukraine exports like neon and palladium could curtail car manufactures. China's zero-COVID policy has crimped production. Total city lockdowns — another underway now in Shanghai — have stopped production of key components that can shut down assembly lines elsewhere.

The war will result in shortages that cause prices to escalate. Russia and Ukraine exports like neon and palladium could curtail car manufactures. China's zero-COVID policy has crimped production. Total city lockdowns — another underway now in Shanghai — have stopped production of key components that can shut down assembly lines elsewhere.

Russia and Ukraine account for 30% of the world's wheat production, and high percentages of the world's sunflower and grapeseed oil on which countries such as China and India rely. All of Ukraine's agricultural exports go out through the Black Sea, now in the midst of a shooting war. Uncertainty alone is causing the price of futures contracts of these commodities to zoom.

![]() And, of course, the inflationary rise of oil on the world market and gasoline at the local pump.

And, of course, the inflationary rise of oil on the world market and gasoline at the local pump.

Nevertheless, Mr. Powell hopes that "the economy achieves a soft landing, with inflation coming down and unemployment holding steady”, as he said to a conference of economists. The Fed board anticipates core inflation (excludes food and energy — e.g., gasoline — as too volatile, as if we can pretend we'll go without) falling to 4.1% at the end of this year, 2.6% next year, and 2.3% in 2024.

the contrarianFormer U.K. central banker Charles Goodhart does not agree and by accurately predicting 2021's inflation has attracted some attention, especially because he foresees inflation setting in for a long haul.

He attributes the manageable inflation of the last couple of decades not to astute central bankers but to the work we exported to millions of low-paid workers across the globe who shipped us far lower priced goods than had we produced them at home. As for home, women entering the workforce as well as the outsize baby-boomer generation caused the labor force to more than double across the decades following World War II, which, along with breaking the unions, allowed business to hire at low wages and keeo prices competitive.

But that, Goodhart says in a Journal article, is changing. Working-age populations in the major economies have started to shrink; individuals and families are having children at less than replacement rate in countries like Japan. China’s demographics say that their working-age population will dip by nearly one-fifth over the next 30 years. Goodhart points to Germany where labor shortages are already so acute that the government seeks 400,000 skilled foreigners a year.

Labor scarcity will enable workers to demand higher wages, which leads to higher prices. Supply chain disruption as well as the nationalistic trends that threaten global trade are causing corporations to shift production onshore at higher cost. The higher proportion of older people owing to greater longevity will tax economies, especially in this country with no sign of controlling the cost of healthcare. Goodhart expects that Chinese companies will need to pay higher wages to lure workers back to factories in the coastal cities which means higher export prices. (The Chinese, too, are reexamining work; 2021 gave birth to tangping or 'lying flat' which means doing the bare minimum to get by and rebeling against societal pressures to overwork — the 996 system of 9:00am to 9:00pm, six days a week.)

Goodhart sees these factors as a permanent shift in demographics and social conditions that will bring inflation as a new normal for decades to come.

Please subscribe if you haven't, or post a comment below about this article, or

click here to go to our front page.

That 7.9% itself misleadingly understates the true level of inflation experienced by ordinary people. Housing, for example is forming an increasing proportion of the household budget either through your rent or through the property taxes based on market values or through the monthly payments on a new mortgage (due to inflated property prices.

Hitherto the inflation in the money supply has been hidden from ordinary people because it has mostly gone into the inflation of assets prices (eg. property and stock markets) and to foreign investors seeking “safe” investments in dollar assets.

That last dollar sink was going to close soon even before the USA response to Russia’s invasion of Ukraine. Those financial sanctions have greatly accelerated the loss of faith in the reliability of the dollar. Without foreigners soaking up dollars, and worse, with foreigners starting to divest from dollars, Expect inflation to accelerate for some time to come. It could well be worse than the 1970s.

The silver lining is that the decline of the dollar will eventually repatriate manufacturing to the USA and strengthen the country long term. However, that is small comfort to those whose standard of living will now plummet and won’t recover for many years.